Question

LKQ Ltd, a Hong Kong corporation, incurred the following capital transactions during the year ended 31 December 2019: Proceeds from sale of tractors (AA30%; purchase

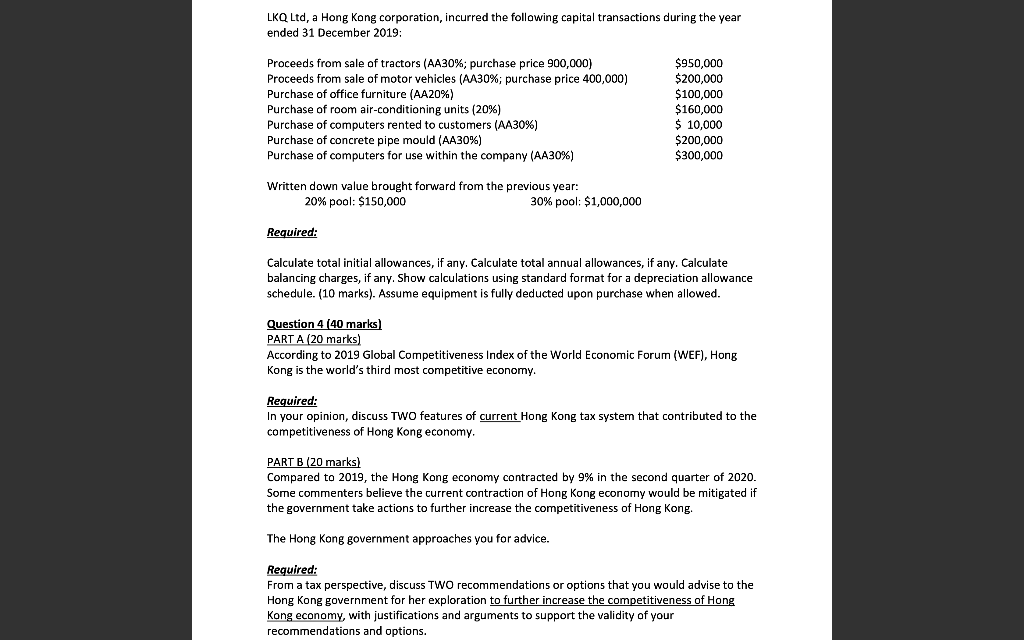

LKQ Ltd, a Hong Kong corporation, incurred the following capital transactions during the year ended 31 December 2019:

Proceeds from sale of tractors (AA30%; purchase price 900,000) Proceeds from sale of motor vehicles (AA30%; purchase price 400,000) Purchase of office furniture (AA20%) Purchase of room air-conditioning units (20%) Purchase of computers rented to customers (AA30%) Purchase of concrete pipe mould (AA30%) Purchase of computers for use within the company (AA30%)

Written down value brought forward from the previous year: 20% pool: $150,000 30% pool: $1,000,000

Required:

$950,000 $200,000 $100,000 $160,000 $ 10,000 $200,000 $300,000

Calculate total initial allowances, if any. Calculate total annual allowances, if any. Calculate balancing charges, if any. Show calculations using standard format for a depreciation allowance schedule. (10 marks). Assume equipment is fully deducted upon purchase when allowed.

LKQ Ltd, a Hong Kong corporation, incurred the following capital transactions during the year ended 31 December 2019: Proceeds from sale of tractors (AA 30%; purchase price 900,000) Proceeds from sale of motor vehicles (AA30%; purchase price 400,000) Purchase of office furniture (AA20%) Purchase of room air-conditioning units (20%) Purchase of computers rented to customers (AA 30%) Purchase of concrete pipe mould (AA 30%) Purchase of computers for use within the company (AA 30%) $950,000 $200,000 $100,000 $160,000 $ 10,000 $200,000 $300,000 Written down value brought forward from the previous year: 20% pool: $150,000 30% pool: $1,000,000 Required: Calculate total initial allowances, if any. Calculate total annual allowances, if any. Calculate balancing charges, if any. Show calculations using standard format for a depreciation allowance schedule. (10 marks). Assume equipment is fully deducted upon purchase when allowed. Question 4 (40 marks) PARTA (20 marks) According to 2019 Global Competitiveness Index of the World Economic Forum (WEF), Hong Kong is the world's third most competitive economy. Required: In your opinion, discuss TWO features of current Hong Kong tax system that contributed to the competitiveness of Hong Kong economy. PART B (20 marks) Compared to 2019, the Hong Kong economy contracted by 9% in the second quarter of 2020. Some commenters believe the current contraction of Hong Kong economy would be mitigated if the government take actions to further increase the competitiveness of Hong Kong. The Hong Kong government approaches you for advice. Required: From a tax perspective, discuss TWO recommendations or options that you would advise to the Hong Kong government for her exploration to further increase the competitiveness of Hong Kong economy, with justifications and arguments to support the validity of your recommendations and options. LKQ Ltd, a Hong Kong corporation, incurred the following capital transactions during the year ended 31 December 2019: Proceeds from sale of tractors (AA 30%; purchase price 900,000) Proceeds from sale of motor vehicles (AA30%; purchase price 400,000) Purchase of office furniture (AA20%) Purchase of room air-conditioning units (20%) Purchase of computers rented to customers (AA 30%) Purchase of concrete pipe mould (AA 30%) Purchase of computers for use within the company (AA 30%) $950,000 $200,000 $100,000 $160,000 $ 10,000 $200,000 $300,000 Written down value brought forward from the previous year: 20% pool: $150,000 30% pool: $1,000,000 Required: Calculate total initial allowances, if any. Calculate total annual allowances, if any. Calculate balancing charges, if any. Show calculations using standard format for a depreciation allowance schedule. (10 marks). Assume equipment is fully deducted upon purchase when allowed. Question 4 (40 marks) PARTA (20 marks) According to 2019 Global Competitiveness Index of the World Economic Forum (WEF), Hong Kong is the world's third most competitive economy. Required: In your opinion, discuss TWO features of current Hong Kong tax system that contributed to the competitiveness of Hong Kong economy. PART B (20 marks) Compared to 2019, the Hong Kong economy contracted by 9% in the second quarter of 2020. Some commenters believe the current contraction of Hong Kong economy would be mitigated if the government take actions to further increase the competitiveness of Hong Kong. The Hong Kong government approaches you for advice. Required: From a tax perspective, discuss TWO recommendations or options that you would advise to the Hong Kong government for her exploration to further increase the competitiveness of Hong Kong economy, with justifications and arguments to support the validity of your recommendations and optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started