Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Liz is currently age 4 3 and happily divorced. She is concerned about becoming a burden on her children and would like some advice regarding

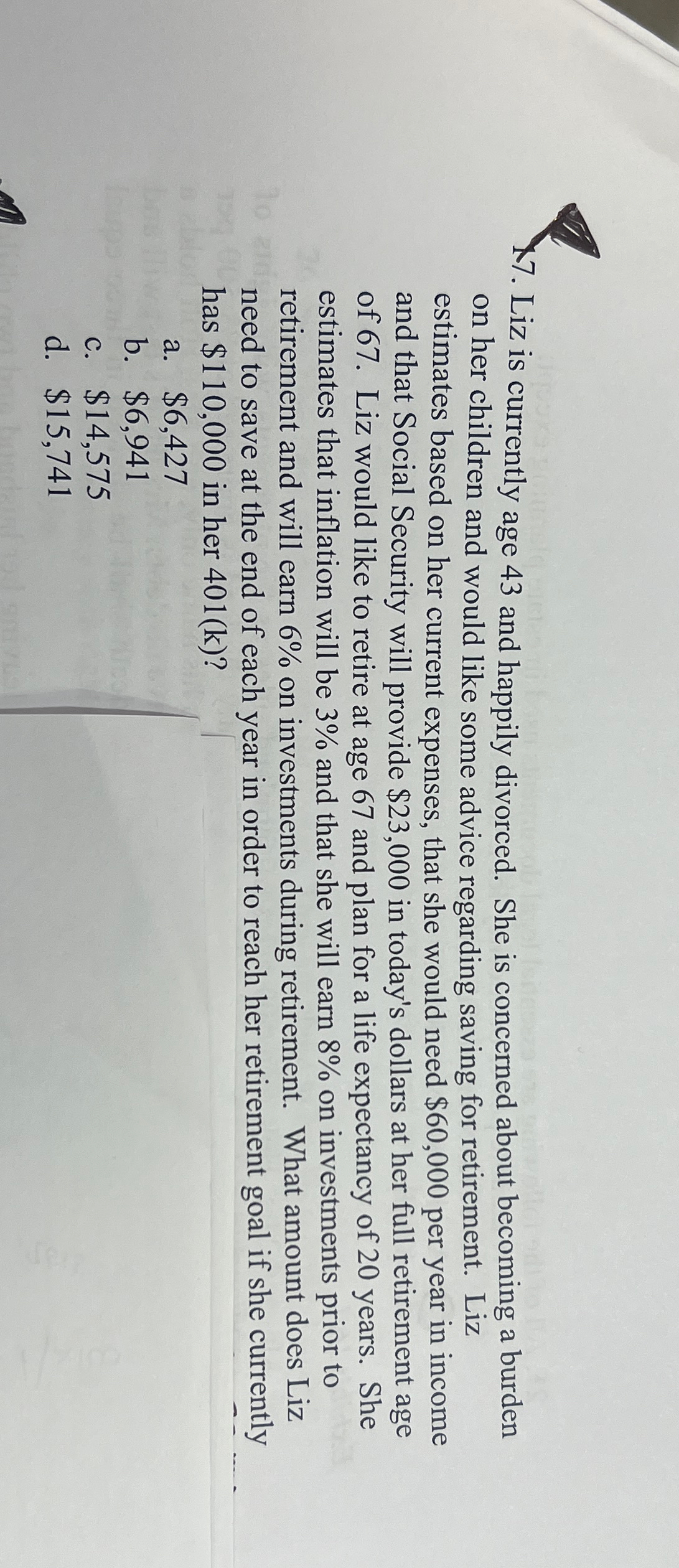

Liz is currently age and happily divorced. She is concerned about becoming a burden on her children and would like some advice regarding saving for retirement. Liz estimates based on her current expenses, that she would need $ per year in income and that Social Security will provide $ in today's dollars at her full retirement age of Liz would like to retire at age and plan for a life expectancy of years. She estimates that inflation will be and that she will earn on investments prior to retirement and will earn on investments during retirement. What amount does Liz need to save at the end of each year in order to reach her retirement goal if she currently has $ in her

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started