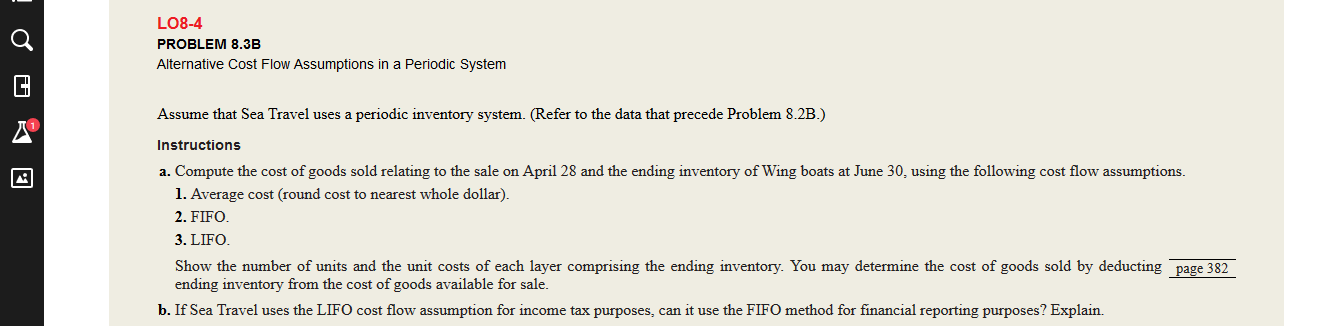

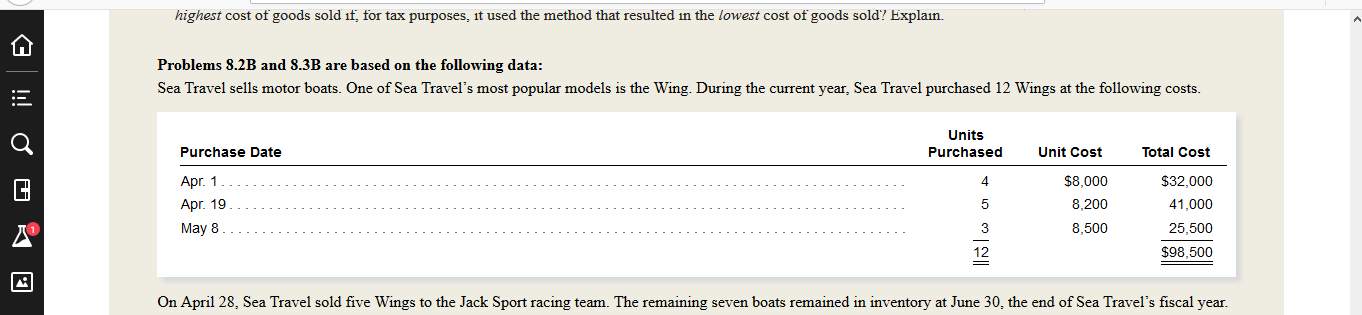

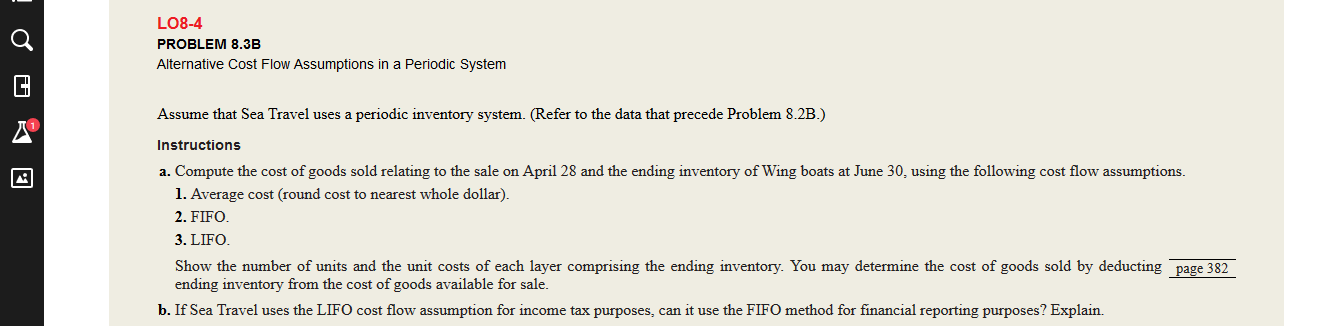

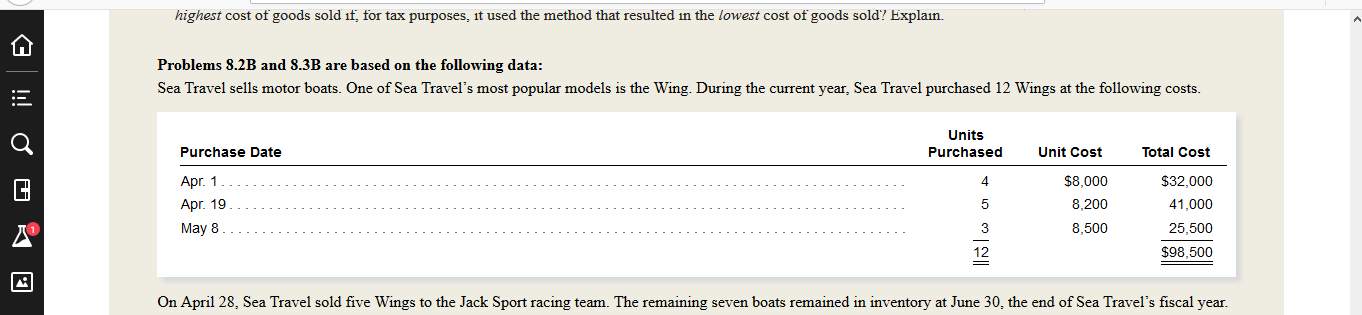

LO8-4 PROBLEM 8.3B Alternative Cost Flow Assumptions in a Periodic System Assume that Sea Travel uses a periodic inventory system (Refer to the data that precede Problem 8.2B.) Instructions a. Compute the cost of goods sold relating to the sale on April 28 and the ending inventory of Wing boats at June 30, using the following cost flow assumptions. 1. Average cost (round cost to nearest whole dollar) 2. FIFO 3. LIFO Show the number of units and the unit costs of each layer comprising the ending inventory. You may determine the cost of goods sold by deducting page 382 ending inventory from the cost of goods available for sale. b. If Sea Travel uses the LIFO cost flow assumption for income tax purposes, can it use the FIFO method for financial reporting purposes? Explain. highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold? Explain Problems 8.2B and 8.3B are based on the following data: Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. Units Total Cost Purchase Date Purchased Unit Cost $8,000 $32,000 Apr. 1 4 41,000 Apr. 19 8,200 25,500 May 8 8,500 12 $98,500 On April 28, Sea Travel sold five Wings to the Jack Sport racing team. The remaining seven boats remained in inventory at June 30, the end of Sea Travel's fiscal year LO8-4 PROBLEM 8.3B Alternative Cost Flow Assumptions in a Periodic System Assume that Sea Travel uses a periodic inventory system (Refer to the data that precede Problem 8.2B.) Instructions a. Compute the cost of goods sold relating to the sale on April 28 and the ending inventory of Wing boats at June 30, using the following cost flow assumptions. 1. Average cost (round cost to nearest whole dollar) 2. FIFO 3. LIFO Show the number of units and the unit costs of each layer comprising the ending inventory. You may determine the cost of goods sold by deducting page 382 ending inventory from the cost of goods available for sale. b. If Sea Travel uses the LIFO cost flow assumption for income tax purposes, can it use the FIFO method for financial reporting purposes? Explain. highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold? Explain Problems 8.2B and 8.3B are based on the following data: Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. Units Total Cost Purchase Date Purchased Unit Cost $8,000 $32,000 Apr. 1 4 41,000 Apr. 19 8,200 25,500 May 8 8,500 12 $98,500 On April 28, Sea Travel sold five Wings to the Jack Sport racing team. The remaining seven boats remained in inventory at June 30, the end of Sea Travel's fiscal year