Answered step by step

Verified Expert Solution

Question

1 Approved Answer

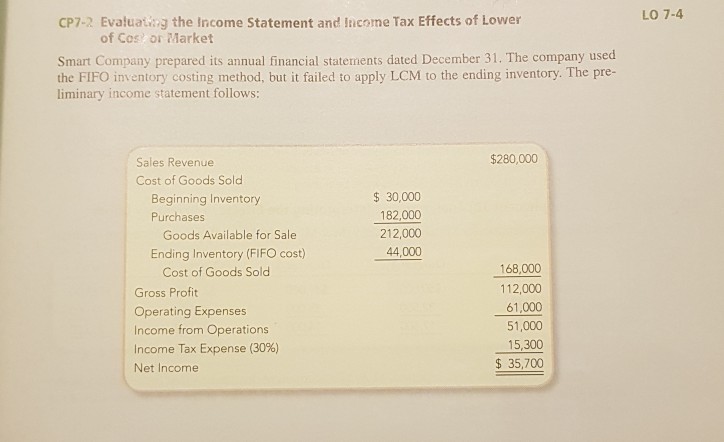

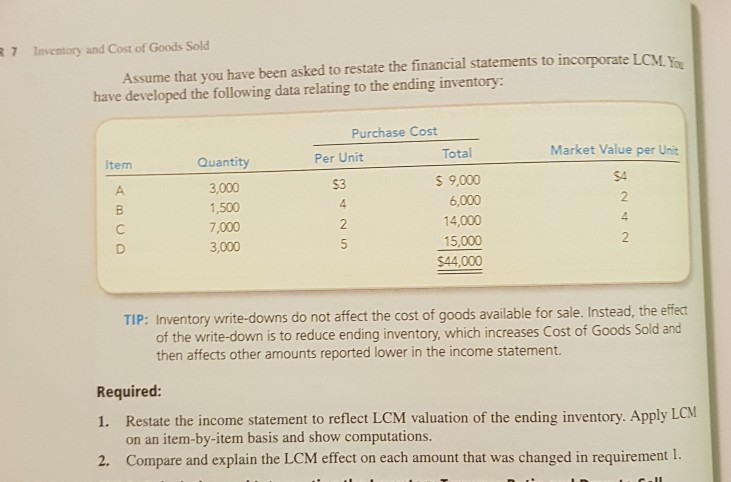

LO 7-4 CP7-2 Evaluatig the Income Statement and Income Tax Effects of Lower of Cos or Market r 31. The company used the FIFO inventory

LO 7-4 CP7-2 Evaluatig the Income Statement and Income Tax Effects of Lower of Cos or Market r 31. The company used the FIFO inventory costing method, but it failed to apply LCM to the ending inventory. The pre- liminary income statement follows $280,000 Sales Revenue Cost of Goods Sold 30,000 182,000 212,000 44,000 Beginning Inventory Purchases Goods Available for Sale Ending Inventory (FIFO cost) 168,000 112,000 61,000 51,000 15,300 35,700 Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Income Tax Expense (30%) Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started