Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Locate the Financial Leverage Graphs document in the Files section of the bCourses site. You can print out this page and answer the question on

- Locate the Financial Leverage Graphs document in the Files section of the bCourses site. You can print out this page and answer the question on that page. If you do not have a printer, then reproduce that page on a sheet of paper.

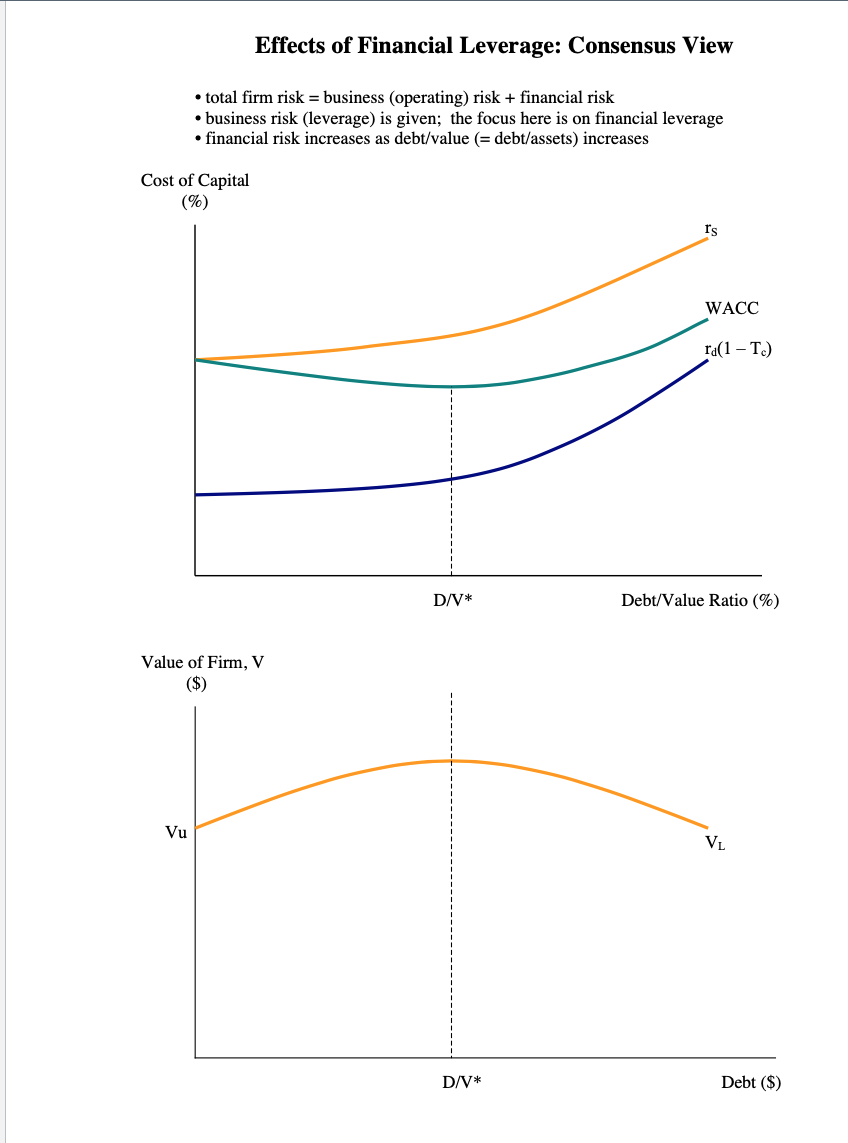

Show graphically and explain what will happen to the graphs if common shareholders become more risk averse. (12 points).

- This question focuses on debt, preferred stock, common stock and retained earnings. Make sure that you provide a complete explanation regarding common stock compared to retained earnings.

If we construct a graph that has the cost of capital on the vertical axis and the risk ofthe firm on the horizontal axis, what does the graph look like? Explain. (

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started