Locate the 2020 Annual Reports (Form 10-K) for Tesla, Inc and Ford Motor Company on the Investor Relations section of the companies websites or sec.gov/edgar.

Locate the 2020 Annual Reports (Form 10-K) for Tesla, Inc and Ford Motor Company on the Investor Relations section of the companies websites or sec.gov/edgar. Be sure to use the audited financial statements and notes in Item 8 of each report to answer the questions. Do not use excerpts or summaries from other parts of the report. Calculate ratios using the information in the financial statements. Do not use other sources.

Annual Reports (Form 10-K) for Ford

Annual Reports (Form 10-K) for Tesla

a.What is the total dollar amount of Teslas probable and reasonably estimable contingent liabilities? Where did you find this amount?

b.Read Teslas note about warranties (pg. 73) and Fords note about warranty and field service actions (Note 25.). How much warranty expense did each company recognize in 2020? Calculate and comment on the ratio of warranty expense to sales for each company.

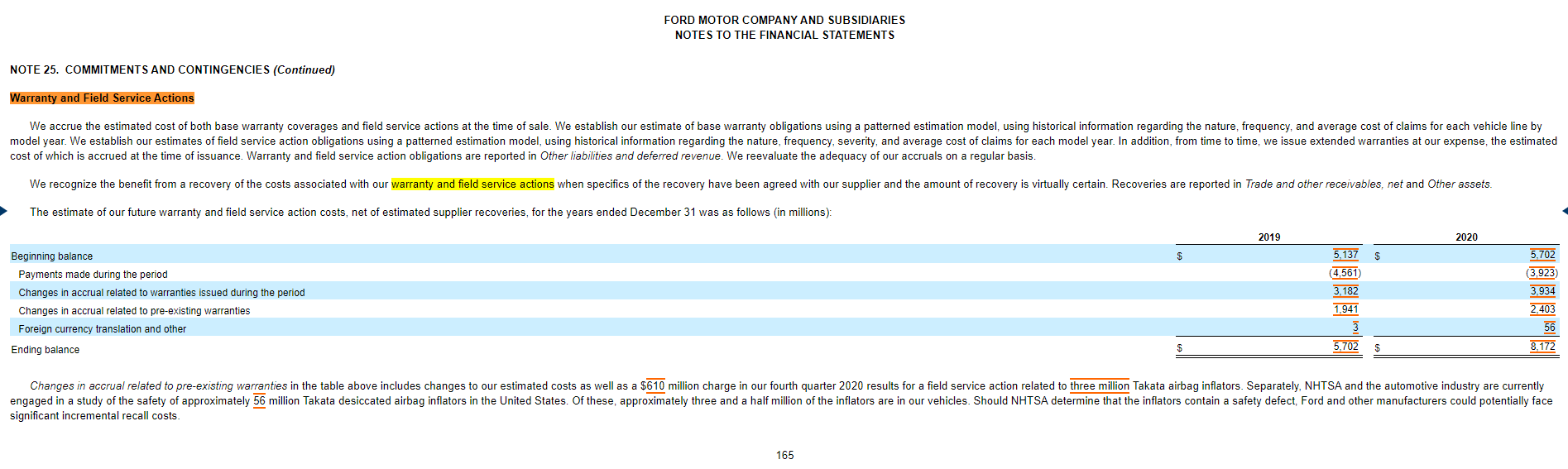

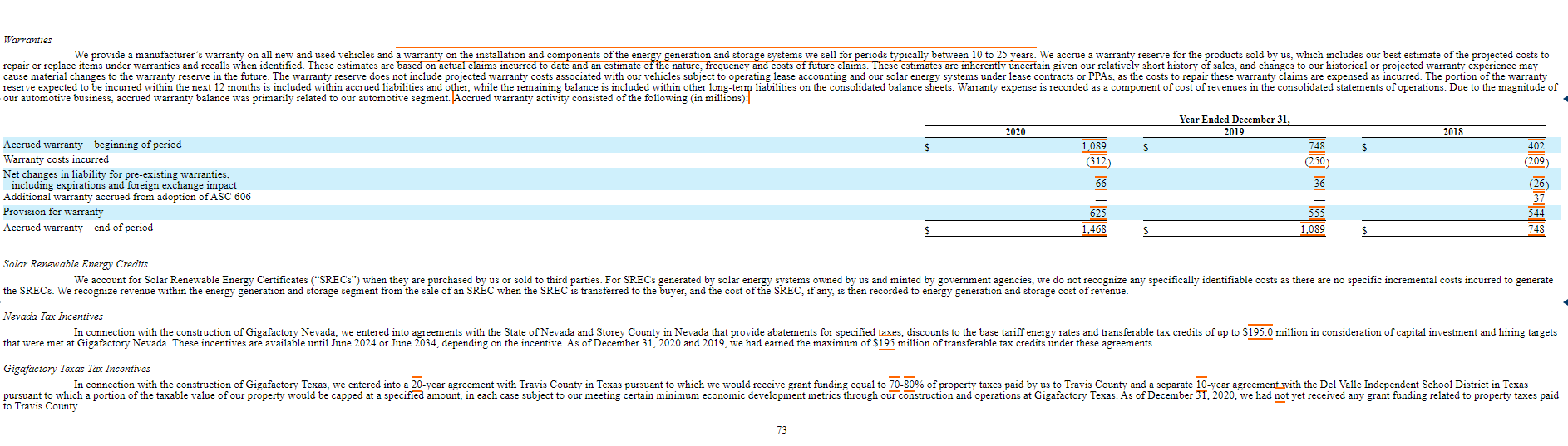

Warranty and Field Service Actions Accrual (United States) As described in Note 25 to the consolidated financial statements, the Company recorded an accrual for estimated future warranty and field service action costs, net of estimated supplier recoveries ("Warranty accrual"), of $8,172 million as of December 31, 2020, of which the United States comprises a significant portion Management accrues the estimated cost of both base warranty coverages and field service actions at the time of sale. Management establishes their estimate of base warranty obligations using a patterned estimation model, using historical information regarding the nature, frequency, and average cost of claims for each vehicle line by model year. Management establishes their estimates of field service action obligations using a patterned estimation model, using historical information regarding the nature, frequency, severity, and average cost of claims for each model year. The principal considerations for our determination that performing procedures relating to the warranty accrual for the United States is a critical audit matter are the significant judgment by management in the estimation of the accrual and development of the patterned estimation model, which led to a high degree of auditor judgment, subjectivity, and effort in performing procedures to evaluate the estimation model and significant assumptions, related to the frequency and average cost of claims. In addition, the audit effort involved the use of professionals with specialized skill and knowledge. Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls related to the estimate of the warranty accrual for the United States. These procedures also included, among others, evaluating the reasonableness of significant assumptions used by management to develop the warranty accrual for the United States, related to the frequency and average cost of claims, in part by considering the historical experience of the Company. Additionally, professionals with specialized skill and knowledge were used to assist in the evaluation of the appropriateness of the model as well as the reasonableness of significant assumptions related to the frequency and average cost of claims. /s/ PricewaterhouseCoopers LLP Detroit, Michigan February 4, 2021 We have served as the Company's auditor since 1946. 101 FORD MOTOR COMPANY AND SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS NOTE 25. COMMITMENTS AND CONTINGENCIES Commitments and contingencies primarily consist of guarantees and indemnifications, litigation and claims, and warranty and field service actions Guarantees and Indemnifications Financial Guarantees. Financial guarantees and indemnifications are recorded at fair value at their inception. Subsequent to initial recognition, the guarantee liability is adjusted at each reporting period to reflect the current estimate of expected payments resulting from possible default events over the remaining life of the guarantee. The maximum potential payments for financial guarantees were $162 million and $346 million at December 31, 2019 and 2020, respectively. The carrying value of recorded liabilities related to financial guarantees was $33 million and 546 million at December 31, 2019 and 2020, respectively. Our financial guarantees consist of debt and lease obligations of certain joint ventures, as well as certain financial obligations of outside third parties, including suppliers, to support our business and economic growth. Expiration dates vary through 2033, and guarantees will terminate on payment and/or cancellation of the underlying obligation. A payment by us would be triggered by failure of the joint venture or other third party to fulfill its obligation covered by the guarantee. In some circumstances, we are entitled to recover from a third party amounts paid by us under the guarantee. Non-Financial Guarantees. Non-financial guarantees and indemnifications are recorded at fair value at their inception. We regularly review our performance risk under these arrangements, and in the event it becomes probable we will be required to perform under a guarantee or indemnity, the amount of probable payment is recorded. The maximum potential payments for non-financial guarantees were $587 million and $245 million at December 31, 2019 and 2020, respectively. The carrying value of recorded liabilities related to non-financial guarantees was $200 million and $48 million at December 31, 2019 and 2020, respectively. We guarantee the resale value of vehicles sold in certain arrangements to daily rental companies. The maximum potential payment of $240 million as of December 31, 2020 represents the total proceeds we guarantee the rental company will receive on resale. Reflecting our present estimate of proceeds the rental companies will receive on resale from third parties, we have recorded $47 million as our best estimate of the amount we will have to pay under the guarantee In the ordinary course of business, we execute contracts involving indemnifications standard in the industry and indemnifications specific to a transaction, such as the sale of a business. These indemnifications might include and are not limited to claims relating to any of the following: environmental, tax, and shareholder matters; intellectual property rights; power generation contracts, governmental regulations and employment-related matters, dealer, supplier, and other commercial contractual relationships, and financial matters, such as securitizations. Performance under these indemnities generally would be triggered by a breach of contract claim brought by a counterparty, including a joint venture or alliance partner, or a third-party claim. While some of these indemnifications are limited in nature, many of them do not limit potential payment. Therefore, we are unable to estimate a maximum amount of future payments that could result from claims made under these unlimited indemnities FORD MOTOR COMPANY AND SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS NOTE 25. COMMITMENTS AND CONTINGENCIES (Continued) Warranty and Field Service Actions We accrue the estimated cost of both base warranty coverages and field service actions at the time of sale. We establish our estimate of base warranty obligations using a patterned estimation model, using historical information regarding the nature, frequency, and average cost of claims for each vehicle line by model year. We establish our estimates of field service action obligations using a patterned estimation model, using historical information regarding the nature, frequency, severity, and average cost of claims for each model year. In addition, from time to time, we issue extended warranties at our expense, the estimated cost of which is accrued at the time of issuance. Warranty and field service action obligations are reported in other liabilities and deferred revenue. We reevaluate the adequacy of our accruals on a regular basis. We recognize the benefit from a recovery of the costs associated with our warranty and field service actions when specifics of the recovery have been agreed with our supplier and the amount of recovery is virtually certain. Recoveries are reported in Trade and other receivables, net and Other assets. The estimate of our future warranty and field service action costs, net of estimated supplier recoveries, for the years ended December 31 was as follows (in millions): 2019 2020 $ 5,137 (4,561 3,182 Beginning balance Payments made during the period Changes in accrual related to warranties issued during the period Changes in accrual related to pre-existing warranties Foreign currency translation and other Ending balance 5,702 (3,923) 3.934 2,403 56 8,172 1,941 5,702 Changes in accrual related to pre-existing warranties in the table above includes changes to our estimated costs as well as a $610 million charge in our fourth quarter 2020 results for a field service action related to three million Takata airbag inflators. Separately, NHTSA and the automotive industry are currently engaged in a study of the safety of approximately 56 million Takata desiccated airbag inflators in the United States. Of these, approximately three and a half million of the inflators are in our vehicles. Should NHTSA determine that the inflators contain a safety defect, Ford and other manufacturers could potentially face significant incremental recall costs 165 Warranties We provide a manufacturer's warranty on all new and used vehicles and a warranty on the installation and components of the energy generation and storage systems we sell for periods typically between 10 to 25 years. We accrue a warranty reserve for the products sold by us, which includes our best estimate of the projected costs to repair or replace items under warranties and recalls when identified. These estimates are based on actual claims incurred to date and an estimate of the nature, frequency and costs of future claims. These estimates are inherently uncertain given our relatively short history of sales and changes to our historical or projected warranty experience may cause material changes to the warranty reserve in the future. The warranty reserve does not include projected warranty costs associated with our vehicles subject to operating lease accounting and our solar energy systems under lease contracts or PPAs, as the costs to repair these warranty claims are expensed as incurred. The portion of the warranty reserve expected to be incurred within the next 12 months is included within accrued liabilities and other, while the remaining balance is included within other long-term liabilities on the consolidated balance sheets. Warranty expense is recorded as a component of cost of revenues in the consolidated statements of operations. Due to the magnitude of our automotive business, accrued warranty balance was primarily related to our automotive segment. Accrued warranty activity consisted of the following (in millions): Year Ended December 31, 2020 2019 2018 Accrued warrantybeginning of period 1,089 $ 402 Warranty costs incurred (312) (250 (209 Net changes in liability for pre-existing warranties, 66 including expirations and foreign exchange impact 36 Additional warranty accrued from adoption of ASC 606 Provision for warranty 625 555 Accrued warranty-end of period 1.468 1,089 748 749 Solar Renewable Energy Credits We account for Solar Renewable Energy Certificates ("SRECS") when they are purchased by us or sold to third parties. For SRECs generated by solar energy systems owned by us and minted by government agencies, we do not recognize any specifically identifiable costs as there are no specific incremental costs incurred to generate the SRECs. We recognize revenue within the energy generation and storage segment from the sale of an SRC when the SREC is transferred to the buyer, and the cost of the SREC, if any, is then recorded to energy generation and storage cost of revenue. Nevada Tax Incentives In connection with the construction of Gigafactory Nevada, we entered into agreements with the State of Nevada and Storey County in Nevada that provide abatements for specified taxes, discounts to the base tariff energy rates and transferable tax credits of up to $195.0 million in consideration of capital investment and hiring targets that were met at Gigafactory Nevada. These incentives are available until June 2024 or June 2034, depending on the incentive. As of December 31, 2020 and 2019, we had earned the maximum of $195 million of transferable tax credits under these agreements. Gigafactory Texas Tax Incentives In connection with the construction of Gigafactory Texas, we enter into a 20-year agreement with ravis County in Texas pursuant to which we would receive grant funding equal to 70-80% of property taxes paid by to Travis County and a separate 10-year agreement with Del Valle Independent School District in Texas pursuant to which a portion of the taxable value of our property would be capped at a specified amount, in each case subject to our meeting certain minimum economic development metrics through our construction and operations at Gigafactory Texas. As of December 31, 2020, we had not yet received any grant funding related to property taxes paid to Travis County 73 The following table presents the potentially dilutive shares that were excluded from the computation of diluted net income (loss) per share of common stock attributable to common stockholders, because their effect was anti-dilutive (in millions): Year Ended December 31, 2020 2019 Stock-based awards Convertible senior notes Warrants 2018 Business Combinations We account for business acquisitions under ASC 805, Business Combinations. The total purchase consideration for an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities assumed at the acquisition date. Costs that are directly attributable to the acquisition are expensed as incurred. Identifiable assets (including intangible assets), liabilities assumed (including contingent liabilities) and noncontrolling interests in an acquisition are measured initially at their fair values at the acquisition date. We recognize goodwill if the fair value of the total purchase consideration and any noncontrolling interests is in excess of the net fair value of the identifiable assets acquired and the liabilities assumed. We recognize a bargain purchase gain within other income (expense), net, on the consolidated statement of operations if the net fair value of the identifiable assets acquired and the liabilities assumed is in excess of the fair value of the total purchase consideration and any noncontrolling interests. We include the results of operations of the acquired business in the consolidated financial statements beginning on the acquisition date. Cash and Cash Equivalents All highly liquid investments with an original maturity of three months or less at the date of purchase are considered cash equivalents. Our cash equivalents are primarily comprised of money market funds. Restricted Cash We maintain certain cash balances restricted as to withdrawal or use. Our restricted cash is comprised primarily of cash as collateral for our sales to lease partners with a resale value guarantee, letters of credit, real estate leases, insurance policies, credit card borrowing facilities and certain operating leases. In addition, restricted cash includes cash received from certain fund investors that have not been released for use by us and cash held to service certain payments under various secured debt facilities. We record restricted cash as other assets in the consolidated balance sheets and determine current or non-current classification based on the expected duration of the restriction. Our total cash and cash equivalents and restricted cash, as presented in the consolidated statements of cash flows, was as follows (in millions): December 31, December 31, December 31, 2020 2019 2018 Cash and cash equivalents 19,384 6,268 3.686 Restricted cash included in prepaid expenses and other current assets 238 246 193 Restricted cash included in other non-current assets 269 398 Total as presented in the consolidated statements of cash flows 19,901 6.783 4,277 Accounts Receivable and Allowance for Doubtful Accounts Accounts receivable primarily include amounts related to receivables from financial institutions and leasing companies offering various financing products to our customers, sales of energy generation and storage products, sales of regulatory credits to other automotive manufacturers, government rebates already passed through to customers and maintenance services on vehicles owned by leasing companies. We provide an allowance against accounts receivable for the amount we expect to be uncollectible. We write-off accounts receivable against the allowance when they are deemed uncollectible. 69 Noncontrolling Interests and Redeemable Noncontrolling Interests Noncontrolling interests and redeemable noncontrolling interests represent third-party interests in the net assets under certain funding arrangements, or funds, that we enter into to finance the costs of solar energy systems and vehicles under operating leases. We have determined that the contractual provisions of the funds represent substantive profit sharing arrangements. We have further determined that the methodology for calculating the noncontrolling interest and redeemable noncontrolling interest balances that reflects the substantive profit sharing arrangements is a balance sheet approach using the hypothetical liquidation at book value ("HLBV) method. We, therefore, determine the amount of the noncontrolling interests and redeemable noncontrolling interests in the net assets of the funds at each balance sheet date using the HLBV method, which is presented on the consolidated balance sheet as noncontrolling interests in subsidiaries and redeemable noncontrolling interests in subsidiaries. Under the HLBV method, the amounts reported as noncontrolling interests and redeemable noncontrolling interests in the consolidated balance sheet represent the amounts the third parties would hypothetically receive at each balance sheet date under the liquidation provisions of the funds, assuming the net assets of the funds were liquidated at their recorded amounts determined in accordance with GAAP and with tax laws effective at the balance sheet date and distributed to the third parties. The third parties' interests in the results of operations of the funds are determined as the difference in the noncontrolling interest and redeemable noncontrolling interest balances in the consolidated balance sheets between the start and end of each reporting period, after taking into account any capital transactions between the funds and the third parties. However, the redeemable noncontrolling interest balance is at least equal to the redemption amount. The redeemable noncontrolling interest balance is presented as temporary equity in the mezzanine section of the consolidated balance sheet since these third parties have the right to redeem their interests in the funds for cash or other assets. For certain funds, there may be significant fluctuations in the ending balance of redeemable noncontrolling interest in subsidiaries and net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries due to changes in the liquidation provisions as time-based milestones are reached. Net Income (Loss) per Share of Common Stock Attributable to Common Stockholders Basic net income (loss) per share of common stock attributable to common stockholders is calculated by dividing net income (loss) attributable to common stockholders by the weighted average shares of common stock outstanding for the period. During the year ended December 31, 2020, we decreased net income attributable to common stockholders by $31 million to arrive at the numerator used to calculate net income per share. During the year ended December 31, 2019, we increased net loss attributable to common stockholders by 58 million to arrive at the numerator used to calculate net loss per share. These adjustments represent the difference between the cash we paid to the financing fund investors for their noncontrolling interest in our subsidiaries and the carrying amount of the noncontrolling interest on our consolidated balance sheets, in accordance with ASC 260, Earnings per Share. Potentially dilutive shares, which are based on the weighted-average shares of common stock underlying outstanding stock based awards_warrants and convertible senior notes 11sing the treasury stock method or the if-converted method. as applicable are included when calculating diluted net income (loss) per share of common stock attributable to common stockholders when their effect is dilutive Since we intend to settle or have settled in cash the principal outstanding under our 0.25% Convertible Senior Notes due in 2019 2019 Notes'), 1.25% Convertible Senior Notes due in 2021 (2021 Notes"), 2.375% Convertible Senior Notes due in 2022 2022 Notes"), 2024 Notes and our subsidiary's 5.50% Convertible Senior Notes due in 2022, we use the treasury stock method applied using our average share price during the period when calculating their potential dilutive effect, if any. Furthermore, in connection with the offerings of our convertible senior notes, we entered into convertible note hedges and warrants (see Note 12. Debt). However, our convertible note hedges are not included when calculating potentially dilutive shares since their effect is always anti-dilutive. Warrants which have a strike price above our average share price during the period were out of the money and were not included in the tables below. Warrants will be included in the weighted-average shares used in computing basic net income (loss) per share of common stock in the period(3) they are settled. The following table presents the reconciliation of basic to diluted weighted average shares used in computing net income (loss) per share of common stock attributable to common stockholders, as adjusted to give effect to the Stock Split (in millions): Year Ended December 31, 2020 2019 2018 Weighted average shares used in computing net income (loss) per share of common stock, basic 933 887 853 Add: Stock-based awards Convertible senior notes Warrants Weighted average shares used in computing net income (10ss) per share of common stock, diluted 1,083 887 853 68 The following table presents the potentially dilutive shares that were excluded from the computation of diluted net income (loss) per share of common stock attributable to common stockholders, because their effect was anti-dilutive (in millions): Year Ended December 31, 2020 2019 Stock-based awards Convertible senior notes Warrants 2018 JAMI Warranty and Field Service Actions Accrual (United States) As described in Note 25 to the consolidated financial statements, the Company recorded an accrual for estimated future warranty and field service action costs, net of estimated supplier recoveries ("Warranty accrual"), of $8,172 million as of December 31, 2020, of which the United States comprises a significant portion Management accrues the estimated cost of both base warranty coverages and field service actions at the time of sale. Management establishes their estimate of base warranty obligations using a patterned estimation model, using historical information regarding the nature, frequency, and average cost of claims for each vehicle line by model year. Management establishes their estimates of field service action obligations using a patterned estimation model, using historical information regarding the nature, frequency, severity, and average cost of claims for each model year. The principal considerations for our determination that performing procedures relating to the warranty accrual for the United States is a critical audit matter are the significant judgment by management in the estimation of the accrual and development of the patterned estimation model, which led to a high degree of auditor judgment, subjectivity, and effort in performing procedures to evaluate the estimation model and significant assumptions, related to the frequency and average cost of claims. In addition, the audit effort involved the use of professionals with specialized skill and knowledge. Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls related to the estimate of the warranty accrual for the United States. These procedures also included, among others, evaluating the reasonableness of significant assumptions used by management to develop the warranty accrual for the United States, related to the frequency and average cost of claims, in part by considering the historical experience of the Company. Additionally, professionals with specialized skill and knowledge were used to assist in the evaluation of the appropriateness of the model as well as the reasonableness of significant assumptions related to the frequency and average cost of claims. /s/ PricewaterhouseCoopers LLP Detroit, Michigan February 4, 2021 We have served as the Company's auditor since 1946. 101 FORD MOTOR COMPANY AND SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS NOTE 25. COMMITMENTS AND CONTINGENCIES Commitments and contingencies primarily consist of guarantees and indemnifications, litigation and claims, and warranty and field service actions Guarantees and Indemnifications Financial Guarantees. Financial guarantees and indemnifications are recorded at fair value at their inception. Subsequent to initial recognition, the guarantee liability is adjusted at each reporting period to reflect the current estimate of expected payments resulting from possible default events over the remaining life of the guarantee. The maximum potential payments for financial guarantees were $162 million and $346 million at December 31, 2019 and 2020, respectively. The carrying value of recorded liabilities related to financial guarantees was $33 million and 546 million at December 31, 2019 and 2020, respectively. Our financial guarantees consist of debt and lease obligations of certain joint ventures, as well as certain financial obligations of outside third parties, including suppliers, to support our business and economic growth. Expiration dates vary through 2033, and guarantees will terminate on payment and/or cancellation of the underlying obligation. A payment by us would be triggered by failure of the joint venture or other third party to fulfill its obligation covered by the guarantee. In some circumstances, we are entitled to recover from a third party amounts paid by us under the guarantee. Non-Financial Guarantees. Non-financial guarantees and indemnifications are recorded at fair value at their inception. We regularly review our performance risk under these arrangements, and in the event it becomes probable we will be required to perform under a guarantee or indemnity, the amount of probable payment is recorded. The maximum potential payments for non-financial guarantees were $587 million and $245 million at December 31, 2019 and 2020, respectively. The carrying value of recorded liabilities related to non-financial guarantees was $200 million and $48 million at December 31, 2019 and 2020, respectively. We guarantee the resale value of vehicles sold in certain arrangements to daily rental companies. The maximum potential payment of $240 million as of December 31, 2020 represents the total proceeds we guarantee the rental company will receive on resale. Reflecting our present estimate of proceeds the rental companies will receive on resale from third parties, we have recorded $47 million as our best estimate of the amount we will have to pay under the guarantee In the ordinary course of business, we execute contracts involving indemnifications standard in the industry and indemnifications specific to a transaction, such as the sale of a business. These indemnifications might include and are not limited to claims relating to any of the following: environmental, tax, and shareholder matters; intellectual property rights; power generation contracts, governmental regulations and employment-related matters, dealer, supplier, and other commercial contractual relationships, and financial matters, such as securitizations. Performance under these indemnities generally would be triggered by a breach of contract claim brought by a counterparty, including a joint venture or alliance partner, or a third-party claim. While some of these indemnifications are limited in nature, many of them do not limit potential payment. Therefore, we are unable to estimate a maximum amount of future payments that could result from claims made under these unlimited indemnities FORD MOTOR COMPANY AND SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS NOTE 25. COMMITMENTS AND CONTINGENCIES (Continued) Warranty and Field Service Actions We accrue the estimated cost of both base warranty coverages and field service actions at the time of sale. We establish our estimate of base warranty obligations using a patterned estimation model, using historical information regarding the nature, frequency, and average cost of claims for each vehicle line by model year. We establish our estimates of field service action obligations using a patterned estimation model, using historical information regarding the nature, frequency, severity, and average cost of claims for each model year. In addition, from time to time, we issue extended warranties at our expense, the estimated cost of which is accrued at the time of issuance. Warranty and field service action obligations are reported in other liabilities and deferred revenue. We reevaluate the adequacy of our accruals on a regular basis. We recognize the benefit from a recovery of the costs associated with our warranty and field service actions when specifics of the recovery have been agreed with our supplier and the amount of recovery is virtually certain. Recoveries are reported in Trade and other receivables, net and Other assets. The estimate of our future warranty and field service action costs, net of estimated supplier recoveries, for the years ended December 31 was as follows (in millions): 2019 2020 $ 5,137 (4,561 3,182 Beginning balance Payments made during the period Changes in accrual related to warranties issued during the period Changes in accrual related to pre-existing warranties Foreign currency translation and other Ending balance 5,702 (3,923) 3.934 2,403 56 8,172 1,941 5,702 Changes in accrual related to pre-existing warranties in the table above includes changes to our estimated costs as well as a $610 million charge in our fourth quarter 2020 results for a field service action related to three million Takata airbag inflators. Separately, NHTSA and the automotive industry are currently engaged in a study of the safety of approximately 56 million Takata desiccated airbag inflators in the United States. Of these, approximately three and a half million of the inflators are in our vehicles. Should NHTSA determine that the inflators contain a safety defect, Ford and other manufacturers could potentially face significant incremental recall costs 165 Warranties We provide a manufacturer's warranty on all new and used vehicles and a warranty on the installation and components of the energy generation and storage systems we sell for periods typically between 10 to 25 years. We accrue a warranty reserve for the products sold by us, which includes our best estimate of the projected costs to repair or replace items under warranties and recalls when identified. These estimates are based on actual claims incurred to date and an estimate of the nature, frequency and costs of future claims. These estimates are inherently uncertain given our relatively short history of sales and changes to our historical or projected warranty experience may cause material changes to the warranty reserve in the future. The warranty reserve does not include projected warranty costs associated with our vehicles subject to operating lease accounting and our solar energy systems under lease contracts or PPAs, as the costs to repair these warranty claims are expensed as incurred. The portion of the warranty reserve expected to be incurred within the next 12 months is included within accrued liabilities and other, while the remaining balance is included within other long-term liabilities on the consolidated balance sheets. Warranty expense is recorded as a component of cost of revenues in the consolidated statements of operations. Due to the magnitude of our automotive business, accrued warranty balance was primarily related to our automotive segment. Accrued warranty activity consisted of the following (in millions): Year Ended December 31, 2020 2019 2018 Accrued warrantybeginning of period 1,089 $ 402 Warranty costs incurred (312) (250 (209 Net changes in liability for pre-existing warranties, 66 including expirations and foreign exchange impact 36 Additional warranty accrued from adoption of ASC 606 Provision for warranty 625 555 Accrued warranty-end of period 1.468 1,089 748 749 Solar Renewable Energy Credits We account for Solar Renewable Energy Certificates ("SRECS") when they are purchased by us or sold to third parties. For SRECs generated by solar energy systems owned by us and minted by government agencies, we do not recognize any specifically identifiable costs as there are no specific incremental costs incurred to generate the SRECs. We recognize revenue within the energy generation and storage segment from the sale of an SRC when the SREC is transferred to the buyer, and the cost of the SREC, if any, is then recorded to energy generation and storage cost of revenue. Nevada Tax Incentives In connection with the construction of Gigafactory Nevada, we entered into agreements with the State of Nevada and Storey County in Nevada that provide abatements for specified taxes, discounts to the base tariff energy rates and transferable tax credits of up to $195.0 million in consideration of capital investment and hiring targets that were met at Gigafactory Nevada. These incentives are available until June 2024 or June 2034, depending on the incentive. As of December 31, 2020 and 2019, we had earned the maximum of $195 million of transferable tax credits under these agreements. Gigafactory Texas Tax Incentives In connection with the construction of Gigafactory Texas, we enter into a 20-year agreement with ravis County in Texas pursuant to which we would receive grant funding equal to 70-80% of property taxes paid by to Travis County and a separate 10-year agreement with Del Valle Independent School District in Texas pursuant to which a portion of the taxable value of our property would be capped at a specified amount, in each case subject to our meeting certain minimum economic development metrics through our construction and operations at Gigafactory Texas. As of December 31, 2020, we had not yet received any grant funding related to property taxes paid to Travis County 73 The following table presents the potentially dilutive shares that were excluded from the computation of diluted net income (loss) per share of common stock attributable to common stockholders, because their effect was anti-dilutive (in millions): Year Ended December 31, 2020 2019 Stock-based awards Convertible senior notes Warrants 2018 Business Combinations We account for business acquisitions under ASC 805, Business Combinations. The total purchase consideration for an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities assumed at the acquisition date. Costs that are directly attributable to the acquisition are expensed as incurred. Identifiable assets (including intangible assets), liabilities assumed (including contingent liabilities) and noncontrolling interests in an acquisition are measured initially at their fair values at the acquisition date. We recognize goodwill if the fair value of the total purchase consideration and any noncontrolling interests is in excess of the net fair value of the identifiable assets acquired and the liabilities assumed. We recognize a bargain purchase gain within other income (expense), net, on the consolidated statement of operations if the net fair value of the identifiable assets acquired and the liabilities assumed is in excess of the fair value of the total purchase consideration and any noncontrolling interests. We include the results of operations of the acquired business in the consolidated financial statements beginning on the acquisition date. Cash and Cash Equivalents All highly liquid investments with an original maturity of three months or less at the date of purchase are considered cash equivalents. Our cash equivalents are primarily comprised of money market funds. Restricted Cash We maintain certain cash balances restricted as to withdrawal or use. Our restricted cash is comprised primarily of cash as collateral for our sales to lease partners with a resale value guarantee, letters of credit, real estate leases, insurance policies, credit card borrowing facilities and certain operating leases. In addition, restricted cash includes cash received from certain fund investors that have not been released for use by us and cash held to service certain payments under various secured debt facilities. We record restricted cash as other assets in the consolidated balance sheets and determine current or non-current classification based on the expected duration of the restriction. Our total cash and cash equivalents and restricted cash, as presented in the consolidated statements of cash flows, was as follows (in millions): December 31, December 31, December 31, 2020 2019 2018 Cash and cash equivalents 19,384 6,268 3.686 Restricted cash included in prepaid expenses and other current assets 238 246 193 Restricted cash included in other non-current assets 269 398 Total as presented in the consolidated statements of cash flows 19,901 6.783 4,277 Accounts Receivable and Allowance for Doubtful Accounts Accounts receivable primarily include amounts related to receivables from financial institutions and leasing companies offering various financing products to our customers, sales of energy generation and storage products, sales of regulatory credits to other automotive manufacturers, government rebates already passed through to customers and maintenance services on vehicles owned by leasing companies. We provide an allowance against accounts receivable for the amount we expect to be uncollectible. We write-off accounts receivable against the allowance when they are deemed uncollectible. 69 Noncontrolling Interests and Redeemable Noncontrolling Interests Noncontrolling interests and redeemable noncontrolling interests represent third-party interests in the net assets under certain funding arrangements, or funds, that we enter into to finance the costs of solar energy systems and vehicles under operating leases. We have determined that the contractual provisions of the funds represent substantive profit sharing arrangements. We have further determined that the methodology for calculating the noncontrolling interest and redeemable noncontrolling interest balances that reflects the substantive profit sharing arrangements is a balance sheet approach using the hypothetical liquidation at book value ("HLBV) method. We, therefore, determine the amount of the noncontrolling interests and redeemable noncontrolling interests in the net assets of the funds at each balance sheet date using the HLBV method, which is presented on the consolidated balance sheet as noncontrolling interests in subsidiaries and redeemable noncontrolling interests in subsidiaries. Under the HLBV method, the amounts reported as noncontrolling interests and redeemable noncontrolling interests in the consolidated balance sheet represent the amounts the third parties would hypothetically receive at each balance sheet date under the liquidation provisions of the funds, assuming the net assets of the funds were liquidated at their recorded amounts determined in accordance with GAAP and with tax laws effective at the balance sheet date and distributed to the third parties. The third parties' interests in the results of operations of the funds are determined as the difference in the noncontrolling interest and redeemable noncontrolling interest balances in the consolidated balance sheets between the start and end of each reporting period, after taking into account any capital transactions between the funds and the third parties. However, the redeemable noncontrolling interest balance is at least equal to the redemption amount. The redeemable noncontrolling interest balance is presented as temporary equity in the mezzanine section of the consolidated balance sheet since these third parties have the right to redeem their interests in the funds for cash or other assets. For certain funds, there may be significant fluctuations in the ending balance of redeemable noncontrolling interest in subsidiaries and net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries due to changes in the liquidation provisions as time-based milestones are reached. Net Income (Loss) per Share of Common Stock Attributable to Common Stockholders Basic net income (loss) per share of common stock attributable to common stockholders is calculated by dividing net income (loss) attributable to common stockholders by the weighted average shares of common stock outstanding for the period. During the year ended December 31, 2020, we decreased net income attributable to common stockholders by $31 million to arrive at the numerator used to calculate net income per share. During the year ended December 31, 2019, we increased net loss attributable to common stockholders by 58 million to arrive at the numerator used to calculate net loss per share. These adjustments represent the difference between the cash we paid to the financing fund investors for their noncontrolling interest in our subsidiaries and the carrying amount of the noncontrolling interest on our consolidated balance sheets, in accordance with ASC 260, Earnings per Share. Potentially dilutive shares, which are based on the weighted-average shares of common stock underlying outstanding stock based awards_warrants and convertible senior notes 11sing the treasury stock method or the if-converted method. as applicable are included when calculating diluted net income (loss) per share of common stock attributable to common stockholders when their effect is dilutive Since we intend to settle or have settled in cash the principal outstanding under our 0.25% Convertible Senior Notes due in 2019 2019 Notes'), 1.25% Convertible Senior Notes due in 2021 (2021 Notes"), 2.375% Convertible Senior Notes due in 2022 2022 Notes"), 2024 Notes and our subsidiary's 5.50% Convertible Senior Notes due in 2022, we use the treasury stock method applied using our average share price during the period when calculating their potential dilutive effect, if any. Furthermore, in connection with the offerings of our convertible senior notes, we entered into convertible note hedges and warrants (see Note 12. Debt). However, our convertible note hedges are not included when calculating potentially dilutive shares since their effect is always anti-dilutive. Warrants which have a strike price above our average share price during the period were out of the money and were not included in the tables below. Warrants will be included in the weighted-average shares used in computing basic net income (loss) per share of common stock in the period(3) they are settled. The following table presents the reconciliation of basic to diluted weighted average shares used in computing net income (loss) per share of common stock attributable to common stockholders, as adjusted to give effect to the Stock Split (in millions): Year Ended December 31, 2020 2019 2018 Weighted average shares used in computing net income (loss) per share of common stock, basic 933 887 853 Add: Stock-based awards Convertible senior notes Warrants Weighted average shares used in computing net income (10ss) per share of common stock, diluted 1,083 887 853 68 The following table presents the potentially dilutive shares that were excluded from the computation of diluted net income (loss) per share of common stock attributable to common stockholders, because their effect was anti-dilutive (in millions): Year Ended December 31, 2020 2019 Stock-based awards Convertible senior notes Warrants 2018 JAMIStep by Step Solution

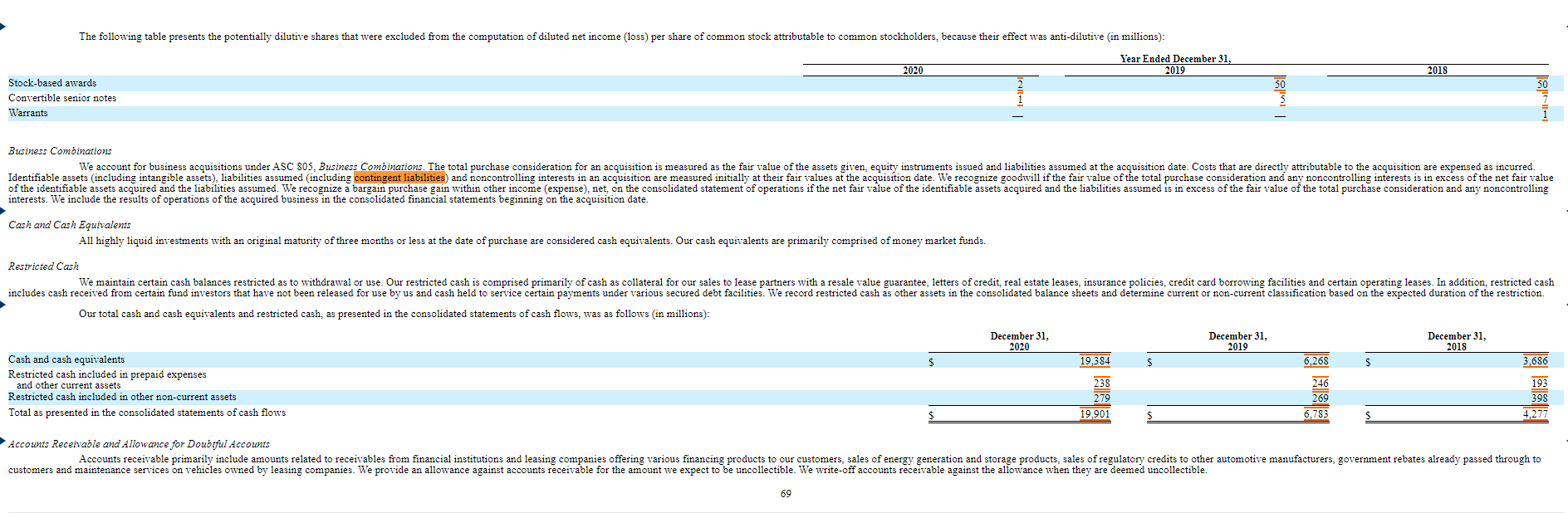

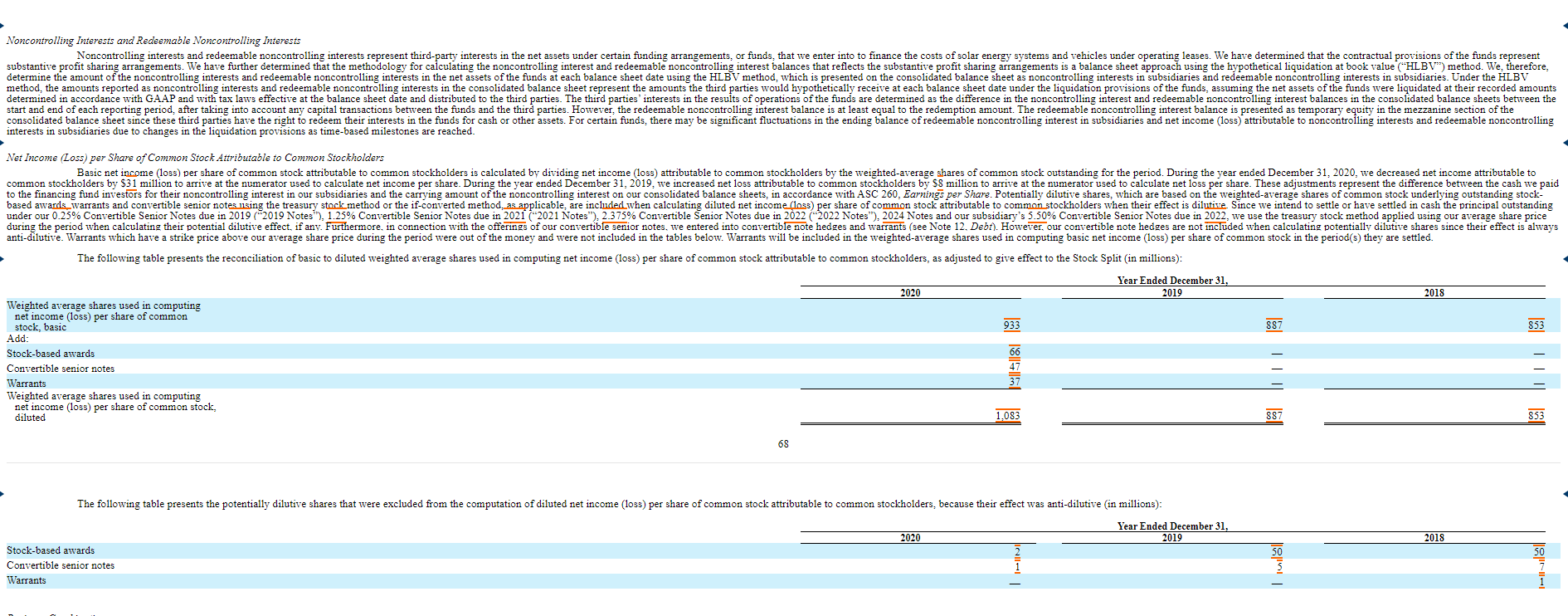

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started