Answered step by step

Verified Expert Solution

Question

1 Approved Answer

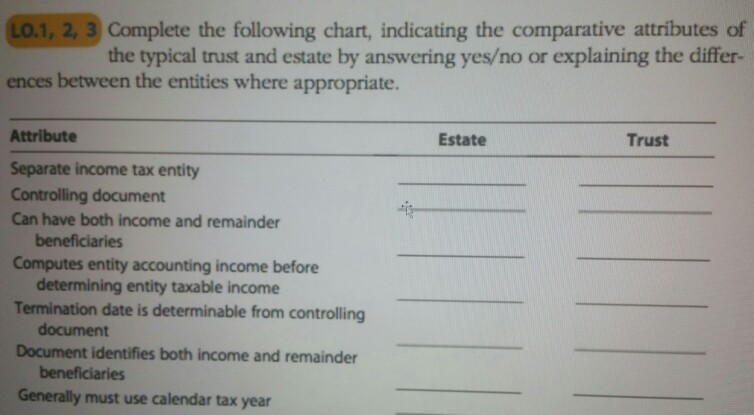

Lo.1, 2, 3 Complete the following chart, indicating the comparative attributes of the typical trust and estate by answering yeso or explaining the differ- ences

Lo.1, 2, 3 Complete the following chart, indicating the comparative attributes of the typical trust and estate by answering yeso or explaining the differ- ences between the entities where appropriate. Attribute Estate Trust Separate income tax entity Controlling document Can have both income and remainder Computes entity accounting income before Termination date is determinable from controlling Document identifies both income and remainder Generally must use calendar tax year beneficiaries determining entity taxable income document beneficiaries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started