Answered step by step

Verified Expert Solution

Question

1 Approved Answer

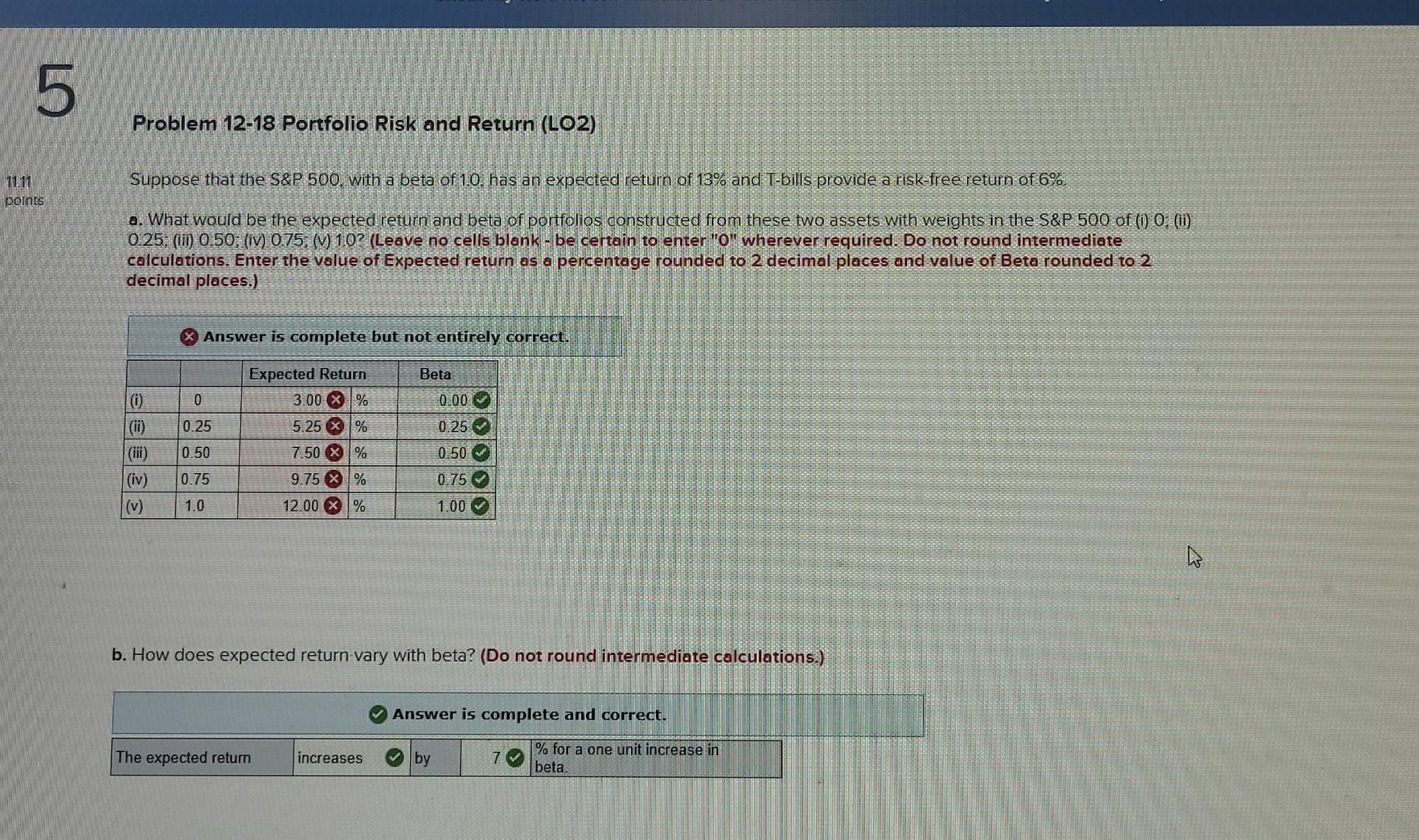

LO Problem 12-18 Portfolio Risk and Return (LO2) Suppose that the S&P 500, with a beta of 1.0. has an expected return of 13% and

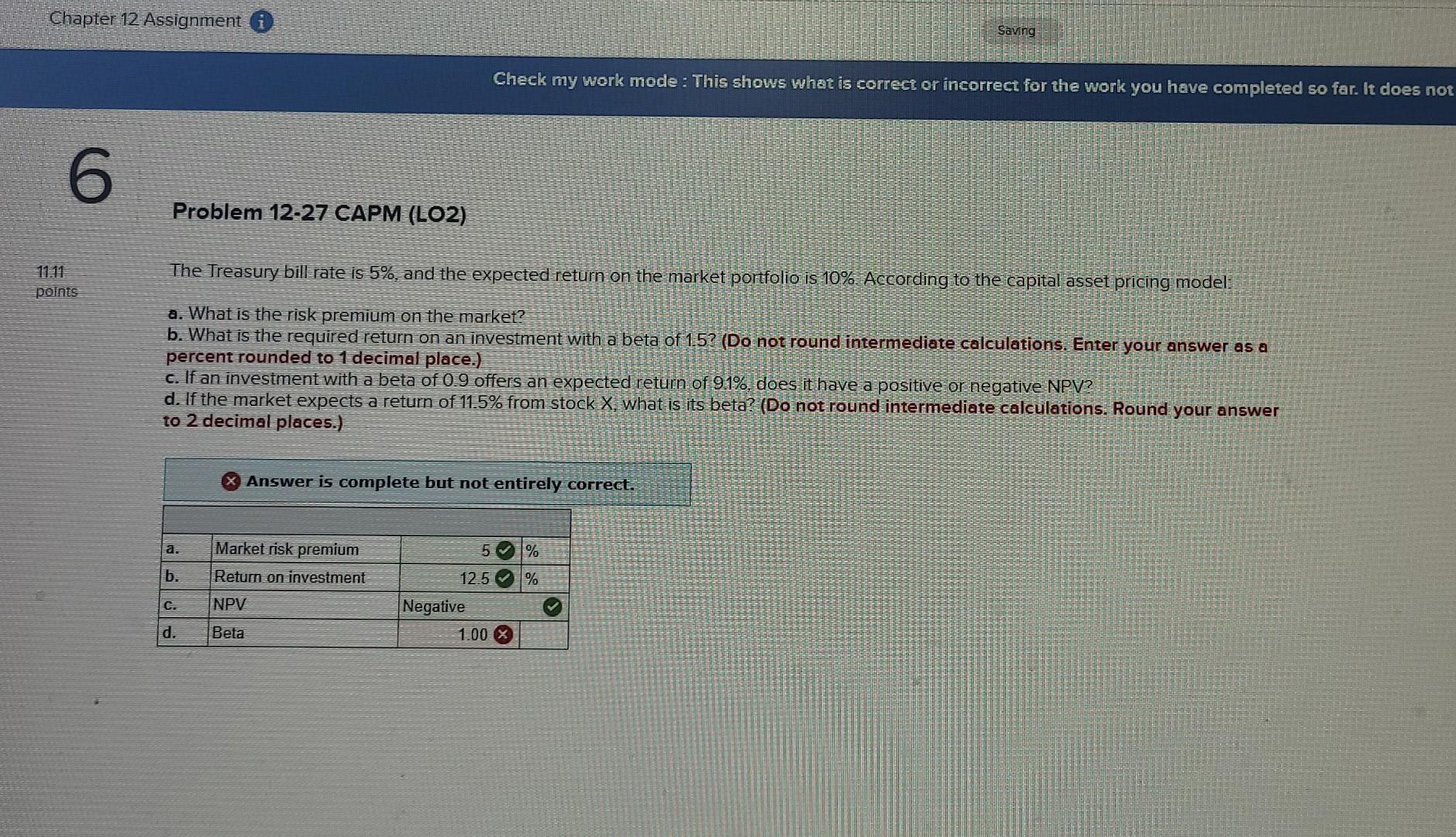

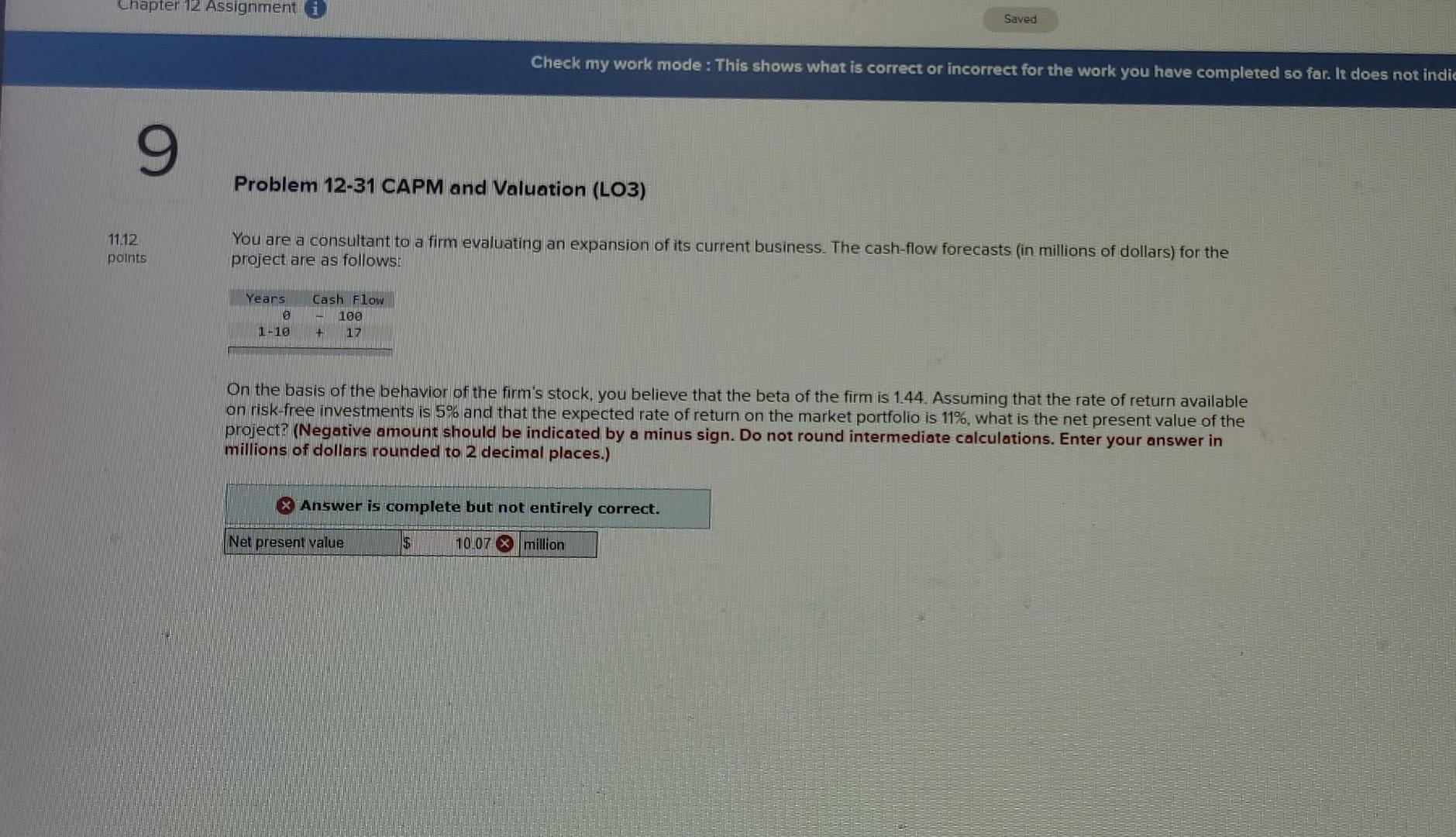

LO Problem 12-18 Portfolio Risk and Return (LO2) Suppose that the S&P 500, with a beta of 1.0. has an expected return of 13% and T-bills provide a risk-free return of 6% 11.11 points a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of (1) 0; (ii) 0.25, (iii) 0.50; (iv) 0.75; (v) 10? (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places.) & Answer is complete but not entirely correct. Beta 0 0.00 0.25 0 (ii) (ii) (iv) (v) 0.25 0.50 Expected Return 3.00 X % 5.25 % 7.50 X % 9.75 X % 12.00 X % 0.50 0.75 0.75 1.0 1.00 b. How does expected return vary with beta? (Do not round intermediate calculations.) Answer is complete and correct. The expected return increases by 7 % for a one unit increase in beta. Chapter 12 Assignment i Saving Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not 6 Problem 12-27 CAPM (LO2) 11.11 points The Treasury bill rate is 5%, and the expected return on the market portfolio is 10%. According to the capital asset pricing model: a. What is the risk premium on the market? b. What is the required return on an investment with a beta of 15? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) c. If an investment with a beta of 0.9 offers an expected return of 91%, does it have a positive or negative NPV? d. If the market expects a return of 11.5% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. a. Market risk premium 5 % b. Return on investment 12.5% c. NPV Negative 1.00 X d. Beta Chapter 12 Assignment i Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indic 9 Problem 12-31 CAPM and Valuation (LO3) 11.12 points You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years a 1-10 Cash Flow 100 + 17 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.44. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 11%, what is the net present value of the project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.) Answer is complete but not entirely correct. Net present value $ 10.07 x million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started