Question

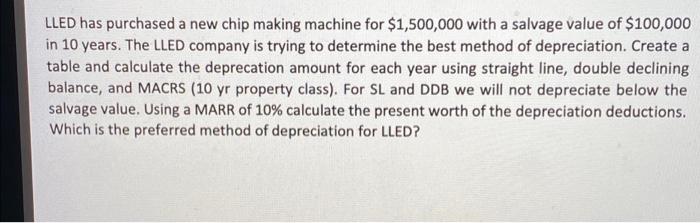

LLED has purchased a new chip making machine for $1,500,000 with a salvage value of $100,000 in 10 years. The LLED company is trying

LLED has purchased a new chip making machine for $1,500,000 with a salvage value of $100,000 in 10 years. The LLED company is trying to determine the best method of depreciation. Create a table and calculate the deprecation amount for each year using straight line, double declining balance, and MACRS (10 yr property class). For SL and DDB we will not depreciate below the salvage value. Using a MARR of 10% calculate the present worth of the depreciation deductions. Which is the preferred method of depreciation for LLED?

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Straightline method In straightline method the depreciable cost of the asset is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Management Science Quantitative Approaches To Decision Making

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

13th Edition

9781111532246, 1111532222, 1111532249, 978-1111532222

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App