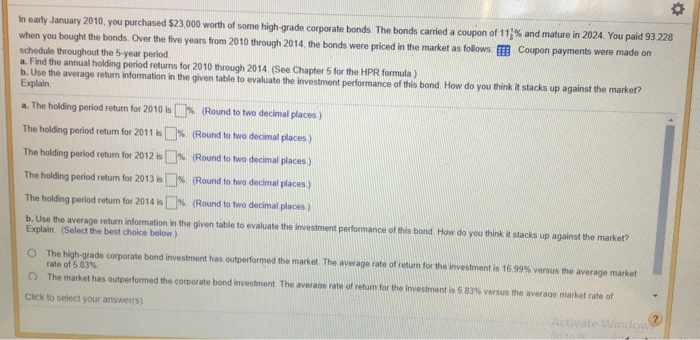

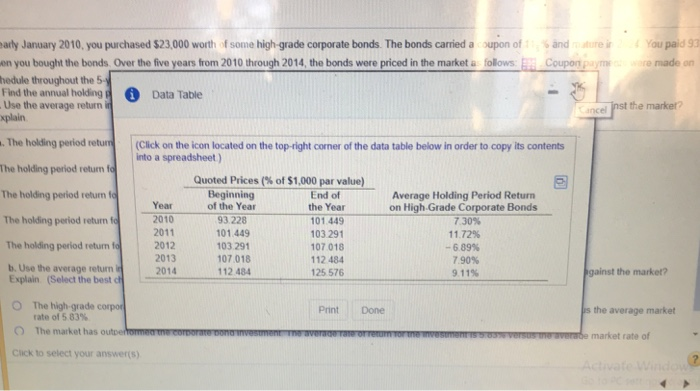

ln early January 2010, you purchased S23 000 worth of some high-rade corpora te bonds The bonds carried a coupon of 1 1;% and mature in 2024 You paid 93 228 when you bought the bonds. Over the five years from 2010 through 2014, the bonds were priced in the market as follows El Coupon payments were made on schedule throughout the 5-year period a. Find the annual holding period returns for 2010 through 2014 (See Chapter 5 for the HPR formula) b. Use the average return information in Explain. the given table to evaluate the investment performance of this bond How do you think it stacks up against the market? a. The holding period return for 2010 is % (Round to two decimal places) The holding period return for 2011 is[]%. (Round to two decimal places) The holding period return for 2012 is[]% (Round to tro decimal places) The holding period return for 2013is[1% (Round to two decimal places) The holding period return for 2014 is[ (Round to two decimal places) b. Use the average return information in the given table to evaluate the investment performance of this bond How do you think i stacks up against the market? Explain. (Select the best choice below) Thehigh-grade corporate bond investment has outperformed the market The average rate o return or the investment is 16 99% versus the average market rate of 5 83% O The market has outperformed the corporate bond investment The averaoe rate of return for he investment is S 63% versus the average market rate of Click to select your answer(s) aly January 2010, you purchased $23,000 worth of some high-grade corporate bonds. The bonds carried acoupon of s ndatre iYou paid 93 re made on en you bought the bonds Over the five years from 2010 through 2014, the bonds were priced in the market a followsCoupont pa hedule throughout the 5- Find the annual holding Data Table Use the average return i xplain incel inst the marker? The holding period retumClick on the icon located on the top-right coner of the data table below in order to copy its contents The holding period returm fo The holding period return f The holding period return fo111 The holding period return fo into a spreadsheet) Quoted Prices (% of $1,000 par value) Year Beginning 2010 End of the Year 101.449 103.291 107 018 112 484 125 576 Average Holding Period Return on High.Grade Corporate Bonds of the Year 93 228 101.449 103.291 107.018 12 484 7 30% 11 7296 -689% 790% 9 11% 2012 2013 b. Use the average return ir gainst the market? Explain (Select the best 2014112 40 O The high grade corpor O The market has outpertomme Click to select your answer(s) Print Done s the average market rate of 5 83% e market rate of