Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155, 000; Current Liabilities - 124.000, Long Term Liabilities

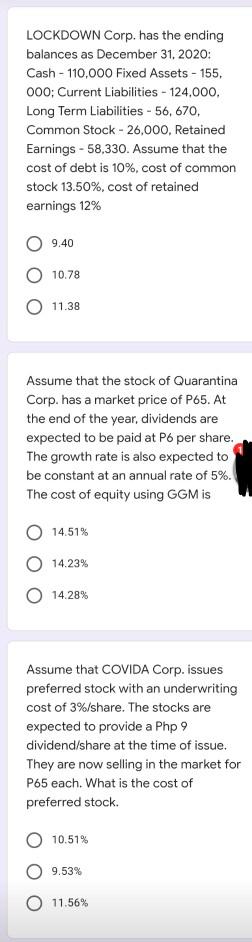

LOCKDOWN Corp. has the ending balances as December 31, 2020: Cash - 110,000 Fixed Assets - 155, 000; Current Liabilities - 124.000, Long Term Liabilities - 56, 670, Common Stock - 26,000, Retained Earnings - 58,330. Assume that the cost of debt is 10%, cost of common stock 13.50%, cost of retained earnings 12% 9.40 10.78 11.38 Assume that the stock of Quarantina Corp. has a market price of P65. At the end of the year, dividends are expected to be paid at P6 per share. The growth rate is also expected to be constant at an annual rate of 5%. The cost of equity using GGM is 14.51% 14.23% 14.28% Assume that COVIDA Corp. issues preferred stock with an underwriting cost of 3%/share. The stocks are expected to provide a Php 9 dividend/share at the time of issue. They are now selling in the market for P65 each. What is the cost of preferred stock. 10.51% 9.53% 11.56%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started