Locate the Notes to the Financial Statements and choose 3 of them. Describe them in your own words. I strongly recommend you choose topics you are familiar with (Depreciation, Revenue Recognition, Accounts Receivable, PP&E, etc). You should submit a total of three paragraphs for this part.

Locate the Notes to the Financial Statements and choose 3 of them. Describe them in your own words. I strongly recommend you choose topics you are familiar with (Depreciation, Revenue Recognition, Accounts Receivable, PP&E, etc). You should submit a total of three paragraphs for this part.

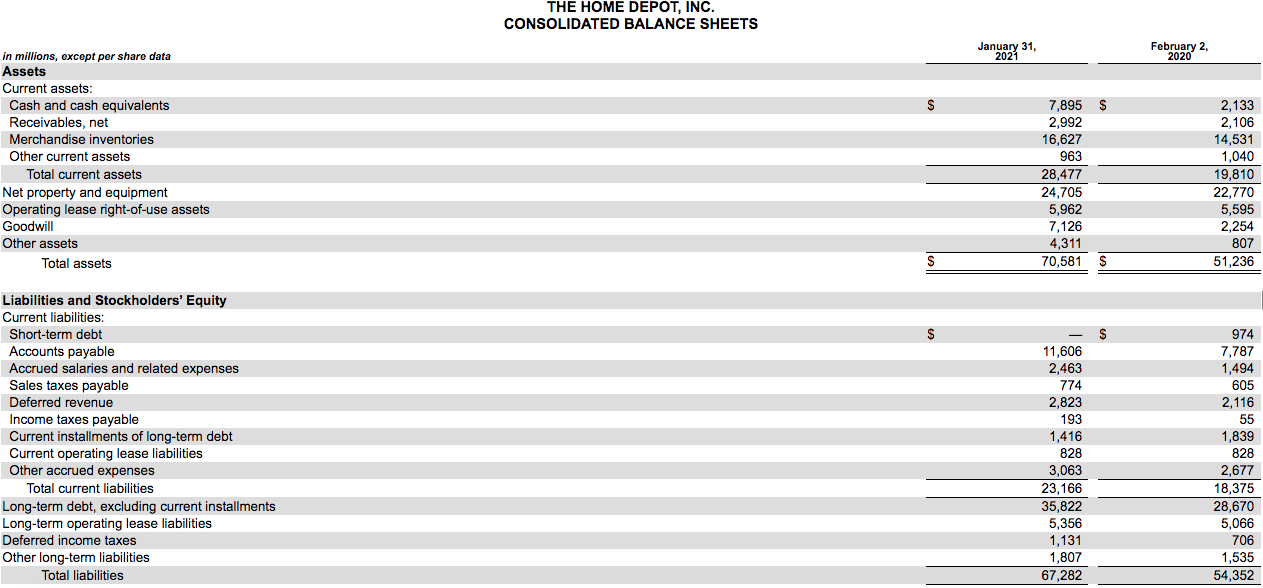

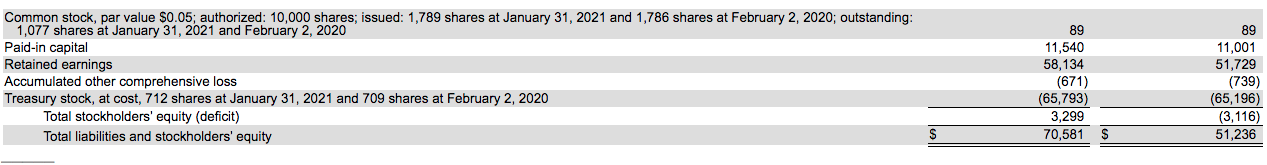

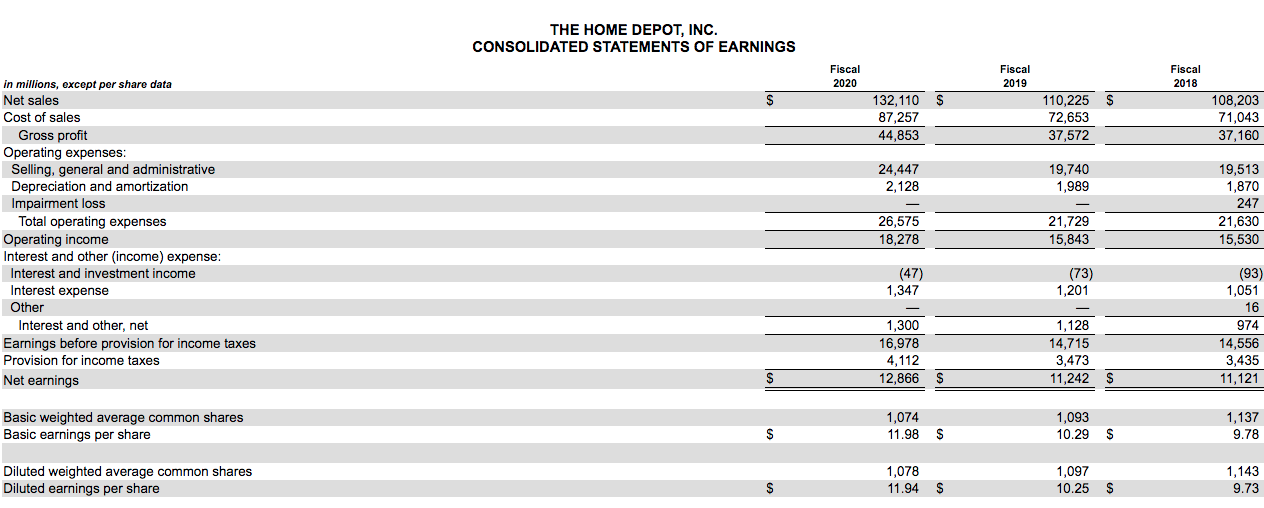

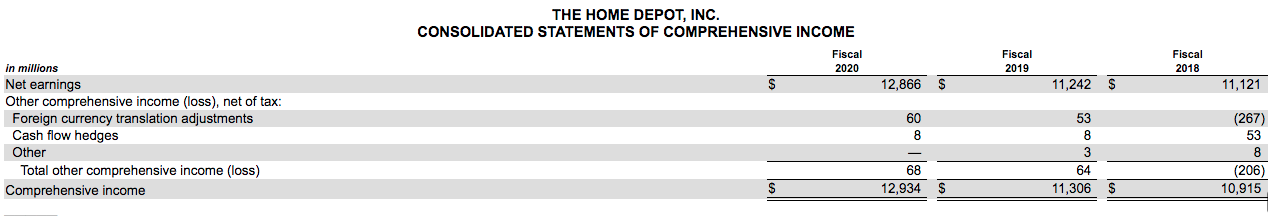

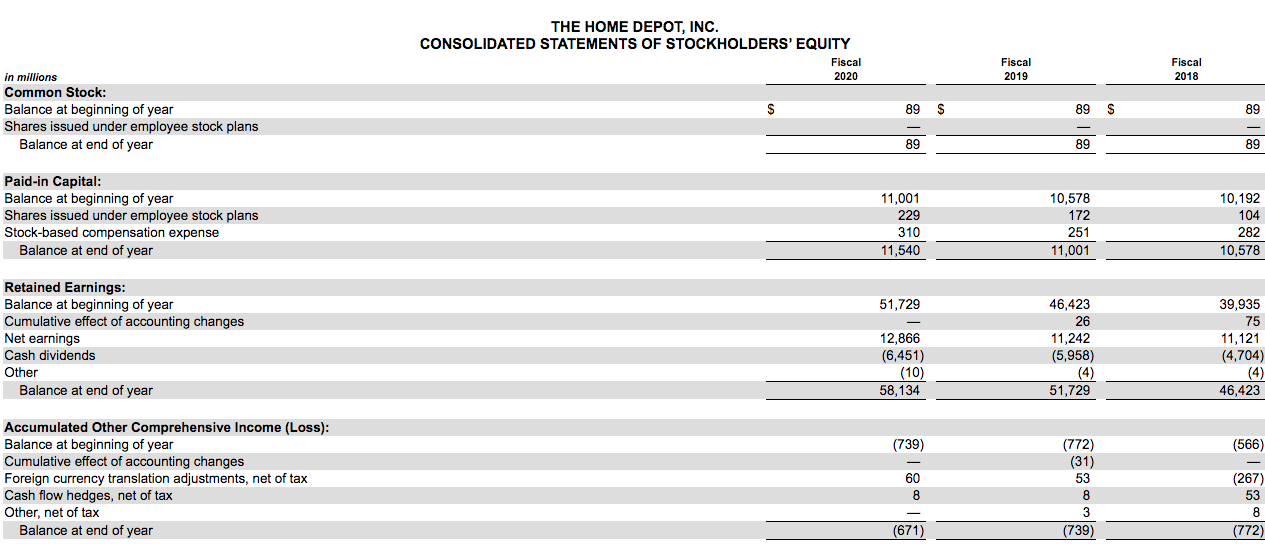

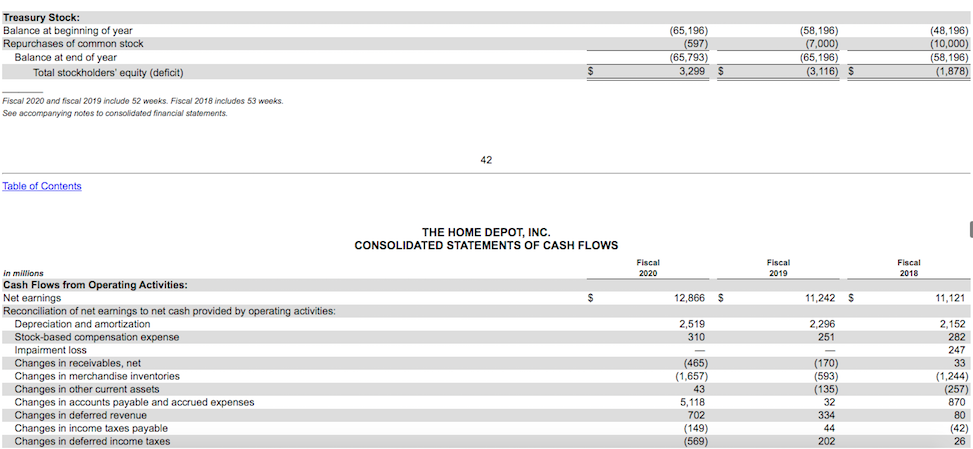

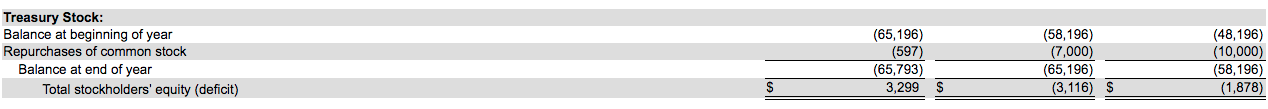

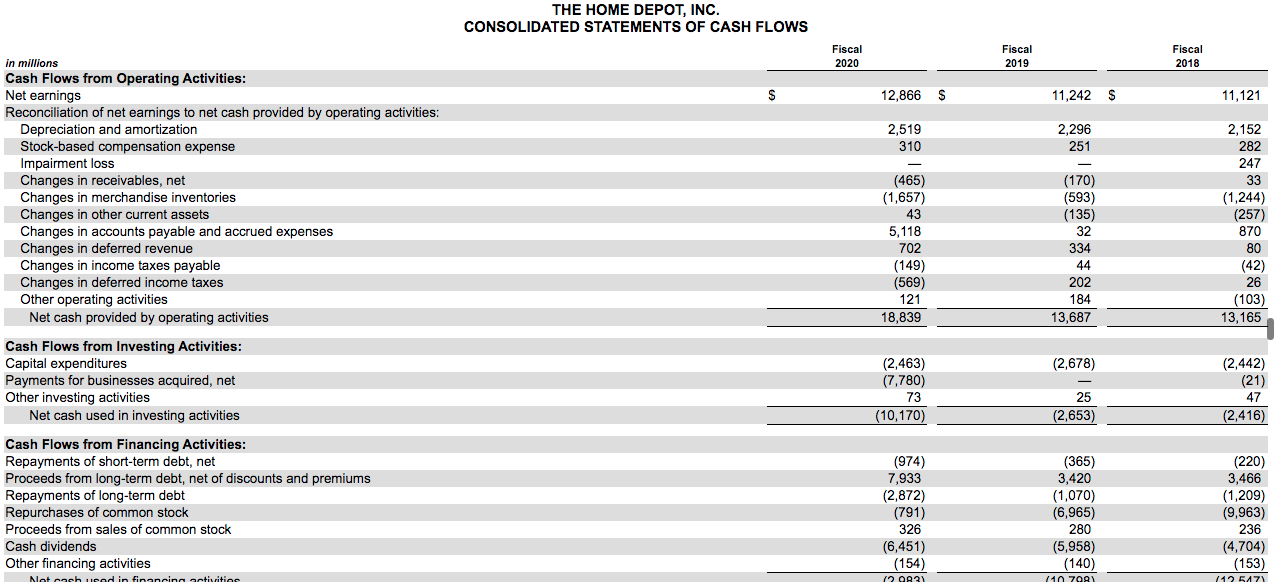

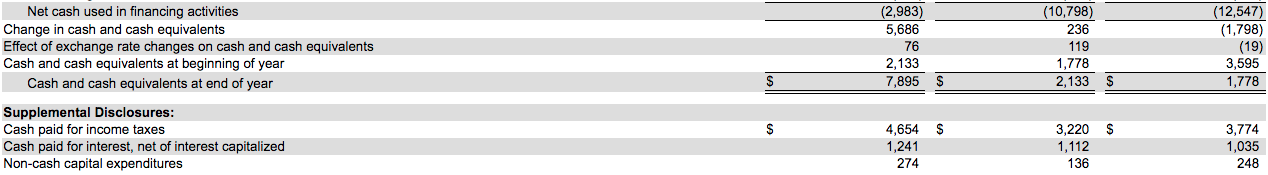

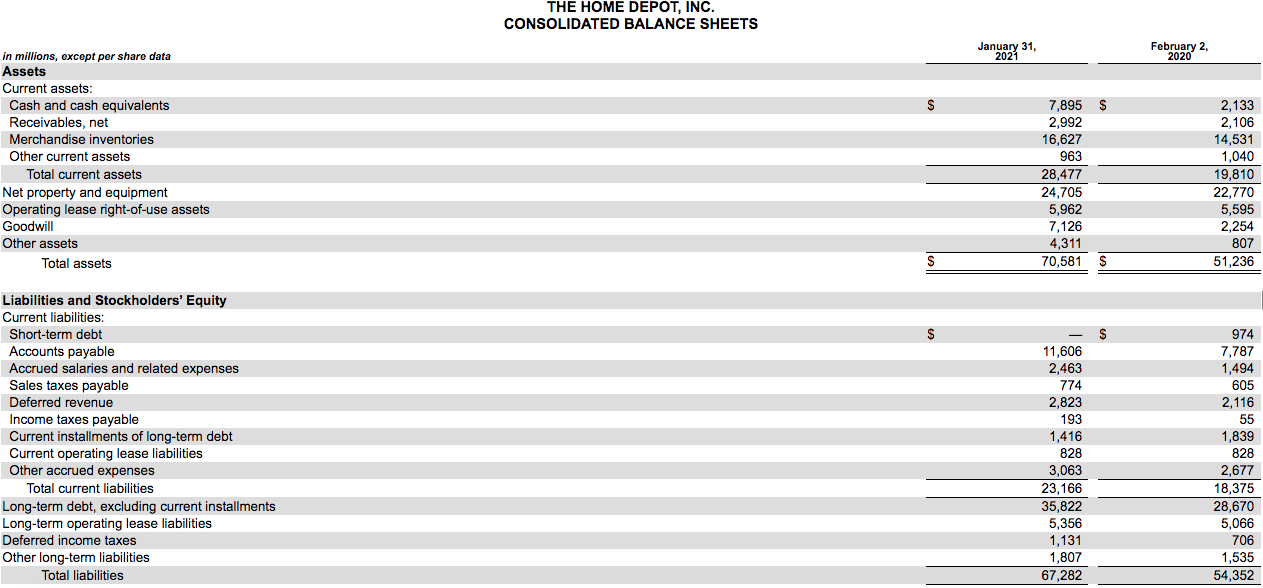

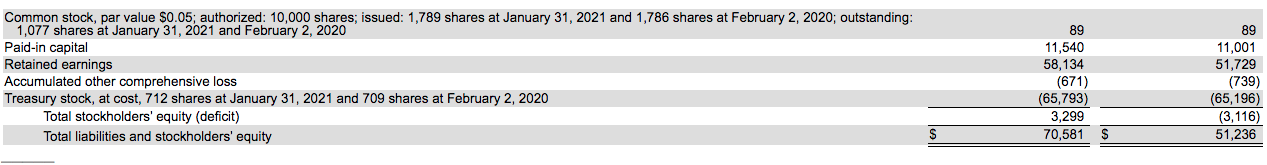

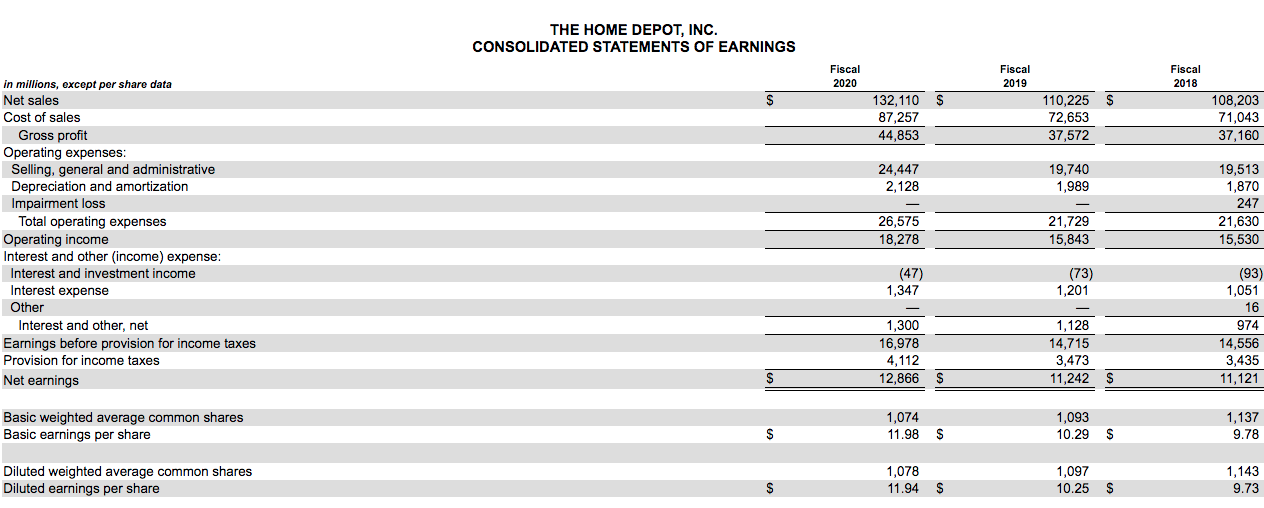

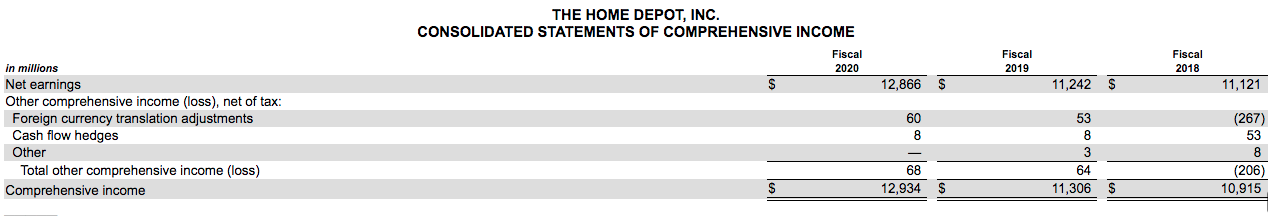

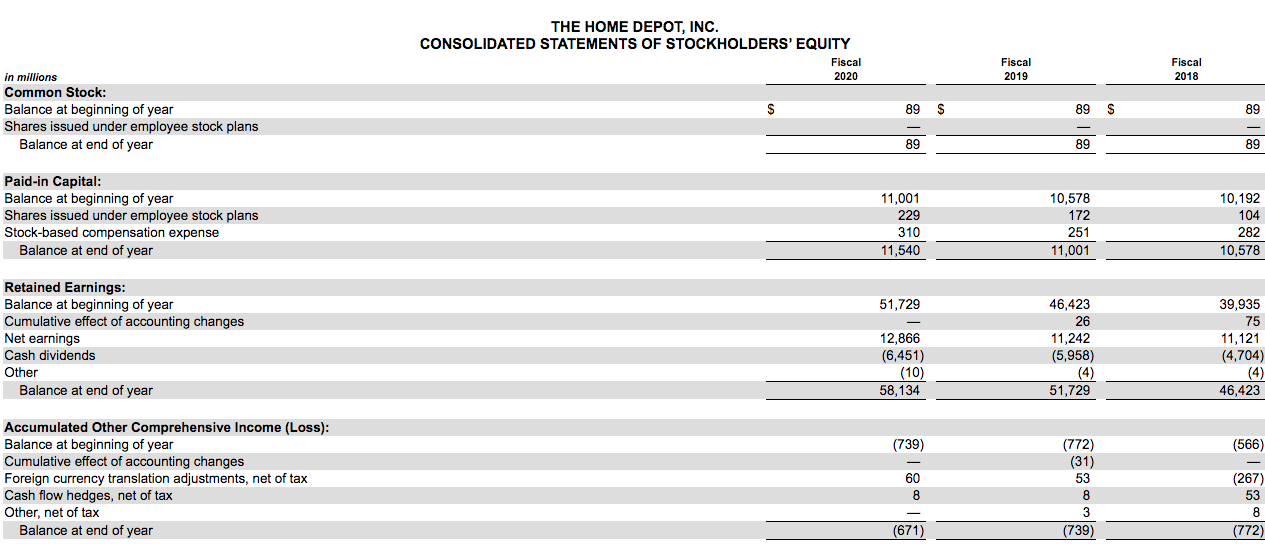

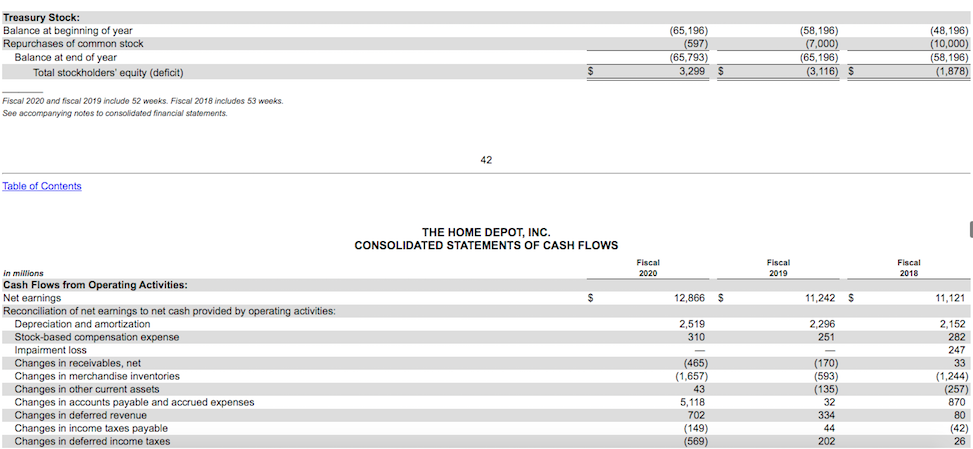

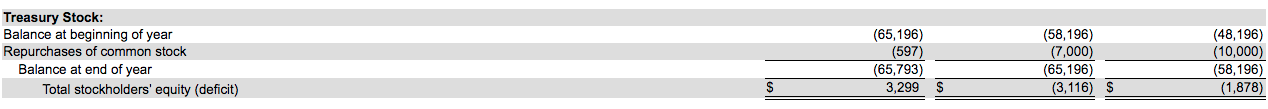

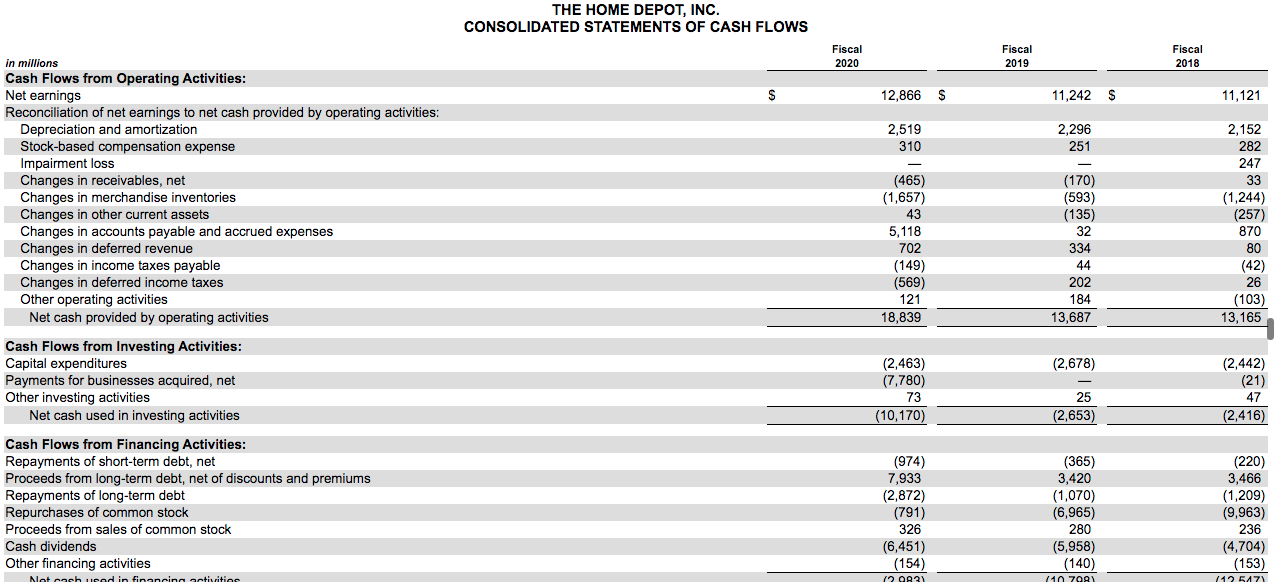

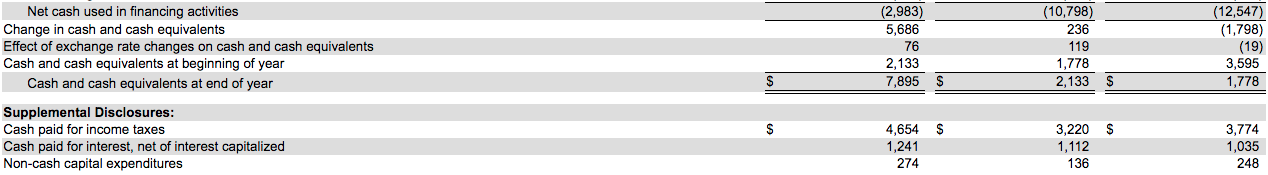

Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,789 shares at January 31, 2021 and 1,786 shares at February 2, 2020; outstanding: 1,077 shares at January 31, 2021 and February 2, 2020 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 712 shares at January 31, 2021 and 709 shares at February 2, 2020 Total stockholders' equity (deficit) Total liabilities and stockholders' equity 89 11,540 58,134 (671) (65,793) 3,299 70,581 89 11,001 51,729 (739) (65,196) (3,116) 51,236 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS Fiscal 2020 Fiscal 2019 Fiscal 2018 S S 132, 110 87,257 44,853 110,225 72,653 37,572 108,203 71,043 37,160 24,447 2,128 19,740 1,989 in millions, except per share data Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings 19,513 1,870 247 21,630 15,530 26,575 18,278 21,729 15,843 (47) 1,347 (73) 1,201 1,300 16,978 1,128 14,715 3,473 11,242 (93) 1,051 16 974 14,556 3,435 11,121 4,112 12,866 Basic weighted average common shares Basic earnings per share 1,074 11.98 1,093 10.29 1,137 9.78 S S S Diluted weighted average common shares Diluted earnings per share 1,078 11.94 $ 1,097 10.25 $ 1,143 9.73 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal 2020 Fiscal 2019 Fiscal 2018 12,866 S 11,242 $ 11,121 in millions Net earnings Other comprehensive income (loss), net of tax: Foreign currency translation adjustments Cash flow hedges Other Total other comprehensive income (loss) Comprehensive income 60 8 53 8 3 64 11,306 (267) 53 8 (206) 10,915 68 12,934 S THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal 2020 Fiscal 2019 Fiscal 2018 in millions Common Stock: Balance at beginning of year Shares issued under employee stock plans Balance at end of year $ 89 $ 89S 89 89 89 89 Paid-in Capital: Balance at beginning of year Shares issued under employee stock plans Stock-based compensation expense Balance at end of year 11,001 229 310 11,540 10,578 172 251 11,001 10,192 104 282 10,578 51,729 Retained Earnings: Balance at beginning of year Cumulative effect of accounting changes Net earnings Cash dividends Other Balance at end of year 46,423 26 11,242 (5,958) (4) 51,729 39,935 75 11,121 (4,704) 12,866 (6,451) (10) 58,134 46,423 (739) (566) Accumulated Other Comprehensive Income (Loss): Balance at beginning of year Cumulative effect of accounting changes Foreign currency translation adjustments, net of tax Cash flow hedges, net of tax Other, net of tax Balance at end of year 60 8 (772) (31) 53 8 3 (739) (267) 53 8 (772) (671) Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' equity (deficit) (65,196) (597) (65,793) 3,299 (58,196) (7,000) ) (65,196) (3,116) $ (48,196) (10,000) (58,196) (1,878) $ s Fiscal 2020 and fiscal 2019 include 52 weeks. Fiscal 2018 includes 53 weeks. See accompanying notes to consolidated financial statements. 42 Table of Contents THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal 2020 Fiscal 2019 Fiscal 2018 $ 12,866 S 11,242 $ 11,121 2,519 310 2.296 251 in millions Cash Flows from Operating Activities: Net earnings Reconciliation of net earnings to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Impairment loss Changes in receivables, net Changes in merchandise inventories Changes in other current assets Changes in accounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes (465) (1,657 43 5,118 702 (149) (569) (170) (593) (135) 32 334 44 202 2,152 282 247 33 (1,244) (257) 870 80 (42) 26 Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' equity (deficit) (65,196) (597) (65,793) 3,299 (58,196) (7,000) (65,196) (3,116) S (48,196) (10,000) (58,196) (1,878) THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal 2020 Fiscal 2019 Fiscal 2018 S 12,866 $ 11,242 $ 11,121 2,519 310 2,296 251 in millions Cash Flows from Operating Activities: Net earnings Reconciliation of net earnings to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Impairment loss Changes in receivables, net Changes in merchandise inventories Changes in other current assets Changes in accounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes Other operating activities Net cash provided by operating activities (465) (1,657) 43 5,118 702 (149) (569) 121 18,839 (170) (593) (135) 32 334 44 202 184 13,687 2,152 282 247 33 (1,244) (257) 870 80 (42) 26 (103) 13,165 (2,678) Cash Flows from Investing Activities: Capital expenditures Payments for businesses acquired, net Other investing activities Net cash used in investing activities (2,463) (7,780) 73 (10,170) (2,442) (21) 47 (2,416) 25 (2,653) Cash Flows from Financing Activities: Repayments of short-term debt, net Proceeds from long-term debt, net of discounts and premiums Repayments of long-term debt Repurchases of common stock Proceeds from sales of common stock Cash dividends Other financing activities (974) 7,933 (2,872) (791) 326 (6,451) (154) (2983) (365) 3,420 (1,070) (6,965) 280 (5,958) (140) 140 709 (220) 3,466 (1,209) (9,963) 236 (4,704) (153) 1125471 Not gob uod in financing activities Net cash used in financing activities Change in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (2,983) 5,686 76 2,133 7,895 (10,798) 236 119 1,778 2,133 (12,547) (1,798) (19) 3,595 1,778 S Supplemental Disclosures: Cash paid for income taxes Cash paid for interest, net of interest capitalized Non-cash capital expenditures 4,654 1,241 274 3,220 $ 1,112 136 3,774 1,035 248

Locate the Notes to the Financial Statements and choose 3 of them. Describe them in your own words. I strongly recommend you choose topics you are familiar with (Depreciation, Revenue Recognition, Accounts Receivable, PP&E, etc). You should submit a total of three paragraphs for this part.

Locate the Notes to the Financial Statements and choose 3 of them. Describe them in your own words. I strongly recommend you choose topics you are familiar with (Depreciation, Revenue Recognition, Accounts Receivable, PP&E, etc). You should submit a total of three paragraphs for this part.