Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Loans Performance Task Part 1: College Information Name: 1. Find the tuition cost for one-year at a college you are interested in attending. You

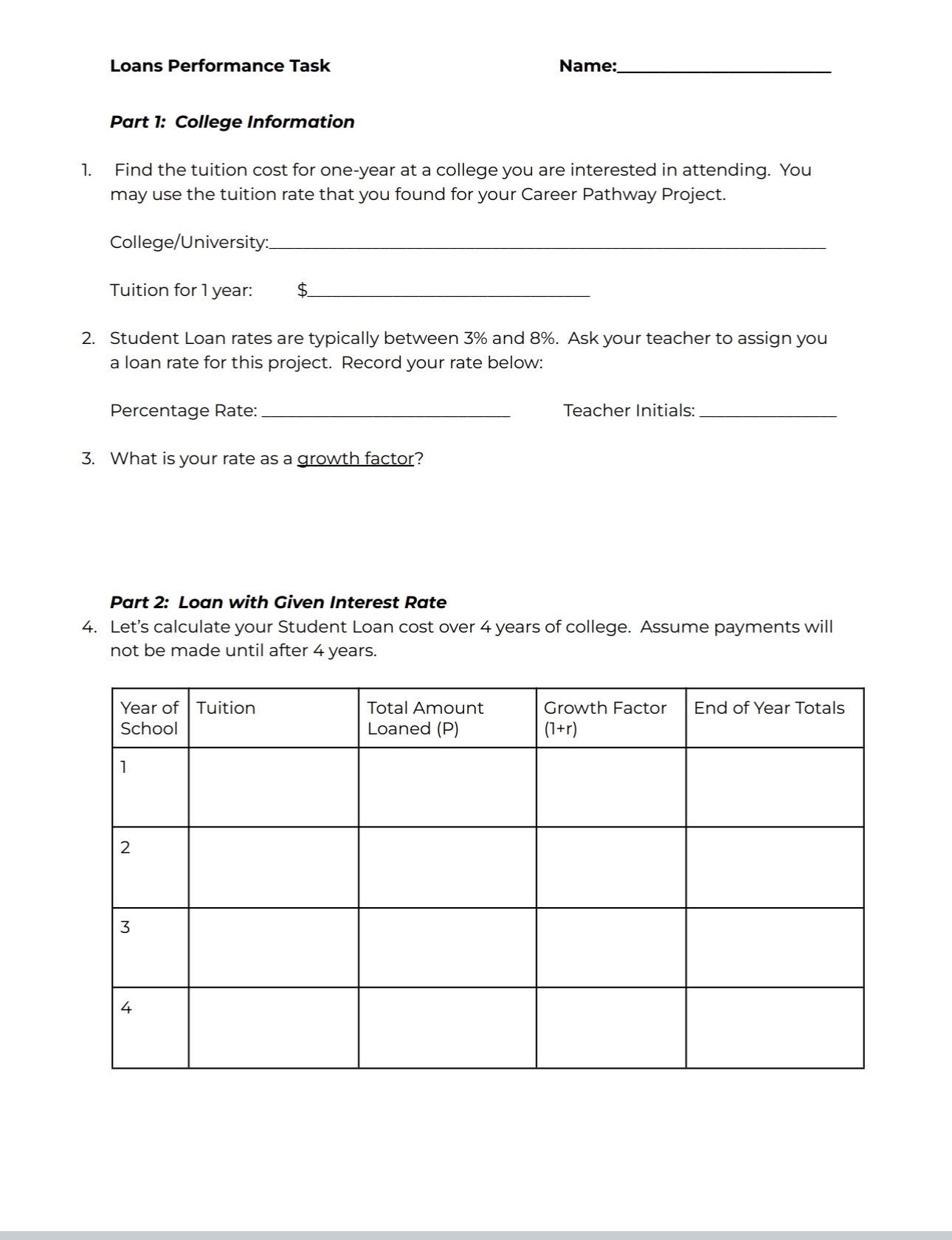

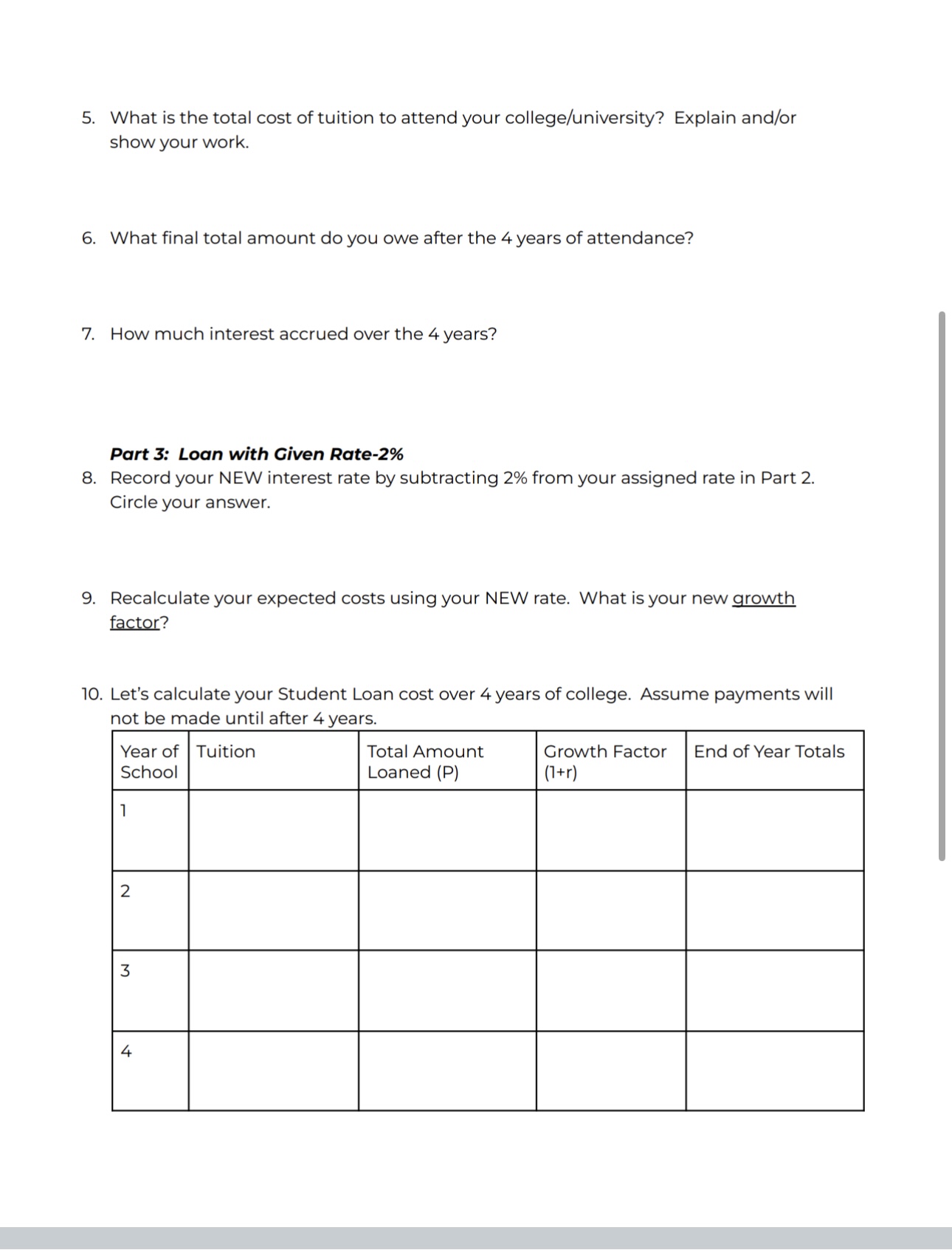

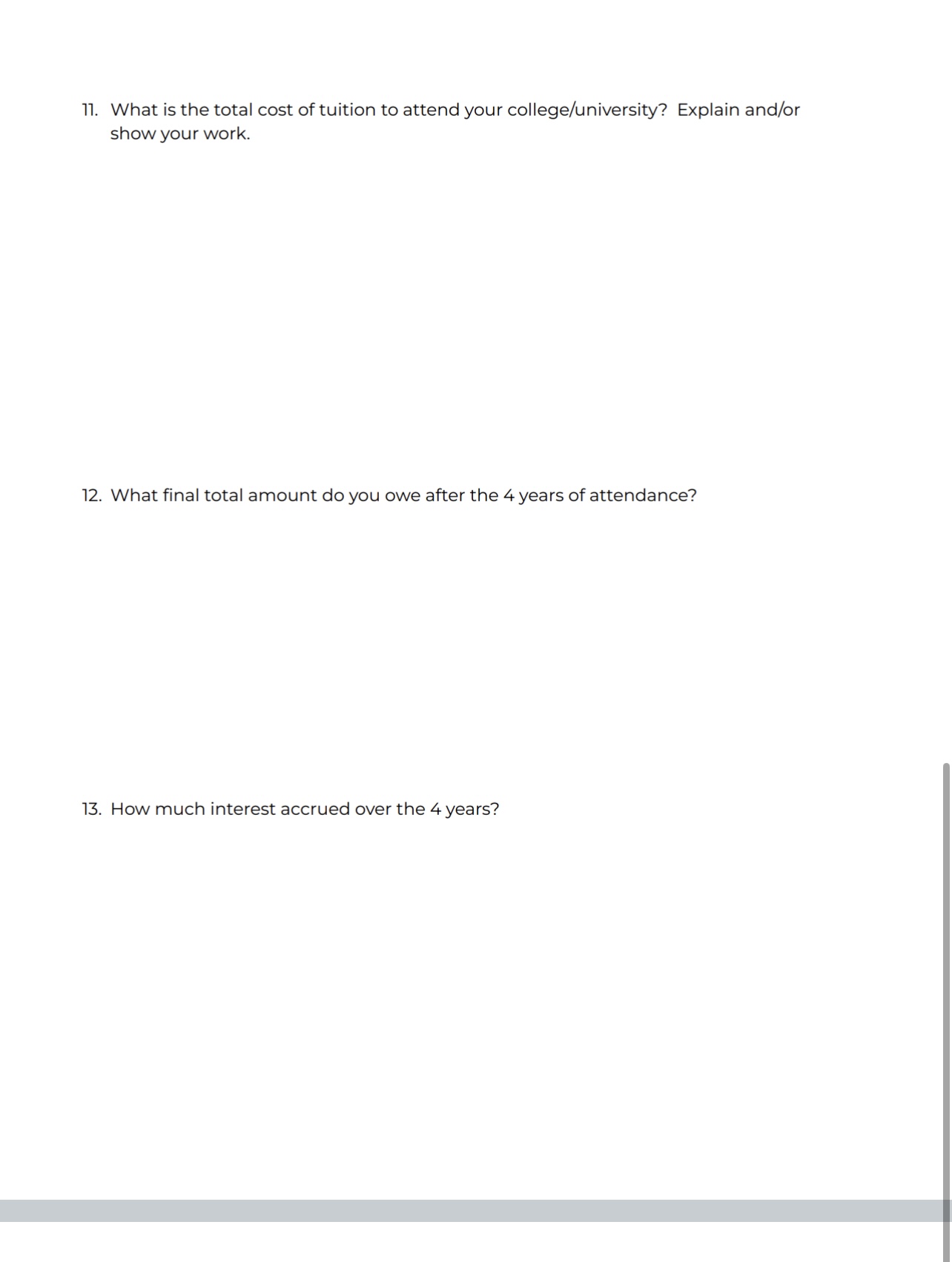

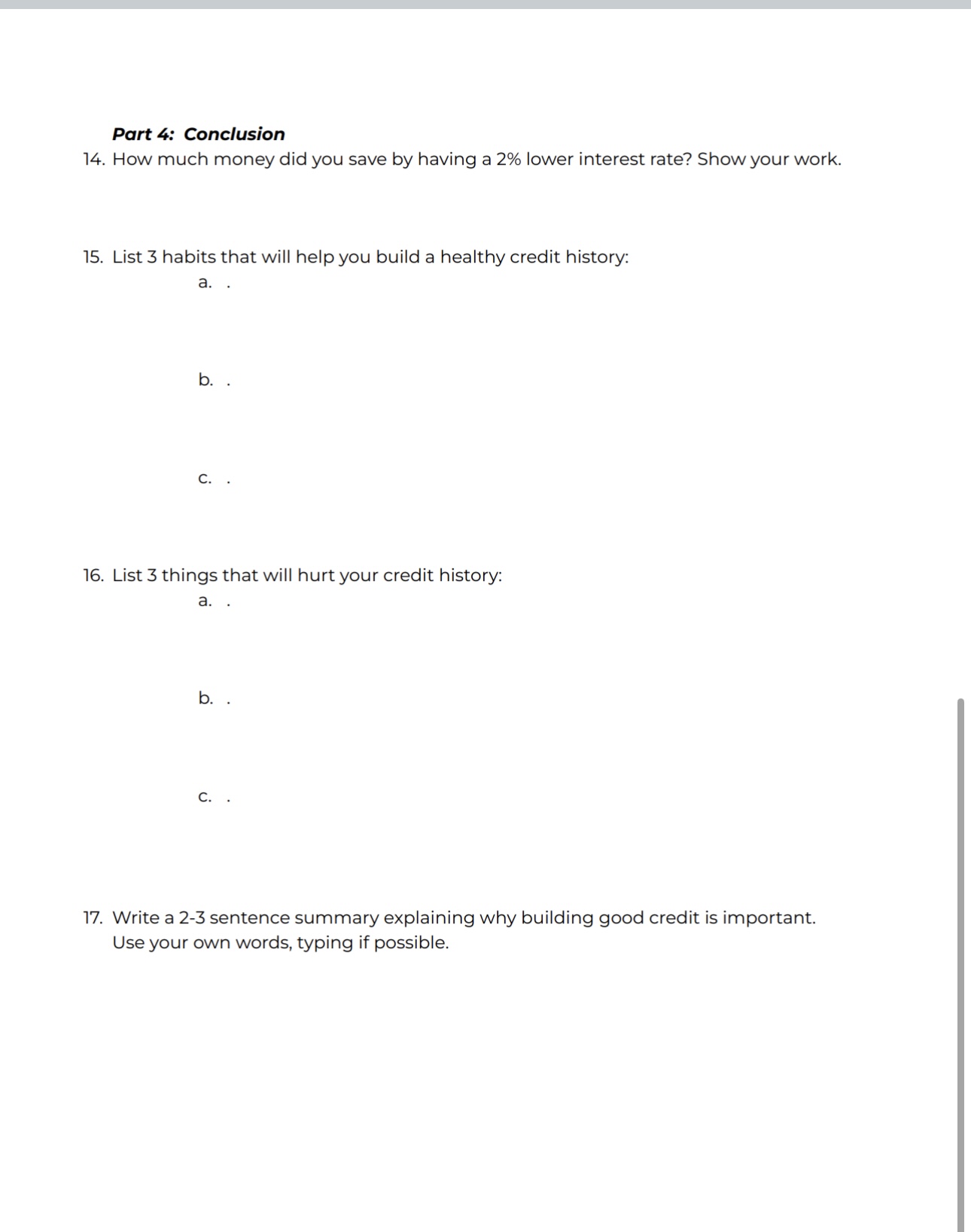

Loans Performance Task Part 1: College Information Name: 1. Find the tuition cost for one-year at a college you are interested in attending. You may use the tuition rate that you found for your Career Pathway Project. College/University:_ Tuition for 1 year: $ 2. Student Loan rates are typically between 3% and 8%. Ask your teacher to assign you a loan rate for this project. Record your rate below: Percentage Rate: 3. What is your rate as a growth factor? Teacher Initials: Part 2: Loan with Given Interest Rate 4. Let's calculate your Student Loan cost over 4 years of college. Assume payments will not be made until after 4 years. Year of Tuition School 1 2 3 4 Total Amount Loaned (P) Growth Factor End of Year Totals (1+r) 5. What is the total cost of tuition to attend your college/university? Explain and/or show your work. 6. What final total amount do you owe after the 4 years of attendance? 7. How much interest accrued over the 4 years? Part 3: Loan with Given Rate-2% 8. Record your NEW interest rate by subtracting 2% from your assigned rate in Part 2. Circle your answer. 9. Recalculate your expected costs using your NEW rate. What is your new growth factor? 10. Let's calculate your Student Loan cost over 4 years of college. Assume payments will not be made until after 4 years. Year of Tuition School 1 2 3 4 Total Amount Loaned (P) Growth Factor End of Year Totals (1+r) 11. What is the total cost of tuition to attend your college/university? Explain and/or show your work. 12. What final total amount do you owe after the 4 years of attendance? 13. How much interest accrued over the 4 years? Part 4: Conclusion 14. How much money did you save by having a 2% lower interest rate? Show your work. 15. List 3 habits that will help you build a healthy credit history: a. . b. . C. 16. List 3 things that will hurt your credit history: a. . b. . C. 17. Write a 2-3 sentence summary explaining why building good credit is important. Use your own words, typing if possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started