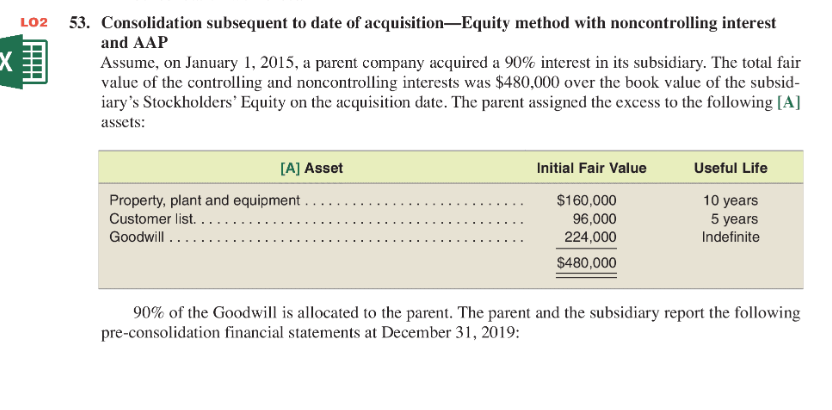

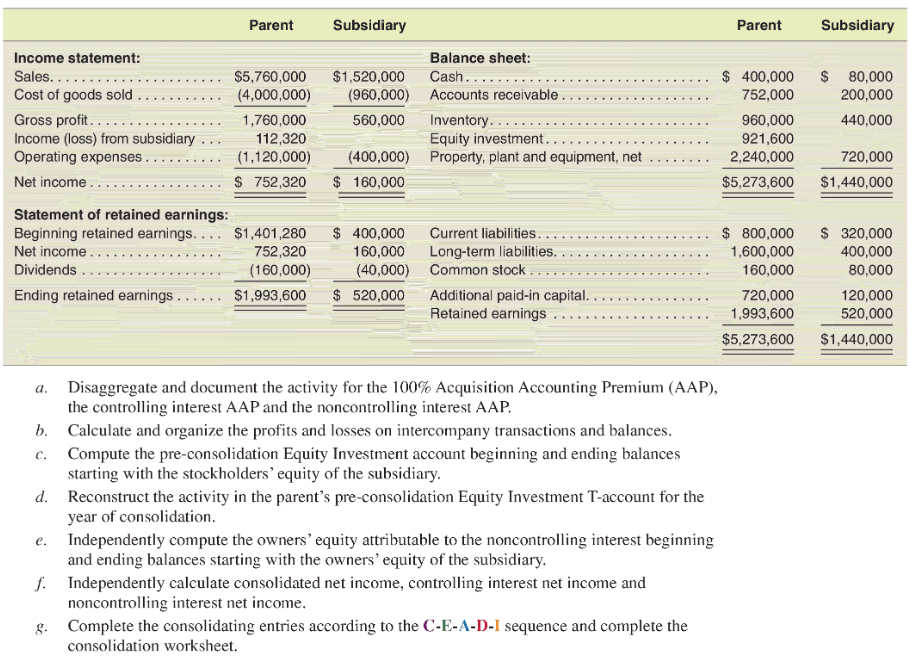

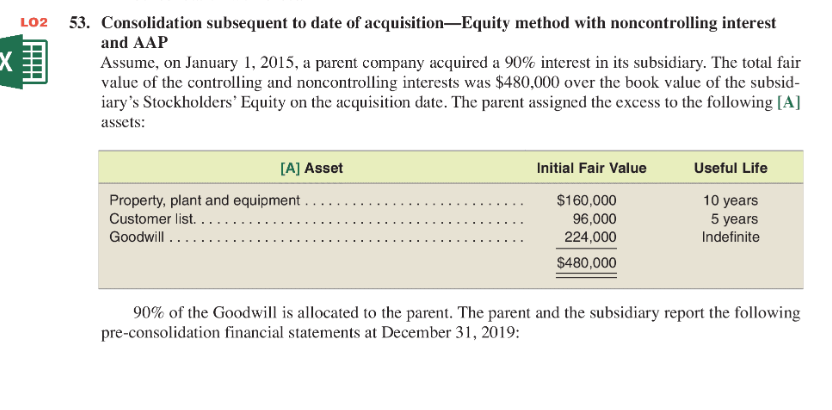

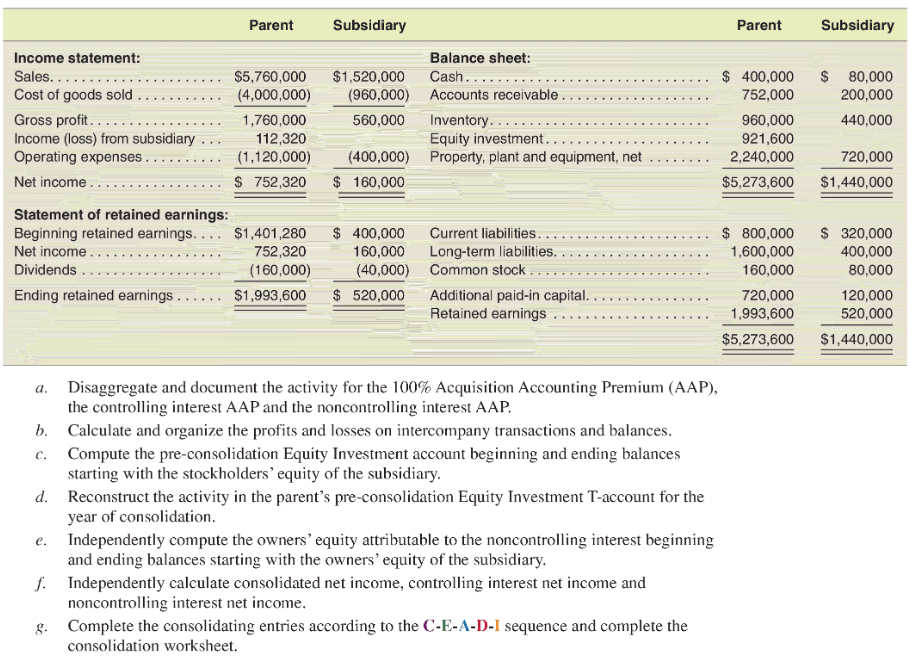

LO2 X2 53. Consolidation subsequent to date of acquisitionEquity method with noncontrolling interest and AAP Assume, on January 1, 2015, a parent company acquired a 90% interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $480,000 over the book value of the subsid- iary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life Property, plant and equipment ............................ Customer list Goodwill... $160,000 96,000 224,000 $480,000 10 years 5 years Indefinite 90% of the Goodwill is allocated to the parent. The parent and the subsidiary report the following pre-consolidation financial statements at December 31, 2019: Parent Subsidiary Parent Subsidiary ..... $ Income statement: Sales... Cost of goods sold ... Gross profit. . Income (loss) from subsidiary ... Operating expenses. Net income $5,760,000 (4,000,000) 1,760,000 112,320 $1,520,000 (960,000) 560,000 Balance sheet: Cash ......... Accounts receivable ........... Inventory.. Equity investment.... Property, plant and equipment, net 80,000 200,000 440,000 $ 400,000 752,000 960,000 921,600 2,240,000 $5,273,600 (400,000) 160,000 720,000 $1,440,000 $ 752,320 $ ..... Statement of retained earnings: Beginning retained earnings.... $1,401,280 Net income... .. 752,320 Dividends.. (160,000) Ending retained earnings ...... $1,993,600 $ 400,000 160,000 (40,000) $ 520,000 Current liabilities. ..... Long-term liabilities. . . Common stock ......... Additional paid-in capital. Retained earnings. $ 800,000 $ 800,00 1,600,000 160,000 720,000 1,993,600 $5,273,600 $ 320,000 400,000 80,000 120.000 520,000 $1,440,000 ..... a. Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP), the controlling interest AAP and the noncontrolling interest AAP. b. Calculate and organize the profits and losses on intercompany transactions and balances. Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary. d. Reconstruct the activity in the parent's pre-consolidation Equity Investment T-account for the year of consolidation. e. Independently compute the owners' equity attributable to the noncontrolling interest beginning and ending balances starting with the owners' equity of the subsidiary. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income, Complete the consolidating entries according to the C-E-A-D-I sequence and complete the consolidation worksheet. LO2 X2 53. Consolidation subsequent to date of acquisitionEquity method with noncontrolling interest and AAP Assume, on January 1, 2015, a parent company acquired a 90% interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $480,000 over the book value of the subsid- iary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life Property, plant and equipment ............................ Customer list Goodwill... $160,000 96,000 224,000 $480,000 10 years 5 years Indefinite 90% of the Goodwill is allocated to the parent. The parent and the subsidiary report the following pre-consolidation financial statements at December 31, 2019: Parent Subsidiary Parent Subsidiary ..... $ Income statement: Sales... Cost of goods sold ... Gross profit. . Income (loss) from subsidiary ... Operating expenses. Net income $5,760,000 (4,000,000) 1,760,000 112,320 $1,520,000 (960,000) 560,000 Balance sheet: Cash ......... Accounts receivable ........... Inventory.. Equity investment.... Property, plant and equipment, net 80,000 200,000 440,000 $ 400,000 752,000 960,000 921,600 2,240,000 $5,273,600 (400,000) 160,000 720,000 $1,440,000 $ 752,320 $ ..... Statement of retained earnings: Beginning retained earnings.... $1,401,280 Net income... .. 752,320 Dividends.. (160,000) Ending retained earnings ...... $1,993,600 $ 400,000 160,000 (40,000) $ 520,000 Current liabilities. ..... Long-term liabilities. . . Common stock ......... Additional paid-in capital. Retained earnings. $ 800,000 $ 800,00 1,600,000 160,000 720,000 1,993,600 $5,273,600 $ 320,000 400,000 80,000 120.000 520,000 $1,440,000 ..... a. Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP), the controlling interest AAP and the noncontrolling interest AAP. b. Calculate and organize the profits and losses on intercompany transactions and balances. Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary. d. Reconstruct the activity in the parent's pre-consolidation Equity Investment T-account for the year of consolidation. e. Independently compute the owners' equity attributable to the noncontrolling interest beginning and ending balances starting with the owners' equity of the subsidiary. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income, Complete the consolidating entries according to the C-E-A-D-I sequence and complete the consolidation worksheet