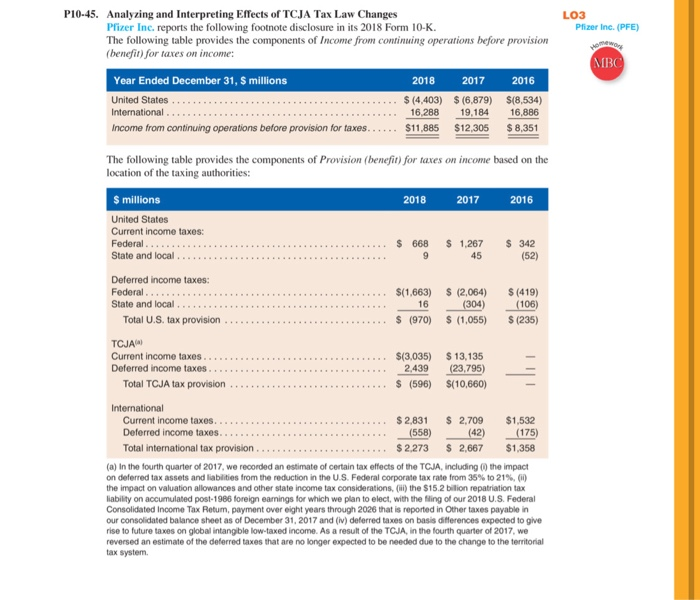

LO3 Plizer Inc. (PFE) MBC P10-45. Analyzing and Interpreting Effects of TCJA Tax Law Changes Pfizer Inc. reports the following footnote disclosure in its 2018 Form 10-K. The following table provides the components of Income from continuing operations before provision (benefit) for taxes on income: Year Ended December 31, $ millions 2018 2017 2016 United States S (4,403) S(6,879) S(8,534) International 16,288 19,184 16,886 Income from continuing operations before provision for taxes.. $11.885 $12,305 $8,351 The following table provides the components of Provision (benefit) for taxes on income based on the location of the taxing authorities: $ millions 2018 2017 2016 United States Current income taxes: Federal $ 668 $ 1.267 $ 342 State and local 9 45 (52) Deferred income taxes: Federal $(1,663) $ (2,064) $ (419) State and local 16 (304) (106) Total U.S. tax provision $ (970) $ (1.055) $(235) TCJA Current income taxes. $(3,035) $ 13,135 Deferred income taxes 2,439 (23,795) Total TCJA tax provision $ (596) S(10,660) International Current income taxes... $ 2.831 $ 2,709 $1,532 Deferred income taxes.. (558) (42) (175) Total international tax provision $ 2,273 $ 2,667 $1,358 (a) In the fourth quarter of 2017, we recorded an estimate of certain tax effects of the TCJA, including the impact on deferred tax assets and liabilities from the reduction in the U.S. Federal corporate tax rate from 35% to 21%, 00 the impact on valuation allowances and other state income tax considerations. (i) the $15.2 billion repatriation tax liability on accumulated post-1986 foreign earnings for which we plan to elect, with the filing of our 2018 U.S. Federal Consolidated Income Tax Retum, payment over eight years through 2026 that is reported in Other taxes payable in our consolidated balance sheet as of December 31, 2017 and (i) deferred taxes on basis differences expected to give rise to future taxes on global intangible low-taxed income. As a result of the TCJA, in the fourth quarter of 2017, we reversed an estimate of the deferred taxes that are no longer expected to be needed due to the change to the territorial tax system e. Pfizer lists four TCJA items that impacted their 2017 tax provision. Explain how each of the four items might have affected Pfizer's 2017 tax expense. LO3 Plizer Inc. (PFE) MBC P10-45. Analyzing and Interpreting Effects of TCJA Tax Law Changes Pfizer Inc. reports the following footnote disclosure in its 2018 Form 10-K. The following table provides the components of Income from continuing operations before provision (benefit) for taxes on income: Year Ended December 31, $ millions 2018 2017 2016 United States S (4,403) S(6,879) S(8,534) International 16,288 19,184 16,886 Income from continuing operations before provision for taxes.. $11.885 $12,305 $8,351 The following table provides the components of Provision (benefit) for taxes on income based on the location of the taxing authorities: $ millions 2018 2017 2016 United States Current income taxes: Federal $ 668 $ 1.267 $ 342 State and local 9 45 (52) Deferred income taxes: Federal $(1,663) $ (2,064) $ (419) State and local 16 (304) (106) Total U.S. tax provision $ (970) $ (1.055) $(235) TCJA Current income taxes. $(3,035) $ 13,135 Deferred income taxes 2,439 (23,795) Total TCJA tax provision $ (596) S(10,660) International Current income taxes... $ 2.831 $ 2,709 $1,532 Deferred income taxes.. (558) (42) (175) Total international tax provision $ 2,273 $ 2,667 $1,358 (a) In the fourth quarter of 2017, we recorded an estimate of certain tax effects of the TCJA, including the impact on deferred tax assets and liabilities from the reduction in the U.S. Federal corporate tax rate from 35% to 21%, 00 the impact on valuation allowances and other state income tax considerations. (i) the $15.2 billion repatriation tax liability on accumulated post-1986 foreign earnings for which we plan to elect, with the filing of our 2018 U.S. Federal Consolidated Income Tax Retum, payment over eight years through 2026 that is reported in Other taxes payable in our consolidated balance sheet as of December 31, 2017 and (i) deferred taxes on basis differences expected to give rise to future taxes on global intangible low-taxed income. As a result of the TCJA, in the fourth quarter of 2017, we reversed an estimate of the deferred taxes that are no longer expected to be needed due to the change to the territorial tax system e. Pfizer lists four TCJA items that impacted their 2017 tax provision. Explain how each of the four items might have affected Pfizer's 2017 tax expense