Answered step by step

Verified Expert Solution

Question

1 Approved Answer

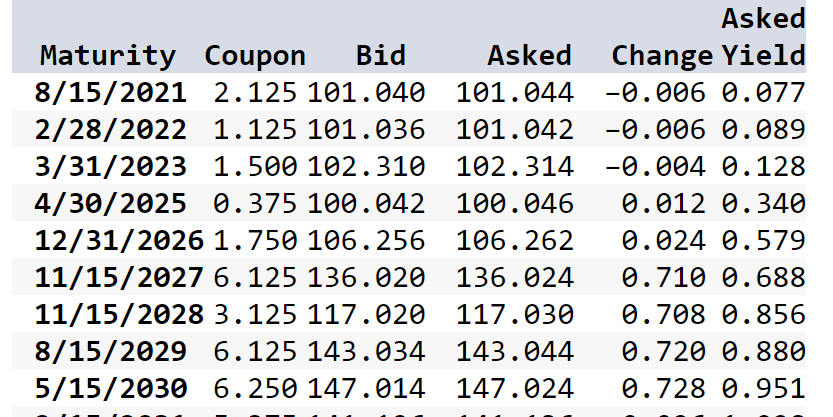

Locate the Treasury issue in Figure 6.4 maturing in May 2030. Assume a par value of $2,000. What is the Coupon Rate? 2. What is

Locate the Treasury issue in Figure 6.4 maturing in May 2030. Assume a par value of $2,000.

- What is the Coupon Rate?

2. What is its bid price in dollars?

3. What was the previous day's asked price in dollars?

Asked Maturity Coupon Bid Asked Change Yield 8/15/20212/28/20223/31/20234/30/202512/31/202611/15/202711/15/20288/15/20295/15/20302.1251.1251.500102.3100.3751.750106.2566.125136.0203.125117.0206.1256.250147.014101.040101.036102.314100.042106.262136.024117.030143.034147.024101.044101.0420.004100.0460.0240.7100.708143.0440.7280.0060.0060.1280.0120.5790.6880.8560.7200.9510.0770.0890.3400.880

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started