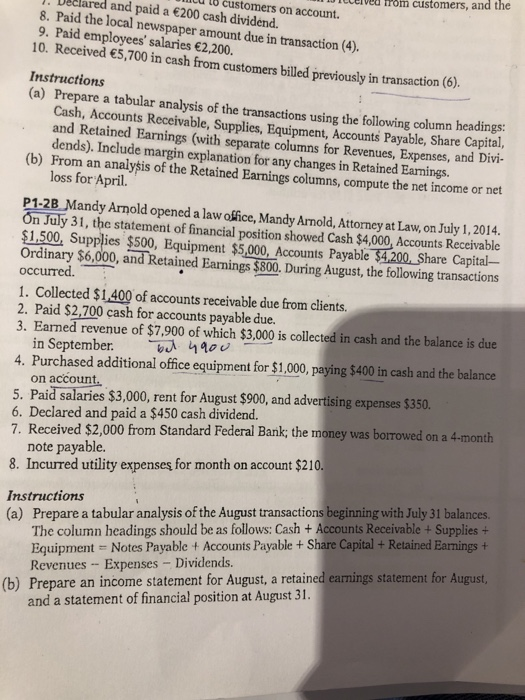

lleived from customers, and the cu o customers on account. 3. Declared and paid a 200 cash dividend. 8. Paid the local newspaper amount due in transaction (4). 9. Paid employees' salaries 2,200. 10. Received 5,700 in cash from customers billed previously in transaction (0). Instructions (a) Prepare a tabular analysis of the transactions using the following column headings. Cash, Accounts Receivable, Supplies, Equipment, Accounts Payable, Share Capital, and Retained Earnings (with separate columns for Revenues, Expenses, and Divi- dends). Include margin explanation for any changes in Retained Eamings. (b) From an analysis of the Retained Earnings columns, compute the net income or net loss for April P1-2B Mandy Arnold opened a law office, Mandy Arnold, Attorney at Law, on July 1, 2014. On July 31, the statement of financial position showed Cash $4,000, Accounts Receivable $1,500, Supplies $500, Equipment $5,000, Accounts Payable $4,200. Share Capital- Ordinary $6,000, and Retained Earnings $800. During August, the following transactions occurred. 1. Collected $1,400 of accounts receivable due from clients. 2. Paid $2,700 cash for accounts payable due. 3. Earned revenue of $7,900 of which $3,000 is collected in cash and the balance is due in September. 4900 4. Purchased additional office equipment for $1,000, paying $400 in cash and the balance on account. 5. Paid salaries $3,000, rent for August $900, and advertising expenses $350. 6. Declared and paid a $450 cash dividend. 7. Received $2,000 from Standard Federal Bank; the money was borrowed on a 4-month note payable. 8. Incurred utility expenses for month on account $210. Instructions (a) Prepare a tabular analysis of the August transactions beginning with July 31 balance The column headings should be as follows: Cash + Accounts Receivable + Supplies + Equipment - Notes Payable + Accounts Payable+ Share Capital + Retained Earnings + Revenues -- Expenses - Dividends. (b) Prepare an income statement for August, a retained earnings statement for August, and a statement of financial position at August 31