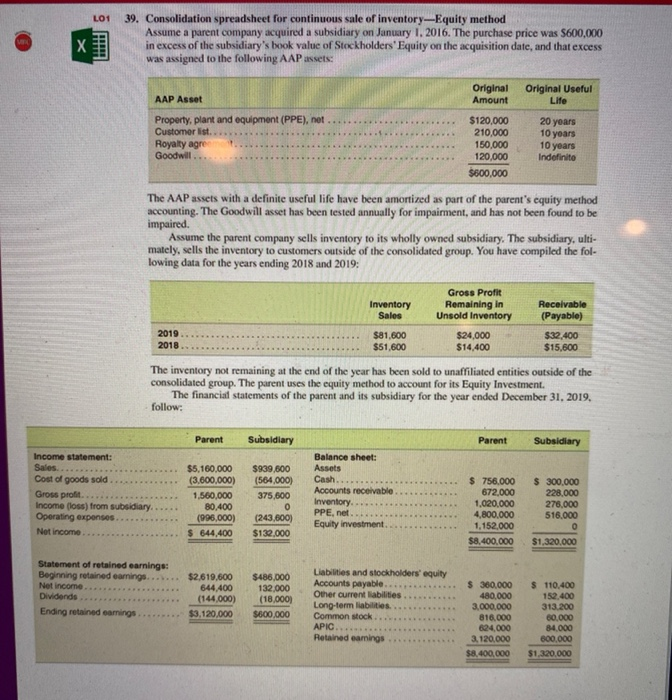

LO1 VE 1 39. Consolidation spreadsheet for continuous sale of inventory-Equity method Assume a parent company acquired a subsidiary on January 1, 2016. The purchase price was $600,000 in excess of the subsidiary's book value of Stockholders' Equity on the acquisition date, and that excess was assigned to the following AAP assets: Original Amount Original Useful AAP Asset Life *** Property, plant and equipment (PPE), net Customer ist Royalty agre Goodwill $120,000 210,000 150,000 120,000 $600,000 20 years 10 years 10 years Indefinito The AAP assets with a definite useful life have been amortized as part of the parent's equity method accounting. The Goodwill asset has been tested annually for impairment, and has not been found to be impaired. Assume the parent company sells inventory to its wholly owned subsidiary. The subsidiary, ulti- mately, sells the inventory to customers outside of the consolidated group. You have compiled the fol- lowing data for the years ending 2018 and 2019: Inventory Sales Gross Profit Remaining in Unsold Inventory $24,000 $14,400 Receivable (Payable) $32,400 $15,600 2019 2018 $81.600 $51,600 The inventory not remaining at the end of the year has been sold to unaffiliated entities outside of the consolidated group. The parent uses the equity method to account for its Equity Investment. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, follow: Parent Subsidiary Parent Subsidiary Income statement: Sales Cost of goods sold Gross profit Income (loss) from subsidiary. Operating expenses Not income $5,160,000 (3.600,000) 1,560,000 80,400 (996,000) $ 644,400 $939,600 (564,000) 375,600 0 (243,600) $132.000 Balance sheet: Assets Cash Accounts receivable Inventory PPE, net Equity investment. $ 756.000 672,000 1.020,000 4,800,000 1,152.000 $8.400.000 $ 300.000 228.000 276,000 516.000 0 $1,320,000 Statement of retained earnings: Beginning retained earnings. Net income Dividends Ending retained earnings $2,619,600 644.400 (144,000) $3,120,000 $486,000 132,000 (18,000) $600,000 Liabilities and stockholders' equity Accounts payable Other current abilities Long-term liabilities. Common stock. APIC Retained earnings $ 350,000 480,000 3,000,000 816.000 624,000 3.120,000 $8,400,000 $ 110,400 152,400 313.200 60.000 84.000 600.000 $1,320.000