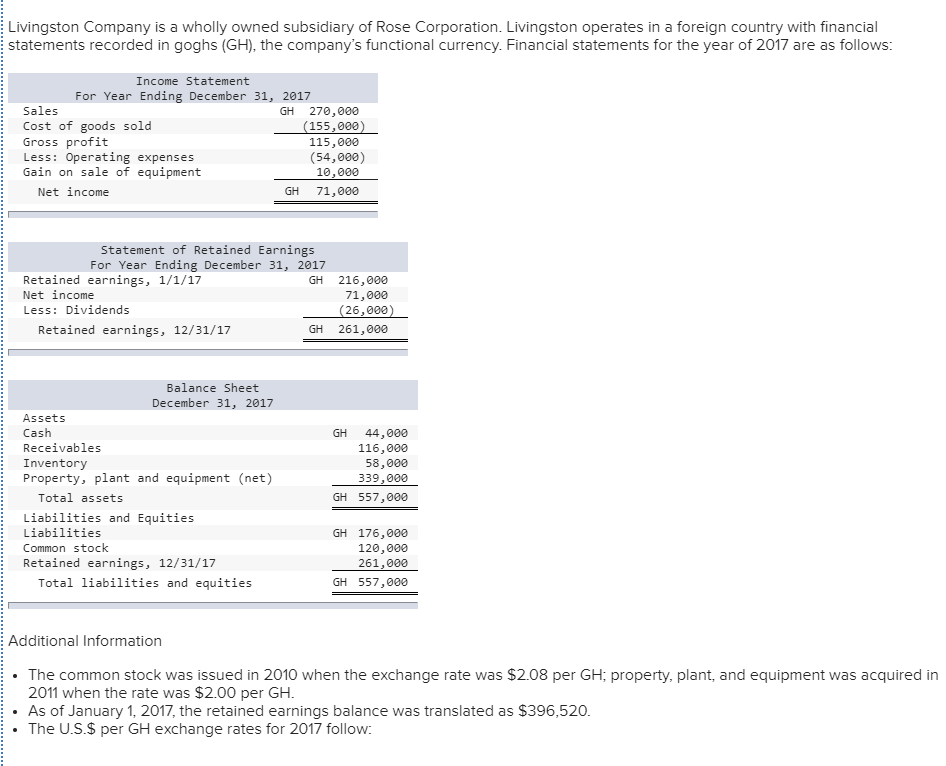

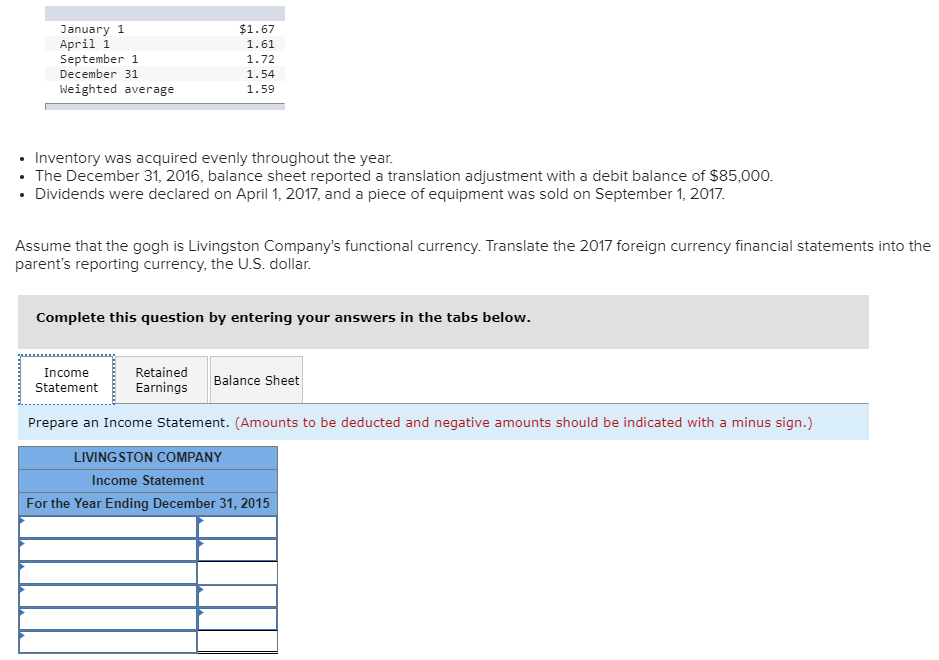

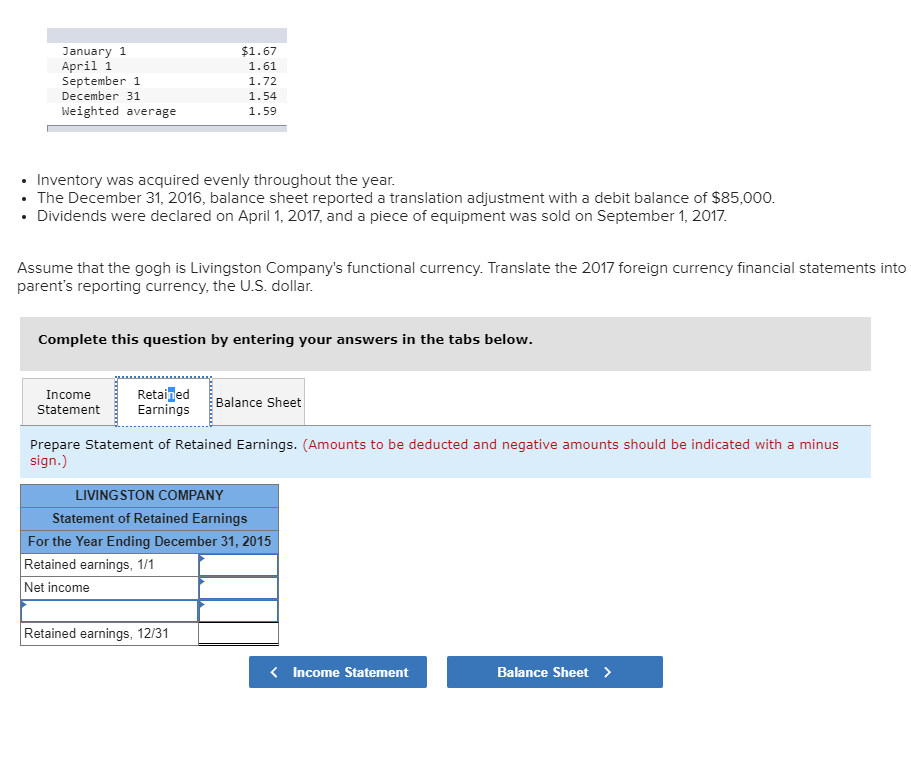

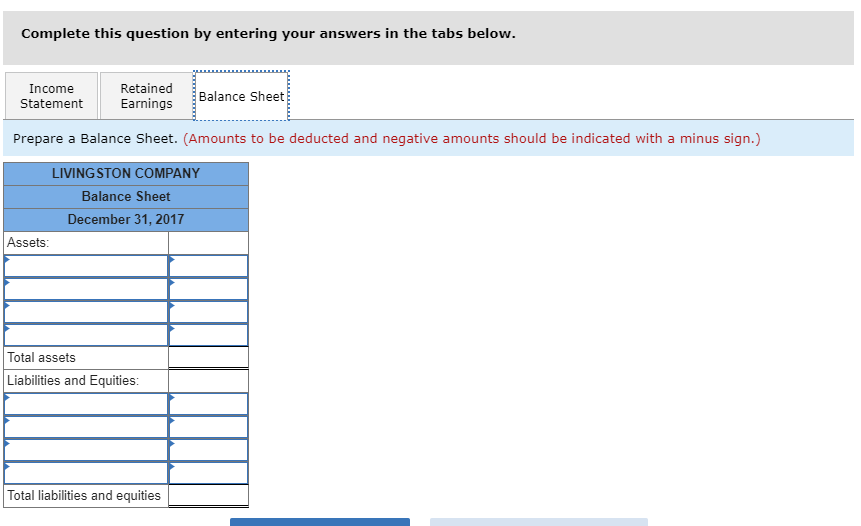

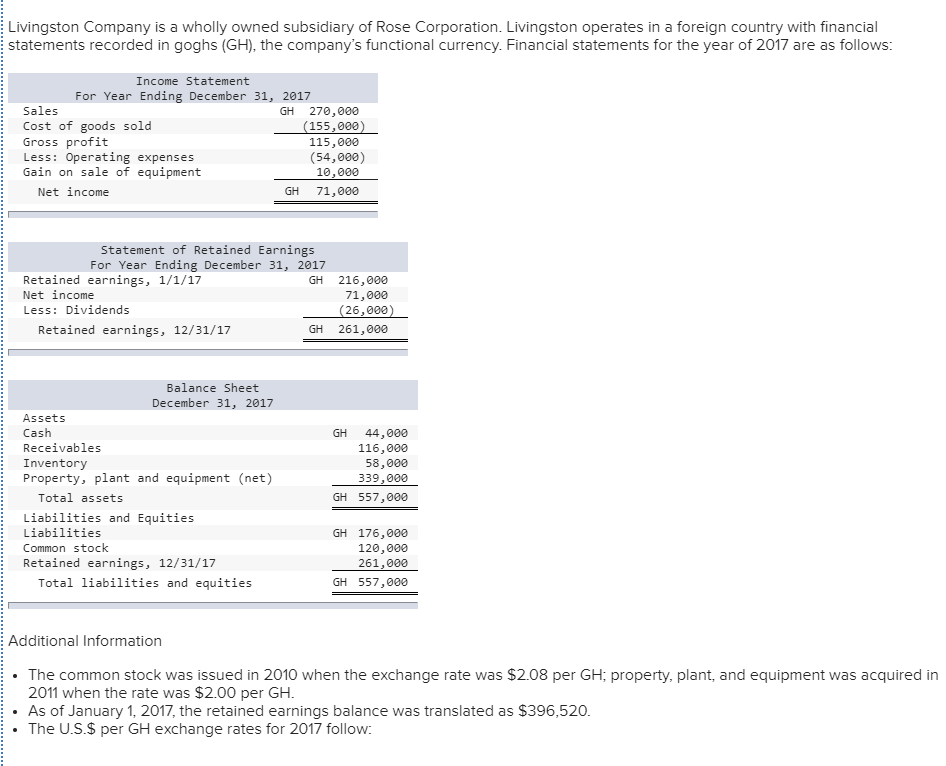

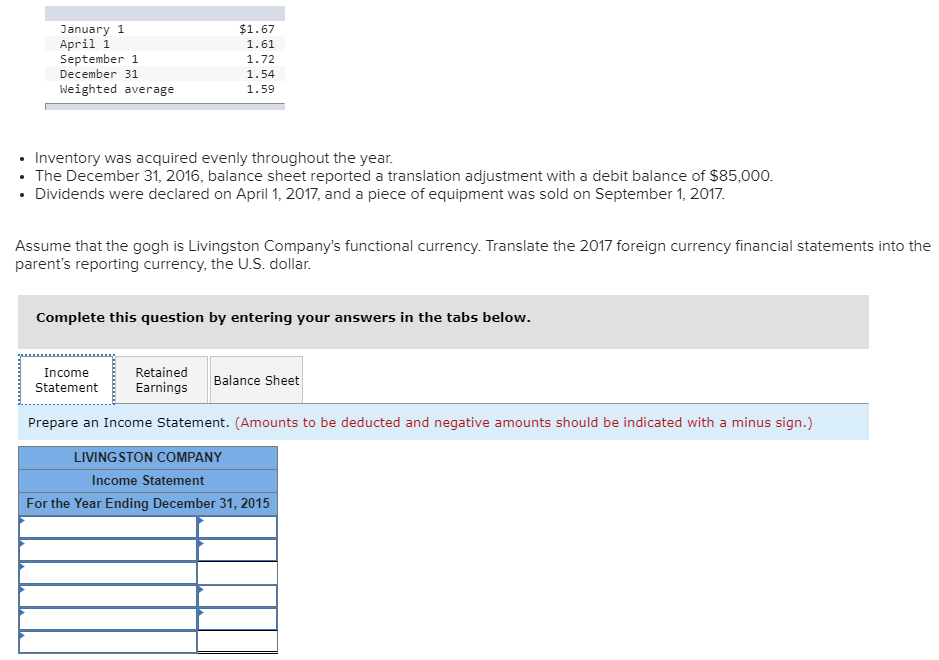

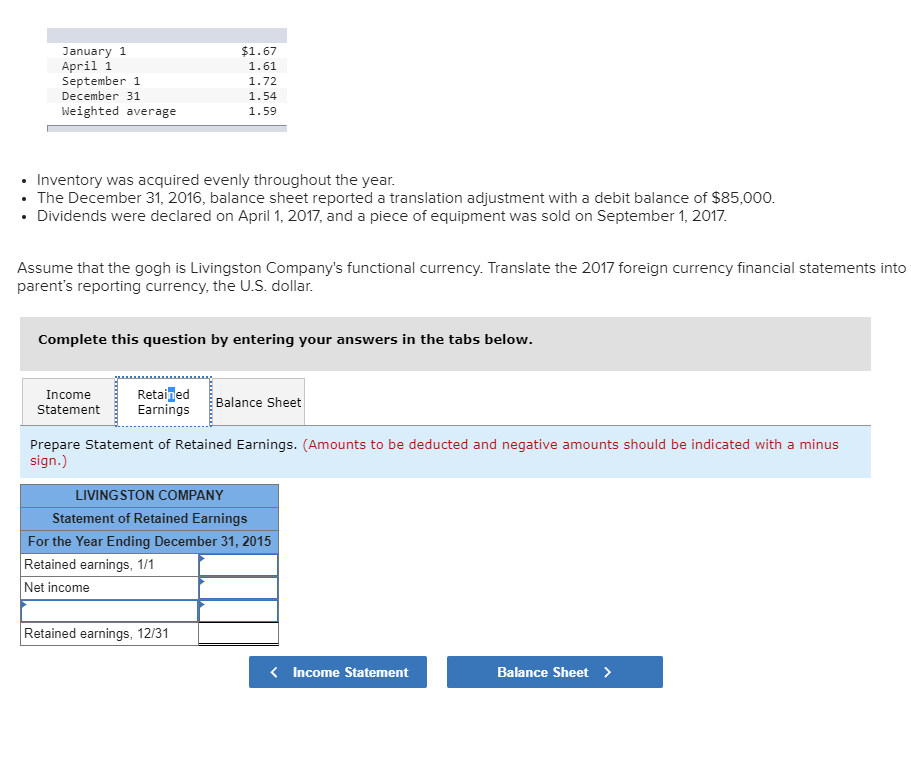

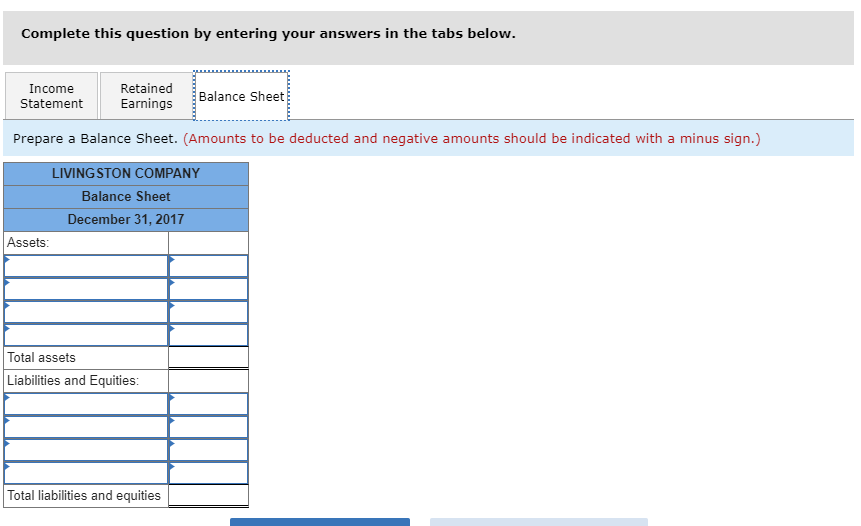

Livingston Company is a wholly owned subsidiary of Rose Corporation. Livingston operates in a foreign country with financial statements recorded in goghs (GH), the company's functional currency. Financial statements for the year of 2017 are as follows Income Statement For Year Ending December 31, 2017 Sales Cost of goods sold Gross profit Less: Operating expenses Gain on sale of equipment GH 270,000 155,000 115,000 (54,000) 10,000 GH 71,000 Net income Statement of Retained Earnings For Year Ending December 31, 2017 Retained earnings, 1/1/17 Net income Less: Dividends GH 216,000 71,000 26,000 GH 261,00 Retained earnings, 12/31/17 Balance Sheet December 31, 2017 Assets Cash Receivables Inventory Property, plant and equipment (net) GH 44,000 116,000 58,000 339,000 GH 557,000 Total assets Liabilities and Equities Liabilities Common stock Retained earnings, 12/31/17 GH 176,000 120,000 261,000 GH 557,000 Total liabilities and equities Additional Information The common stock was issued in 2010 when the exchange rate was $2.08 per GH: property, plant, and equipment was acquired in 2011 when the rate was $2.00 per GH As of January 1, 2017, the retained earnings balance was translated as $396,520 . The U.S.$ per GH exchange rates for 2017 follow: $1.67 1.61 1.72 1.54 1.59 January April 1 September 1 December 31 Weighted average Inventory was acquired evenly throughout the year The December 31, 2016, balance sheet reported a translation adjustment with a debit balance of $85,000 .Dividends were declared on April 1, 2017, and a piece of equipment was sold on September 1, 2017 Assume that the gogh is Livingston Company's functional currency. Translate the 2017 foreign currency financial statements into the parent's reporting currency, the U.S. dollar Complete this question by entering your answers in the tabs below RetainedBalance Sheet Earnings Income Statement Prepare an Income Statement. (Amounts to be deducted and negative amounts should be indicated with a minus sign.) LIVINGSTON COMPANY Income Statement For the Year Ending December 31, 2015 anuary1 April 1 September 1 December 31 Weighted average $1.67 1.72 1.54 1.59 . Inventory was acquired evenly throughout the year . The December 31, 2016, balance sheet reported a translation adjustment with a debit balance of $85,000 . Dividends were declared on April 1, 2017, and a piece of equipment was sold on September 1, 2017, Assume that the gogh is Livingston Company's functional currency. Translate the 2017 foreign currency financial statements into parent's reporting currency, the U.S. dollar Complete this question by entering your answers in the tabs below Retained Balance Sheet Earnings Income Statement Prepare Statement of Retained Earnings. (Amounts to be deducted and negative amounts should be indicated with a minus sign LIVINGSTON COMPANY Statement of Retained Earnings For the Year Ending December 31, 2015 Retained earnings, 1/1 Net income Retained earnings, 12131 K Income Statement Balance Sheet > Complete this question by entering your answers in the tabs below. Retained Income Balance Sheet tatement Earnings Prepare a Balance Sheet. (Amounts to be deducted and negative amounts should be indicated with a minus sign.) LIVINGSTON COMPANY Balance Sheet December 31, 2017 Assets Total assets Liabilities and Equities Total liabilities and equities