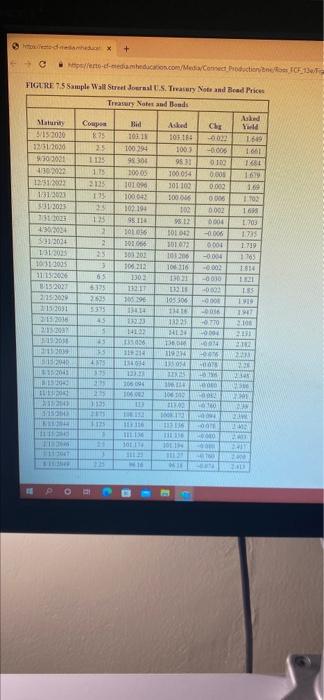

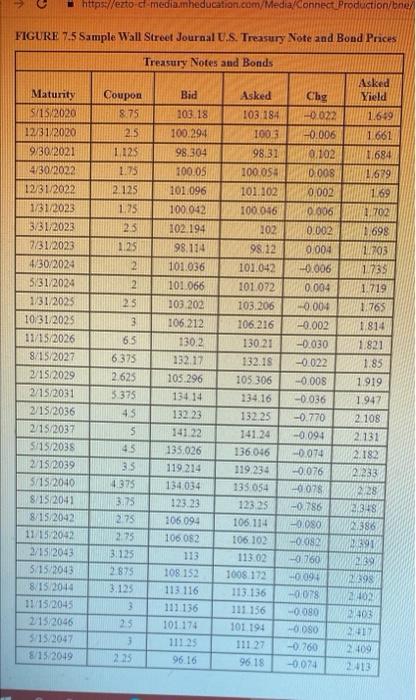

Locate the Treasury issue in Figure 7.5 maturing in August 2041. Assume a par value of $10,000 a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 3.750 % a. Coupon rate b. Bid price c. Previous day's price homex + > serto--dmheducation.com/Media/Cated Production of FIGURE 7.5 Sample Wall Street Journal US. Taury Note and Bead Price Treasury Notes and Bonds Bid Chi PHIM 875 25 1113 TO 10311 100.294 1056 Maturity 12030 33312030 9301021 130 2002 120 131.2023 $13035 Asked 103 1003 953 100014 101 100 1000 123 225 1:35 20 13 -0.006 0100 0.005 0.002 0.004 0.002 0004 -0.006 1619 1661 10 16 1.00 1 TO 16 1.703 1733 1.799 1763 2014 001 1 1491 SEOULSE 13021 tre 101 TOTES 109.05 101.09 100.042 102.194 95110 SORES 202666 303202 104212 1302 1211 100296 1 33033 0172 2 23 3 1000 90101 59 SES 108 110 10 -0054 -0.002 - 030 -0.003 -0.000 ITE IT041 1312023 100111025 313006 815202 225 2009 111051 26520362 22 2011 1.55 193306 22 5355 SIT 18223 3.100 770 04 COTT TH HO 2012 HOLIC CHA ST 735 1192 1350 INS TE 20 11.2010 10 11121 1 133.1 1050 104 553 22 18 CE 106 GO 2333 SU C1 CHIGE M 1113 1118 TIL 2011 WE OOO TO HE 10 24 https://ezto-cf-media.heducation.com/Media/Connect Production/bine/ FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices Treasury Notes and Bonds Bid Coupon 8.75 Chg -0.022 Asked Yield 1.649 25 1661 1.684 1128 1.75 1.679 -0.006 0.102 0.008 0,002 0.006 0.002 2.125 1/69 1.702 1.75 23 1.25 0.004 0.006 103.18 100.294 98,304 100.05 101.096 100 042 102. 194 98.114 101.036 101.066 103.202 106.212 130.2 132.17 105 296 134.14 132 23 1. 1.703 1735 2 1.719 Maturity S/13/2020 12/31/2020 9/30/2021 4/30/2022 12/31/2022 1/31/2023 3/31, 2023 1/31/2023 4/30/2024 3/31/2024 1/31/2025 10 31, 2025 11/15/2026 8/15/2027 2/15/2029 2/15/2031 2/15/2036 2/15/2037 5/15/2035 2/15/2039 5/15 20:10 8/15 2041 8/15/2042 11:15 2052 2/152043 5/15/2043 8/15 2014 11/15/2045 215/2046 5/15/2047 8/15/2019 2 25 3 6.5 6.373 2.625 3.375 45 $ Asked 103.184 1003 98.31 1000S 101.102 100046 102 98.12 101042 101.072 103.206 106.216 130.21 132.18 105 306 134.16 132.25 141.24 136.046 119.234 135 054 123.25 106.114 106.102 113.02 1008 172 113.136 111 156 101 194 111 27 96.18 1.765 1814 1.821 1.85 1919 1.947 2.108 2.131 2.182 2.233 228 2348 2386 391 39 2098 45 35 4.375 3.75 275 2.73 3.125 2875 3.125 3 25 0.004 -0.004 -0.002 -0.030 -0.022 0.008 -0.036 -0.770 -0.094 -0.074 -0.076 0078 -0.786 OSO -0.032 -0.760 0098 -0.078 -0.080 -LOSO -0.760 -0,074 135.026 119 214 134 034 123.23 106 094 106 082 113 108 152 113 116 111136 101.174 111.25 96.16 3 403 2017 2109 2013 223