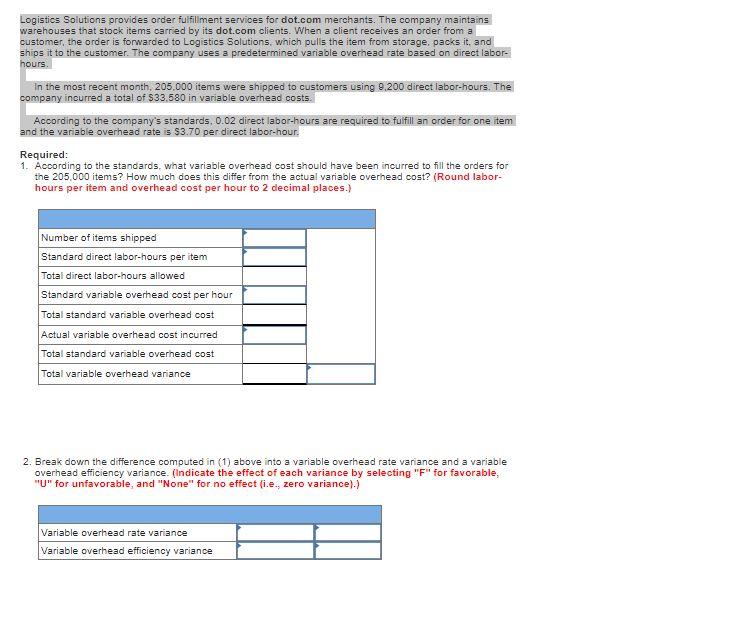

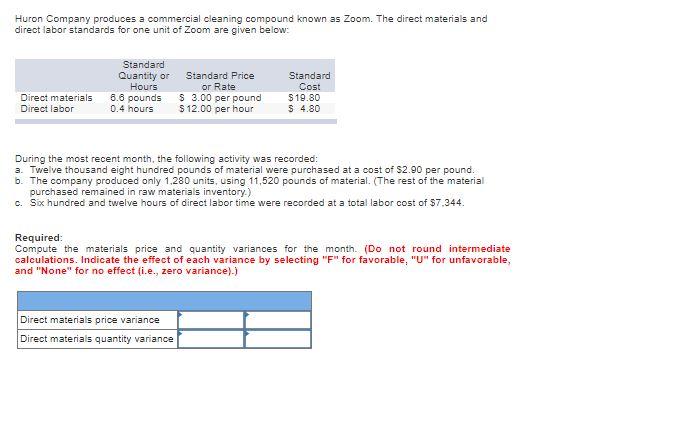

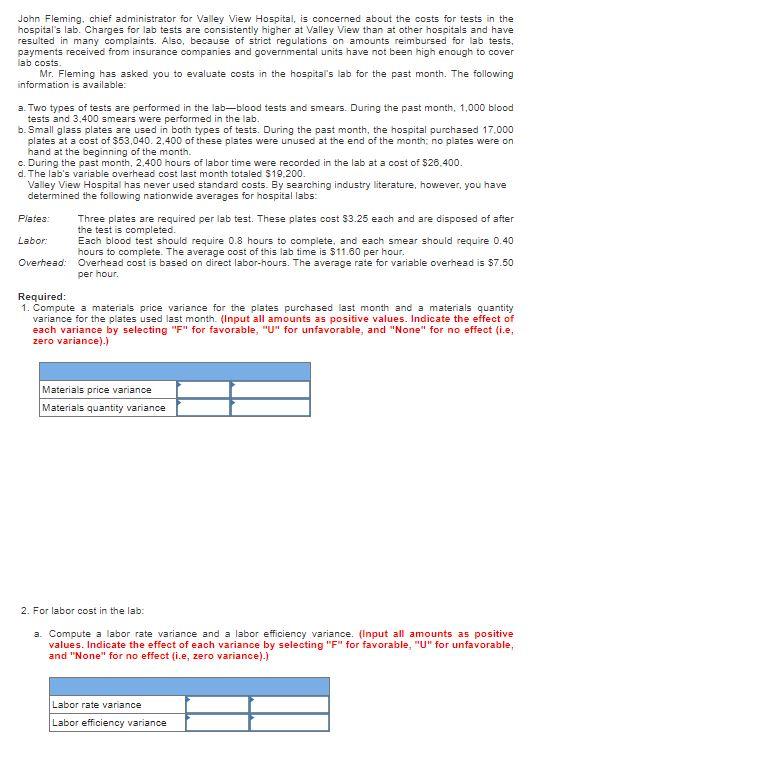

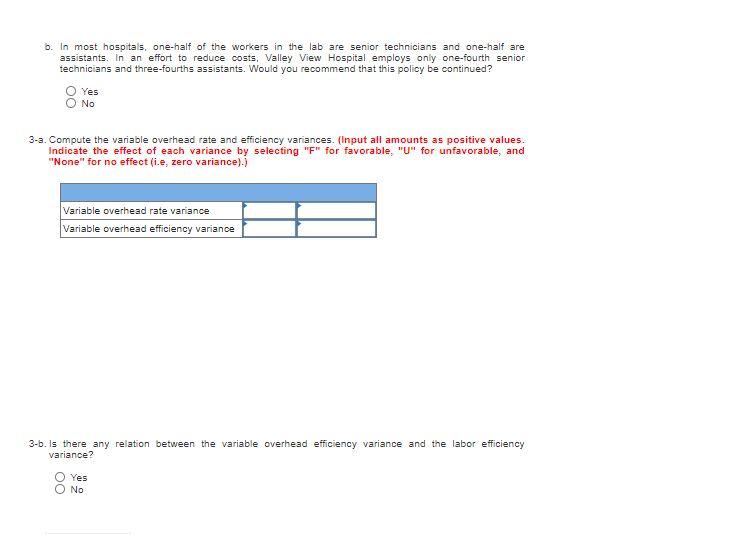

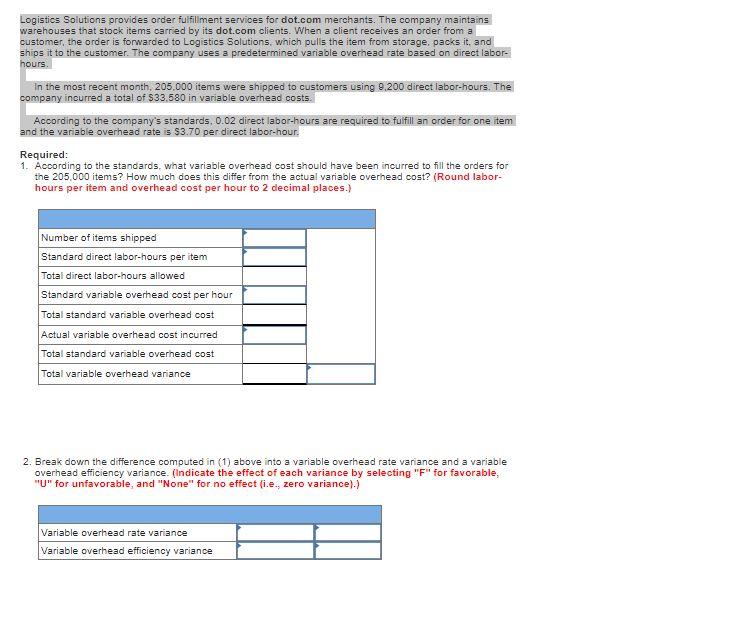

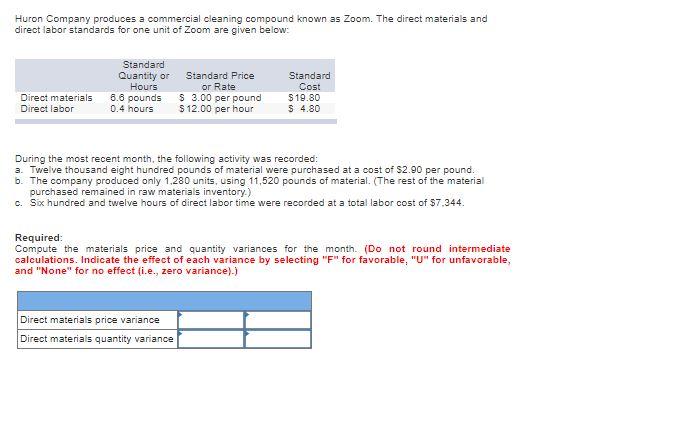

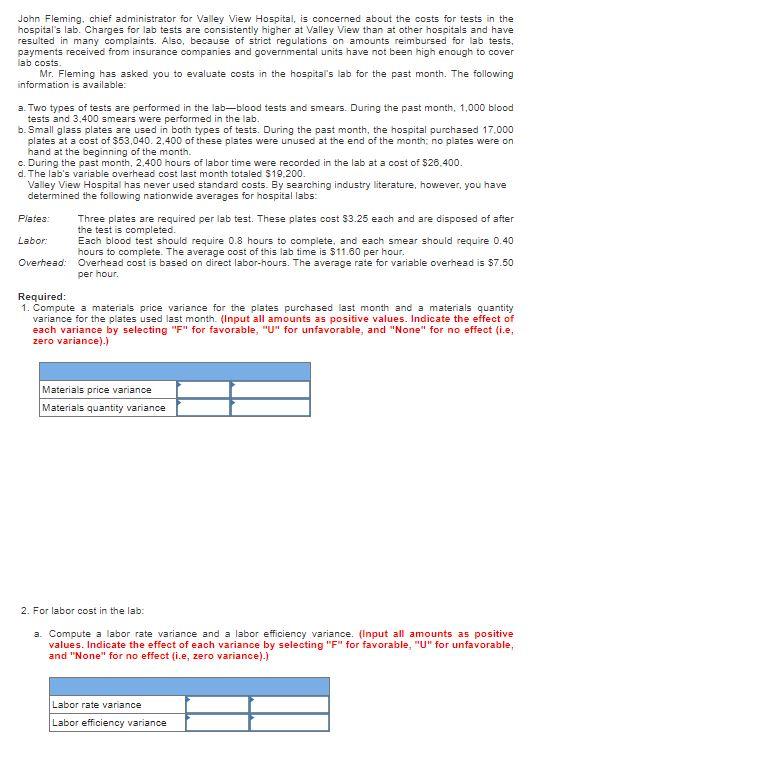

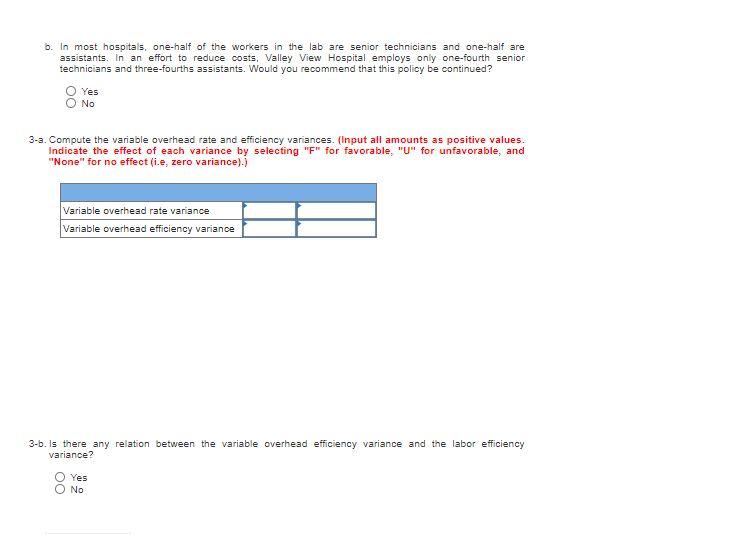

Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor- hours. In the most recent month, 205.000 items were shipped to customers using 9.200 direct labor-hours. The company incurred a total of $33.580 in variable overhead costs. According to the company's standards, 0.02 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.70 per direct labor-hour. Required: 1. According to the standards, what variable overhead cost should have been incurred to fill the orders for the 205.000 items? How much does this differ from the actual variable overhead cost? (Round labor- hours per item and overhead cost per hour to 2 decimal places. Number of items shipped Standard direct labor-hours per item Total direct labor-hours allowed Standard variable overhead cost per hour Total standard variable overhead cost Actual variable overhead cost incurred Total standard variable overhead cost Total variable overhead variance 2. Break down the difference computed in (t) above into a variable overhead rate variance and a variable overhead efficiency variance. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) Variable overhead rate variance Variable overhead efficiency variance Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours 8.6 pounds 0.4 hours Direct materials Direct labor Standard Price or Rate $ 3.00 per pound $12.00 per hour Standard Cost $19.80 $ 4.80 During the most recent month, the following activity was recorded: a. Twelve thousand eight hundred pounds of material were purchased at a cost of $2.90 per pound. b. The company produced only 1,280 units, using 11,520 pounds of material. The rest of the material purchased remained in raw materials inventory) c. Six hundred and twelve hours of direct labor time were recorded at a total labor cost of $7.344. Required: Compute the materials price and quantity variances for the month. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect i.e., zero variance).) Direct materials price variance Direct materiais quantity variance John Fleming, chief administrator for Valley View Hospital, is concerned about the costs for tests in the hospital's lab. Charges for lab tests are consistently higher at Valley View than at other hospitals and have resulted in many complaints. Also, because of strict regulations on amounts reimbursed for lab tests. payments received from insurance companies and governmental units have not been high enough to cover lab costs Mr. Fleming has asked you to evaluate costs in the hospital's lab for the past month. The following information is available: a. Two types of tests are performed in the lab-blood tests and smears. During the past month, 1,000 blood tests and 3,400 smears were performed in the lab. b. Small glass plates are used in both types of tests. During the past month, the hospital purchased 17.000 plates at a cost of $53,040.2.400 of these plates were unused at the end of the month: no plates were on hand at the beginning of the month. c. During the past month, 2.400 hours of labor time were recorded in the lab at a cost of $26.400. d. The lab's variable overhead cost last month totaled $19.200. Valley View Hospital has never used standard costs. By searching industry literature, however, you have determined the following nationwide averages for hospital labs: Plates: Three plates are required per lab test. These plates cost $3.25 each and are disposed of after the test is completed. Labor: Each blood test should require 0.8 hours to complete, and each smear should require 0.40 hours to complete. The average cost of this lab time is $11.60 per hour. Overhead Overhead cost is based on direct labor-hours. The average rate for variable overhead is $7.50 per hour. Required: 1. Compute a materials price variance for the plates purchased last month and a materiais quantity variance for the plates used last month. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect i.e. zero variance).) Materials price variance Materials quantity variance 2. For labor cost in the lab: a. Compute a labor rate variance and a labor efficiency variance. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect i.e, zero variance).) Labor rate variance Labor efficiency variance b. In most hospitals, one-half of the workers in the lab are senior technicians and one-half are assistants. In an effort to reduce costs, Valley View Hospital employs only one-fourth senior technicians and three-fourths assistants. Would you recommend that this policy be continued? O Yes No 3-a. Compute the variable overhead rate and efficiency variances. (Input all amounts as positive values. Indicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (ie, zero variance).) Variable overhead rate variance Variable overhead efficiency variance 3-b. Is there any relation between the variable overhead efficiency variance and the labor efficiency variance? oo Yes No