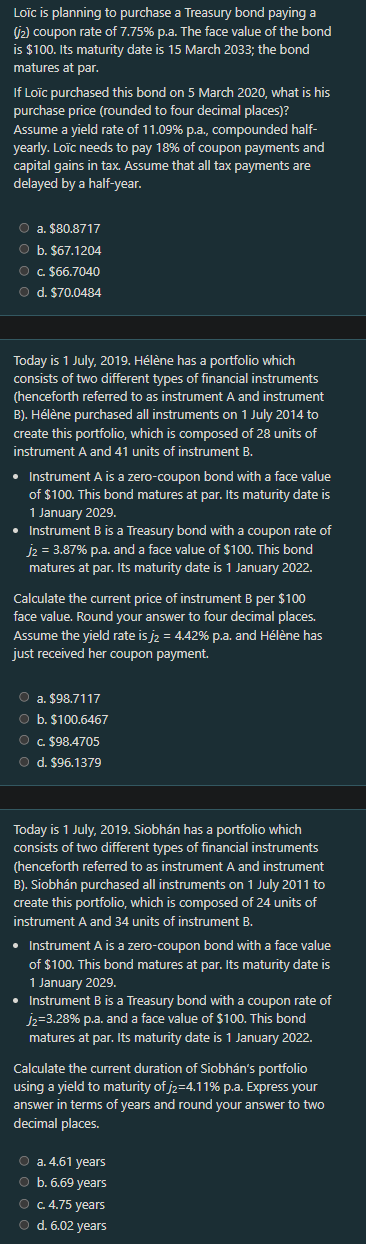

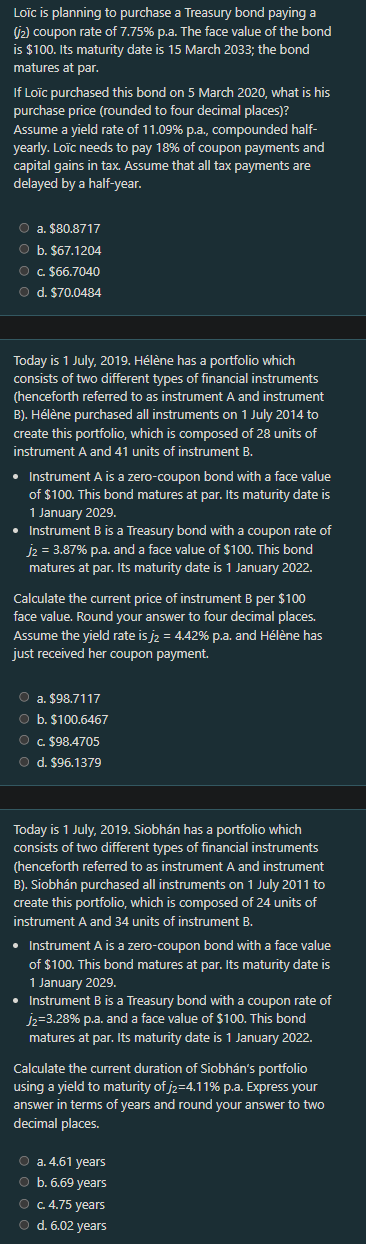

Loc is planning to purchase a Treasury bond paying a (12) coupon rate of 7.75% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loic purchased this bond on 5 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 11.09% p.a., compounded half- yearly. Loc needs to pay 18% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year. O a. $80.8717 O b. $67.1204 O c $66.7040 c. O d. $70.0484 Today is 1 July, 2019. Hlne has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Hlne purchased all instruments on 1 July 2014 to create this portfolio, which is composed of 28 units of instrument A and 41 units of instrument B. Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. Instrument B is a Treasury bond with a coupon rate of j2 = 3.87% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current price of instrument B per $100 face value. Round your answer to four decimal places. Assume the yield rate is j2 = 4.42% p.a. and Hlne has just received her coupon payment. O a. $98.7117 O b. $100.6467 O c. $98.4705 O d. $96.1379 Today is 1 July, 2019. Siobhn has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Siobhn purchased all instruments on 1 July 2011 to create this portfolio, which is composed of 24 units of instrument A and 34 units of instrument B. Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. Instrument B is a Treasury bond with a coupon rate of j2=3.28% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current duration of Siobhn's portfolio using a yield to maturity of j2=4.11% p.a. Express your answer in terms of years and round your answer to two decimal places. O a. 4.61 years O b. 6.69 years O c 4.75 years . O d. 6.02 years Loc is planning to purchase a Treasury bond paying a (12) coupon rate of 7.75% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loic purchased this bond on 5 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 11.09% p.a., compounded half- yearly. Loc needs to pay 18% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year. O a. $80.8717 O b. $67.1204 O c $66.7040 c. O d. $70.0484 Today is 1 July, 2019. Hlne has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Hlne purchased all instruments on 1 July 2014 to create this portfolio, which is composed of 28 units of instrument A and 41 units of instrument B. Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. Instrument B is a Treasury bond with a coupon rate of j2 = 3.87% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current price of instrument B per $100 face value. Round your answer to four decimal places. Assume the yield rate is j2 = 4.42% p.a. and Hlne has just received her coupon payment. O a. $98.7117 O b. $100.6467 O c. $98.4705 O d. $96.1379 Today is 1 July, 2019. Siobhn has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Siobhn purchased all instruments on 1 July 2011 to create this portfolio, which is composed of 24 units of instrument A and 34 units of instrument B. Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. Instrument B is a Treasury bond with a coupon rate of j2=3.28% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current duration of Siobhn's portfolio using a yield to maturity of j2=4.11% p.a. Express your answer in terms of years and round your answer to two decimal places. O a. 4.61 years O b. 6.69 years O c 4.75 years . O d. 6.02 years