Question

Local Mexican Food Co. Local Mexican Food Co., operated and licensed others to operate fast-service restaurants named Holy Guacamole. The menu featured tacos, burritos, and

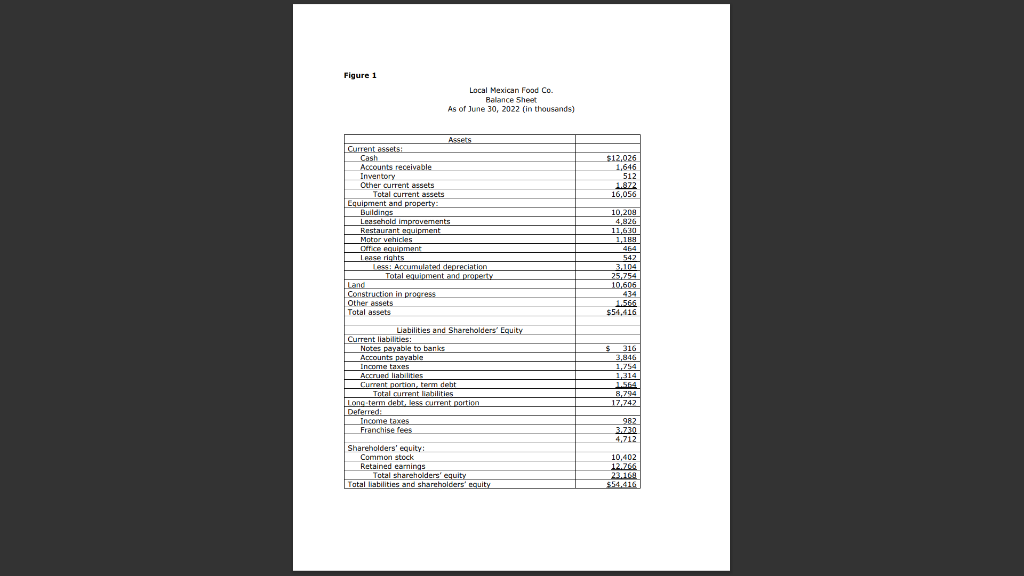

Local Mexican Food Co. Local Mexican Food Co., operated and licensed others to operate fast-service restaurants named Holy Guacamole. The menu featured tacos, burritos, and enchiladas. The walls were painted bold colors and decorated with murals of various Mexican landscapes. The first Holy Guacamole was opened in Saskatoon, Saskatchewan, 9 years ago. Now there are 253 restaurants operating across Canada and in some northern states, of which 120 are operated by the company and 133 by franchisees. In addition, 4 restaurants are under construction by the company, and 64 by franchisees. Figure 1 is a balance sheet as June 30, 2022. Each Holy Guacamole restaurant was built to the same specifications for exterior style and interior dcor. The buildings were painted red and were on approximately one acre of land. The parking lots were arranged to hold 30 35 vehicles. The standard restaurant contained about 2,000 square feet, seated 80 persons, and included a drive through service. The restaurants were in heavily populated areas because they needed a large number of customers to be successful. All of the restaurants offered the same menu. Three tacos: fish, beef and tofu; beef burrito, cheese burrito, chicken enchilada and beef enchilada. Local Mexican Food Co. created advertisements commercials to promote the restaurant chain. The prospective franchisee signed a contract that included the option of operating a certain number of Holy Guacamole restaurants in a prescribed area. A new location cost $18,000. There is also a royalty of 4% of sales. Local Mexican Food Co. planned to begin construction on five new company-owned restaurants during 2023. The exact size of the building was not determined, although the specific sites had already been selected.

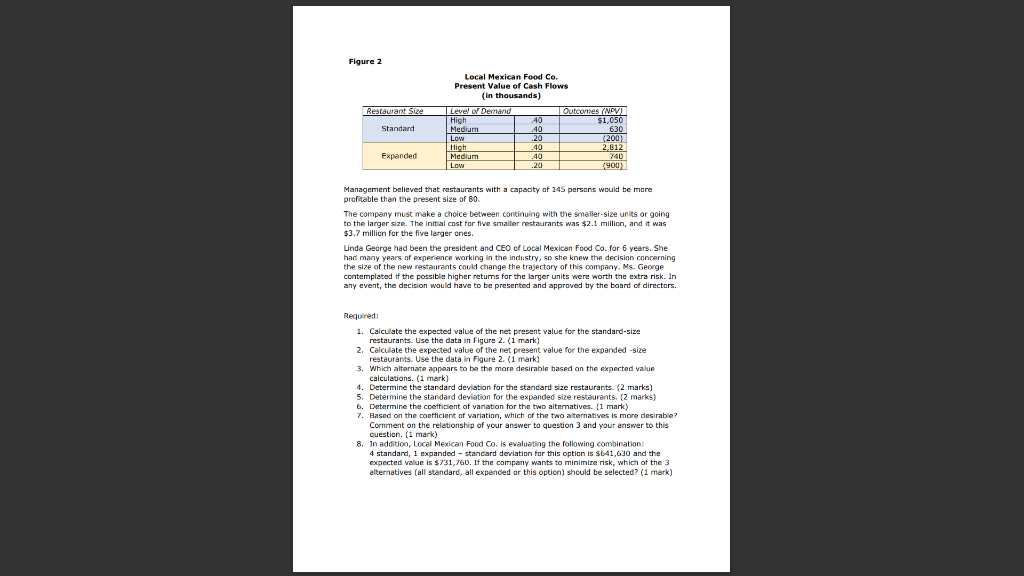

Management believed that restaurants with a capacity of 145 persons would be more profitable than the present size of 80. The company must make a choice between continuing with the smaller-size units or going to the larger size. The initial cost for five smaller restaurants was $2.1 million, and it was $3.7 million for the five larger ones. Linda George had been the president and CEO of Local Mexican Food Co. for 6 years. She had many years of experience working in the industry, so she knew the decision concerning the size of the new restaurants could change the trajectory of this company. Ms. George contemplated if the possible higher returns for the larger units were worth the extra risk. In any event, the decision would have to be presented and approved by the board of directors.

Required: 1. Calculate the expected value of the net present value for the standard-size restaurants. Use the data in Figure 2. (1 mark)

2. Calculate the expected value of the net present value for the expanded -size restaurants. Use the data in Figure 2. (1 mark)

3. Which alternate appears to be the more desirable based on the expected value calculations. (1 mark)

4. Determine the standard deviation for the standard size restaurants. (2 marks)

5. Determine the standard deviation for the expanded size restaurants. (2 marks)

6. Determine the coefficient of variation for the two alternatives. (1 mark)

7. Based on the coefficient of variation, which of the two alternatives is more desirable? Comment on the relationship of your answer to question 3 and your answer to this question. (1 mark)

8. In addition, Local Mexican Food Co. is evaluating the following combination: 4 standard, 1 expanded standard deviation for this option is $641,630 and the expected value is $731,760. If the company wants to minimize risk, which of the 3 alternatives (all standard, all expanded or this option) should be selected? (1 mark)

8. In addition, Local Mexican Food Co. is evaluating the following combination: 4 standard, 1 expanded standard deviation for this option is $641,630 and the expected value is $731,760. If the company wants to minimize risk, which of the 3 alternatives (all standard, all expanded or this option) should be selected? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started