Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LJS Co. faces increasing needs for capital Fortunately it has an AA credit rating. The corporate tax rate is 40 percent The firm's financial

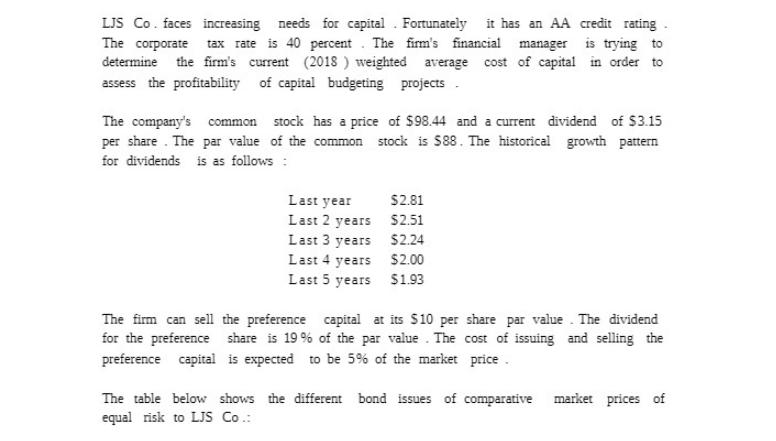

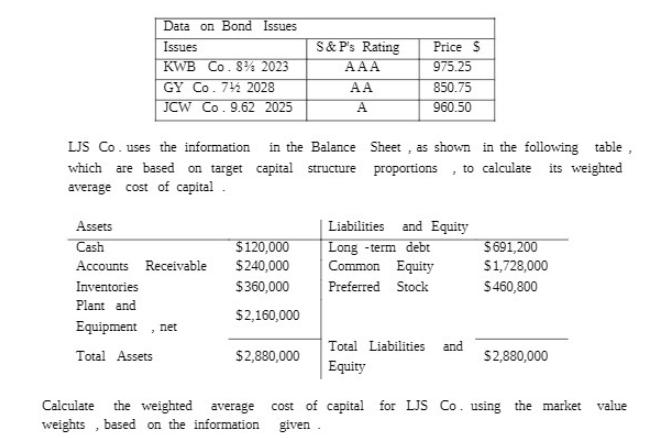

LJS Co. faces increasing needs for capital Fortunately it has an AA credit rating. The corporate tax rate is 40 percent The firm's financial manager is trying to determine the firm's current (2018) weighted average cost of capital in order to assess the profitability of capital budgeting projects. The company's common stock has a price of $98.44 and a current dividend of $3.15 per share. The par value of the common stock is $88. The historical growth pattern for dividends is as follows: Last year $2.81 Last 2 years $2.51 Last 3 years $2.24 Last 4 years $2.00 Last 5 years $1.93 The firm can sell the preference capital at its $10 per share par value The dividend for the preference share is 19% of the par value The cost of issuing and selling the preference capital is expected to be 5% of the market price. The table below shows the different bond issues of comparative equal risk to LJS Co.: market prices of Data on Bond Issues Issues S&P's Rating Price $ KWB Co. 8% 2023 AAA 975.25 GY Co. 7 2028 AA 850.75 JCW Co. 9.62 2025 A 960.50 LJS Co. uses the information in the Balance Sheet, as shown in the following table, which are based on target capital structure proportions, to calculate its weighted average cost of capital. Assets Liabilities and Equity Cash $120,000 Long-term debt $691,200 Accounts Receivable $240,000 Common Equity $1,728,000 Inventories $360,000 Preferred Stock $460,800 Plant and $2,160,000 Equipment net Total Liabilities and Total Assets $2,880,000 $2,880,000 Equity Calculate the weighted average cost of capital for LJS Co. using the market value weights, based on the information given.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the weighted average cost of capital WACC for LJS Co we need to find the cost of each component of capital and then weight them based on their market values 1 Cost of Common Equity Given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started