Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LivingWell manufactures bicycles it plans to sell for $800 each. The bicycles require 10 lbs of aluminum each (which is the only direct material

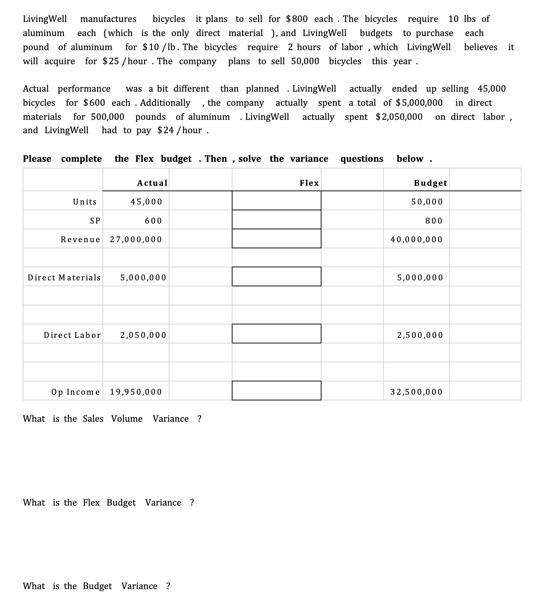

LivingWell manufactures bicycles it plans to sell for $800 each. The bicycles require 10 lbs of aluminum each (which is the only direct material ), and LivingWell budgets to purchase each pound of aluminum for $10/lb. The bicycles require 2 hours of labor, which LivingWell believes it will acquire for $25/hour. The company plans to sell 50,000 bicycles this year. Actual performance was a bit different than planned LivingWell actually ended up selling 45,000 bicycles for $600 each. Additionally, the company actually spent a total of $5,000,000 in direct materials for 500,000 pounds of aluminum. LivingWell actually spent $2,050,000 on direct labor, and LivingWell had to pay $24/hour. Please complete the Flex budget. Then, solve the variance questions below. Units SP Revenue Actual 45,000 600 27,000,000 Direct Materials 5,000,000 Direct Labor 2,050,000 Op Income 19,950,000 What is the Sales Volume Variance ? What is the Flex Budget Variance ? What is the Budget Variance ? Flex Budget 50,000 800 40,000,000 5,000,000 2,500,000 32,500,000

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the flex budget we need to determine the expected values for each item at the actual sales volume of 45000 units the actual performance T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started