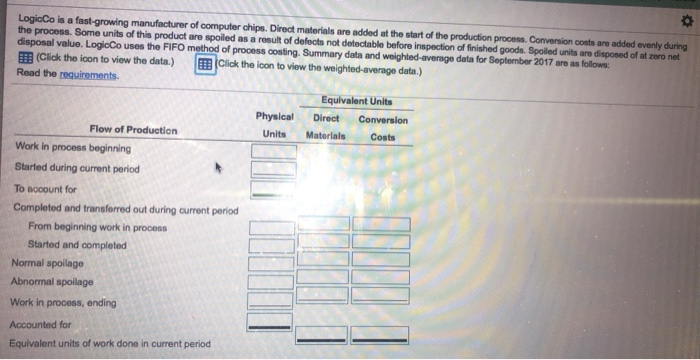

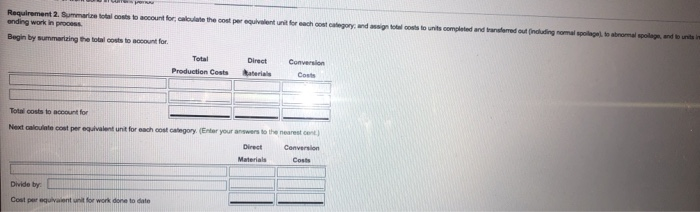

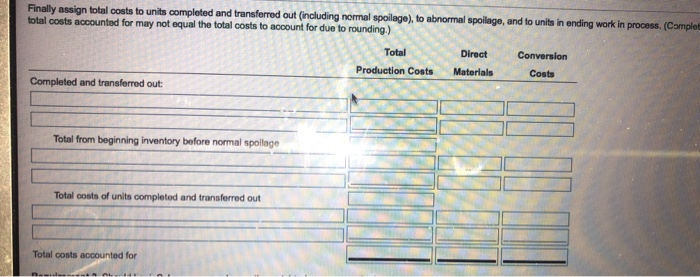

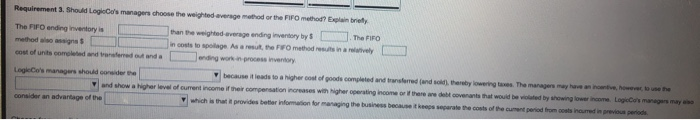

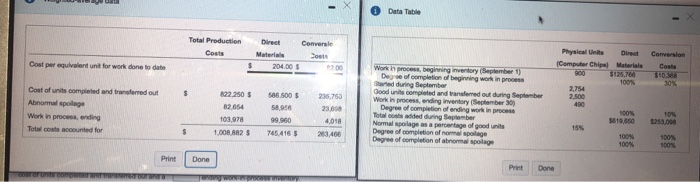

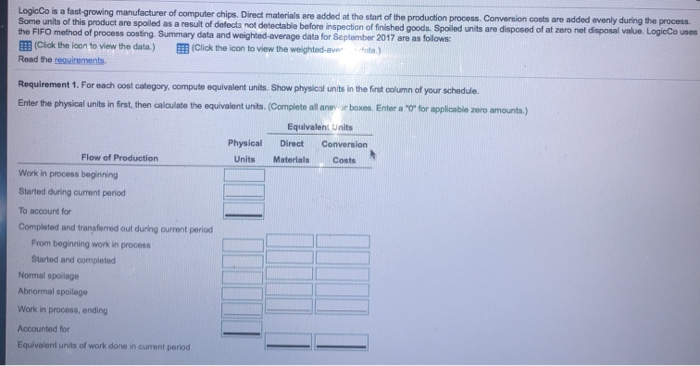

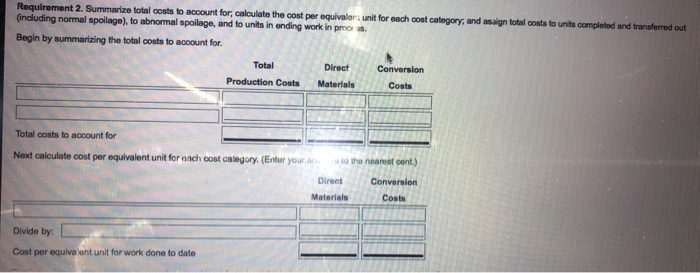

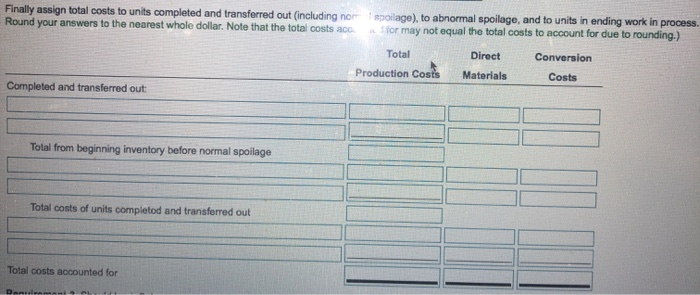

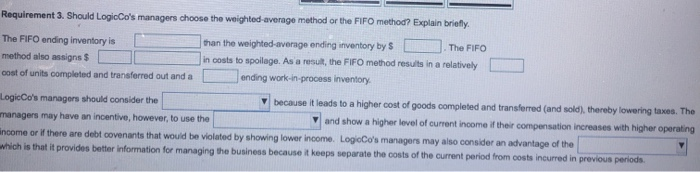

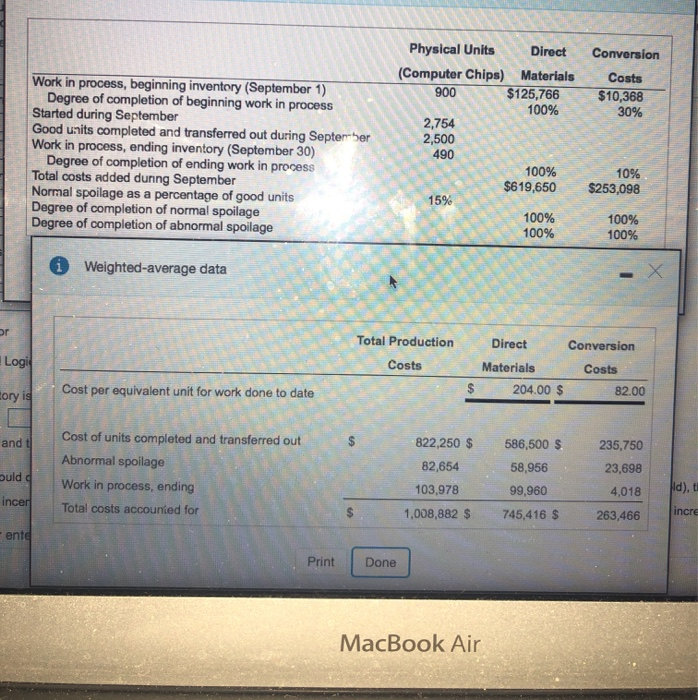

LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of disposal value. LogicCo uses the FIFO method of process costing. Summary data and weighted-average data for September 2017 are as follows BEB (Click the icon to view the data.) zero net EE (Click the icon to view the weighted-average data.) Read the requirements Equlvalent Units Physical Conversion Direct Flow of Production Units Materlals Costs Work in process beginning Started during current period To nocount for Completed and transferred out during current period From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending Accounted for Equivalent units of work done in current period nwwuarl Requirement 2. Summarze tolal costs to account for, caloulate the cost per equivalent unit for each oost category and assign totl cols to units compleled and randlemed out (ndluding nomal spollagel to abnomal spolage, and to units in anding work in process Begin by summarizing the total costs to account for Direct Tetal Conversion Production Costs taterials Costs Total costs to account for Next caloulate cost per equivalent unit for each cost caegory. (Enter your answers to the nearest cent Direct Conversion Costs Materials Divide by Cost per equivaient unit for work done to date Finally assign total costs to units completed and transferred out (including normal spoileage), to abnormal spoilage, and to units in ending work in process. (Complet total costs accounted for may not equal the total costs to account for due to rounding.) Total Direct Conversion Materials Production Costs Costs Completed and transferred out: Total from beginning inventory before normal spollage Total oosts of units completed and transferred out Total costs accounted for Requirement 3. Should LogieCo's managers choose the weighted average method or the FIFO method? Explain briety The FIFO ending inventory is than the weighted-average ending inventory by $ The FIFO method also assigns 5 in costs to spolage As a resut, the FIFO method resuts in a relatvely cost of units completed and transfeed ou and a ending work in process inventory because it leads to a higher cost of goods completed and transferred (and sold), thereby lowering taxes The managers may have an inoentive, however to use the LogieCo's managers should oonsider the and show a higher level of curment income if their compensation increases with higher operating income or if there ane debt covenants that would be violated by showing lower income. LogicCo's managers may aso which is that it provides beter information for managing the business because it keeps separate the costs of the cument period from costs inoured in previous periods consider an advantage of the Data Table Total Production Direct Conversle Physical Units Costs Materials Direct Conversion Cost per equivalent unt for work done to date (Computer Chipa) Materlals $125,766 100 % 204.00 S Costs Work in process, beginning inventory (September 1) Degre of completion of beginning work in process Sarted during September Good units completed and transfemed out during September Work in process, ending inventory (September 30) Degree of completion of ending work in process Total oosts added during September Nomal spoilage as a parcentage of good units Degree of completion of nomal spoilage Degree of completion of abnomal spolage 200 900 $10.368 30% 2754 2,500 Cost of units completed and transferred out 822 250 s86.500 236,750 Abnomal spoilage 490 82.654 58,956 23,608 s00% 10% Work in process, ending 103.978 9819,650 99,960 4,018 $253,090 Total costs acoounted for 15% 1,008,882 745416 23,466 100% 100 % 100 % 100 % Print Done Print Done LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defecta not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the FIFO method of process costing. Summary data and weighted-average data for September 2017 are as follows: EB (Clck the ioon to view the data.) Read the requirements (Click the lcon to view the weighted-ave ta.) Requirement 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. Enter the physical units in first, then caloulate the equivalent units. (Complete all ans r boxes. Enter a "0" for applicable zero amounts.) Equivaleni Units Physical Direct Conversion Flow of Production Units Materials Costs Work in process beginning Started during current period To account for Completed and transferred out during ourrent period From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending Accounted for Equivalent units of work done in current period Requirement 2. Summarize total costs to account for; calculate the cost per equivaler: unit for each cost category; and asaign total costs to units completed and transferred out (including nomal spoilage), to abnormal spoilage, and to units in ending work in proor ss Begin by summarizing the total costs to account for Total Conversion Direct Production Costs Materfals Costs Total costs to account for Next calculate cost per equivalent unit for ench cost calegory. (Enter your an a to the nearest cent.) Direct Conversion Materials Costs Divide by Cost per equivalent unit for work done to date Finally assign total costs to units completed and transferred out (including no Round your answers to the nearest whole dollar. Note that the total costs acc poilage), to abnormal spoilage, and to units in ending work in process. for may not equal the total costs to account for due to rounding.) Total Direct Conversion Production Costs Costs Materials Completed and transferred out Total from beginning inventory before normal spoilage Total costs of units completod and transferred out Total costs accounted for Dentirems Requirement 3. Should LogicCo's managers choose the weighted-average method or the FIFO method? Explain briefly. The FIFO ending inventory is than the weighted-average ending inventory by S The FIFO method also assigns $ in costs to spoilage. As a result, the FIFO method results in a relatively ending work-in-process inventory. cost of units completed and transferred out and a because it leads to a higher cost of goods completed and transferred (and sold), thereby lowering taxes. The LogicCo's managers should consider the and show a higher level of current income if their compensation increases with higher operating managers may have an incentive, however, to use the ncome or if there are debt covenants that would be violated by showing lower income. LogicCo's managers may also consider an advantage of the which is that it provides better information for managing the business because it keeps separate the costs of the current period from costs incurred in previous periods Physical Units Direct Conversion (Computer Chips) Materials $125,766 100% Costs Work in process, beginning inventory (September 1) Degree of completion of beginning work in process Started during September Good units completed and transferred out during Septerber Work in process, ending inventory (September 30) Degree of completion of ending work in process Total costs added dunng September Normal spoilage as a percentage of good units Degree of completion of normal spoilage Degree of completion of abnormal spoilage 900 $10,368 30% 2,754 2,500 490 100% $619,650 10% $253,098 15% 100% 100% 100% 100% iWeighted-average data or Total Production Direct Conversion Logi Costs Materials Costs Cost per equivalent unit for work done to date $ 204.00 $ 82.00 ory is Cost of units completed and transferred out and t 822,250 $ 586,500 S 235,750 Abnormal spoilage 82,654 58,956 23,698 ould d Work in process, ending d), t 103,978 99,960 4,018 incer Total costs accounied for incre 1,008,882$ 745,416 $ 263,466 ente Print Done MacBook Air LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of disposal value. LogicCo uses the FIFO method of process costing. Summary data and weighted-average data for September 2017 are as follows BEB (Click the icon to view the data.) zero net EE (Click the icon to view the weighted-average data.) Read the requirements Equlvalent Units Physical Conversion Direct Flow of Production Units Materlals Costs Work in process beginning Started during current period To nocount for Completed and transferred out during current period From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending Accounted for Equivalent units of work done in current period nwwuarl Requirement 2. Summarze tolal costs to account for, caloulate the cost per equivalent unit for each oost category and assign totl cols to units compleled and randlemed out (ndluding nomal spollagel to abnomal spolage, and to units in anding work in process Begin by summarizing the total costs to account for Direct Tetal Conversion Production Costs taterials Costs Total costs to account for Next caloulate cost per equivalent unit for each cost caegory. (Enter your answers to the nearest cent Direct Conversion Costs Materials Divide by Cost per equivaient unit for work done to date Finally assign total costs to units completed and transferred out (including normal spoileage), to abnormal spoilage, and to units in ending work in process. (Complet total costs accounted for may not equal the total costs to account for due to rounding.) Total Direct Conversion Materials Production Costs Costs Completed and transferred out: Total from beginning inventory before normal spollage Total oosts of units completed and transferred out Total costs accounted for Requirement 3. Should LogieCo's managers choose the weighted average method or the FIFO method? Explain briety The FIFO ending inventory is than the weighted-average ending inventory by $ The FIFO method also assigns 5 in costs to spolage As a resut, the FIFO method resuts in a relatvely cost of units completed and transfeed ou and a ending work in process inventory because it leads to a higher cost of goods completed and transferred (and sold), thereby lowering taxes The managers may have an inoentive, however to use the LogieCo's managers should oonsider the and show a higher level of curment income if their compensation increases with higher operating income or if there ane debt covenants that would be violated by showing lower income. LogicCo's managers may aso which is that it provides beter information for managing the business because it keeps separate the costs of the cument period from costs inoured in previous periods consider an advantage of the Data Table Total Production Direct Conversle Physical Units Costs Materials Direct Conversion Cost per equivalent unt for work done to date (Computer Chipa) Materlals $125,766 100 % 204.00 S Costs Work in process, beginning inventory (September 1) Degre of completion of beginning work in process Sarted during September Good units completed and transfemed out during September Work in process, ending inventory (September 30) Degree of completion of ending work in process Total oosts added during September Nomal spoilage as a parcentage of good units Degree of completion of nomal spoilage Degree of completion of abnomal spolage 200 900 $10.368 30% 2754 2,500 Cost of units completed and transferred out 822 250 s86.500 236,750 Abnomal spoilage 490 82.654 58,956 23,608 s00% 10% Work in process, ending 103.978 9819,650 99,960 4,018 $253,090 Total costs acoounted for 15% 1,008,882 745416 23,466 100% 100 % 100 % 100 % Print Done Print Done LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defecta not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the FIFO method of process costing. Summary data and weighted-average data for September 2017 are as follows: EB (Clck the ioon to view the data.) Read the requirements (Click the lcon to view the weighted-ave ta.) Requirement 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. Enter the physical units in first, then caloulate the equivalent units. (Complete all ans r boxes. Enter a "0" for applicable zero amounts.) Equivaleni Units Physical Direct Conversion Flow of Production Units Materials Costs Work in process beginning Started during current period To account for Completed and transferred out during ourrent period From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending Accounted for Equivalent units of work done in current period Requirement 2. Summarize total costs to account for; calculate the cost per equivaler: unit for each cost category; and asaign total costs to units completed and transferred out (including nomal spoilage), to abnormal spoilage, and to units in ending work in proor ss Begin by summarizing the total costs to account for Total Conversion Direct Production Costs Materfals Costs Total costs to account for Next calculate cost per equivalent unit for ench cost calegory. (Enter your an a to the nearest cent.) Direct Conversion Materials Costs Divide by Cost per equivalent unit for work done to date Finally assign total costs to units completed and transferred out (including no Round your answers to the nearest whole dollar. Note that the total costs acc poilage), to abnormal spoilage, and to units in ending work in process. for may not equal the total costs to account for due to rounding.) Total Direct Conversion Production Costs Costs Materials Completed and transferred out Total from beginning inventory before normal spoilage Total costs of units completod and transferred out Total costs accounted for Dentirems Requirement 3. Should LogicCo's managers choose the weighted-average method or the FIFO method? Explain briefly. The FIFO ending inventory is than the weighted-average ending inventory by S The FIFO method also assigns $ in costs to spoilage. As a result, the FIFO method results in a relatively ending work-in-process inventory. cost of units completed and transferred out and a because it leads to a higher cost of goods completed and transferred (and sold), thereby lowering taxes. The LogicCo's managers should consider the and show a higher level of current income if their compensation increases with higher operating managers may have an incentive, however, to use the ncome or if there are debt covenants that would be violated by showing lower income. LogicCo's managers may also consider an advantage of the which is that it provides better information for managing the business because it keeps separate the costs of the current period from costs incurred in previous periods Physical Units Direct Conversion (Computer Chips) Materials $125,766 100% Costs Work in process, beginning inventory (September 1) Degree of completion of beginning work in process Started during September Good units completed and transferred out during Septerber Work in process, ending inventory (September 30) Degree of completion of ending work in process Total costs added dunng September Normal spoilage as a percentage of good units Degree of completion of normal spoilage Degree of completion of abnormal spoilage 900 $10,368 30% 2,754 2,500 490 100% $619,650 10% $253,098 15% 100% 100% 100% 100% iWeighted-average data or Total Production Direct Conversion Logi Costs Materials Costs Cost per equivalent unit for work done to date $ 204.00 $ 82.00 ory is Cost of units completed and transferred out and t 822,250 $ 586,500 S 235,750 Abnormal spoilage 82,654 58,956 23,698 ould d Work in process, ending d), t 103,978 99,960 4,018 incer Total costs accounied for incre 1,008,882$ 745,416 $ 263,466 ente Print Done MacBook Air