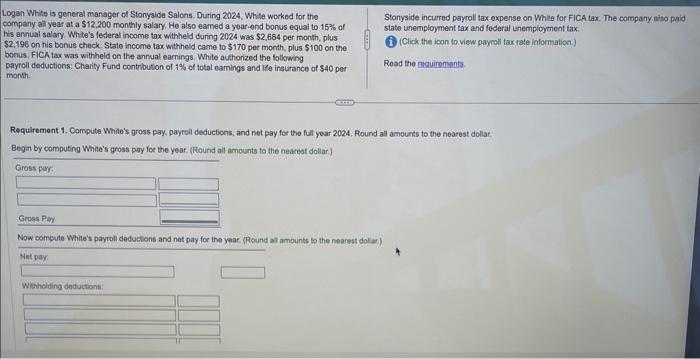

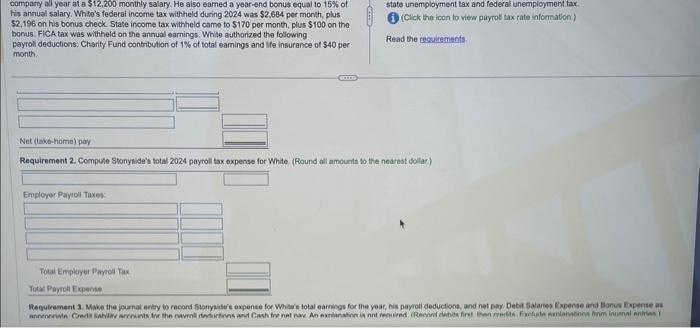

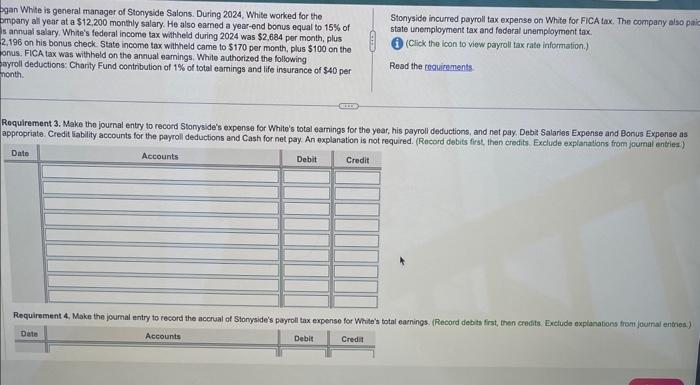

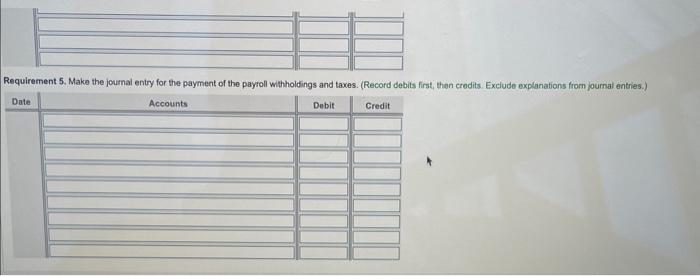

Logan White is general manager of Stonyside Salons. During 2024, White worked for the company ail year at a $12,200 monthly salary. He also earned a yoar-ond bonus equai to 15% of Ws annual salary. White's federal income tax withheld during 2024 was $2,684 per month, plus $2,196 on his bonus check. State income tax withheld came to $170 per month, plus $100 on the bonus, FICA tax was withheld on the annual eamings. White authorized the following payroll deductions: Charity Fund contribution of 1% of total oamings and lee insurance of $40 per Stonyside incurred payroll tax expense on Whit for FICA tax. The company olso paid state unemployment tax and federal unempioyment tax. month. (Click the icon to view payroll tax rate informabion.) Requirement 1. Corrpute White's gross pay, payroll deductions, and net pay for the full year 2024, Round all amounts to the nearest dollar. Begin by computing White's gross poy for the year. (Round all amounts to the nearest dollar.) Now compute Whie's payroli dedustions and not pay for the year. (Round al amounts to the nearest dolar) comparty all year at a $12,200 monthly salary. He also earned a year-end bonus equal to 15% of His annual salary. Whie's federal income tax withheld during 2024 was $2.684 per month, plus $2,196 on his bonus check. State income tax withheld camo to $170 por month, plus $100 on tho boras. FICA tax was withheld on the annual earnings. While guthorized the following payroll deductions; Charity Fund contribution of 1% of total eamings and life insurance of $40 per. month. pgan White is general manager of Stonyside Salons. During 2024. White worked for the ompary all year at a $12,200 monthly salary. He also eamed a year-end bonus equal to 15% of 5 annual salary. White's federal income tax withheld during 2024 was $2,684 per month, plus 2,196 on his bonus check. State income tax witheld came to $170 per month, plus $100 on the onus. FICA tax was withheld on the annual eamings. White authorized the following yroil deductions: Charity Fund contribution of 1% of total eamings and life insurance of $40 per Stonyside incurred payroll tax expense on White for FICA thx. The company also paic state unemployment tax and foderal unemployment tax. (i) (Click the icon to view payroll tax rate information.) Requirement 3. Make the journal entry to record Stonyside's expense for Whito's total eamings for the year, his payroll deductions, and net pay. Dobit Salaries Expense and Bonus Expense as appropriate. Credit 5ability accounts for the payroll deductions and Cash for net pay. An explanation is not required. (Rocord debits firse, then credits. Exclude explanations from joumal entries) Requirement 5. Make the journal entry for the payment of the payroll withholdings and taxes. (Record debits first, then credits. Exclude explanations from journal entries.)