Answered step by step

Verified Expert Solution

Question

1 Approved Answer

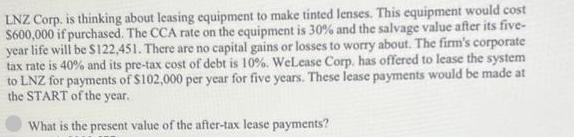

LNZ Corp. is thinking about leasing equipment to make tinted lenses. This equipment would cost $600,000 if purchased. The CCA rate on the equipment

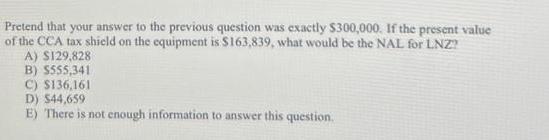

LNZ Corp. is thinking about leasing equipment to make tinted lenses. This equipment would cost $600,000 if purchased. The CCA rate on the equipment is 30% and the salvage value after its five- year life will be $122,451. There are no capital gains or losses to worry about. The firm's corporate tax rate is 40% and its pre-tax cost of debt is 10%. WeLease Corp, has offered to lease the system to LNZ for payments of $102,000 per year for five years. These lease payments would be made at the START of the year. What is the present value of the after-tax lease payments? Pretend that your answer to the previous question was exactly $300,000. If the present value of the CCA tax shield on the equipment is $163,839, what would be the NAL for LNZ? A) $129,828 B) $555,341 C) $136,161 D) $44,659 E) There is not enough information to answer this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the present value of the a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started