Answered step by step

Verified Expert Solution

Question

1 Approved Answer

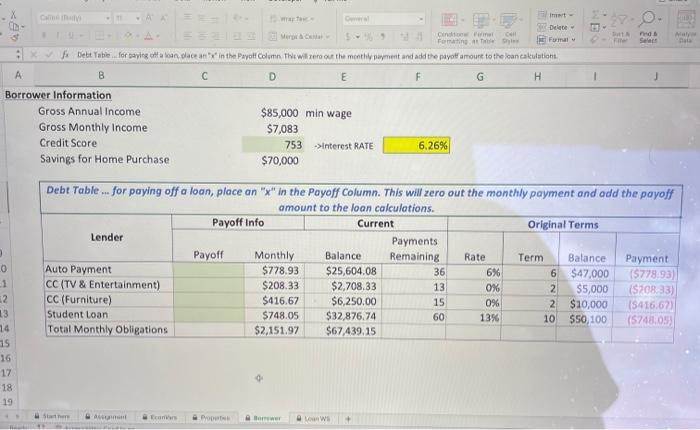

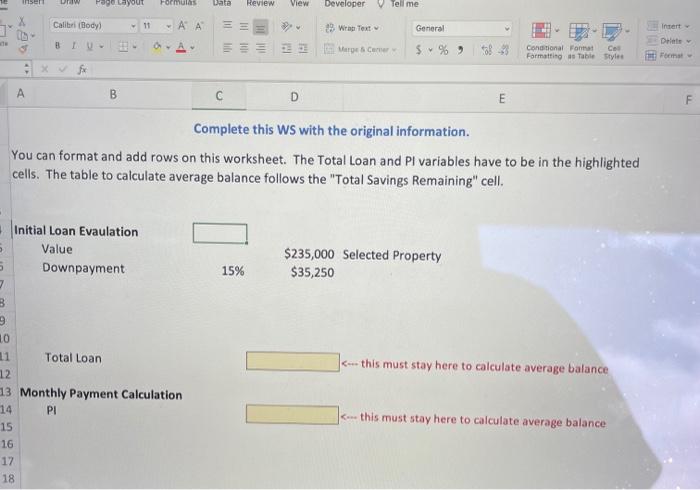

loan calculation This workbook has the following worksheets. Go through and look at all of them before you start working. 1. Base Downpayment-start with 15%

loan calculation

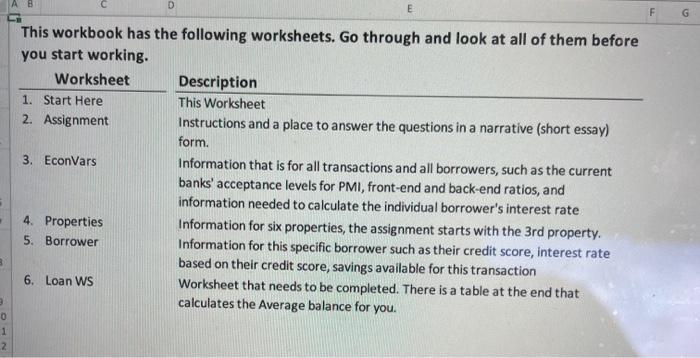

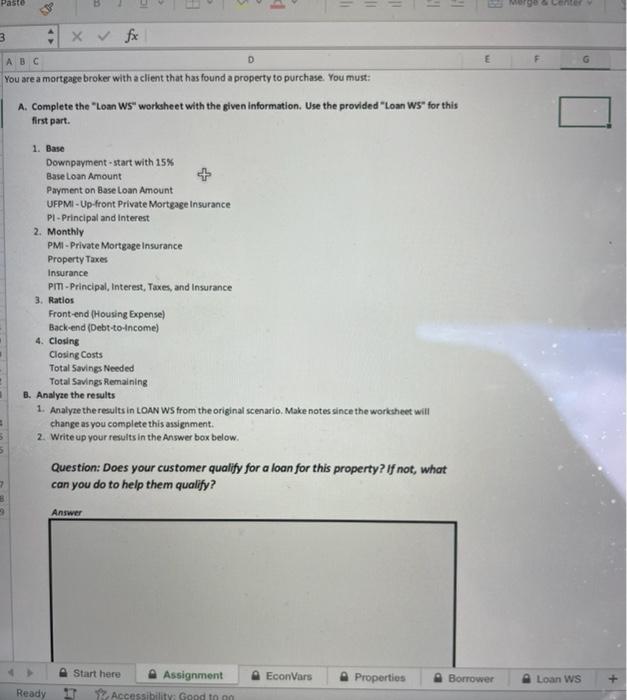

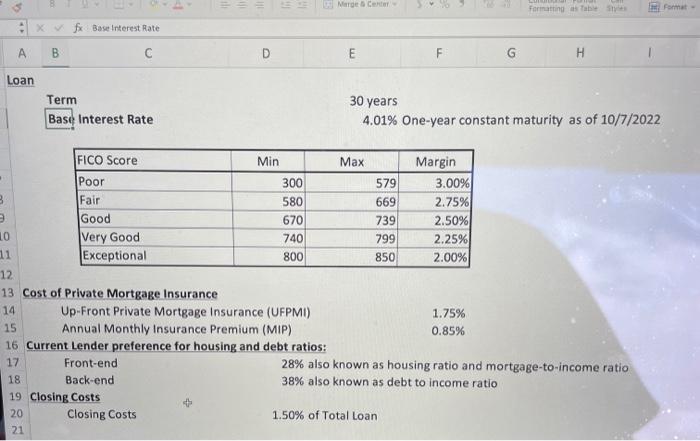

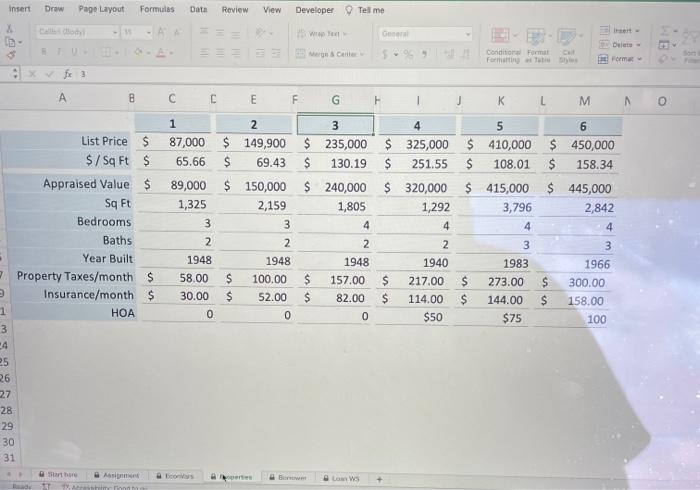

This workbook has the following worksheets. Go through and look at all of them before you start working. 1. Base Downpayment-start with 15% Base Loan Amount Payment on Base Loan Amount UFPMI-Up-front Private Mortgage insurance PI-Principal and interest 2. Monthly PMi-Private Mortgage Insurance Property Taxes Insurance PIT-Principal, Interest, Taxes, and Insurance 3. Ratios Front-end (Housing Expense) Back-end (Debt-to-income) 4. Closing Closing Costs Total Savings Needed Total Savings remaining B. Analyze the results 1. Analyze the results in LOAN WS from the original scenario. Make notes since the woricaheet will change as you complete this assignment. 2. Write up your results in the Answer box below. Question: Does your customer qualify for a loan for this property? If not, what can you do to help them qualify? Term Base Interest Rate 30 years 4.01% One-year constant maturity as of 10/7/2022 Cost of Private Mortgage Insurance Up-Front Private Mortgage insurance (UFPMI) Annual Monthly Insurance Premium (MIP) 1.75% Current Lender preference for housing and debt ratios: 0.85% Debt Table... for paying off a loan, place an " x " in the Payoff Column. This will zero out the monthly payment and odd the payoff Complete this WS with the original information. You can format and add rows on this worksheet. The Total Loan and PI variables have to be in the highlighted cells. The table to calculate average balance follows the "Total Savings Remaining" cell. This workbook has the following worksheets. Go through and look at all of them before you start working. 1. Base Downpayment-start with 15% Base Loan Amount Payment on Base Loan Amount UFPMI-Up-front Private Mortgage insurance PI-Principal and interest 2. Monthly PMi-Private Mortgage Insurance Property Taxes Insurance PIT-Principal, Interest, Taxes, and Insurance 3. Ratios Front-end (Housing Expense) Back-end (Debt-to-income) 4. Closing Closing Costs Total Savings Needed Total Savings remaining B. Analyze the results 1. Analyze the results in LOAN WS from the original scenario. Make notes since the woricaheet will change as you complete this assignment. 2. Write up your results in the Answer box below. Question: Does your customer qualify for a loan for this property? If not, what can you do to help them qualify? Term Base Interest Rate 30 years 4.01% One-year constant maturity as of 10/7/2022 Cost of Private Mortgage Insurance Up-Front Private Mortgage insurance (UFPMI) Annual Monthly Insurance Premium (MIP) 1.75% Current Lender preference for housing and debt ratios: 0.85% Debt Table... for paying off a loan, place an " x " in the Payoff Column. This will zero out the monthly payment and odd the payoff Complete this WS with the original information. You can format and add rows on this worksheet. The Total Loan and PI variables have to be in the highlighted cells. The table to calculate average balance follows the "Total Savings Remaining" cell Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started