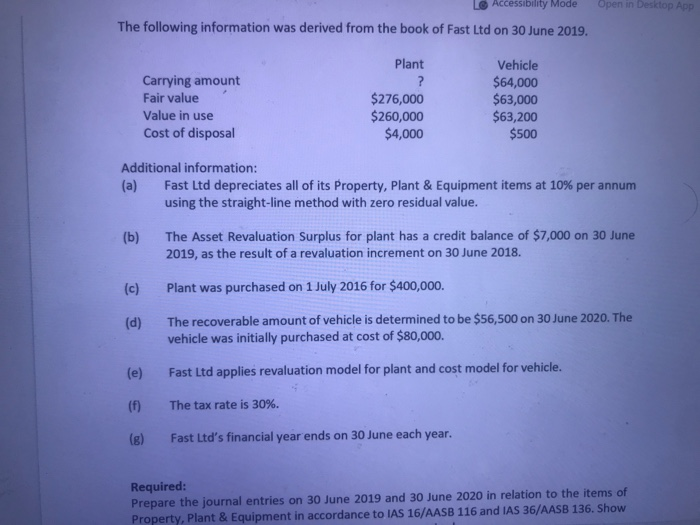

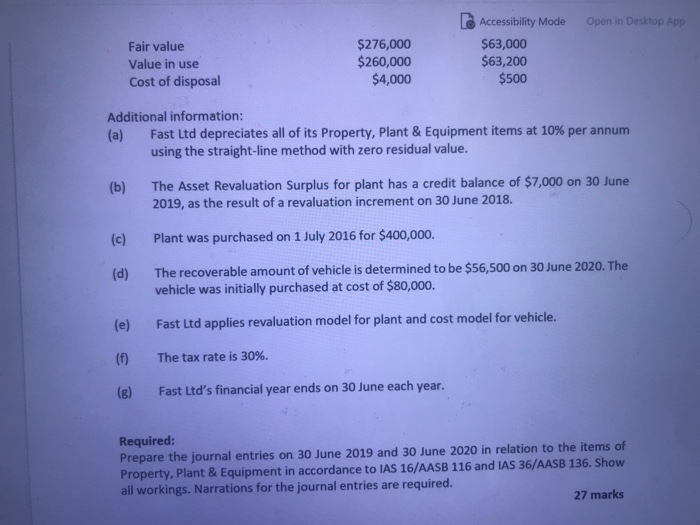

Lo Accessibility Mode Open in Desktop App The following information was derived from the book of Fast Ltd on 30 June 2019. Plant Carrying amount Fair value Value in use Cost of disposal ? $276,000 $260,000 $4,000 Vehicle $64,000 $63,000 $63,200 $500 Additional information: (a) Fast Ltd depreciates all of its Property, Plant & Equipment items at 10% per annum using the straight-line method with zero residual value. (b) The Asset Revaluation Surplus for plant has a credit balance of $7,000 on 30 June 2019, as the result of a revaluation increment on 30 June 2018. (c) Plant was purchased on 1 July 2016 for $400,000. (d) The recoverable amount of vehicle is determined to be $56,500 on 30 June 2020. The vehicle was initially purchased at cost of $80,000. (e) Fast Ltd applies revaluation model for plant and cost model for vehicle. (f) The tax rate is 30%. (8) Fast Ltd's financial year ends on 30 June each year. Required: Prepare the journal entries on 30 June 2019 and 30 June 2020 in relation to the items of Property, Plant & Equipment in accordance to IAS 16/AASB 116 and IAS 36/AASB 136. Show Open in Desktop App Fair value Value in use Cost of disposal $276,000 $260,000 $4,000 Accessibility Mode $63,000 $63,200 $500 Additional information: (a) Fast Ltd depreciates all of its Property, Plant & Equipment items at 10% per annum using the straight-line method with zero residual value. (b) The Asset Revaluation Surplus for plant has a credit balance of $7,000 on 30 June 2019, as the result of a revaluation increment on 30 June 2018. (c) Plant was purchased on 1 July 2016 for $400,000. (d) The recoverable amount of vehicle is determined to be $56,500 on 30 June 2020. The vehicle was initially purchased at cost of $80,000. (e) Fast Ltd applies revaluation model for plant and cost model for vehicle. (f) The tax rate is 30%. (8) Fast Ltd's financial year ends on 30 June each year. Required: Prepare the journal entries on 30 June 2019 and 30 June 2020 in relation to the items of Property, Plant & Equipment in accordance to IAS 16/AASB 116 and IAS 36/AASB 136. Show all workings. Narrations for the journal entries are required. 27 marks