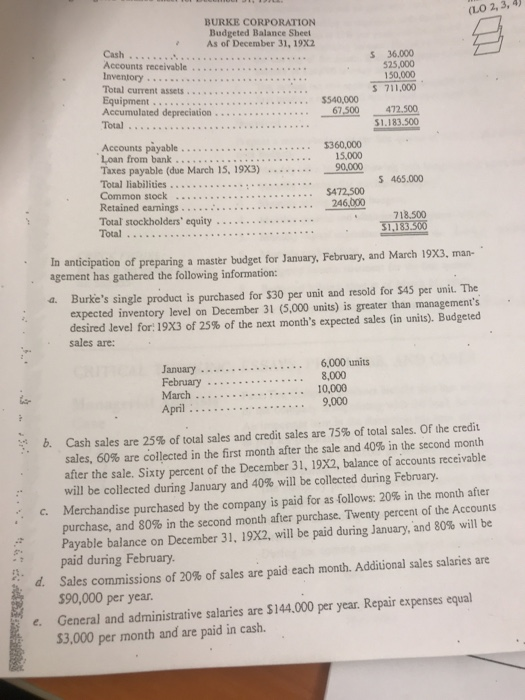

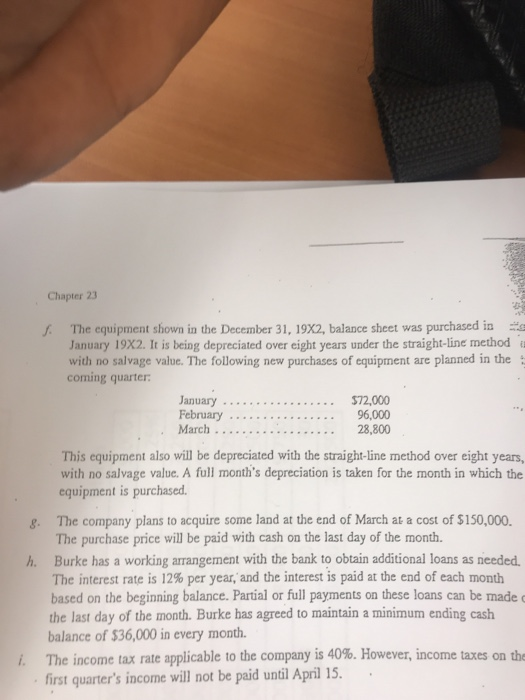

(LO 2, 3, 4) BURKE CORPORATION Budgeted Balance Sheet As of December 31, 19x2 Cash 36.000 525,000 150,000 S 711,000 Accounts receivable Inventory Equipment Total Loan from bank ...67.500472.500 51.183.500 $360,000 15,000 90.000 Taxes payable (due March 15, 19X3) Total liabilities Common stock 5 465.000 Retained earnings Total stockholders' equity 246,000 718.500 51,183.500 ticipation of preparing a master budget for January, February, and March 19X3, man- agement has gathered the following information: a Burke's single product is purchased for s30 per unit and resold for $45 per unit. The expected inventory level on December 31 (5,000 units) is greater than management's desired level for: 19X3 of 25% of the next month's expected sales (in units). Budgeted sales are: 10,000 9,000 March April Cash sales are 25% of total sales and credit sales are 75% of total sales. Of the credit sales, 60% are collected in the first month after the sale and 40% in the second month after the sale. Sixty percent of the December 31, 19x2, balance of accounts receivable will be collected during January and 40% will be collected during February. Merchandise purchased by the company is paid for as follows: 20% in the month after purchase, and 80% in the second month after purchase. Twenty percent of the Accounts Payable balance on December 31, 1992, will be paid during January, and 80% will be paid during February. Sales commissions of 20% of sales are paid each month. Additional sales salaries are 90,000 per year b. :, ", c. d. e. General and administrative salaries are $144.000 per year. Repair epenses equal 3,000 per month and are paid in cash. Chapter 23 The equipment shown in the December 31, 19X2, balance sheet was purchased in January 19x2. It is being depreciated over eight years under the straight-line method u with no salvage value. The following new purchases of equipment are planned in the comng quarter February .96,000 This equipment also will be depreciated with the straight-line method over eight years, with no salvage value. A full month's depreciation is taken for the month in which the equipment is purchased The company plans to acquire some land at the end of March at a cost of $150,000. The purchase price will be paid with cash on the last day of the month. g. h. Burke has a working arrangement with the bank to obtain additional loans as needed The interest rate is 12% per year, and the interest is paid at the end of each month based on the beginning balance. Partial or full payments on these loans can be made c the last day of the month. Burke has agreed to maintain a minimum ending cash balance of $36,000 in every month. The income tax rate applicable to the company is 40%. However, income taxes on the i. first quarter's income will not be paid until April 15