Answered step by step

Verified Expert Solution

Question

1 Approved Answer

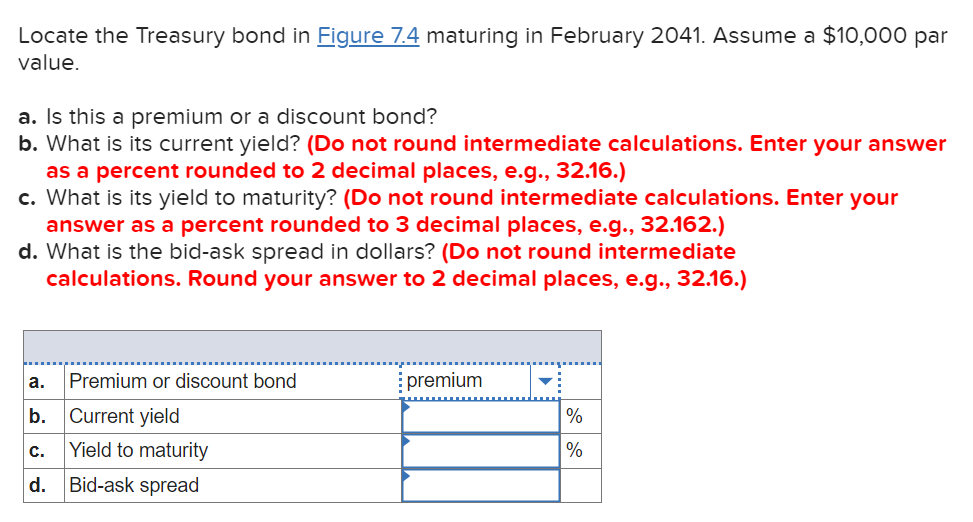

Locate the Treasury bond in maturing in February 2041. Assume a $10,000 par value. a. Is this a premium or a discount bond? b. What

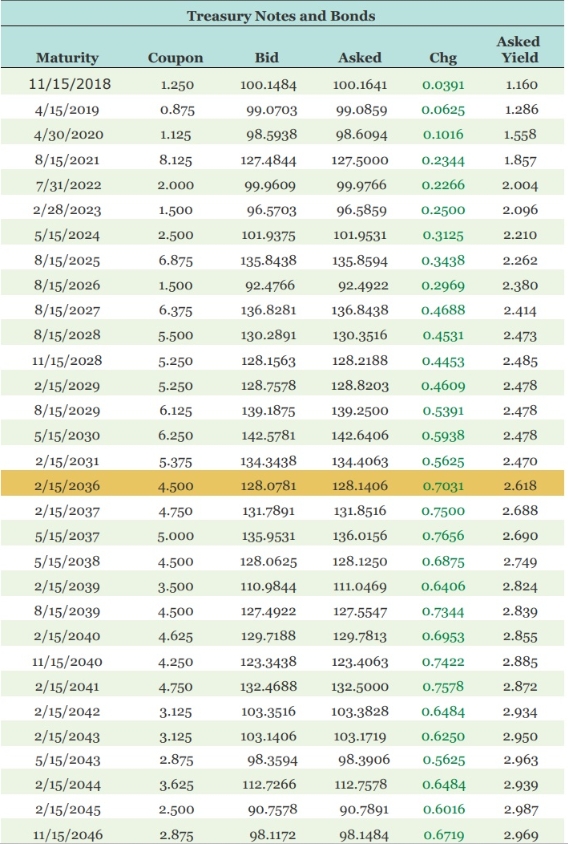

Locate the Treasury bond in maturing in February 2041. Assume a $10,000 par value. a. Is this a premium or a discount bond? b. What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places, e.g., 32.162.) d. What is the bid-ask spread in dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Treasury Notes and Bonds } \\ \hline Maturity & Coupon & Bid & Asked & Chg & AskedYield \\ \hline 11/15/2018 & 1.250 & 100.1484 & 100.1641 & 0.0391 & 1.160 \\ \hline 4/15/2019 & 0.875 & 99.0703 & 99.0859 & 0.0625 & 1.286 \\ \hline 4/30/2020 & 1.125 & 98.5938 & 98.6094 & 0.1016 & 1.558 \\ \hline 8/15/2021 & 8.125 & 127.4844 & 127.5000 & 0.2344 & 1.857 \\ \hline 7/31/2022 & 2.000 & 99.9609 & 99.9766 & 0.2266 & 2.004 \\ \hline 2/28/2023 & 1.500 & 96.5703 & 96.5859 & 0.2500 & 2.096 \\ \hline 5/15/2024 & 2.500 & 101.9375 & 101.9531 & 0.3125 & 2.210 \\ \hline 8/15/2025 & 6.875 & 135.8438 & 135.8594 & 0.3438 & 2.262 \\ \hline 8/15/2026 & 1.500 & 92.4766 & 92.4922 & 0.2969 & 2.380 \\ \hline 8/15/2027 & 6.375 & 136.8281 & 136.8438 & 0.4688 & 2.414 \\ \hline 8/15/2028 & 5500 & 130.2891 & 130.3516 & 0.4531 & 2.473 \\ \hline 11/15/2028 & 5.250 & 128.1563 & 128.2188 & 0.4453 & 2.485 \\ \hline 2/15/2029 & 5.250 & 128.7578 & 128.8203 & 0.4609 & 2.478 \\ \hline 8/15/2029 & 6.125 & 139.1875 & 139.2500 & 0.5391 & 2.478 \\ \hline 5/15/2030 & 6.250 & 142.5781 & 142.6406 & 0.5938 & 2.478 \\ \hline 2/15/2031 & 5375 & 134.3438 & 134.4063 & 0.5625 & 2.470 \\ \hline 2/15/2036 & 4.500 & 128.0781 & 128.1406 & 0.7031 & 2.618 \\ \hline 2/15/2037 & 4.750 & 131.7891 & 131.8516 & 0.7500 & 2.688 \\ \hline 5/15/2037 & 5.000 & 135.9531 & 136.0156 & 0.7656 & 2.690 \\ \hline 5/15/2038 & 4.500 & 128.0625 & 128.1250 & 0.6875 & 2.749 \\ \hline 2/15/2039 & 3.500 & 110.9844 & 111.0469 & 0.6406 & 2.824 \\ \hline 8/15/2039 & 4.500 & 127.4922 & 127.5547 & 0.7344 & 2.839 \\ \hline 2/15/2040 & 4.625 & 129.7188 & 129.7813 & 0.6953 & 2.855 \\ \hline 11/15/2040 & 4.250 & 123.3438 & 123.4063 & 0.7422 & 2.885 \\ \hline 2/15/2041 & 4.750 & 132.4688 & 132.5000 & 0.7578 & 2.872 \\ \hline 2/15/2042 & 3.125 & 103.3516 & 103.3828 & 0.6484 & 2.934 \\ \hline 2/15/2043 & 3.125 & 103.1406 & 103.1719 & 0.6250 & 2.950 \\ \hline 5/15/2043 & 2.875 & 98.3594 & 98.3906 & 0.5625 & 2.963 \\ \hline 2/15/2044 & 3.625 & 112.7266 & 112.7578 & 0.6484 & 2.939 \\ \hline 2/15/2045 & 2.500 & 90.7578 & 90.7891 & 0.6016 & 2.987 \\ \hline 11/15/2046 & 2.875 & 98.1172 & 98.1484 & 0.6719 & 2.969 \\ \hline \end{tabular}

Locate the Treasury bond in maturing in February 2041. Assume a $10,000 par value. a. Is this a premium or a discount bond? b. What is its current yield? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is its yield to maturity? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places, e.g., 32.162.) d. What is the bid-ask spread in dollars? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.) \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Treasury Notes and Bonds } \\ \hline Maturity & Coupon & Bid & Asked & Chg & AskedYield \\ \hline 11/15/2018 & 1.250 & 100.1484 & 100.1641 & 0.0391 & 1.160 \\ \hline 4/15/2019 & 0.875 & 99.0703 & 99.0859 & 0.0625 & 1.286 \\ \hline 4/30/2020 & 1.125 & 98.5938 & 98.6094 & 0.1016 & 1.558 \\ \hline 8/15/2021 & 8.125 & 127.4844 & 127.5000 & 0.2344 & 1.857 \\ \hline 7/31/2022 & 2.000 & 99.9609 & 99.9766 & 0.2266 & 2.004 \\ \hline 2/28/2023 & 1.500 & 96.5703 & 96.5859 & 0.2500 & 2.096 \\ \hline 5/15/2024 & 2.500 & 101.9375 & 101.9531 & 0.3125 & 2.210 \\ \hline 8/15/2025 & 6.875 & 135.8438 & 135.8594 & 0.3438 & 2.262 \\ \hline 8/15/2026 & 1.500 & 92.4766 & 92.4922 & 0.2969 & 2.380 \\ \hline 8/15/2027 & 6.375 & 136.8281 & 136.8438 & 0.4688 & 2.414 \\ \hline 8/15/2028 & 5500 & 130.2891 & 130.3516 & 0.4531 & 2.473 \\ \hline 11/15/2028 & 5.250 & 128.1563 & 128.2188 & 0.4453 & 2.485 \\ \hline 2/15/2029 & 5.250 & 128.7578 & 128.8203 & 0.4609 & 2.478 \\ \hline 8/15/2029 & 6.125 & 139.1875 & 139.2500 & 0.5391 & 2.478 \\ \hline 5/15/2030 & 6.250 & 142.5781 & 142.6406 & 0.5938 & 2.478 \\ \hline 2/15/2031 & 5375 & 134.3438 & 134.4063 & 0.5625 & 2.470 \\ \hline 2/15/2036 & 4.500 & 128.0781 & 128.1406 & 0.7031 & 2.618 \\ \hline 2/15/2037 & 4.750 & 131.7891 & 131.8516 & 0.7500 & 2.688 \\ \hline 5/15/2037 & 5.000 & 135.9531 & 136.0156 & 0.7656 & 2.690 \\ \hline 5/15/2038 & 4.500 & 128.0625 & 128.1250 & 0.6875 & 2.749 \\ \hline 2/15/2039 & 3.500 & 110.9844 & 111.0469 & 0.6406 & 2.824 \\ \hline 8/15/2039 & 4.500 & 127.4922 & 127.5547 & 0.7344 & 2.839 \\ \hline 2/15/2040 & 4.625 & 129.7188 & 129.7813 & 0.6953 & 2.855 \\ \hline 11/15/2040 & 4.250 & 123.3438 & 123.4063 & 0.7422 & 2.885 \\ \hline 2/15/2041 & 4.750 & 132.4688 & 132.5000 & 0.7578 & 2.872 \\ \hline 2/15/2042 & 3.125 & 103.3516 & 103.3828 & 0.6484 & 2.934 \\ \hline 2/15/2043 & 3.125 & 103.1406 & 103.1719 & 0.6250 & 2.950 \\ \hline 5/15/2043 & 2.875 & 98.3594 & 98.3906 & 0.5625 & 2.963 \\ \hline 2/15/2044 & 3.625 & 112.7266 & 112.7578 & 0.6484 & 2.939 \\ \hline 2/15/2045 & 2.500 & 90.7578 & 90.7891 & 0.6016 & 2.987 \\ \hline 11/15/2046 & 2.875 & 98.1172 & 98.1484 & 0.6719 & 2.969 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started