Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tried every possible number, please help :((((( Requlred Information Problem 19-44 (LO 19-2) (Algo) [The following information applies to the questions displayed below.] This year,

Tried every possible number, please help :(((((

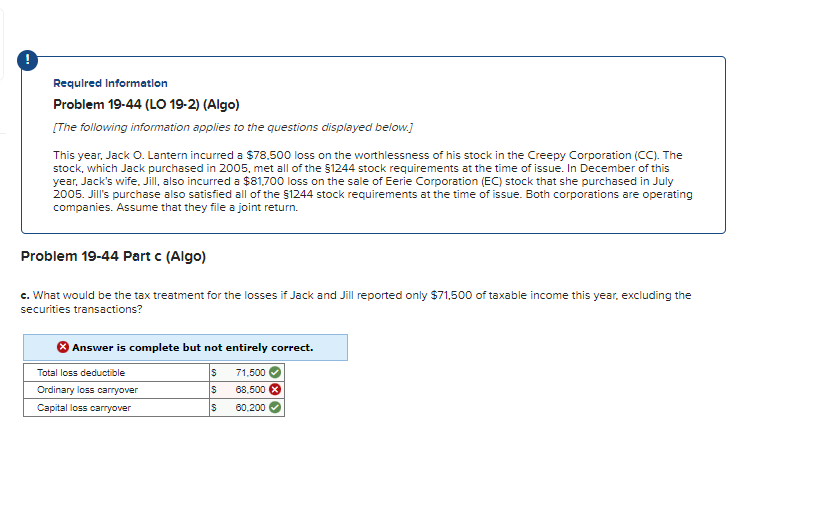

Requlred Information Problem 19-44 (LO 19-2) (Algo) [The following information applies to the questions displayed below.] This year, Jack 0 . Lantern incurred a $78,500 loss on the worthlessness of his stock in the Creepy Corporation (CC). The stock, which Jack purchased in 2005 , met all of the \$1244 stock requirements at the time of issue. In December of this year, Jack's wife, Jill, also incurred a $81,700 loss on the sale of Eerie Corporation (EC) stock that she purchased in July 2005. Jill's purchase also satisfied all of the $1244 stock requirements at the time of issue. Both corporations are operating companies. Assume that they file a joint return. Problem 19-44 Part c (Algo) c. What would be the tax treatment for the losses if Jack and Jill reported only $71,500 of taxable income this year, excluding the securities transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started