Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Loan contracts are set for different time periods. Contracts that mature between 1 to 10 years are called intermediate-term credit, or term loans. When firms

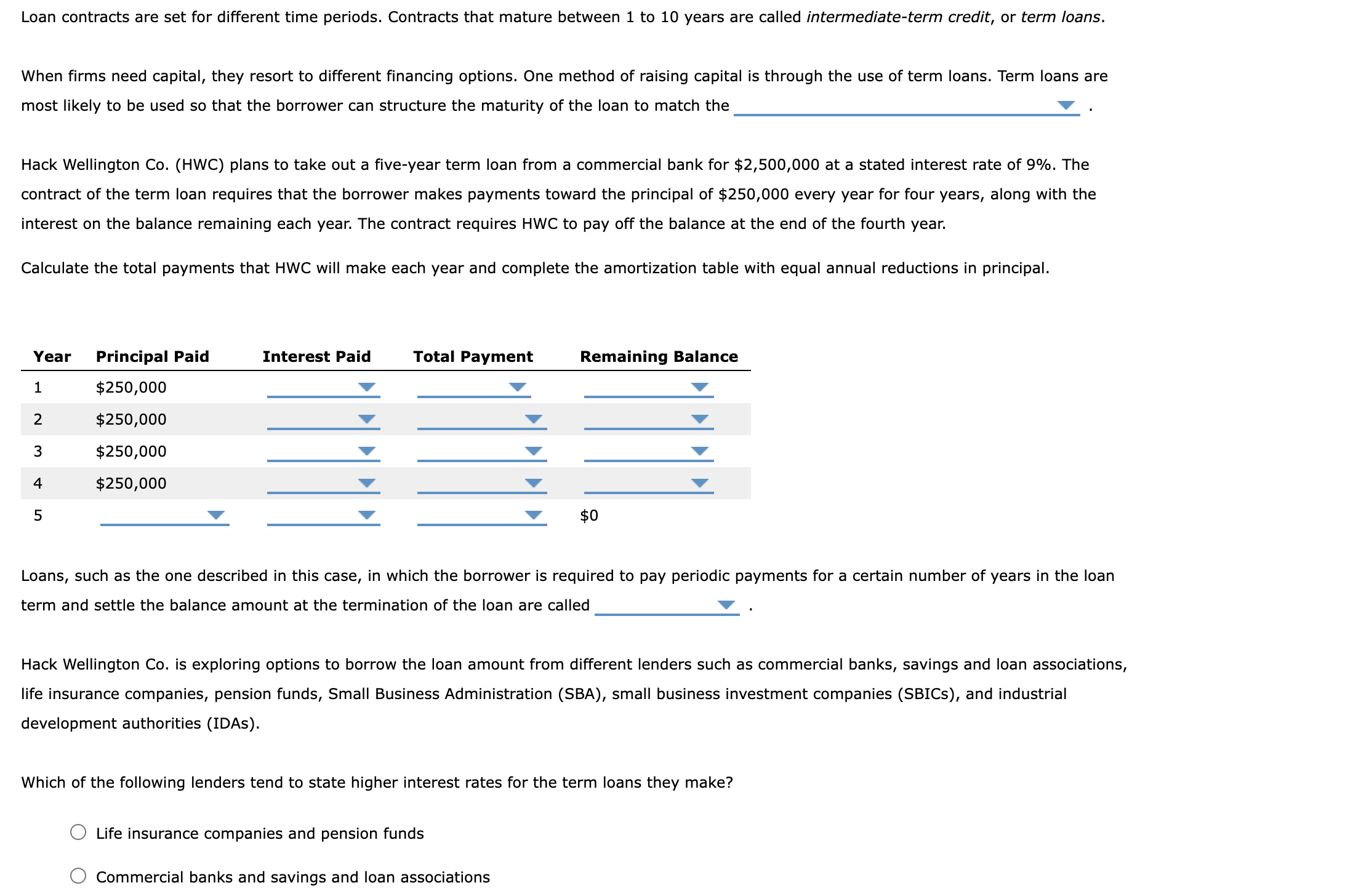

Loan contracts are set for different time periods. Contracts that mature between 1 to 10 years are called intermediate-term credit, or term loans. When firms need capital, they resort to different financing options. One method of raising capital is through the use of term loans. Term loans are most likely to be used so that the borrower can structure the maturity of the loan to match the Hack Wellington Co. (HWC) plans to take out a five-year term loan from a commercial bank for $2,500,000 at a stated interest rate of 9%. The contract of the term loan requires that the borrower makes payments toward the principal of $250,000 every year for four years, along with the interest on the balance remaining each year. The contract requires HWC to pay off the balance at the end of the fourth year. Calculate the total payments that HWC will make each year and complete the amortization table with equal annual reductions in principal. Loans, such as the one described in this case, in which the borrower is required to pay periodic payments for a certain number of years in the loan term and settle the balance amount at the termination of the loan are called Hack Wellington Co. is exploring options to borrow the loan amount from different lenders such as commercial banks, savings and loan associations, life insurance companies, pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and industrial development authorities (IDAs). Which of the following lenders tend to state higher interest rates for the term loans they make? Life insurance companies and pension funds Commercial banks and savings and loan associations

Loan contracts are set for different time periods. Contracts that mature between 1 to 10 years are called intermediate-term credit, or term loans. When firms need capital, they resort to different financing options. One method of raising capital is through the use of term loans. Term loans are most likely to be used so that the borrower can structure the maturity of the loan to match the Hack Wellington Co. (HWC) plans to take out a five-year term loan from a commercial bank for $2,500,000 at a stated interest rate of 9%. The contract of the term loan requires that the borrower makes payments toward the principal of $250,000 every year for four years, along with the interest on the balance remaining each year. The contract requires HWC to pay off the balance at the end of the fourth year. Calculate the total payments that HWC will make each year and complete the amortization table with equal annual reductions in principal. Loans, such as the one described in this case, in which the borrower is required to pay periodic payments for a certain number of years in the loan term and settle the balance amount at the termination of the loan are called Hack Wellington Co. is exploring options to borrow the loan amount from different lenders such as commercial banks, savings and loan associations, life insurance companies, pension funds, Small Business Administration (SBA), small business investment companies (SBICs), and industrial development authorities (IDAs). Which of the following lenders tend to state higher interest rates for the term loans they make? Life insurance companies and pension funds Commercial banks and savings and loan associations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started