Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Login Corp. employs a standard costing system. The company has capacity to produce 35,000 units per year and applies overhead is applied on the

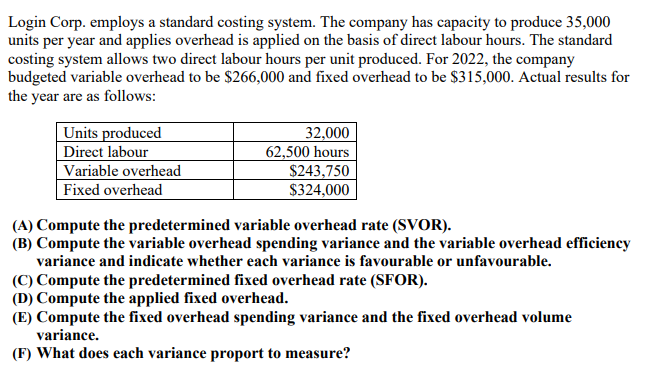

Login Corp. employs a standard costing system. The company has capacity to produce 35,000 units per year and applies overhead is applied on the basis of direct labour hours. The standard costing system allows two direct labour hours per unit produced. For 2022, the company budgeted variable overhead to be $266,000 and fixed overhead to be $315,000. Actual results for the year are as follows: Units produced | Direct labour Variable overhead | Fixed overhead 32,000 62,500 hours $243,750 $324,000 (A) Compute the predetermined variable overhead rate (SVOR). (B) Compute the variable overhead spending variance and the variable overhead efficiency variance and indicate whether each variance is favourable or unfavourable. (C) Compute the predetermined fixed overhead rate (SFOR). (D) Compute the applied fixed overhead. (E) Compute the fixed overhead spending variance and the fixed overhead volume variance. (F) What does each variance proport to measure?

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A Budgeted labor hours Budgeted units of production Standard labor hours per unit 35000270000 Predet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started