Answered step by step

Verified Expert Solution

Question

1 Approved Answer

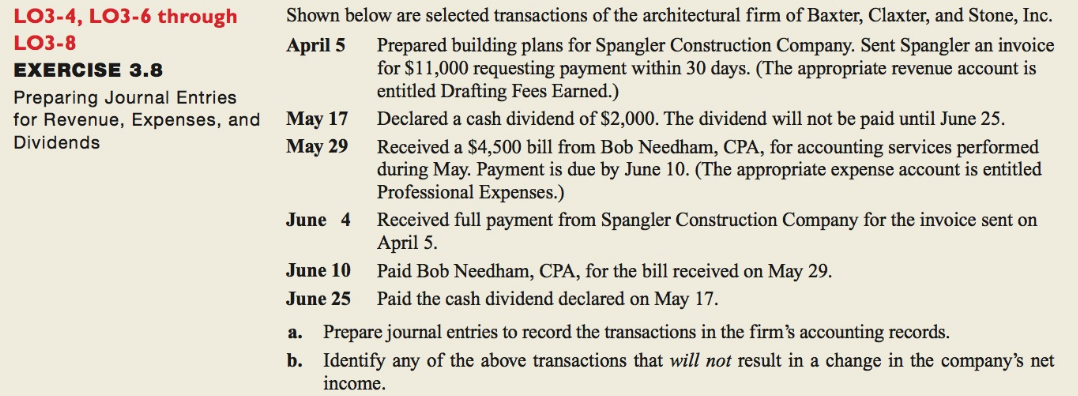

LO3-4, LO3-6 through LO3-8 EXERCISE 3.8 Preparing Journal Entries for Revenue, Expenses, and Dividends Shown below are selected transactions of the architectural firm of Baxter,

LO3-4, LO3-6 through LO3-8 EXERCISE 3.8 Preparing Journal Entries for Revenue, Expenses, and Dividends Shown below are selected transactions of the architectural firm of Baxter, Claxter, and Stone, Inc. April 5 Prepared building plans for Spangler Construction Company. Sent Spangler an invoice for $11,000 requesting payment within 30 days. (The appropriate revenue account is entitled Drafting Fees Earned.) May 17 Declared a cash dividend of \$2,000. The dividend will not be paid until June 25. May 29 Received a $4,500 bill from Bob Needham, CPA, for accounting services performed during May. Payment is due by June 10. (The appropriate expense account is entitled Professional Expenses.) June 4 Received full payment from Spangler Construction Company for the invoice sent on April 5. June 10 Paid Bob Needham, CPA, for the bill received on May 29. June 25 Paid the cash dividend declared on May 17. a. Prepare journal entries to record the transactions in the firm's accounting records. b. Identify any of the above transactions that will not result in a change in the company's net income

LO3-4, LO3-6 through LO3-8 EXERCISE 3.8 Preparing Journal Entries for Revenue, Expenses, and Dividends Shown below are selected transactions of the architectural firm of Baxter, Claxter, and Stone, Inc. April 5 Prepared building plans for Spangler Construction Company. Sent Spangler an invoice for $11,000 requesting payment within 30 days. (The appropriate revenue account is entitled Drafting Fees Earned.) May 17 Declared a cash dividend of \$2,000. The dividend will not be paid until June 25. May 29 Received a $4,500 bill from Bob Needham, CPA, for accounting services performed during May. Payment is due by June 10. (The appropriate expense account is entitled Professional Expenses.) June 4 Received full payment from Spangler Construction Company for the invoice sent on April 5. June 10 Paid Bob Needham, CPA, for the bill received on May 29. June 25 Paid the cash dividend declared on May 17. a. Prepare journal entries to record the transactions in the firm's accounting records. b. Identify any of the above transactions that will not result in a change in the company's net income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started