Question

Logan B. Taylor is a widower whose wife, Sara, died on June 6, 2017. He lives at 4680 Dogwood Lane, Springfield, MO 65801. He is

Logan B. Taylor is a widower whose wife, Sara, died on June 6, 2017. He lives at 4680 Dogwood Lane, Springfield, MO 65801. He is employed as a paralegal by a local law firm. During 2019, he had the following receipts:

Logan inherited securities worth $60,000 from his uncle, Daniel, who died in 2019. Logan also was the designated beneficiary of an insurance policy on Daniels life with a maturity value of $200,000. The lot in St. Louis was purchased on May 2, 2014, for $85,000 and held as an investment. Because the neighborhood has deteriorated, Logan decided to cut his losses and sold the lot on January 5, 2019, for $80,000. The estate sale consisted largely of items belonging to Sara and Daniel (e.g., camper, boat, furniture, and fishing and hunting equipment). Logan estimates that the property sold originally cost at least twice the $9,000 he received and has declined or stayed the same in value since Sara and Daniel died.

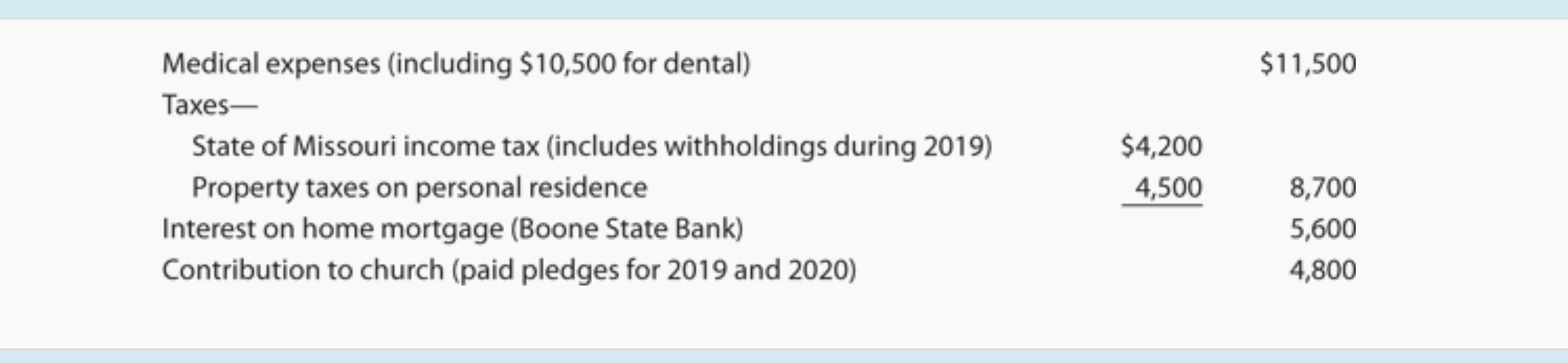

Logans expenditures for 2019 include the following:

While Logan and his dependents are covered by his employers health insurance policy, he is subject to a deductible, and dental care is not included. The $10,500 dental charge was for Helens implants. Helen is Logans widowed mother, who lives with him (see below). Logan normally pledges $2,400 ($200 per month) each year to his church. On December 5, 2019, upon the advice of his pastor, he prepaid his pledge for 2020.

Logans household, all of whom he supports, includes the following:

| Social Security Number | Birth Date | |

|---|---|---|

| Logan Taylor (age 48) | 123-45-6787 | 08/30/1971 |

| Helen Taylor (age 70) | 123-45-6780 | 01/13/1949 |

| Asher Taylor (age 23) | 123-45-6783 | 07/18/1996 |

| Mia Taylor (age 22) | 123-45-6784 | 02/16/1997 |

Helen receives a modest Social Security benefit. Asher, a son, is a full-time student in dental school and earns $4,500 as a part-time dental assistant. Mia, a daughter, does not work and is engaged to be married.

Part 1Tax Computation ( IRS forms 1040, Schedule 1, A, D, and form 8949)

Using the appropriate forms and schedules, compute Logans income tax for 2019. Federal income tax of $4,500 was withheld from his wages. If Logan has any overpayment on his income tax, he wants the refund sent to him. Assume that the proper amounts of Social Security and Medicare taxes were withheld. Logan does not own and did not use any virtual currency during the year, and he does not want to contribute to the Presidential Election Campaign Fund. Suggested software: ProConnect Tax Online.

Part 2Follow-Up Advice

In early 2020, the following take place:

-

Helen decides that she wants to live with one of her daughters and moves to Arizona.

-

Asher graduates from dental school and joins an existing practice in St. Louis.

-

Mia marries, and she and her husband move in with his parents.

-

Using the insurance proceeds he received on Daniels death, Logan pays off the mortgage on his personal residence.

Logan believes that these events may have an effect on his tax position for 2020. Therefore, he requests your advice.

Write a letter to Logan explaining in general terms the changes that will occur for tax purposes. Assume that Logans salary and other factors not mentioned (e.g., property and state income taxes) will remain the same.

$11,500 Medical expenses (including $10,500 for dental) Taxes- State of Missouri income tax (includes withholdings during 2019) Property taxes on personal residence Interest on home mortgage (Boone State Bank) Contribution to church (paid pledges for 2019 and 2020) $4,200 4,500 8,700 5,600 4,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started