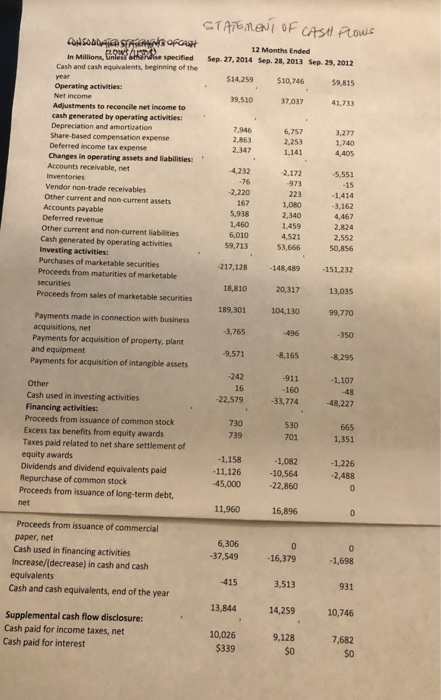

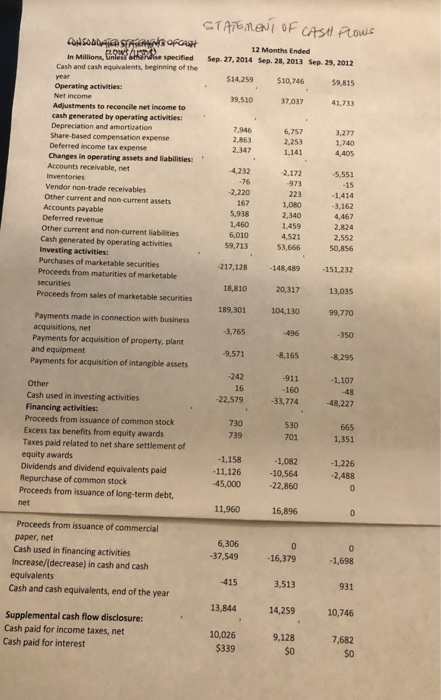

locate the largest amount of cash generated by the company's financing activities. identify the transaction that contributes to this particular cash inflow. ( year is 2013)

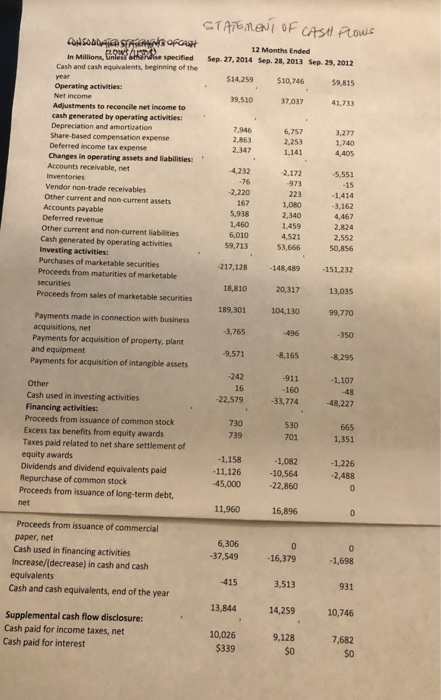

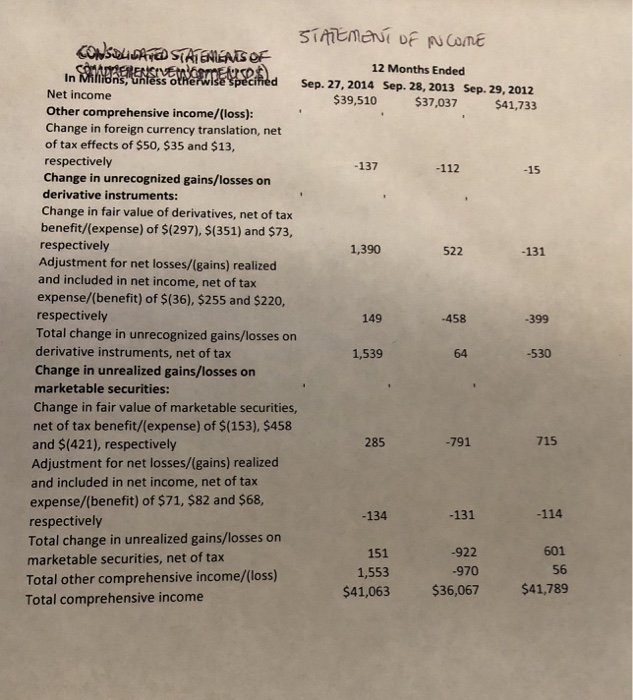

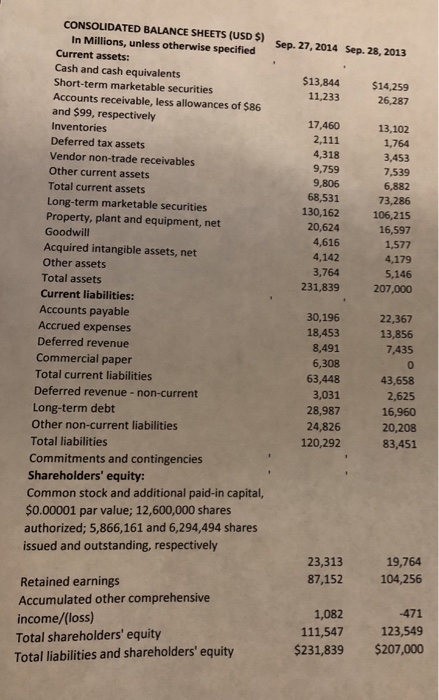

3.277 1.459 2.824 STATEMENT OF CASH Flows OHSODASIEWS OF CAST 12 Months Ended in Million s de specified Sep 27,2014 Sep 28, 2013 Sep 29, 2012 Cash and cash equivalents, beginning of the $14.259 $10,746 $9,815 Operating activities: Net income 39,510 37,037 41,733 Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization 7.946 6,757 Share-based compensation expense 2.863 2.253 1,740 Deferred income tax expense 2.347 1,141 4,405 Changes in operating assets and liabilities: Accounts receivable, net -4.232 -2.172 -5,551 Inventories -75 Vendor non-trade receivables -2,220 -1,414 Other current and non-current assets 167 1,080 -3.162 Accounts payable 5,938 2,340 4,467 Deferred revenue 1,460 Other current and non-current liabilities 6,010 4,521 2,552 Cash generated by operating activities 59,713 53,666 50,856 Investing activities: Purchases of marketable securities -217,128 -148,489 -151,232 Proceeds from maturities of marketable Securities 18,810 20,317 13,035 Proceeds from sales of marketable securities 189,301 104,130 99,770 Payments made in connection with business acquisitions, net -496 -350 Payments for acquisition of property, plant and equipment -9,571 -8,165 -8,295 Payments for acquisition of intangible assets -242 -911 -1,107 Other - 160 Cash used in investing activities -22,579 -33,774 -48,227 Financing activities: Proceeds from issuance of common stock 730 530 665 Excess tax benefits from equity awards 701 1,351 Taxes paid related to net share settlement of equity awards -1,158 -1,082 -1.226 Dividends and dividend equivalents paid -11,126 -10,564 -2,488 Repurchase of common stock -45,000 -22,860 Proceeds from issuance of long-term debt, 11,960 16,896 Proceeds from issuance of commercial paper, net 6,306 0 Cash used in financing activities -37,549 -16,379 -1,698 Increase/(decrease) in cash and cash equivalents -415 3,513 931 Cash and cash equivalents, end of the year 13,844 14,259 10,746 Supplemental cash flow disclosure: Cash paid for income taxes, net 10,026 9,128 Cash paid for interest $339 -3,765 7,682 $0 -112 -15 522 STATEMENT OF INCOME CONSOLIDATED STATENEATS OF in the sentes senere specified 12 Months Ended Sep. 27, 2014 Sep. 28, 2013 Sep. 29, 2012 Net income $39,510 $37,037 $41,733 Other comprehensive income/(loss): Change in foreign currency translation, net of tax effects of $50, $35 and $13, respectively - 137 Change in unrecognized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(297), $(351) and $73, respectively 1,390 -131 Adjustment for net losses/(gains) realized and included in net income, net of tax expense/(benefit) of $(36), $255 and $220, respectively 149 -458 -399 Total change in unrecognized gains/losses on derivative instruments, net of tax 1,539 -530 Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit/(expense) of $(153), $458 and $(421), respectively -791 Adjustment for net losses/(gains) realized and included in net income, net of tax expense/(benefit) of $71, $82 and $68, - 134 -131 -114 respectively Total change in unrealized gains/losses on 151 -922 601 marketable securities, net of tax 1,553 -970 56 Total other comprehensive income/(loss) $41,063 $36,067 $41,789 Total comprehensive income 285 715 CONSOLIDATED BALANCE SHEETS (USD $) s In Millions, unless otherwise specified Sep. 27, 2014 Sep. 28, 2013 Current assets: Cash and cash equivalents Short-term marketable securities $13,844 $14,259 Accounts receivable, less allowances of $86 11,233 26,287 and $99, respectively Inventories 17,460 13,102 Deferred tax assets 2,111 1,764 Vendor non-trade receivables 4,318 3,453 9,759 Other current assets 7,539 9,806 Total current assets 6,882 68,531 Long-term marketable securities 73,286 Property, plant and equipment, net 130,162 106,215 20,624 16,597 Goodwill 4,616 Acquired intangible assets, net 1,577 4,142 Other assets 4,179 3,764 5,146 Total assets 231,839 207,000 Current liabilities: Accounts payable 30,196 22,367 Accrued expenses 18,453 13,856 Deferred revenue 8,491 7,435 Commercial paper 6,308 Total current liabilities 63,448 43,658 Deferred revenue -non-current 3,031 2,625 Long-term debt 28,987 16,960 Other non-current liabilities 24,826 20,208 Total liabilities 120,292 83,451 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value; 12,600,000 shares authorized; 5,866,161 and 6,294,494 shares issued and outstanding, respectively 23,313 19,764 Retained earnings 87,152 104,256 Accumulated other comprehensive income/(loss) 1,082 -471 111,547 123,549 Total shareholders' equity $231,839 $207,000 Total liabilities and shareholders' equity