Answered step by step

Verified Expert Solution

Question

1 Approved Answer

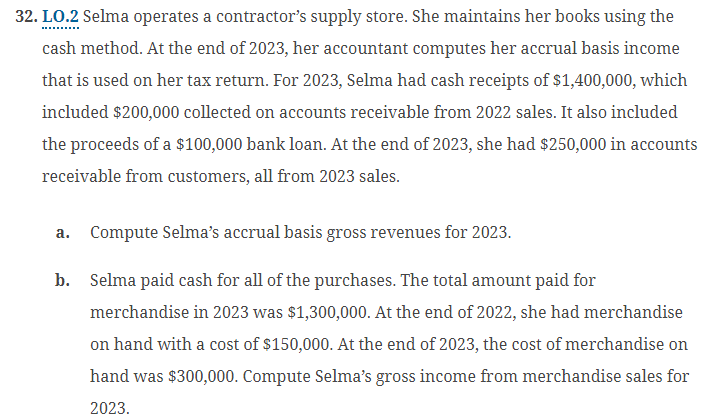

LO . 2 Selma operates a contractor's supply store. She maintains her books using the cash method. At the end of 2 0 2 3

LO Selma operates a contractor's supply store. She maintains her books using the

cash method. At the end of her accountant computes her accrual basis income

that is used on her tax return. For Selma had cash receipts of $ which

included $ collected on accounts receivable from sales. It also included

the proceeds of a $ bank loan. At the end of she had $ in accounts

receivable from customers, all from sales.

a Compute Selma's accrual basis gross revenues for

b Selma paid cash for all of the purchases. The total amount paid for

merchandise in was $ At the end of she had merchandise

on hand with a cost of $ At the end of the cost of merchandise on

hand was $ Compute Selma's gross income from merchandise sales for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started