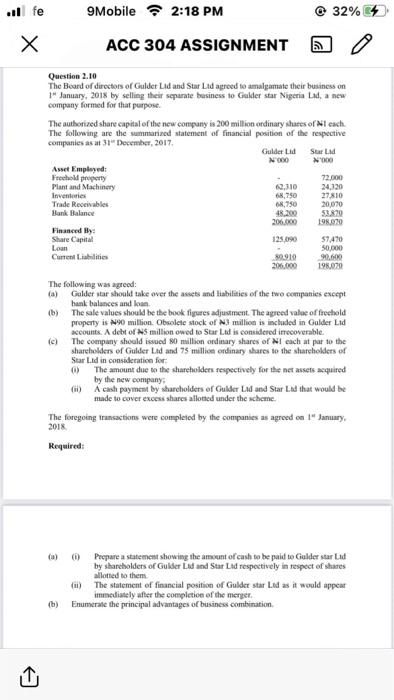

ll fe 9Mobile 2:18 PM 32% 4 ACC 304 ASSIGNMENT 68.750 27.810 Question 2.10 The Board of directors of Gulder Lad and Star Lid agreed te amalgamate their business on 14 January, 2018 by selling their separate business to Gulder star Nigeria Lada new company formed for that purpose. The authorized share capital of the new company is 200 million ordinary shares of Nl each The following are the summarized statement of financial position of the respective companies as at 31 December, 2017 Gulder Led Star Led N000 N000 Asset Employed Freeho porty 72.000 Plant and Machinery 2.310 24,720 Inventaries Trade Receivables 68,750 20,070 Bank Balance 48.200 51.820 206.000 198.070 Financed by Share Capital 125.090 57.470 Loan 50,000 Current Liabilities 30919 90.600 26.000 198.070 The following was agreed Galder star should take over the assets and liabilities of the two companies except hank balances and loan (b) The sale values should be the book figures adjustment. The agreed value of freehold property is N90 million. Obsolete stock of million is included in Gulder Lid accounts. A debt of NS million owed to Star Lid is considered irrecoverable. (c) The company should issued 80 million ordinary shares of NI each at par to the shareholders of Gulder Led and 75 million ordinary shares to the shareholders of Star Lid in consideration for The amount due to the shareholders respectively for the net assets acquired by the new company: (0) A cash payment by shareholders of Gulder Lad and Star Lid that would be made to cover excess shares allotted under the scheme The foregoing transactions were completed by the companies as agreed on 19 January 2018 c) Required: (3) ) Prepare a statement showing the amount of cash to be paid to Galder stard by shareholders of Gulder Lad and Star Led respectively in respect of shares slotted to them. () The statement of financial position of Gulder star Lod as it would appear immediately after the completion of the merger. Enumerate the principal advantages of business combination (b) ll fe 9Mobile 2:18 PM 32% 4 ACC 304 ASSIGNMENT 68.750 27.810 Question 2.10 The Board of directors of Gulder Lad and Star Lid agreed te amalgamate their business on 14 January, 2018 by selling their separate business to Gulder star Nigeria Lada new company formed for that purpose. The authorized share capital of the new company is 200 million ordinary shares of Nl each The following are the summarized statement of financial position of the respective companies as at 31 December, 2017 Gulder Led Star Led N000 N000 Asset Employed Freeho porty 72.000 Plant and Machinery 2.310 24,720 Inventaries Trade Receivables 68,750 20,070 Bank Balance 48.200 51.820 206.000 198.070 Financed by Share Capital 125.090 57.470 Loan 50,000 Current Liabilities 30919 90.600 26.000 198.070 The following was agreed Galder star should take over the assets and liabilities of the two companies except hank balances and loan (b) The sale values should be the book figures adjustment. The agreed value of freehold property is N90 million. Obsolete stock of million is included in Gulder Lid accounts. A debt of NS million owed to Star Lid is considered irrecoverable. (c) The company should issued 80 million ordinary shares of NI each at par to the shareholders of Gulder Led and 75 million ordinary shares to the shareholders of Star Lid in consideration for The amount due to the shareholders respectively for the net assets acquired by the new company: (0) A cash payment by shareholders of Gulder Lad and Star Lid that would be made to cover excess shares allotted under the scheme The foregoing transactions were completed by the companies as agreed on 19 January 2018 c) Required: (3) ) Prepare a statement showing the amount of cash to be paid to Galder stard by shareholders of Gulder Lad and Star Led respectively in respect of shares slotted to them. () The statement of financial position of Gulder star Lod as it would appear immediately after the completion of the merger. Enumerate the principal advantages of business combination (b)