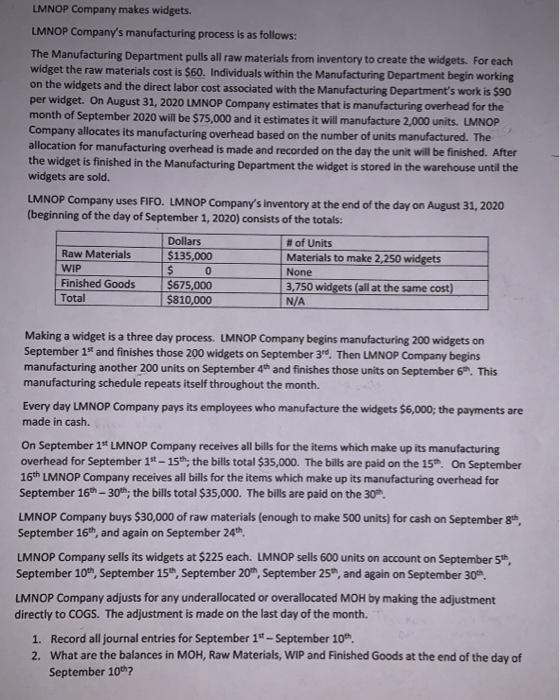

LMNOP Company makes widgets. LMNOP Company's manufacturing process is as follows: The Manufacturing Department pulls all raw materials from inventory to create the widgets. For each widget the raw materials cost is $60. Individuals within the Manufacturing Department begin working on the widgets and the direct labor cost associated with the Manufacturing Department's work is $90 per widget. On August 31, 2020 LMNOP Company estimates that is manufacturing overhead for the month of September 2020 will be $75,000 and it estimates it will manufacture 2,000 units. LMNOP Company allocates its manufacturing overhead based on the number of units manufactured. The allocation for manufacturing overhead is made and recorded on the day the unit will be finished. After the widget is finished in the Manufacturing Department the widget is stored in the warehouse until the widgets are sold. LMNOP Company uses FIFO. LMNOP Company's inventory at the end of the day on August 31, 2020 (beginning of the day of September 1, 2020) consists of the totals: Dollars # of Units Raw Materials $135,000 Materials to make 2,250 widgets WIP $ 0 None Finished Goods $675,000 3,750 widgets (all at the same cost) Total $810,000 N/A Making a widget is a three day process. LMNOP Company begins manufacturing 200 widgets on September 19 and finishes those 200 widgets on September 30. Then LMNOP Company begins manufacturing another 200 units on September 4th and finishes those units on September 6. This manufacturing schedule repeats itself throughout the month. Every day LMNOP Company pays its employees who manufacture the widgets $6,000; the payments are made in cash. On September 1* LMNOP Company receives all bills for the items which make up its manufacturing overhead for September 1st - 15th, the bills total $35,000. The bills are paid on the 15th. On September 16th LMNOP Company receives all bills for the items which make up its manufacturing overhead for September 16th - 30th, the bills total $35,000. The bills are paid on the 30 LMNOP Company buys $30,000 of raw materials (enough to make 500 units) for cash on September 8, September 16th, and again on September 24th. LMNOP Company sells its widgets at $225 each. LMNOP sells 600 units on account on September 5, September 10, September 15, September 2015, September 25", and again on September 30h. LMNOP Company adjusts for any underallocated or overallocated MOH by making the adjustment directly to COGS. The adjustment is made on the last day of the month. 1. Record all journal entries for September 14 - September 10 2. What are the balances in MOH, Raw Materials, WIP and Finished Goods at the end of the day of September 10th? LMNOP Company makes widgets. LMNOP Company's manufacturing process is as follows: The Manufacturing Department pulls all raw materials from inventory to create the widgets. For each widget the raw materials cost is $60. Individuals within the Manufacturing Department begin working on the widgets and the direct labor cost associated with the Manufacturing Department's work is $90 per widget. On August 31, 2020 LMNOP Company estimates that is manufacturing overhead for the month of September 2020 will be $75,000 and it estimates it will manufacture 2,000 units. LMNOP Company allocates its manufacturing overhead based on the number of units manufactured. The allocation for manufacturing overhead is made and recorded on the day the unit will be finished. After the widget is finished in the Manufacturing Department the widget is stored in the warehouse until the widgets are sold. LMNOP Company uses FIFO. LMNOP Company's inventory at the end of the day on August 31, 2020 (beginning of the day of September 1, 2020) consists of the totals: Dollars # of Units Raw Materials $135,000 Materials to make 2,250 widgets WIP $ 0 None Finished Goods $675,000 3,750 widgets (all at the same cost) Total $810,000 N/A Making a widget is a three day process. LMNOP Company begins manufacturing 200 widgets on September 19 and finishes those 200 widgets on September 30. Then LMNOP Company begins manufacturing another 200 units on September 4th and finishes those units on September 6. This manufacturing schedule repeats itself throughout the month. Every day LMNOP Company pays its employees who manufacture the widgets $6,000; the payments are made in cash. On September 1* LMNOP Company receives all bills for the items which make up its manufacturing overhead for September 1st - 15th, the bills total $35,000. The bills are paid on the 15th. On September 16th LMNOP Company receives all bills for the items which make up its manufacturing overhead for September 16th - 30th, the bills total $35,000. The bills are paid on the 30 LMNOP Company buys $30,000 of raw materials (enough to make 500 units) for cash on September 8, September 16th, and again on September 24th. LMNOP Company sells its widgets at $225 each. LMNOP sells 600 units on account on September 5, September 10, September 15, September 2015, September 25", and again on September 30h. LMNOP Company adjusts for any underallocated or overallocated MOH by making the adjustment directly to COGS. The adjustment is made on the last day of the month. 1. Record all journal entries for September 14 - September 10 2. What are the balances in MOH, Raw Materials, WIP and Finished Goods at the end of the day of September 10th