Answered step by step

Verified Expert Solution

Question

1 Approved Answer

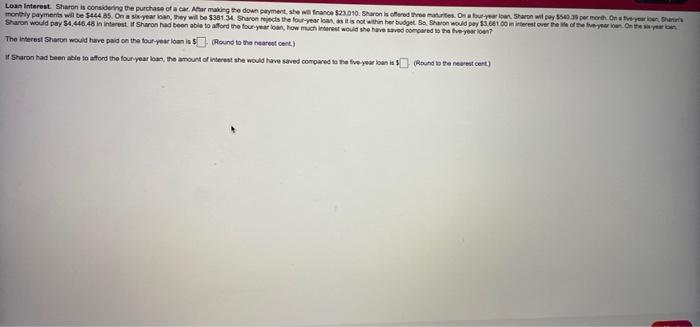

Loan Interest. Sharon is considering the purchase of a car. After making the down payment, she will finance $ 2 3 , 0 1 0

Loan Interest.Sharon is considering the purchase of a car. After making the down payment, she will finance

Loan Interest Sharon is considering the purchase of a car. Ahor making the down payment she will finance $23.010. Sharon is offered three matures Os bouwloan, Sharon wipe 350 per month monthly payments will be $444 85. On a six year loan, they will be 5361 34. Sharon rejects the four-year on as it is not within het budget Se Sharon would pay $3.880 m teret over the year. On the Sharon would pay $4,446.48 in interest Sharon had been able to afford the four year for how much interest would the have saved compared to the fro year? The Interest Sharon would have paid on the four-year lois Round to the nearest Cent) Sharon had been able to afford the four year kaarthe mount of interest she would have saved compared to live your tonia Round we newest cent) $23,010.

Sharon is offered three maturities. On a four-year loan, Sharon will pay $540.39

per month. On a five-year loan, Sharon's monthly payments will be $444.85.

On a six-year loan, they will be $381.34.

Sharon rejects the four-year loan, as it is not within her budget. So, Sharon would pay $3,681.00

in interest over the life of the five-year loan. On the six-year loan, Sharon would pay $4,446.48

in interest. If Sharon had been able to afford the four-year loan, how much interest would she have saved compared to the five-year loan?The interest Sharon would have paid on the four-year loan is

If Sharon had been able to afford the four-year loan, the amount of interest she would have saved compared to the five-year loan is

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started