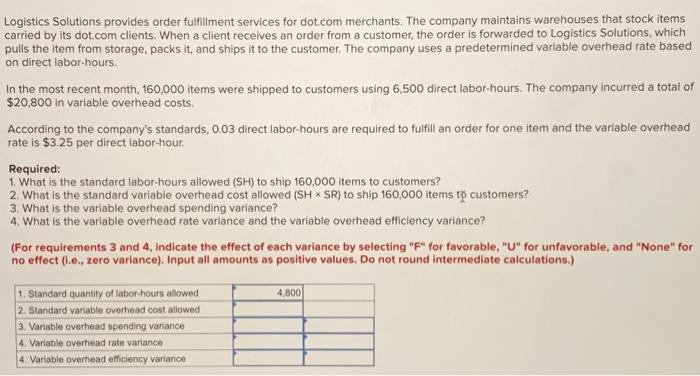

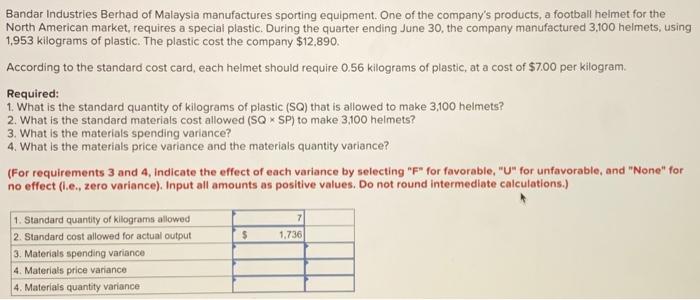

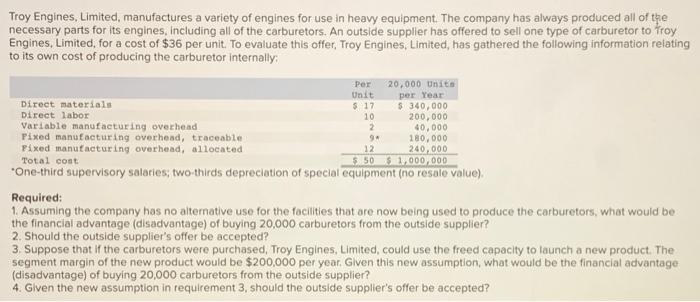

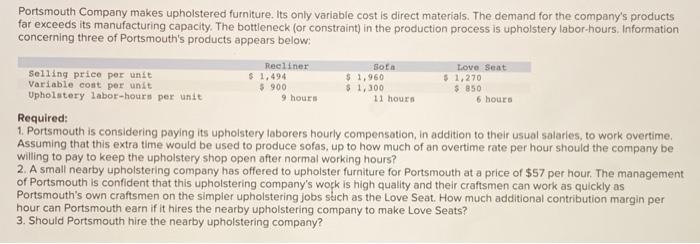

Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solutions, which pulls the item from storage, packs it, and ships it to the customer. The company uses a predetermined variable overhead rate based on direct labor-hours. In the most recent month, 160,000 items were shipped to customers using 6,500 direct labor-hours. The company incurred a total of $20,800 in variable overhead costs. According to the company's standards, 0.03 direct labor-hours are required to fulfill an order for one item and the variable overhead rate is $3.25 per direct labor-hour. Required: 1. What is the standard labor-hours allowed (SH) to ship 160,000 items to customers? 2. What is the standard variable overhead cost allowed (SH * SR) to ship 160,000 items to customers? 3. What is the variable overhead spending variance? 4. What is the variable overhead rate variance and the variable overhead efficiency variance? (For requirements 3 and 4. Indicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (t.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 4,800 1. Standard quantity of labor hours allowed 2. Standard variable overhead cost allowed 3. Variable overhead spending variance 4. Variable overhead rate variance 4. Variable overhead efficiency variance Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 3,100 helmets, using 1,953 kilograms of plastic. The plastic cost the company $12,890. According to the standard cost card, each helmet should require 0.56 kilograms of plastic, at a cost of $7.00 per kilogram Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,100 helmets? 2. What is the standard materials cost allowed (SQ * SP) to make 3,100 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 7 1.736 $ 1. Standard quantity of kilograms allowed 2. Standard cost allowed for actual output 3. Materials spending variance 4. Materials price variance 4. Materials quantity variance Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to troy Engines, Limited, for a cost of $36 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally Per 20,000 units Unit per Year Direct materials $ 17 $ 340,000 Direct labor 10 200,000 Variable manufacturing overhead 2 40,000 Pixed manufacturing overhead, traceable 94 180,000 Pixed manufacturing overhead, allocated 12 240,000 Total cost 5.50 $ 1,000,000 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value) Required: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 20,000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Limited, could use the freed capacity to launch a new product. The segment margin of the new product would be $200,000 per year . Given this new assumption, what would be the financial advantage (disadvantage) of buying 20,000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted? Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours, Information concerning three of Portsmouth's products appears below: Recliner Sota Love Seat Selling price per unit $ 1,494 $ 1,960 5.1,270 Variable cont per unit $ 900 $ 1,300 $ 850 Upholstery labor-hours per unit 9 hours 11 hours 6 hours Required: 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be Willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for Portsmouth at a price of $57 per hour. The management of Portsmouth is confident that this upholstering company's work is high quality and their craftsmen can work as quickly as Portsmouth's own craftsmen on the simpler upholstering Jobs such as the Love Seat. How much additional contribution margin per hour can Portsmouth earn if it hires the nearby upholstering company to make Love Seats? 3. Should Portsmouth hire the nearby upholstering company