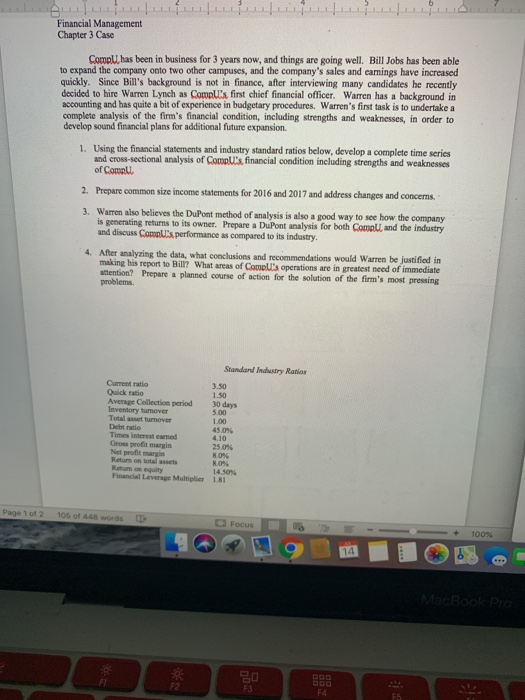

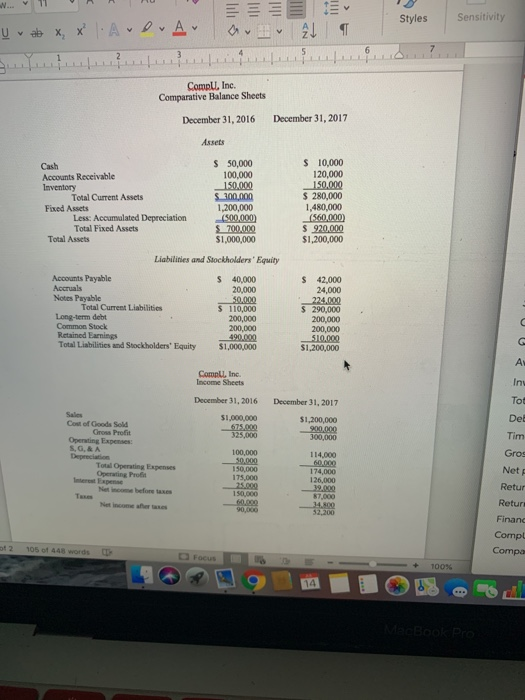

LLLLLLLLL LLLLLLLLL Financial Management Chapter 3 Case Comp has been in business for 3 years now, and things are going well. Bill Jobs has been able to expand the company onto two other campuses, and the company's sales and carings have increased quickly. Since Bill's background is not in finance, after interviewing many candidates he recently decided to hire Warren Lynch as Compu's first chief financial officer. Warren has a background in accounting and has quite a bit of experience in budgetary procedures. Warren's first task is to undertake a complete analysis of the firm's financial condition, including strengths and weaknesses, in order to develop sound financial plans for additional future expansion 1. Using the financial statements and industry standard ratios below, develop a complete time series and cross-sectional analysis of Com s, financial condition including strengths and weaknesses of Compul 2. Prepare common sire income statements for 2016 and 2017 and address changes and concerns. 3. Warren also believes the DuPont method of analysis is also a good way to see how the company is generating returns to its owner. Prepare a DuPont analysis for both Comp and the industry and discuss Compus performance compared to its industry. 4. Aher analyzing the data, what conclusions and recommendations would Warren be justified in making his report to Bill? What areas of Compusoperations are in greatest need of immediate attention? Prepare a planned course of action for the solution of the firm's most pressing problems Standard Industry Ratio Cum days Avenge Collectie period Inventory tumover Total asset turnover Det ratio Times interes med 45.096 410 Financial Leverage Multiplier 14.sons 18 OF 100% g 14 02 FA N 11 RAHU Styles Sensitivity Uab X, X ADAT Compul, Inc. Comparative Balance Sheets December 31, 2016 December 31, 2017 Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Less: Accumulated Depreciation Total Fixed Assets Total Assets $ 50,000 100.000 150,000 $ 300,000 1,200,000 (500,000) $ 700.000 $1,000,000 $ 10,000 120,000 150.000 $ 280,000 1.480.000 (560,000) $ 920.000 $1.200.000 Liabilities and Stockholders' Equity Accounts Payable Accruals Notes Payable Total Current Liabilities Long-term debt Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $ 40.000 20,000 50.000 $ 110,000 200,000 200,000 490,000 $1,000,000 $ 42,000 24,000 224,000 $ 290,000 200,000 200,000 510,000 $1,200,000 Compl. Inc Income Sheets December 31, 2016 December 31, 2017 $1.000.000 675.000 325,000 $1,200,000 900,000 300.000 Sales Cost of Goods Sold Cross Profit Operating Expenses S. , & A Depreciation Total Operating Expenses Operating Profit 100,000 150.000 175.000 114.000 60.000 174.000 126.000 Tot Dec Tim Gros Net Retur Retur Finand Compu Compa Netice before taxes 87.000 2 105 of 443 words 100%