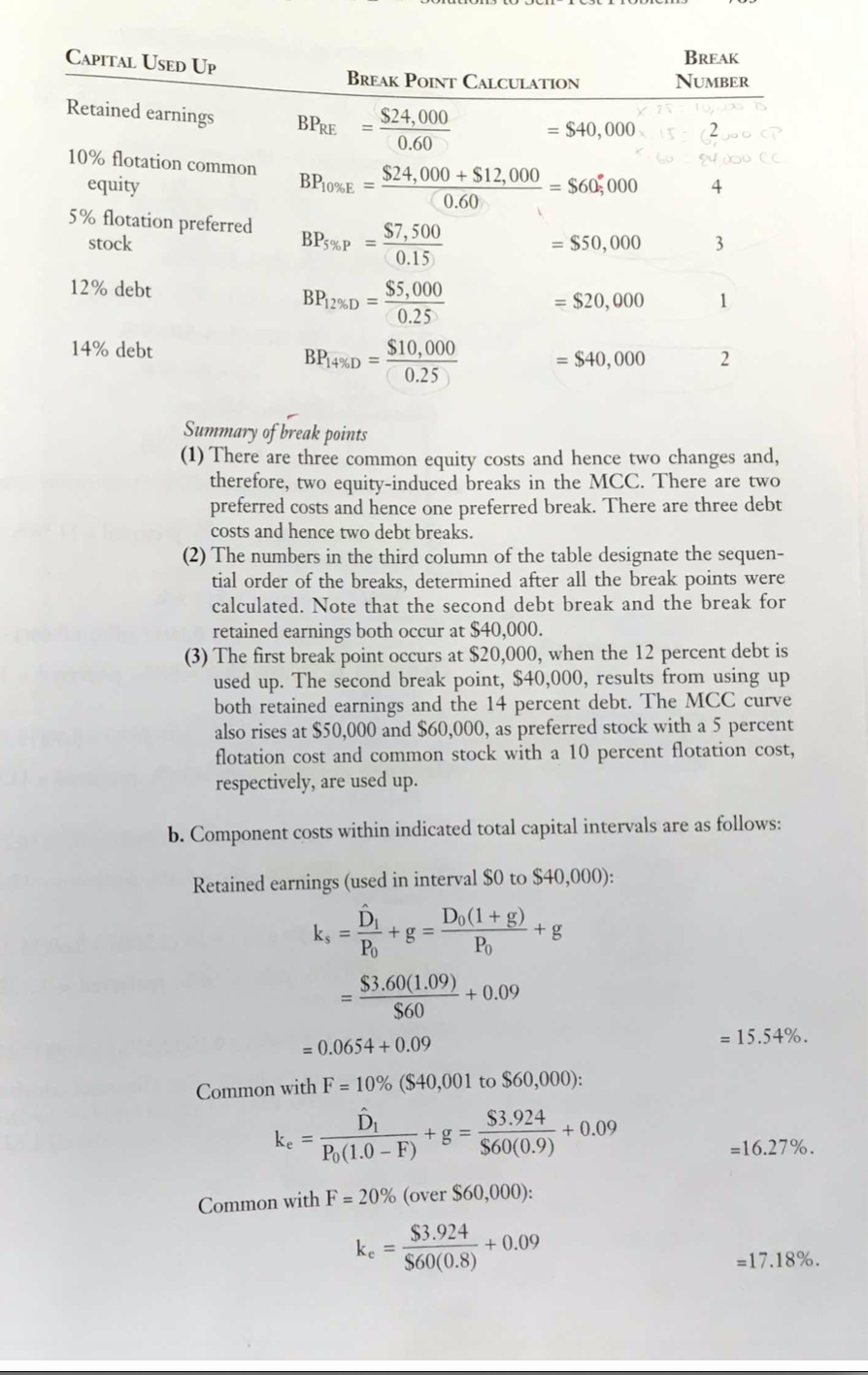

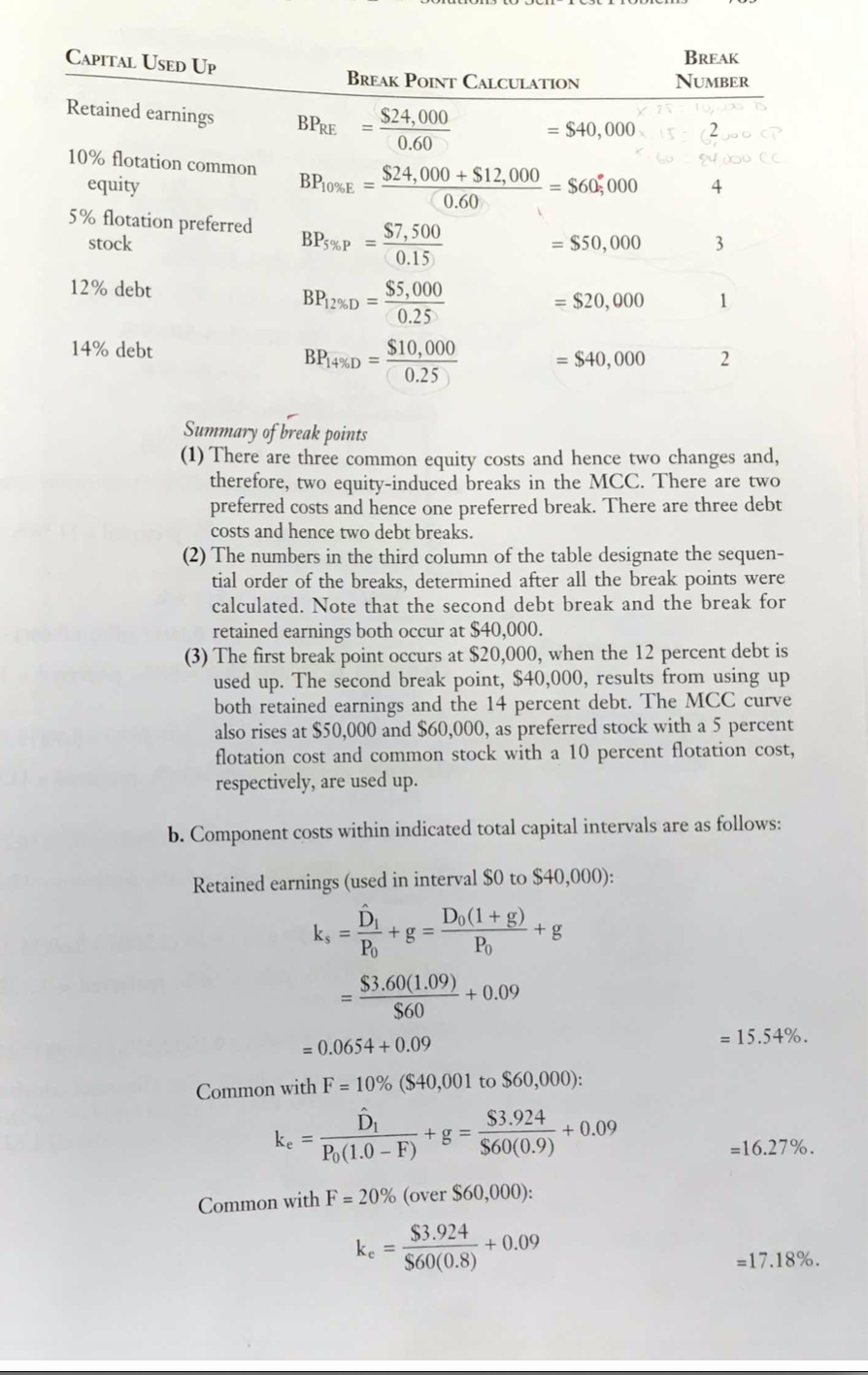

LLO LUCILLICI CAPITAL USED UP BREAK POINT CALCULATION BREAK NUMBER Retained earnings BPRE $24,000 10% flotation common = $40,0005 2200 0.60 DODONC - $24,000 + $12,000 0 = $60,000 sa 0.60 equity BP 5% flotation preferred stock BP5% - $7,500 = $50,000 0.15 12% debt BP12%D = $5,000 = $20,000 14% debt 0.25 $10,000 BP 4%D = 0.25 = $40,000 2 Summary of break points (1) There are three common equity costs and hence two changes and, therefore, two equity-induced breaks in the MCC. There are two preferred costs and hence one preferred break. There are three debt costs and hence two debt breaks. (2) The numbers in the third column of the table designate the sequen- tial order of the breaks, determined after all the break points were calculated. Note that the second debt break and the break for retained earnings both occur at $40,000. (3) The first break point occurs at $20,000, when the 12 percent debt is used up. The second break point, $40,000, results from using up both retained earnings and the 14 percent debt. The MCC curve also rises at $50,000 and $60,000, as preferred stock with a 5 percent flotation cost and common stock with a 10 percent flotation cost, respectively, are used up. b. Component costs within indicated total capital intervals are as follows: Retained earnings (used in interval $0 to $40,000): . D. Do(1 + g). k = P8 P8 + g = $3.60(1.09) +0.09 = 15.54%. $60 = 0.0654 +0.09 Common with F = 10% ($40,001 to $60,000): $3.924 ke = P. (1.0 - F) 8 $60(0.9) Di_ +g= 560(0.9) - + 0.09 =16.27% Common with F = 20% (over $60,000): $3.924 ke = S60(0.8) +0.09 =17.18% LLO LUCILLICI CAPITAL USED UP BREAK POINT CALCULATION BREAK NUMBER Retained earnings BPRE $24,000 10% flotation common = $40,0005 2200 0.60 DODONC - $24,000 + $12,000 0 = $60,000 sa 0.60 equity BP 5% flotation preferred stock BP5% - $7,500 = $50,000 0.15 12% debt BP12%D = $5,000 = $20,000 14% debt 0.25 $10,000 BP 4%D = 0.25 = $40,000 2 Summary of break points (1) There are three common equity costs and hence two changes and, therefore, two equity-induced breaks in the MCC. There are two preferred costs and hence one preferred break. There are three debt costs and hence two debt breaks. (2) The numbers in the third column of the table designate the sequen- tial order of the breaks, determined after all the break points were calculated. Note that the second debt break and the break for retained earnings both occur at $40,000. (3) The first break point occurs at $20,000, when the 12 percent debt is used up. The second break point, $40,000, results from using up both retained earnings and the 14 percent debt. The MCC curve also rises at $50,000 and $60,000, as preferred stock with a 5 percent flotation cost and common stock with a 10 percent flotation cost, respectively, are used up. b. Component costs within indicated total capital intervals are as follows: Retained earnings (used in interval $0 to $40,000): . D. Do(1 + g). k = P8 P8 + g = $3.60(1.09) +0.09 = 15.54%. $60 = 0.0654 +0.09 Common with F = 10% ($40,001 to $60,000): $3.924 ke = P. (1.0 - F) 8 $60(0.9) Di_ +g= 560(0.9) - + 0.09 =16.27% Common with F = 20% (over $60,000): $3.924 ke = S60(0.8) +0.09 =17.18%