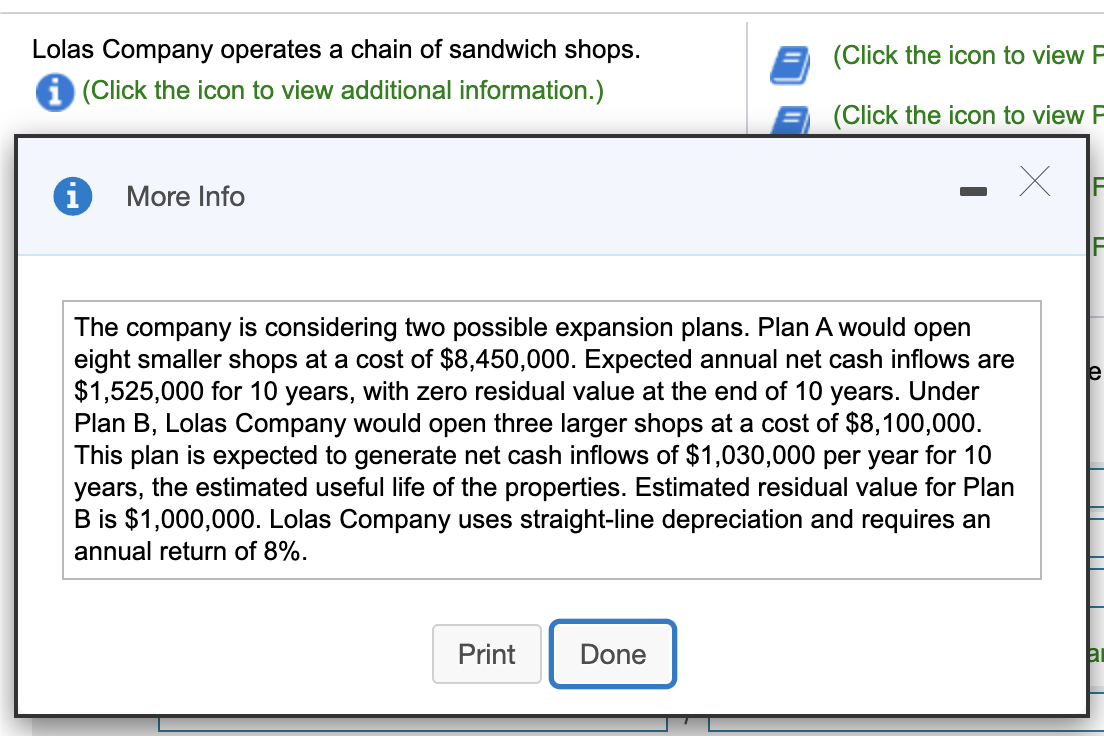

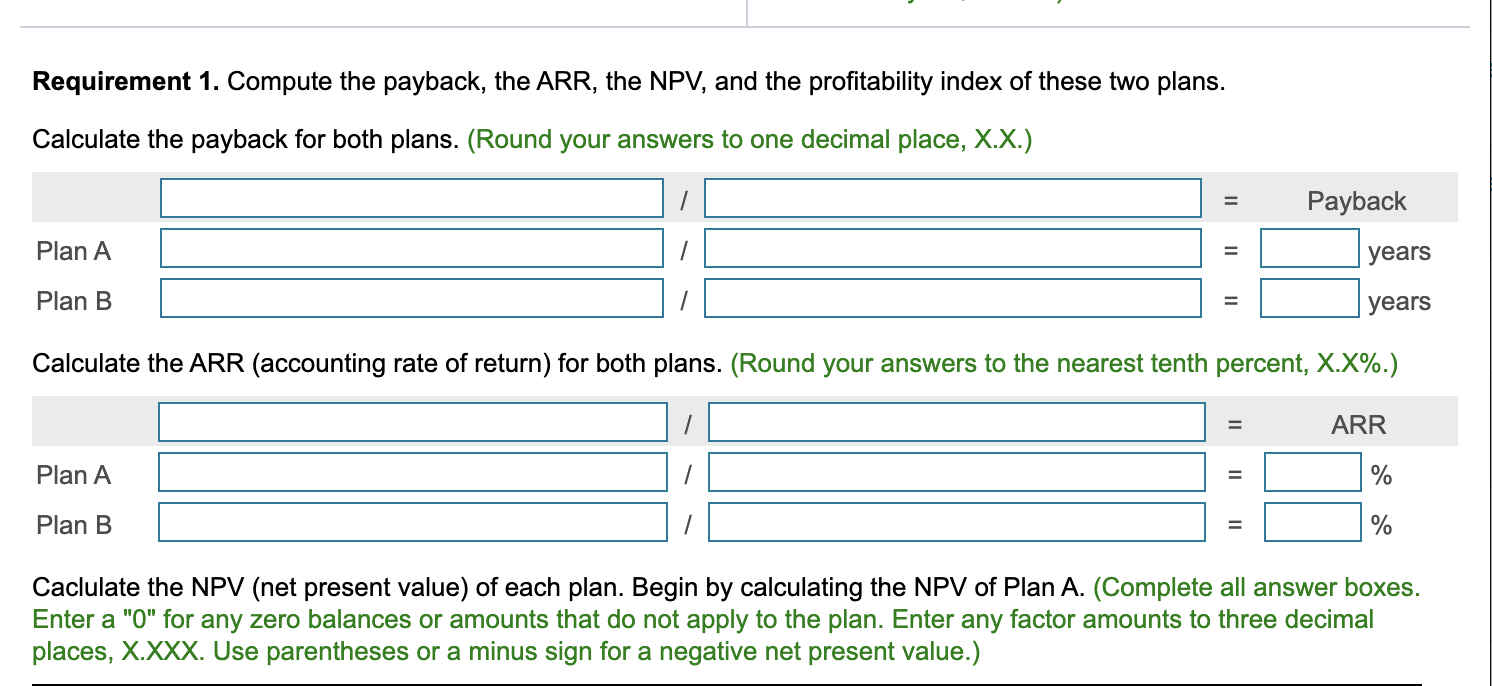

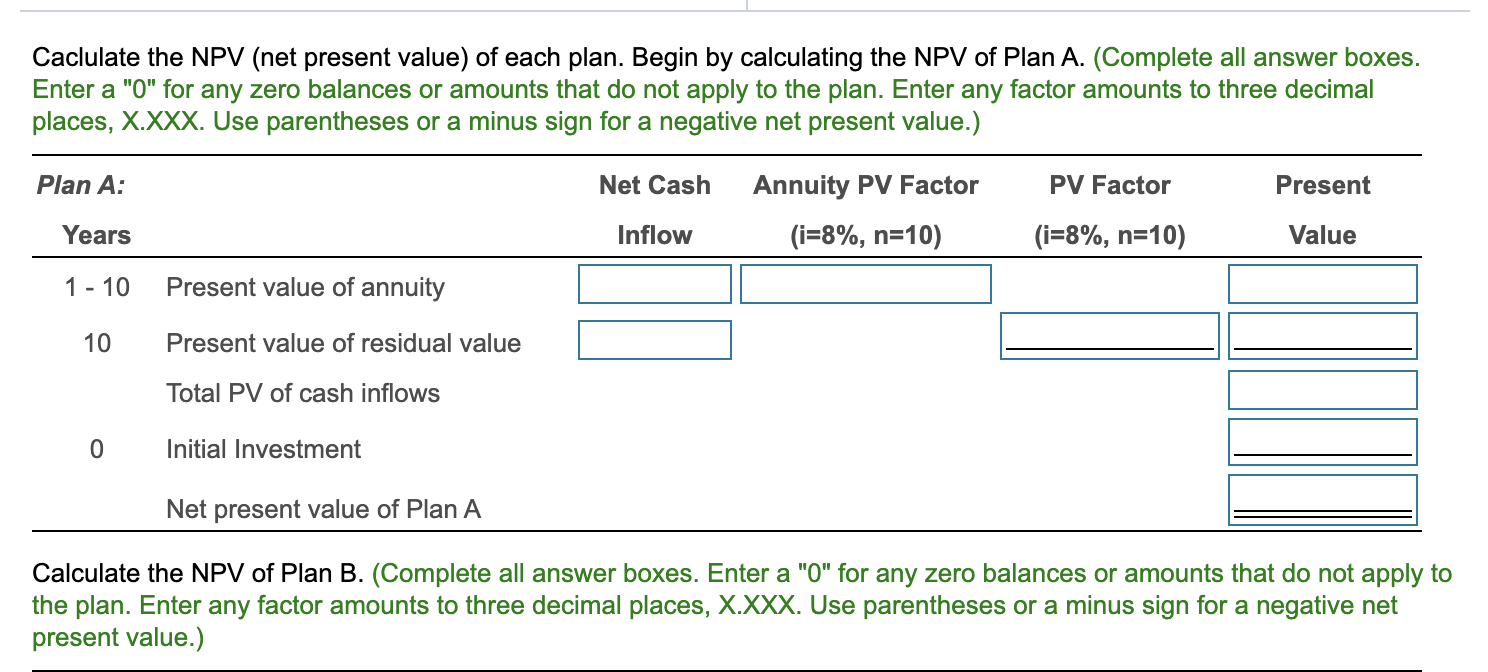

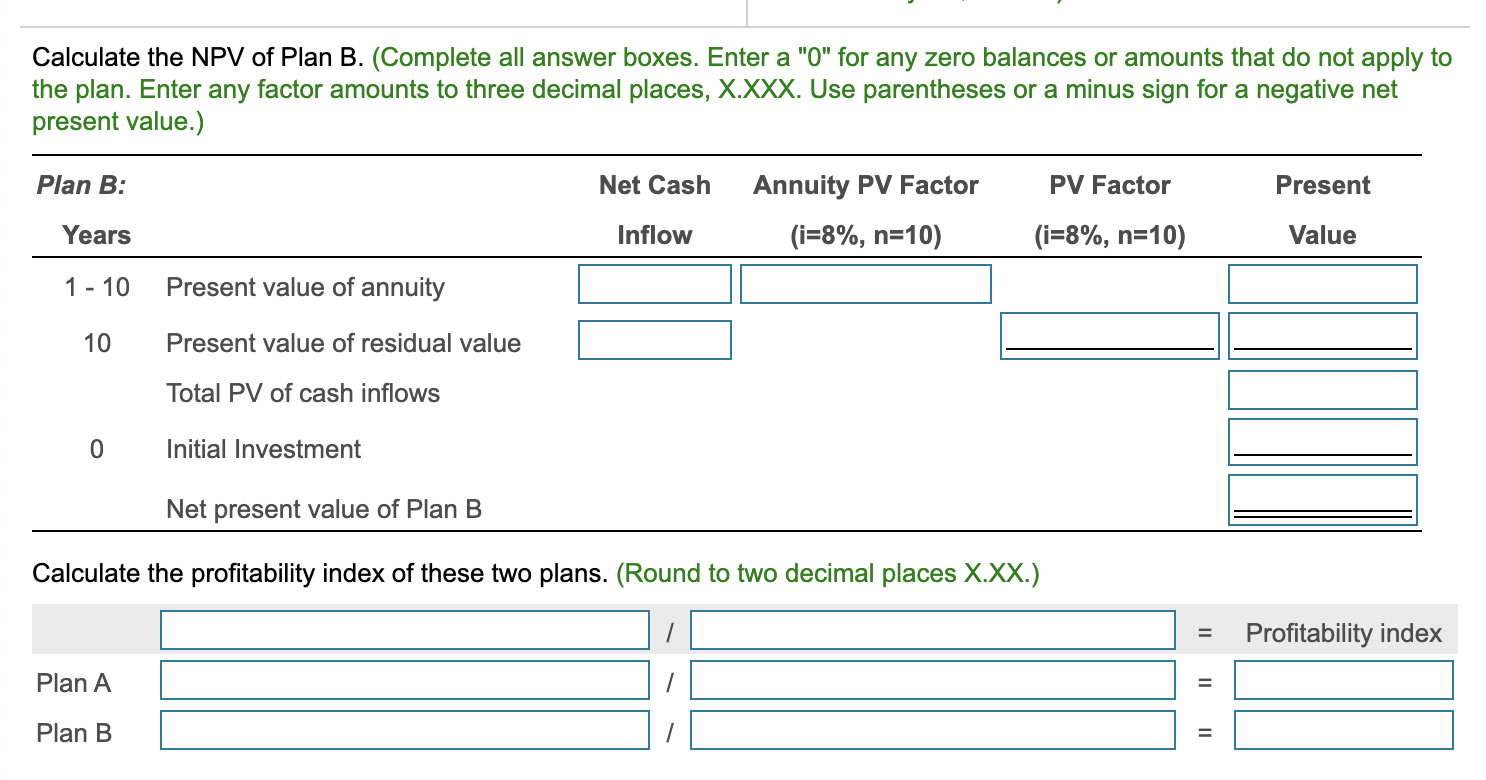

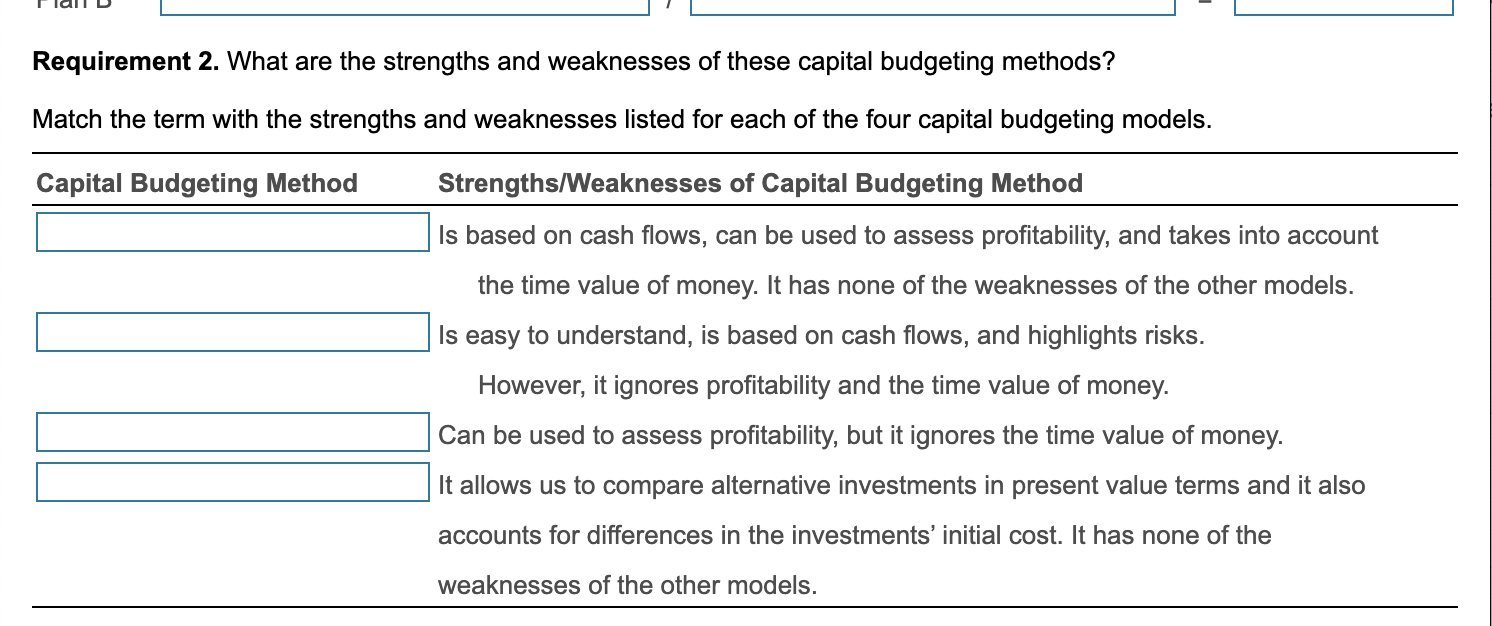

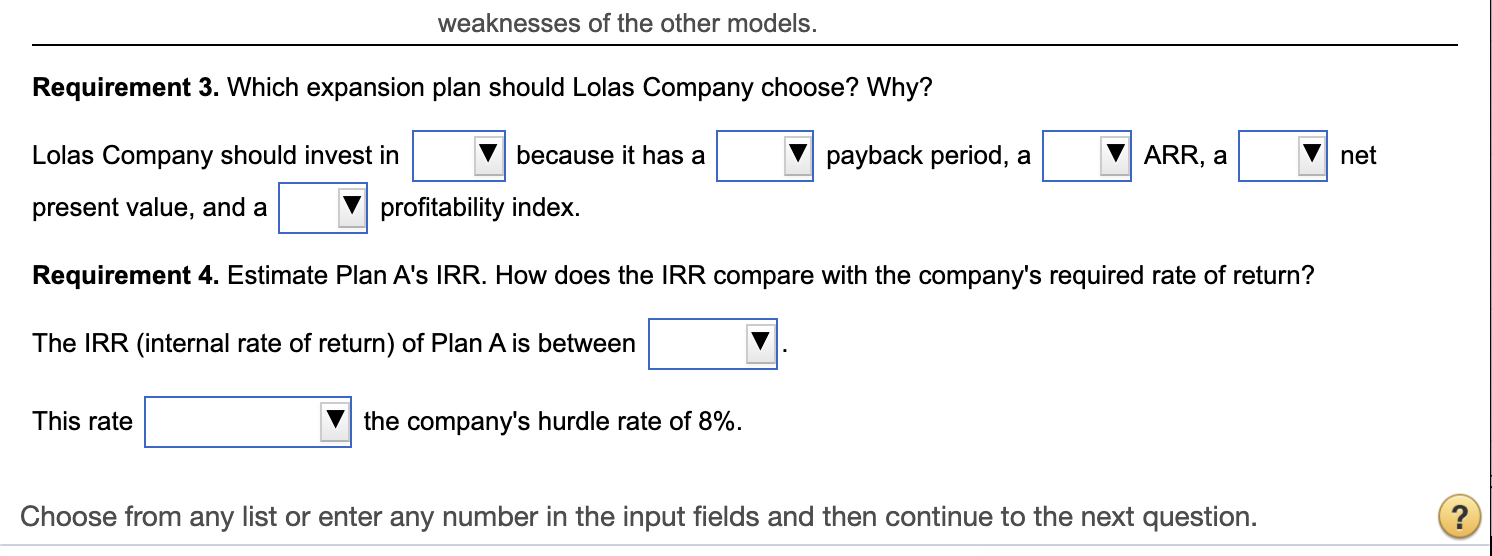

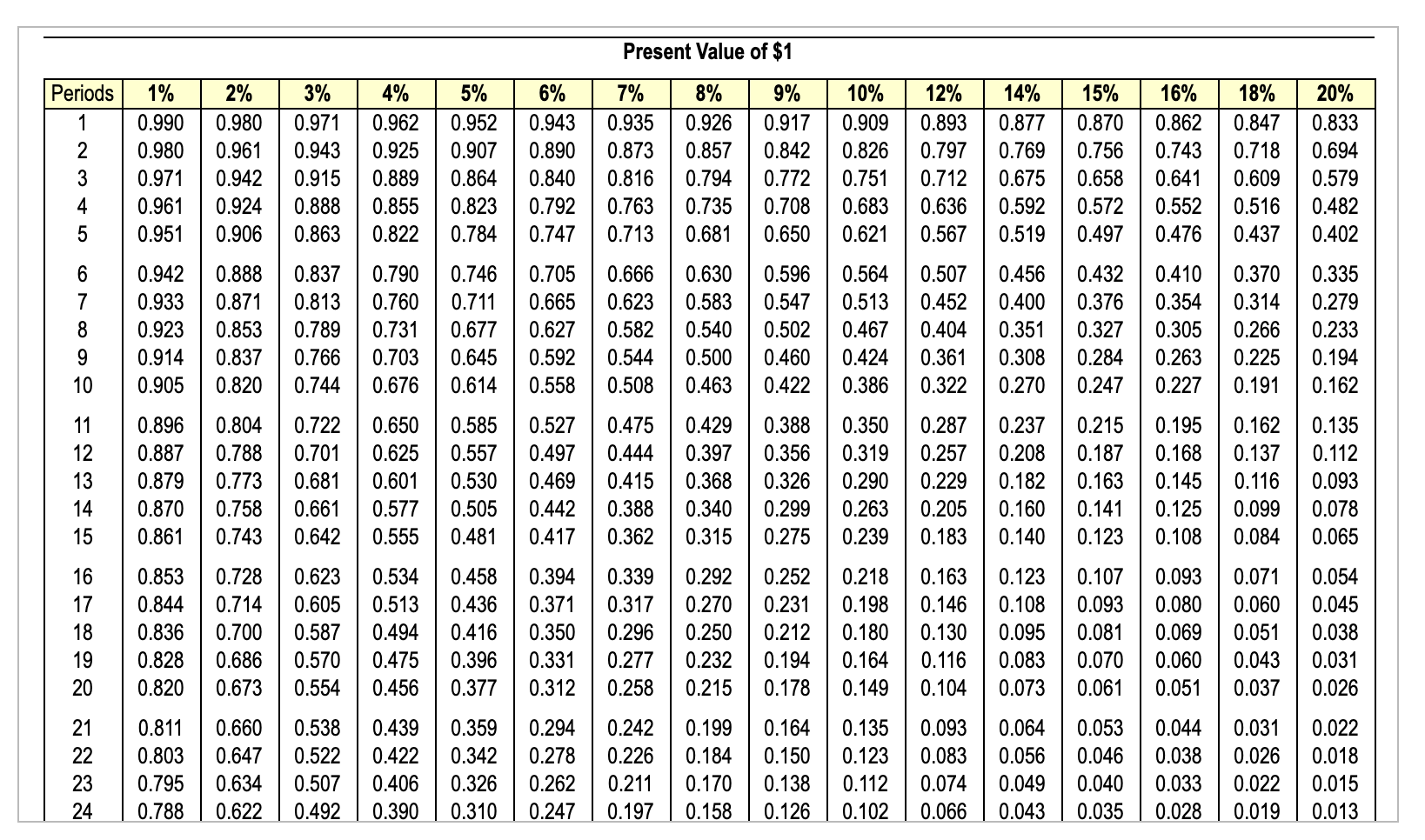

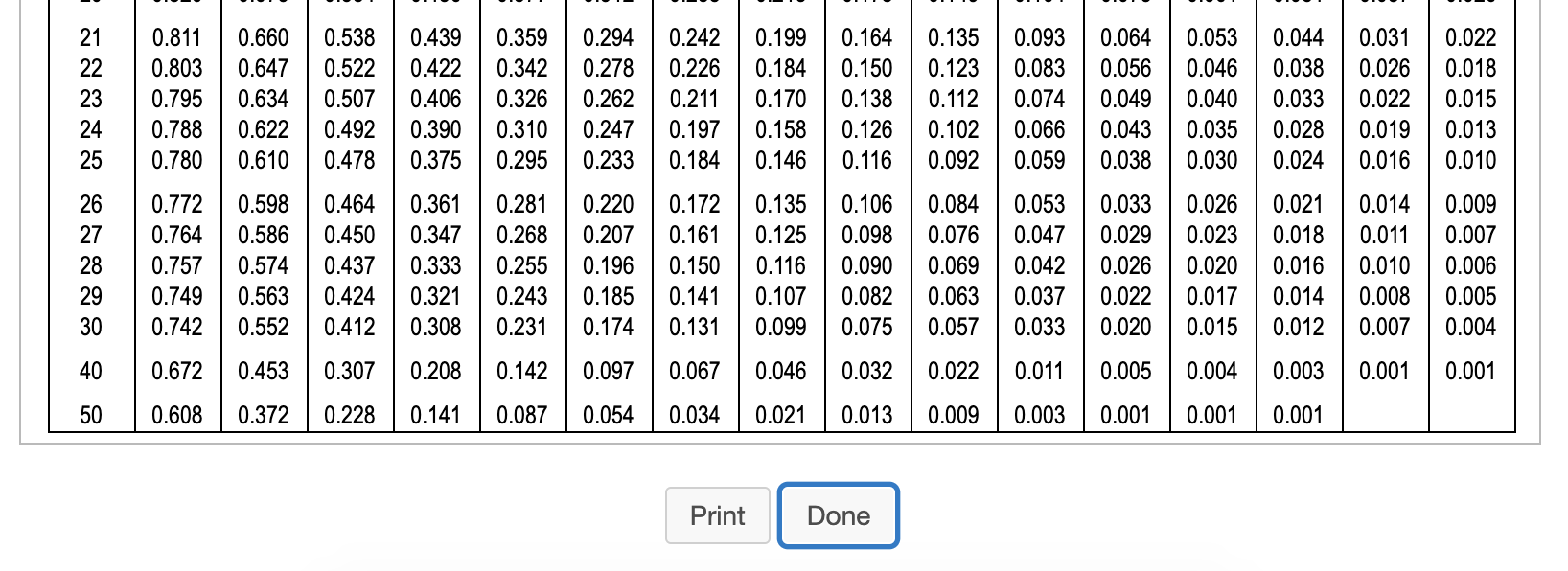

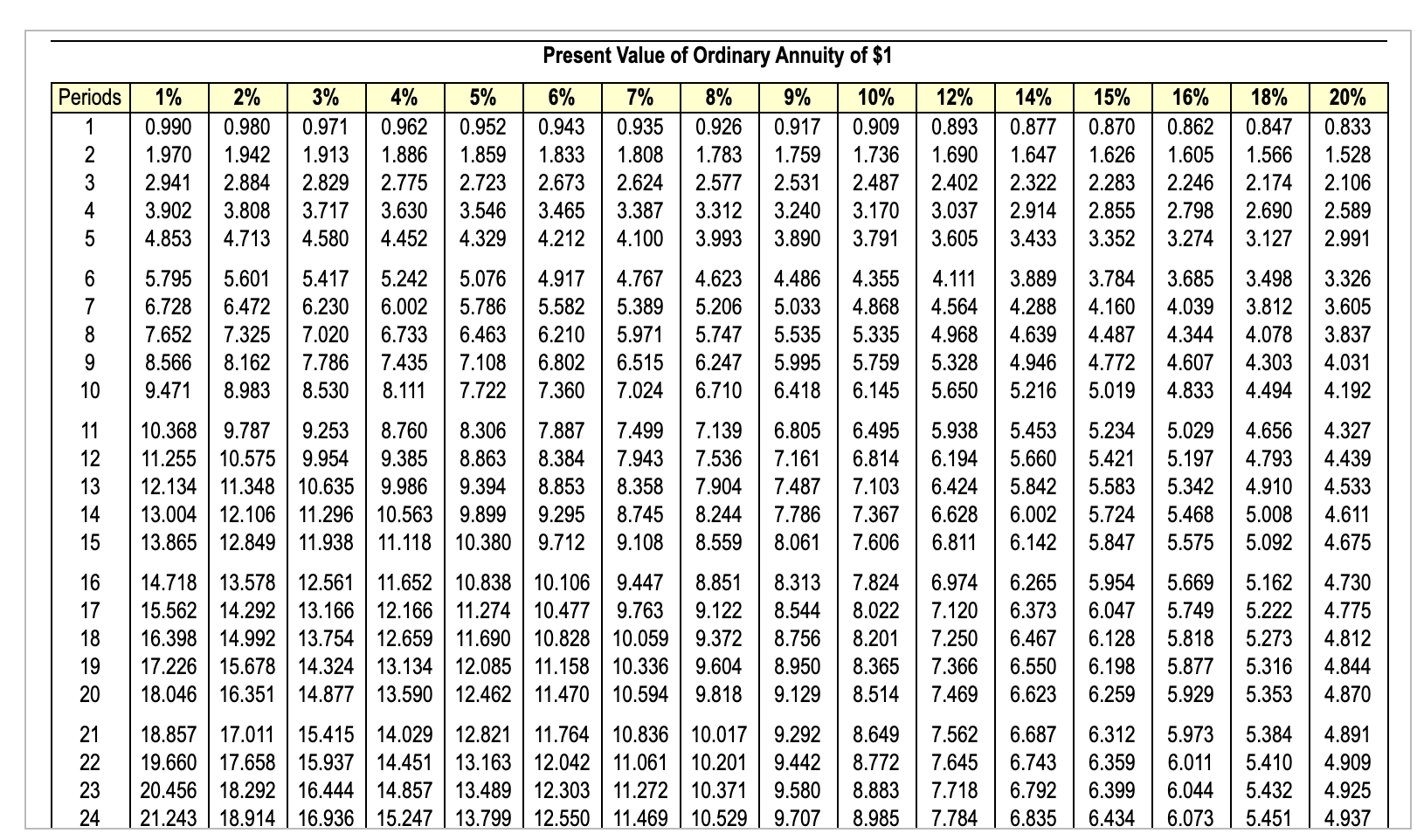

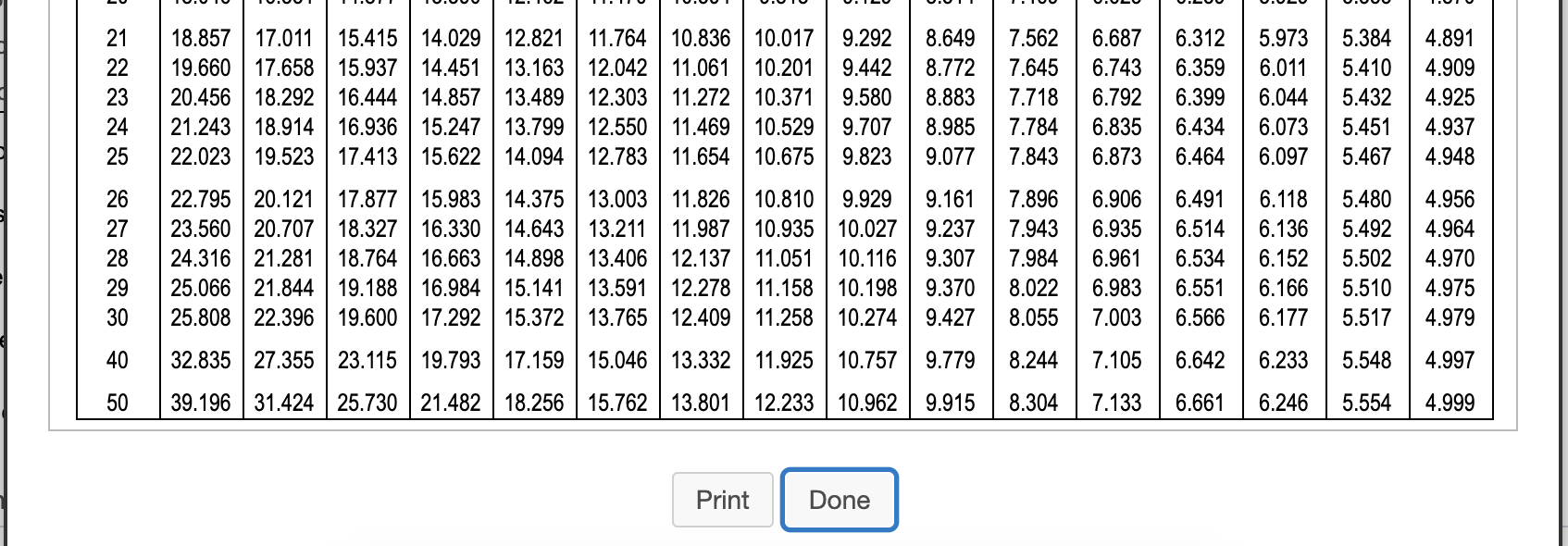

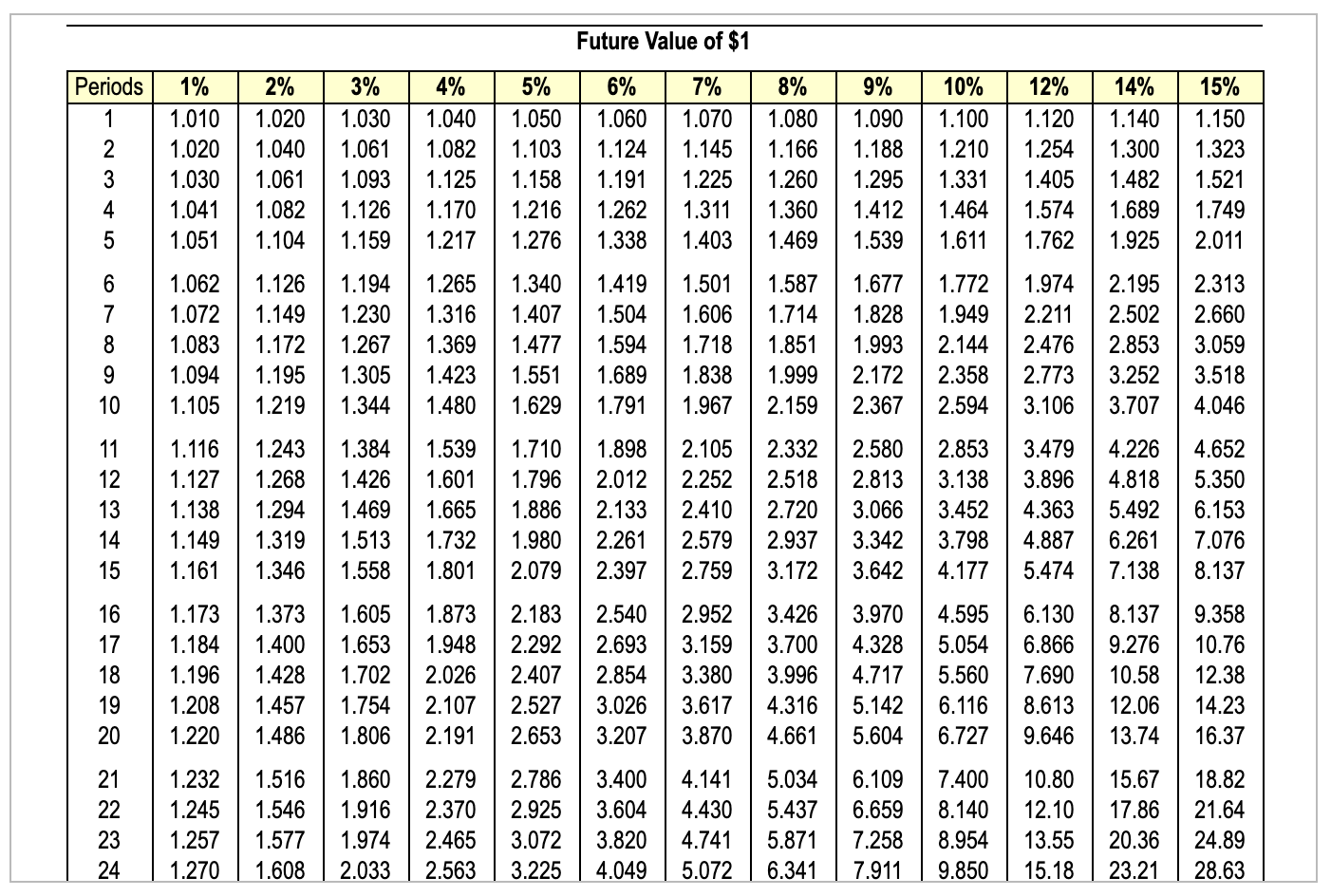

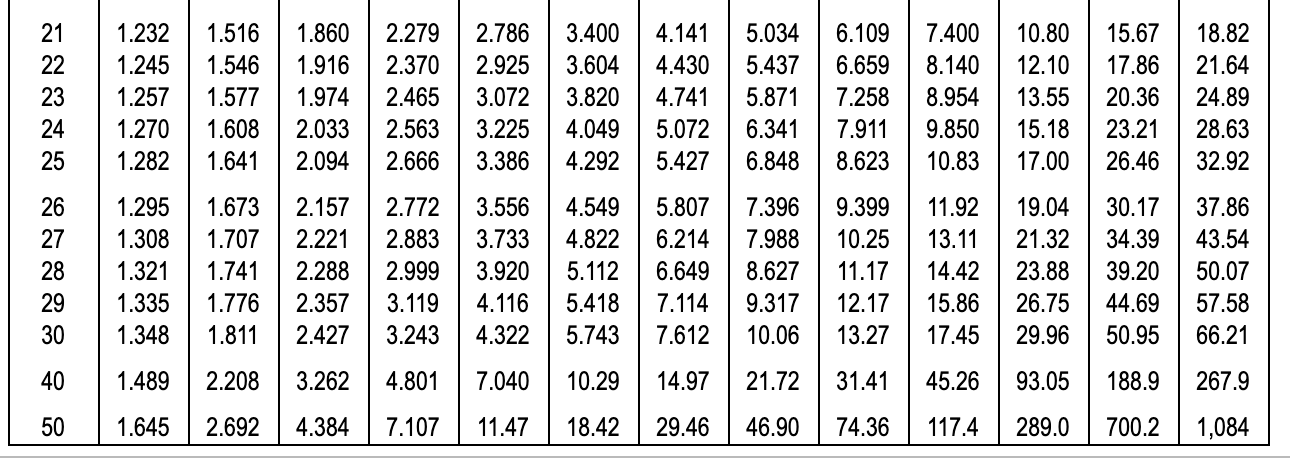

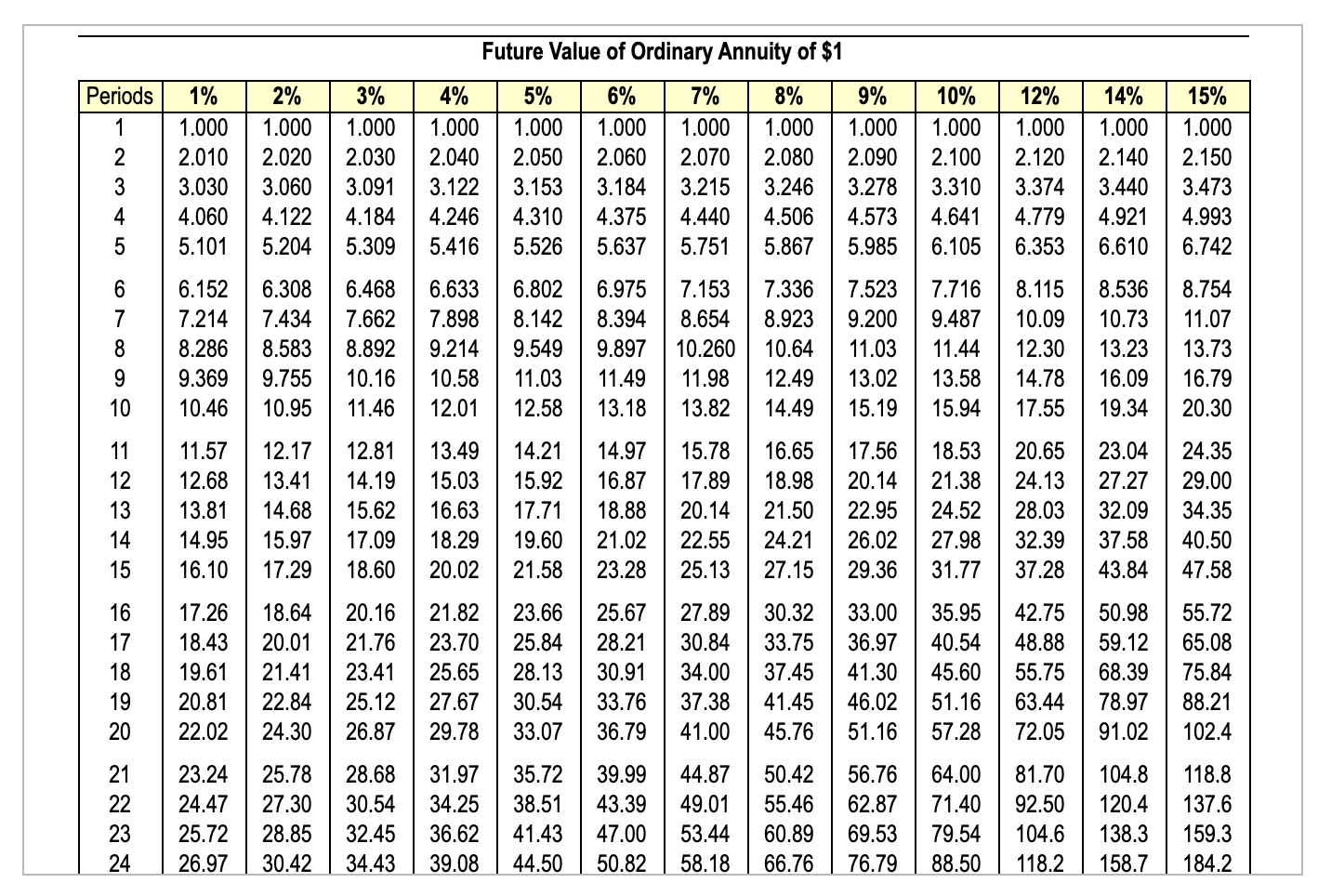

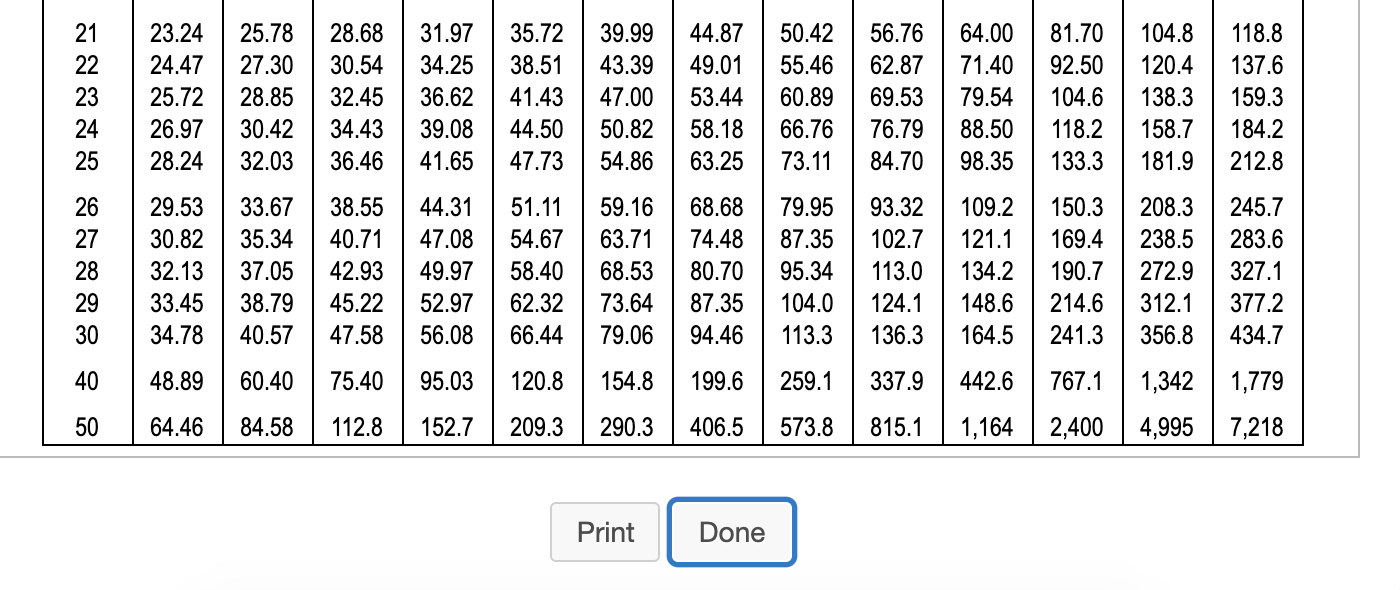

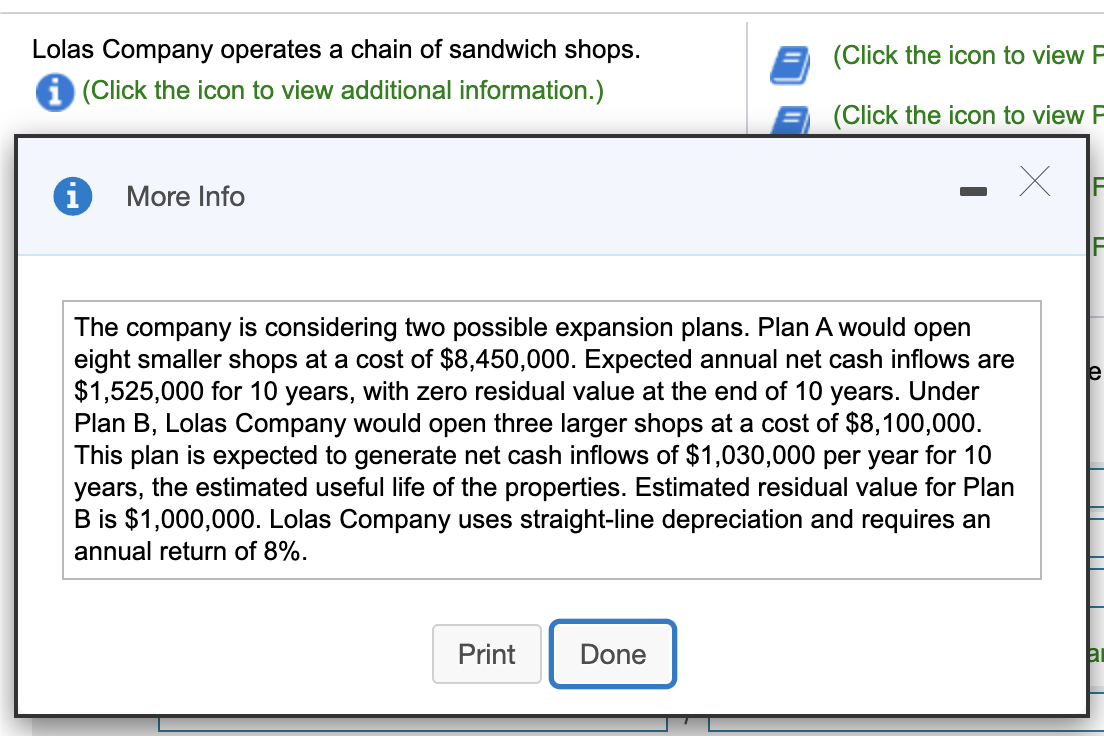

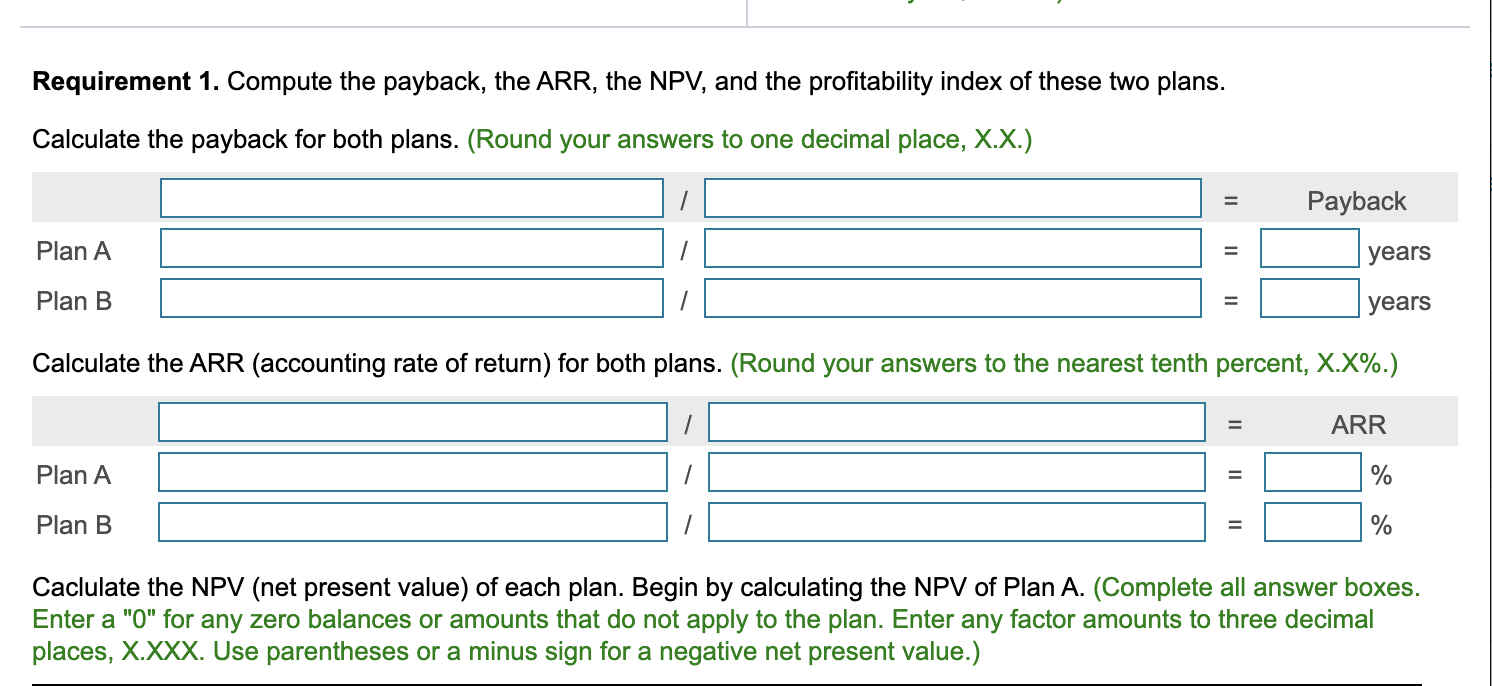

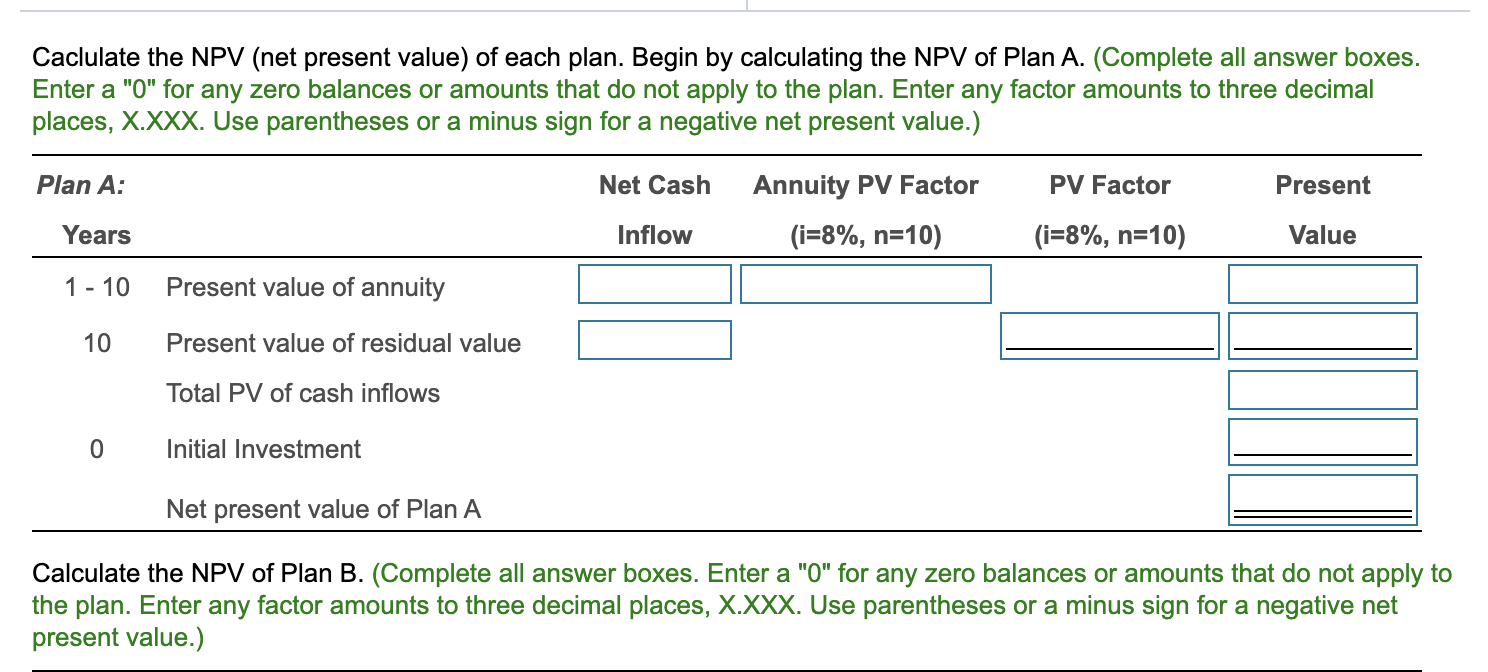

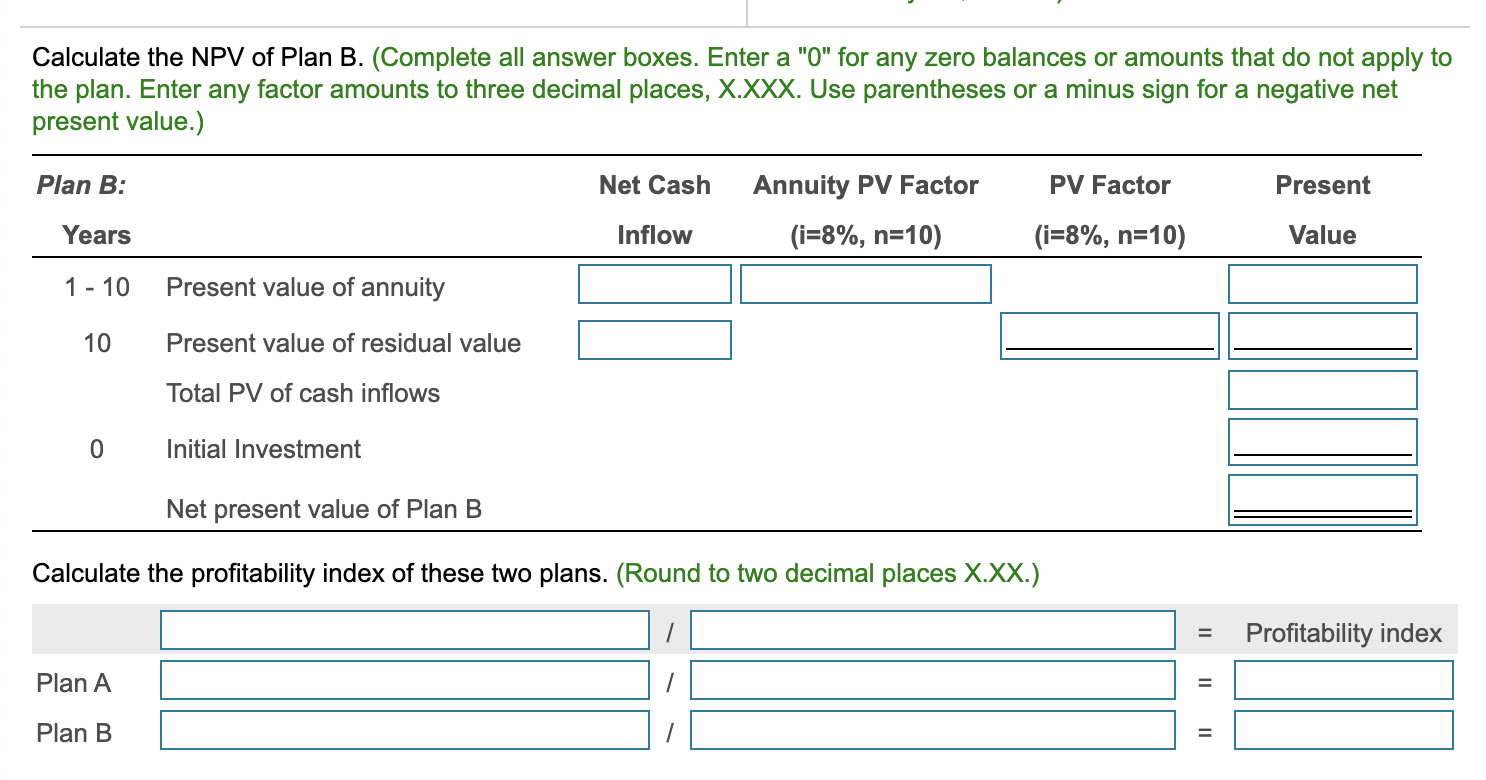

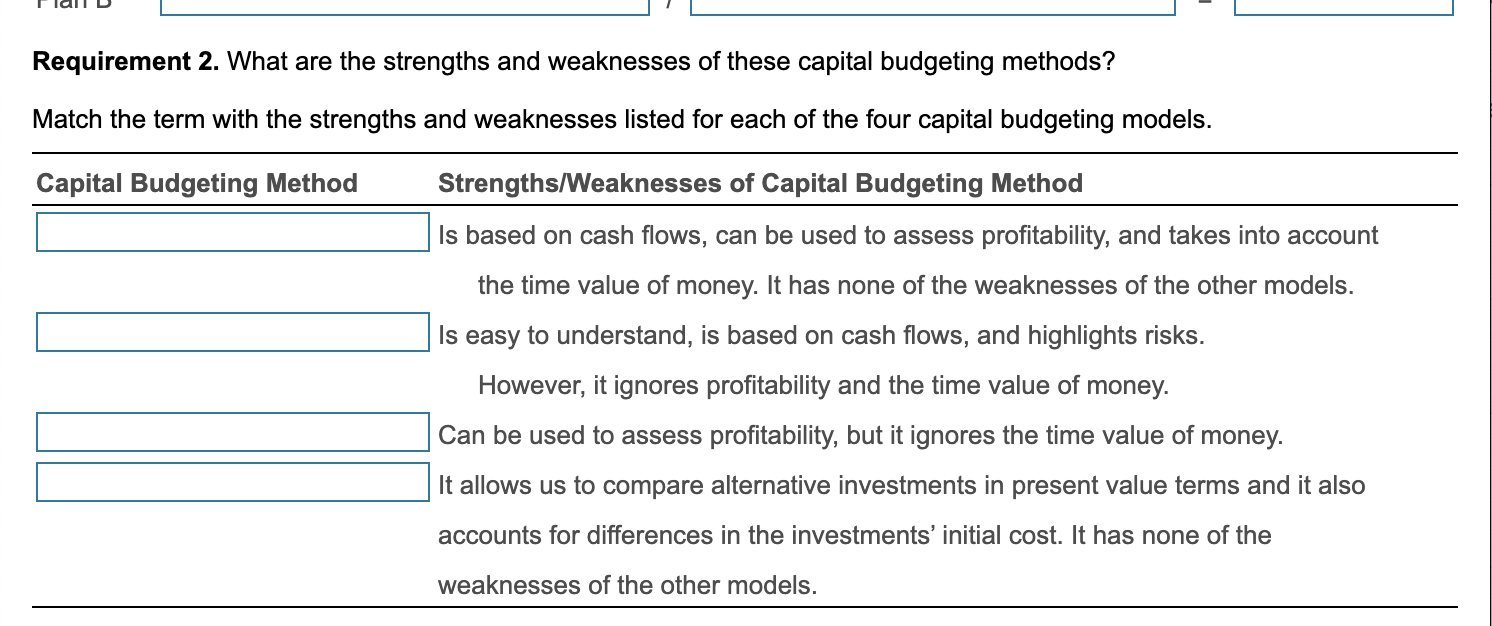

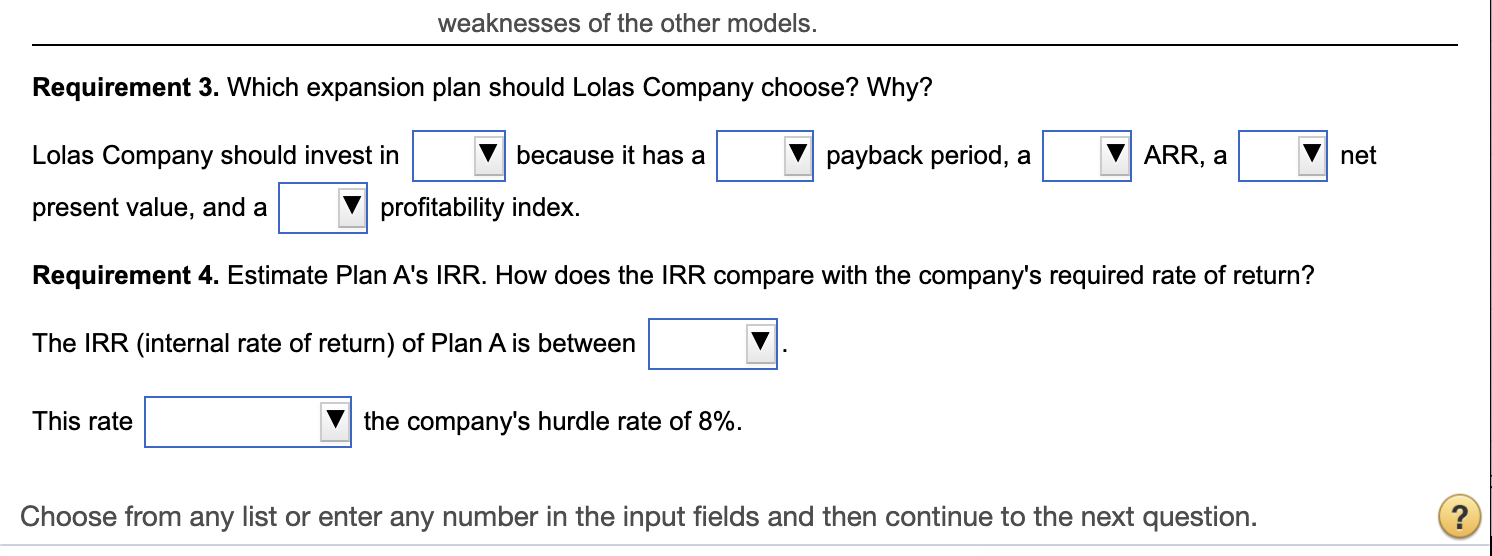

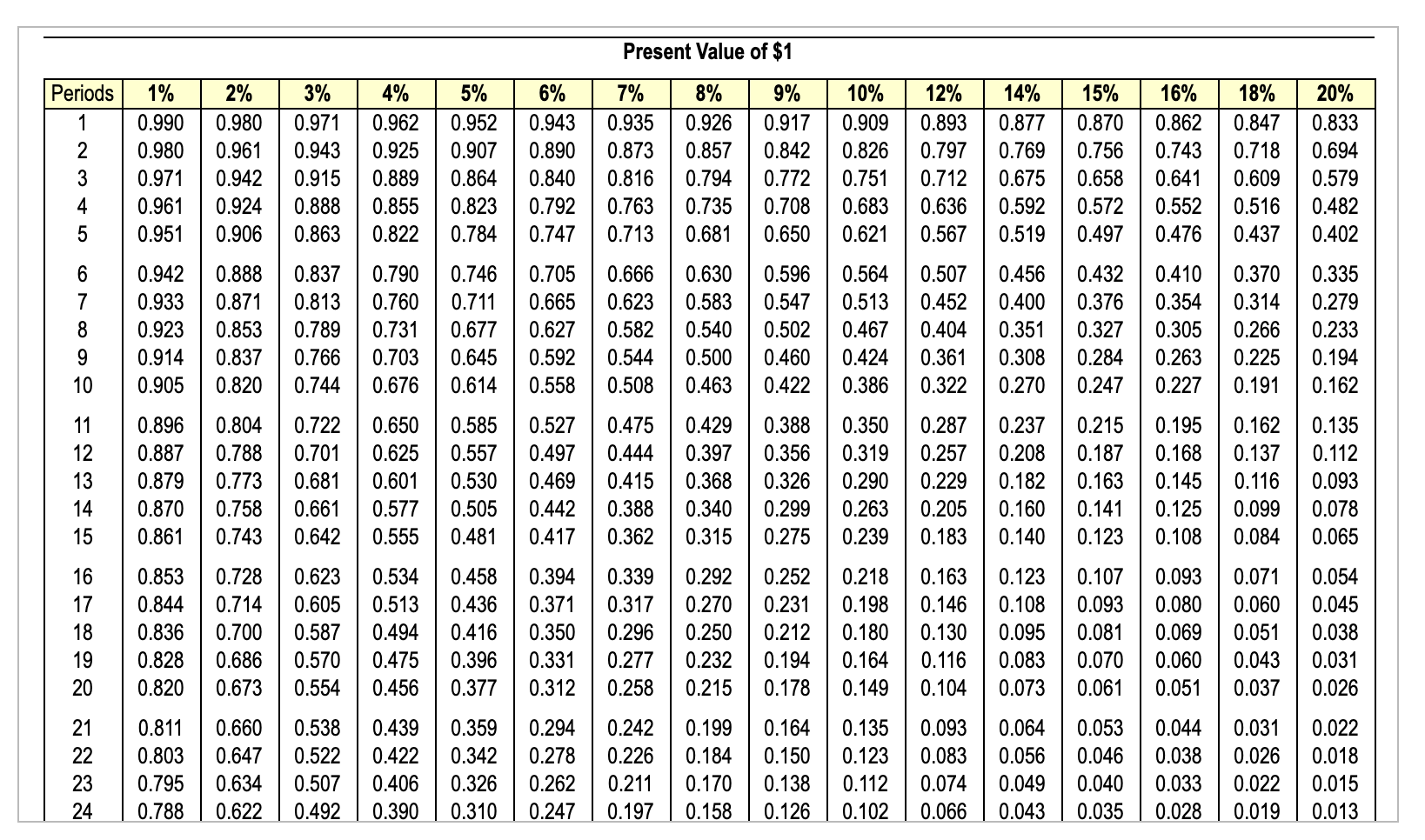

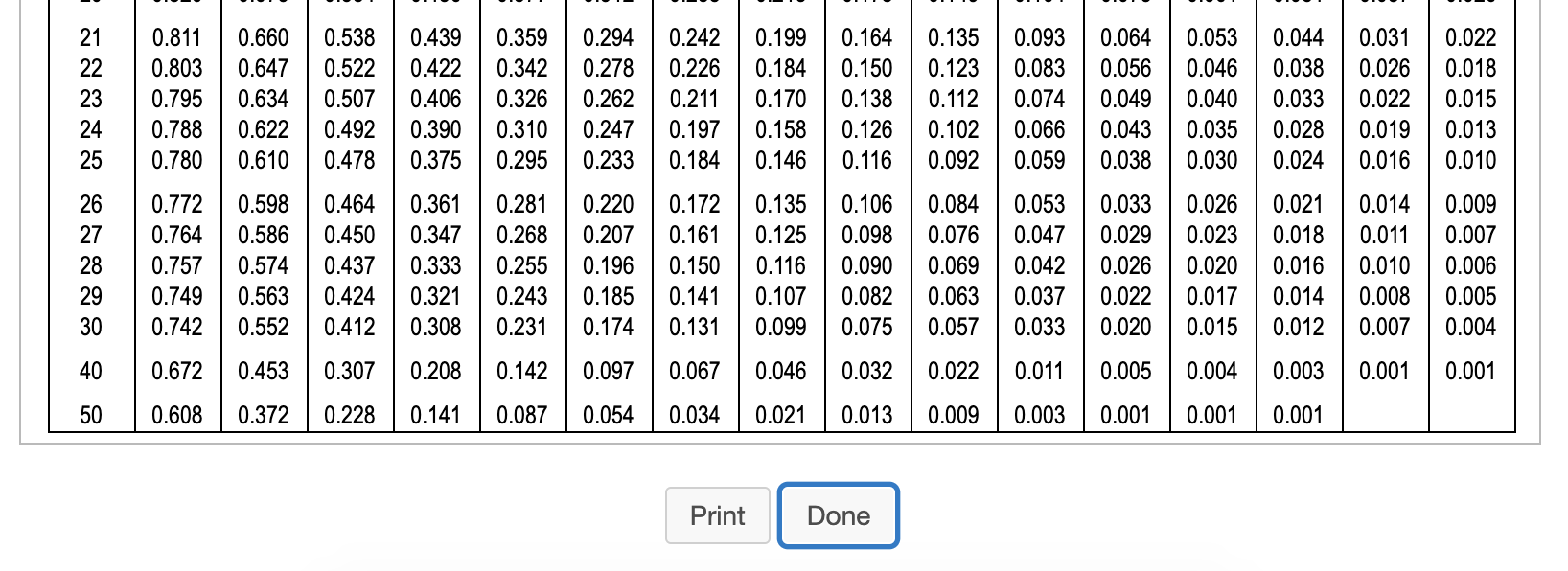

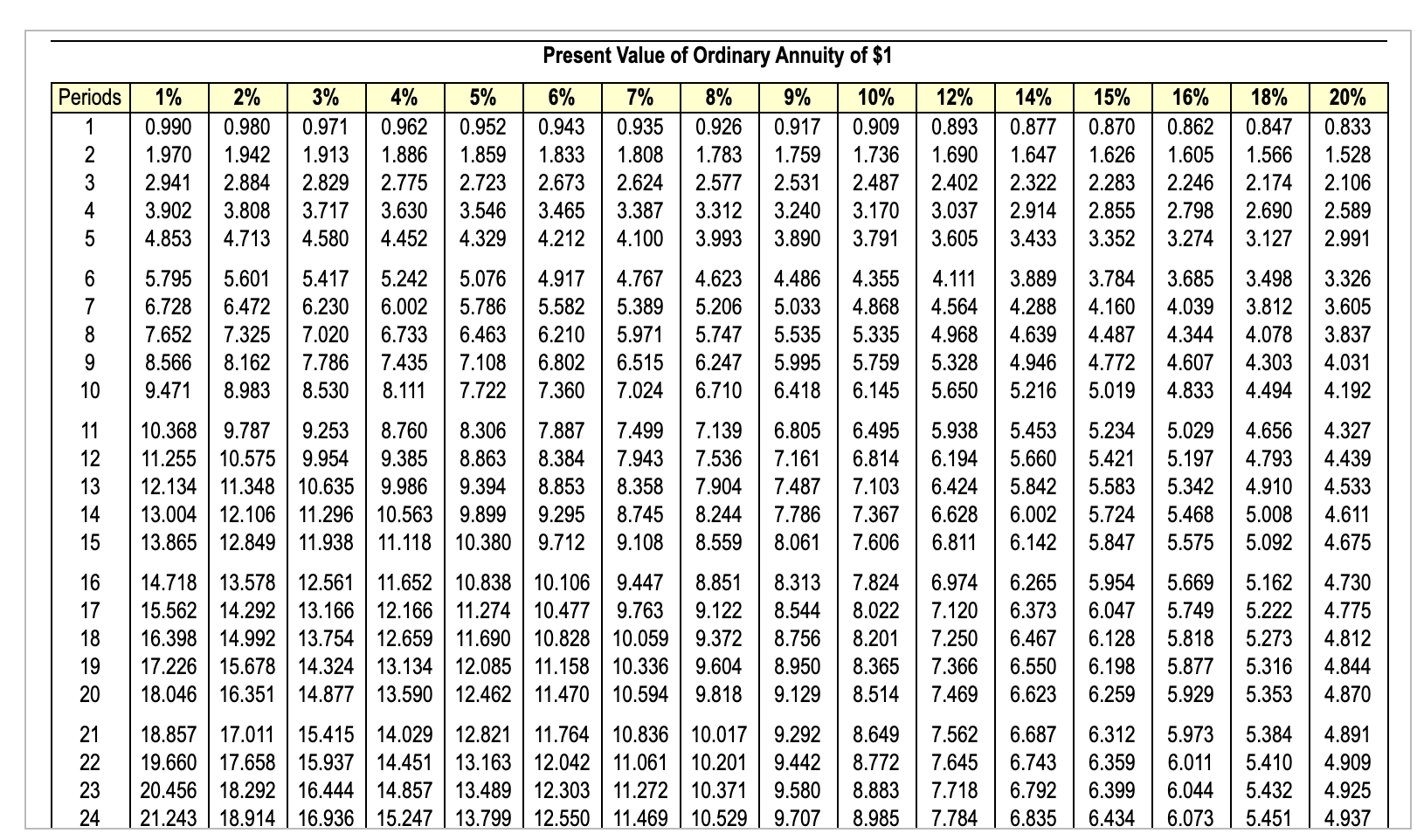

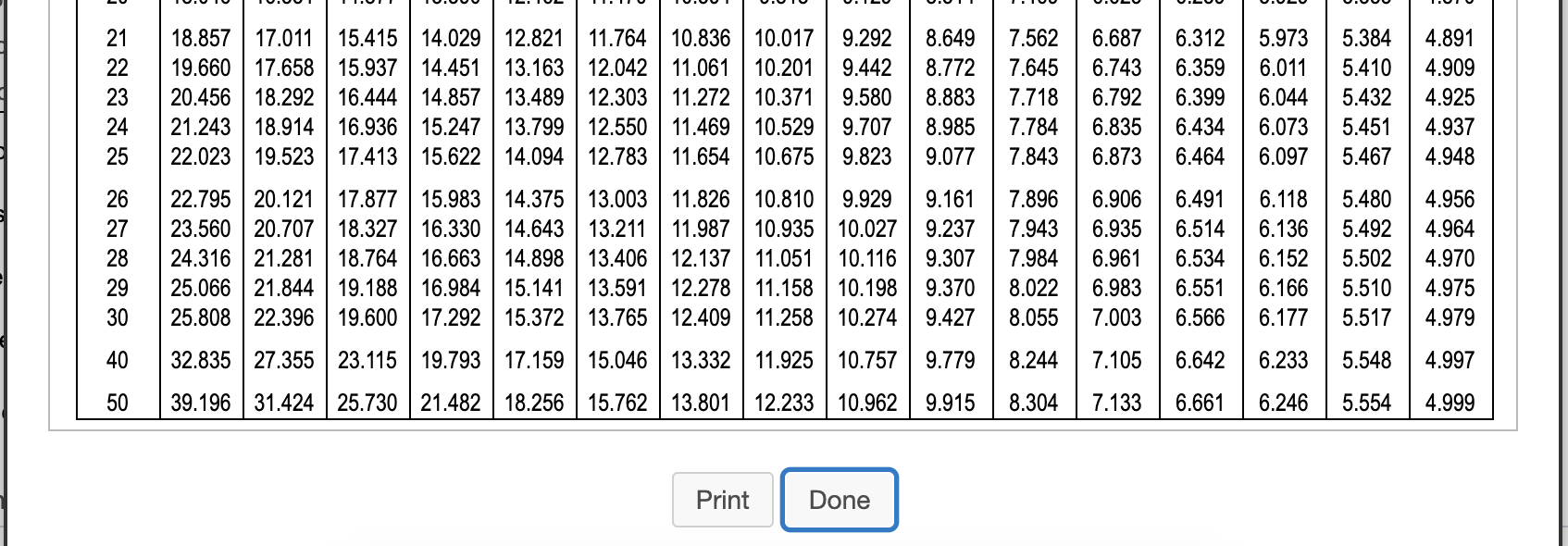

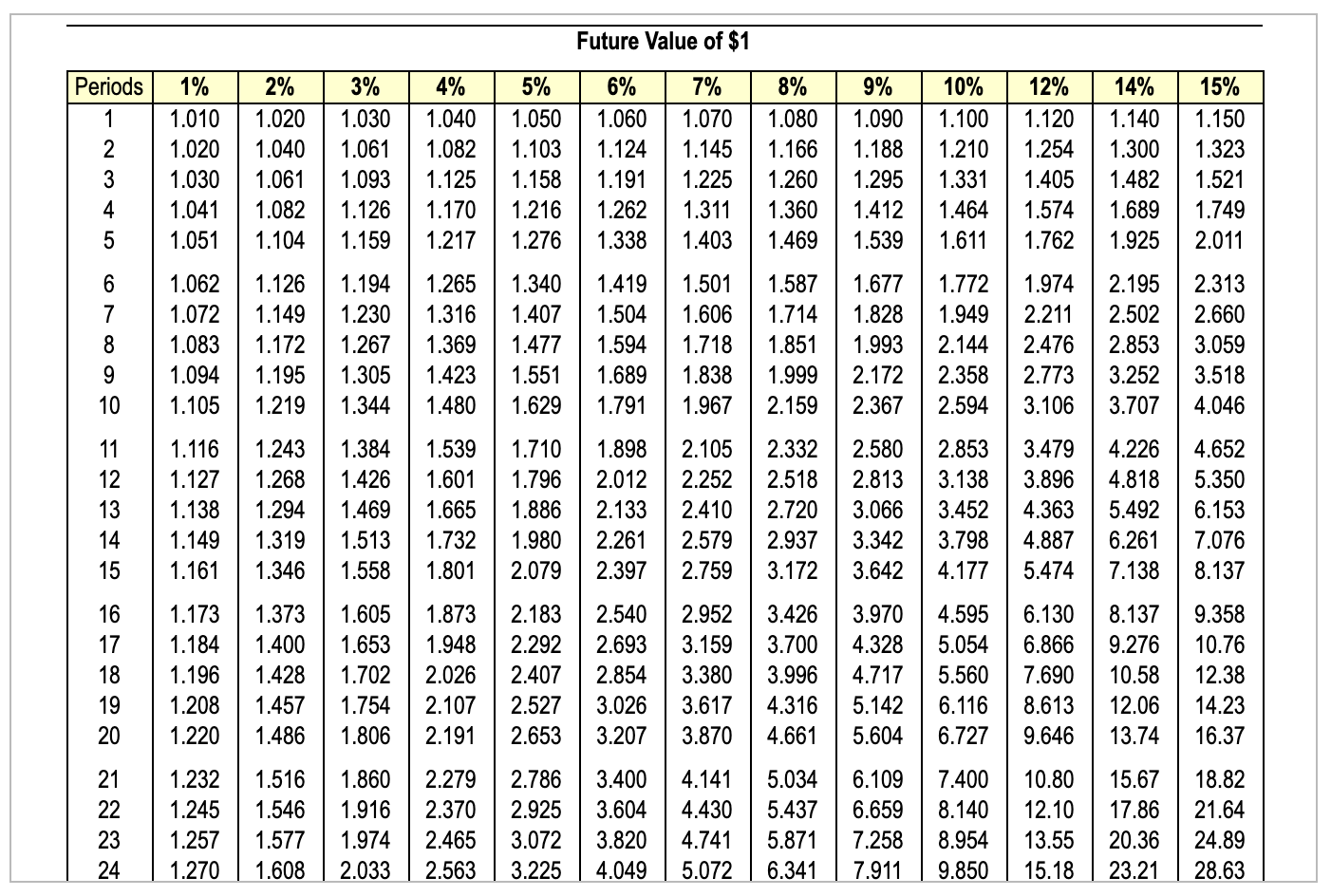

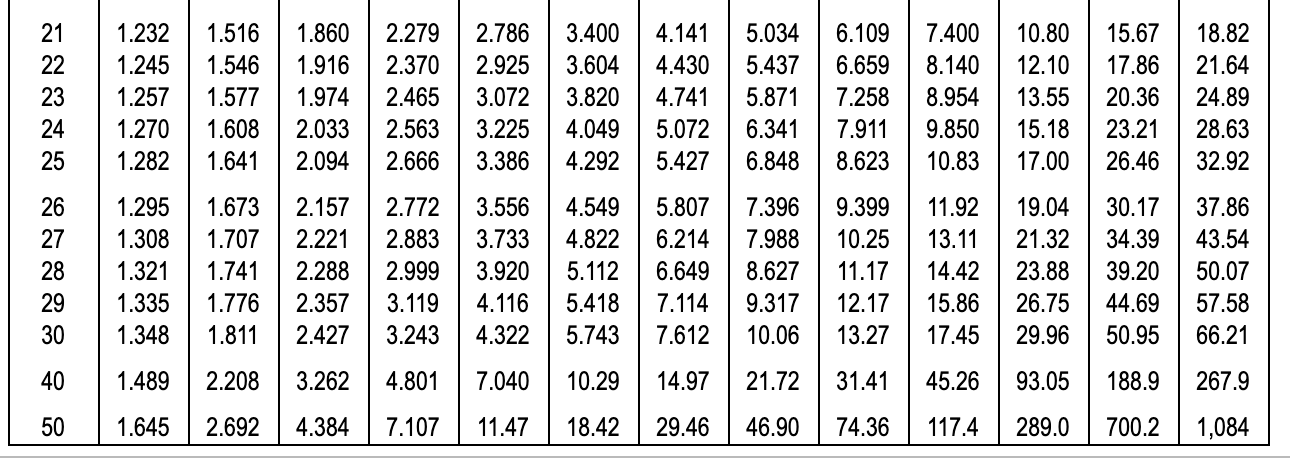

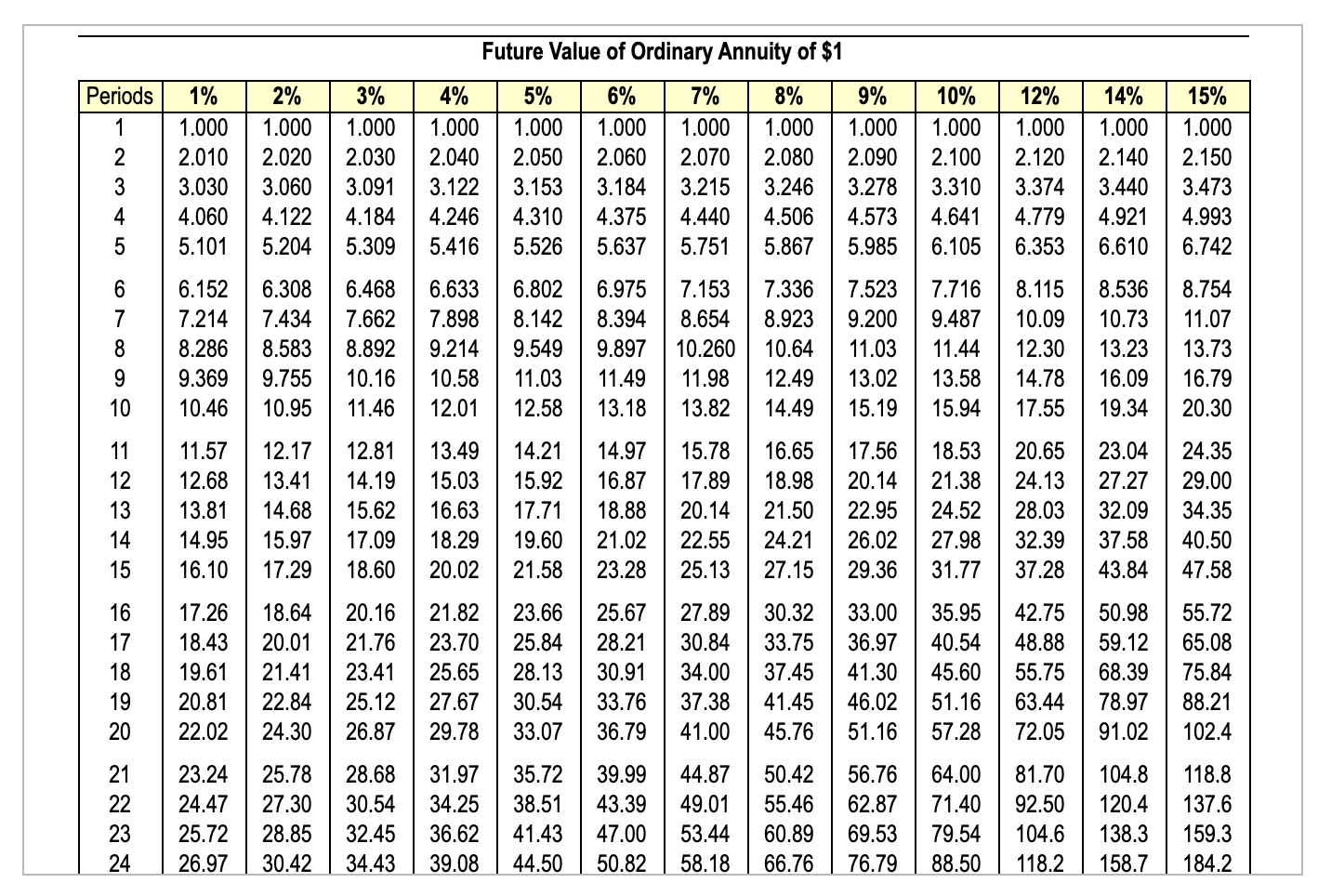

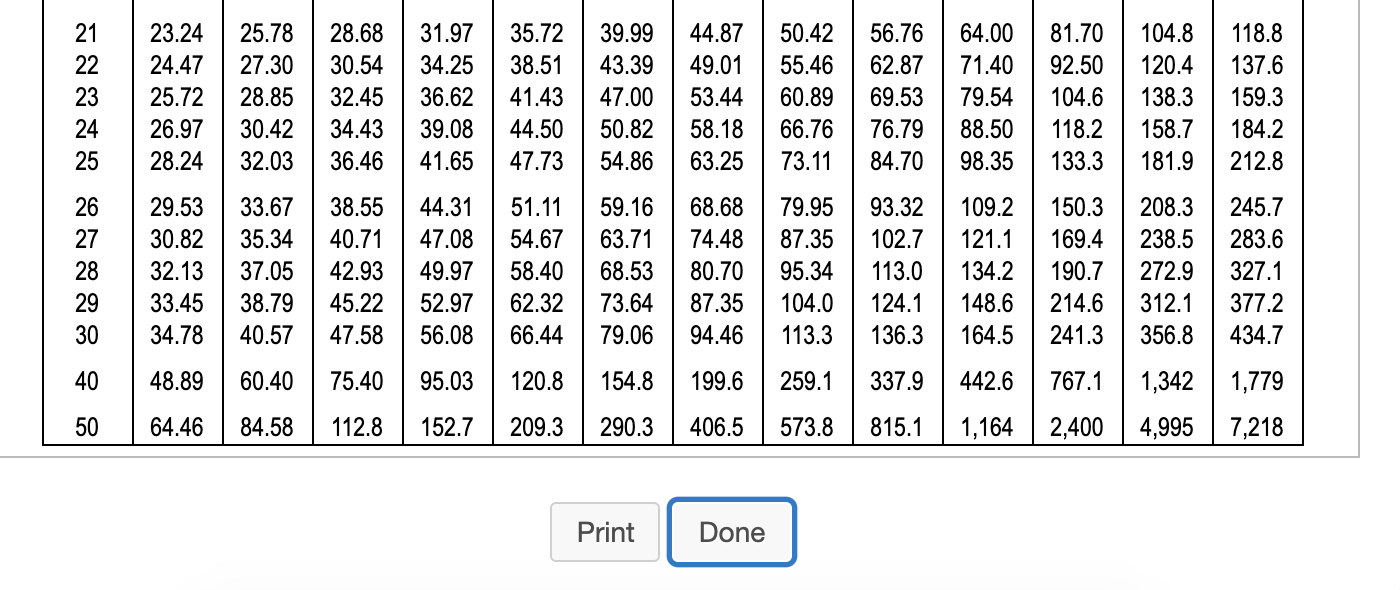

Lolas Company operates a chain of sandwich shops. (Click the icon to view additional information.) 2 (Click the icon to view F - (Click the icon to view More Info The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,450,000. Expected annual net cash inflows are $1,525,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lolas Company would open three larger shops at a cost of $8,100,000. This plan is expected to generate net cash inflows of $1.030.000 per vear for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1,000,000. Lolas Company uses straight-line depreciation and requires an annual return of 8%. Print Done Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. Calculate the payback for both plans. (Round your answers to one decimal place, X.X.) Payback Plan A = years years Plan B Calculate the ARR (accounting rate of return) for both plans. (Round your answers to the nearest tenth percent, X.X%.) ARR Plan A Plan B Caclulate the NPV (net present value) of each plan. Begin by calculating the NPV of Plan A. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each plan. Begin by calculating the NPV of Plan A. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Plan A: Present Net Cash Inflow Annuity PV Factor (i=8%, n=10) PV Factor (i=8%, n=10) Years Value 1 - 10 Present value of annuity Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan A Calculate the NPV of Plan B. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Calculate the NPV of Plan B. (Complete all answer boxes. Enter a "0" for any zero balances or amounts that do not apply to the plan. Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Plan B: Net Cash Present Annuity PV Factor (i=8%, n=10) PV Factor (i=8%, n=10) Years Inflow Value 1 - 10 Present value of annuity Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan B Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) = Profitability index Plan A Plan B Flall Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models. Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models. Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money. It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments' initial cost. It has none of the weaknesses of the other models. weaknesses of the other models. net Requirement 3. Which expansion plan should Lolas Company choose? Why? Lolas Company should invest in because it has a payback period, a V ARR, a present value, and a profitability index. Requirement 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of return) of Plan A is between This rate V the company's hurdle rate of 8%. Choose from any list or enter any number in the input fields and then continue to the next question. | Present Value of $1 Periods | 1% | 2% | 3% | 4% | 5% | 6%, | 7% | 8% | 9% | 10% | 12% | 14% | 15% | 16% | 18% | 20% 0.990 10.980 10.971 | 0.962 10.952 10.943 10.935 10.926 10.917 10.909 | 10.893 10.877 10.870 10.862 10.847 10.833 0.980 10.961 10.943 10.925 0.907 10.890 0.873 0.857 | 10.842 10.826 10.797 | 10.769 0.756 10.743 10.694 0.971 0.942 0.915 0.889 || 0.864 10.840 0.816 0.794 10.772 10.712 0.675 0.658 10.641 10.609 10.579 0.961 0.924 0.888 10.855 0.823 0.792 0.763 0.735 0.708 10.683 0.636 10.592 | 0.572 | 0.552 10.516 10.482 0.951 0.906 0.863 10.822 0.784 0.747 10.713 0.681 10.650 0.567 10.519 10.497 | 0.476 10.437 0.402 0.751 c3456 0.621 890 H2B466MB9%88% 0.942 0.888 10.837 0.790 0.746 0.705 0.666 0.630 0.596 10.564 0.507 10.456 0.432 0.410 10.370 0.335 0.933 0.871 10.813 0.760 0.711 0.665 10.623 10.583 | 0.547 10.513 10.452 10.400 10.376 10.354 10.314 10.279 0.923 0.853 10.789 0.731 0.677 0.627 0.582 0.540 0.502 10.467 10.404 0.351 0.327 0.305 0.266 10.233 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 10.424 10.361 0.308 0.284 0.263 10.225 0.194 0.905 0.820 0.744 0.676 0.614 0.558 10.508 0.463 0.422 0.386 0.322 0.270 0.247 10.227 10.191 10.162 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 10.237 0.215 0.195 10.162 0.135 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 10.208 0.187 0.168 0.137 10.112 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 10.116 0.093 0.870 0.758 0.661 10.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 10.125 0.099 0.078 0.861 0.743 0.642 | 0.555 0.481 0.417 10.362 0.315 0.275 0.239 10.183 | 0.140 0.123 10.108 10.084 0.065 0.853 | 0.728 | 0.623 0.534 | 0.458 | 0.394 | 0.339 0.292 10.252 | 0.218 | 0.163 | 0.123 10.107 | 10.093 | 0.071 0.054 0.844 0.714 10.605 0.513 10.436 | 0.371 0.317 0.270 0.231 0.198 10.146 0.108 0.093 0.080 0.060 0.045 0.836 | 0.700 | 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 10.038 10.828 | 0.686 | 0.570 0.475 0.396 0.331 0.277 0.232 0.194 | 0.164 | 0.116 | 0.083 | 0.070 | 0.060 | 0.043 || 0.031 10.820 | 0.673 | 0.554 0.456 | 0.377 | 0.312 | 0.258 | 0.215 | 0.178 | 0.149 | 0.104 | 0.073 | 0.061 | 0.051 | 0.037 10.026 10.811 | 0.660 10.538 10.439 | 0.359 | | 0.294 0.242 0.199 0.164 0.135 10.093 10.064 10.053 | | 0.044 | 0.031 10.022 0.803 0.647 0.522 0.422 | 0.342 0.278 0.226 0.184 10.150 10.123 10.083 0.056 | 0.046 | 10.038 | 0.026 0.018 0.795 | 0.634 | 0.507 10.406 | 0.326 | 10.262 0.211 | 0.170 | 0.138 | 0.112 | 0.074 10.049 0.040 10.033 | 0.022 10.015 | 0.788 | 0.622 | 0.492 | 0.390 | 0.310 | 0.247 | 0.197 | 0.158 | 0.126 | 0.102 | 0.066 | 0.043 | 0.035 | 0.028 | 0.019 | 0.013 0.811 0.803 0.795 0.788 0.780 0.660 0.647 0.634 0.622 0.610 0.538 0.522 0.507 0.492 0.478 | 0.439 0.422 0.406 0.390 0.375 0.359 0.342 0.326 0.310 0.295 0.294 0.278 0.262 0.247 0.233 0.242 0.226 0.211 0.197 0.184 0.1640.135 0.150 0.123 0.138 0.112 0.126 0.102 0.116 0.092 0.093 0.083 0.074 0.066 0.059 0.064 0.056 0.049 0.043 0.038 0.053 0.046 0.040 0.035 0.030 0.044 0.038 0.033 0.028 0.024 0.031 0.026 0.022 0.019 0.016 0.022 0.018 0.015 0.013 0.010 0.199 0.184 0.170 0.158 0.146 0.135 0.125 0.116 0.107 0.099 0.281 0.268 0.772 0.764 0.757 0.749 0.742 0.598 0.586 0.574 0.563 0.552 0.464 0.450 0.437 0.424 0.412 0.361 0.347 0.333 0.321 0.308 0.255 0.243 0.231 0.220 0.207 0.196 0.185 0.174 0.172 0.161 0.150 0.141 0.131 0.106 0.098 0.090 0.082 0.075 0.084 0.076 0.069 0.063 0.057 0.053 0.047 0.042 0.037 0.033 0.033 0.029 0.026 0.022 0.020 0.026 0.023 0.020 0.017 0.015 0.021 0.014 0.018 0.011 0.016 0.010 0.014 0.008 0.0120.007 0.003 0.001 0.001 0.009 0.007 0.006 0.005 0.004 0.307 0.142 0.097 0.046 0.032 0.022 0.0110.005 0.004 0.001 0.672 0.608 | 0.453 0.372 0.208 0.141 0.067 0.034 0.228 0.087 0.054 0.021 0.013 0.009 0.003 0.001 0.001 Print Done Present Value of Ordinary Annuity of $1 | Periods] 1% | 2% 3% | 4% | 5% | 6% 7% | 8% | 9% 10% 12% 14% 15% 16% 18% | 20%, 10.990 | 0.980 | 0.971 | 0.962 | 0.952 | 0.943 | 0.935 | 0.926 | 0.917 10.909 | 0.893 | 0.877 | 0.870 | 0.862 | 0.847 | 0.833 1.970 | 1.942 | 1.913 | 1.886 | 1.859 | 1.833 | 1.808 | 1.783 | 1.759 | 1.736 11.690 | 1.647 | 1.626 | 1.605 | 1.566 | 1.528 2.941 12.884 2.829 2.775 2.723 | 2.673 | 2.624 | 2.577 2.531 2.487 2.402 2.322 | 2.283 2.246 2.174 2.106 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 8.853 45 67890HQ846689%a889 5.795 5.601 5.417 5.242 5.076 4.917 4.767 14.623 14.486 4.355 4.111 3.889 3.784 3.685 3.498 3.326 6.728 6.472 6.230 6.002 5.786 5.582 5.389 | 5.206 15.033 4.868 14.564 4.288 4.160 4.039 3.812 3.605 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 8.566 | 8.162 7.786 7.435 7.108 6.802 | 6.515 6.247 15.995 15.759 | 5.328 4.946 4.772 4.607 14.303 4.031 9.471 8.983 8.530 88.111 7.722 7.360 | 7.024 6.710 6.418 6.145 5.650 15.216 15.019 4.833 14.494 4.192 10.368 | 19.787 9.253 8.760 18.306 17.887 17.499 7.139 6.805 6.495 5.938 15.453 | 5.234 5.029 14.656 14.327 11.255 110.575 19.954 19.385 18.863 8.384 7.943 7.536 7.161 6.814 16.194 15.660 15.421 5.197 4.793 4.439 12.134 | 11.348 | 10.635 19.986 19.394 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 14.910 4.533 13.004 | 12.106 | 11.296 | 10.563 | 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 13.865 | 12.849 | 11.938 | 11.118 | 10.380 | 9.712 9.108 8.559 8.061 7.606 16.811 16.142 | 15.847 5.575 5.092 4.675 14.718| 13.578 | 12.561 | 11.652 | 10.838| 10.106 19.447 8.851 8.313 7.824 6.974 6.265 5.954 5.669 15.162 4.730 15.562 14.292 13.166 12.166 | 11.274 | 10.477 || 9.763 9.122 8.544 8.022 7.120 6.373 6.047 5.749 5.222 4.775 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 5.818 5.273 4.812 17.226 15.678 14.324 | 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 18.046 | 16.351 | 14.877 | 13.590 12.462 | 11.470 10.594 | 9.818 19.129 | 8.514 7.469 6.623 6.259 5.929 5.353 4.870 | 18.857 | 17.011 | 15.415| 14.029 | 12.821 | 11.764 | 10.836 | 10.017 9.292 8.649 7.562 6.687 6.312 5.973 5.384 4.891 19.660 117.658 | 13.163|12.042 | 11.061|10.201 9.442 8.772 6.743 6.359 6.011 5.410 4.909 20.456 | 18.292 16.444 114.857113.489 112.303 | 11.272 | 10.371| 9.580 8.883 7.718 | 6.792 6.399 6.044 5.432 4.925 | 21.243 | 18.914| 16.936 | 15.247 | 13.799 | 12.550 | 11.469 | 10.529 | 9.707 | 8.985 17.784 | 6.835 | 6.434 16.073 | 5.451 | 4.937 6.128 6.198 7.645 10.00 This M 16.TUL U.UU 12.0293.163 6.312 6.359 6.399 6.434 6.464 5.973 6.011 6.044 6.073 6.097 4.891 4.909 4.925 4.937 4.948 18.857 17.011 15.415 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 19.660 | 17.658 15.937 | 14.451 13.163 12.042 11.061 10.201 9.442 8.772 7.645 6.743 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 7.718 6.792 21.243 | 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 7.784 6.835 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.1617.896 6.906 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 7.943 6.935 24.316 21.281 18.764 16.663 14.898 | 13.406 12.137 11.051 10.116 9.307 7.984 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.022 6.983 25.808 22.396 19.600 17.292 15.372 13.765 12.409 | 11.258 10.274 9.4278.055 7.003 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 | 9.779 | 8.244 | 7.105 39.196 31.424 25.730 21.482 18.256 15.762 | 13.801 | 12.233 10.962 9.915 8.304 7.133 5.384 5.410 5.432 5.451 5.467 5.480 5.492 5.502 5.510 5.517 6.491 6.514 6.534 6.961 6.118 6.136 6.152 6.166 6.177 4.956 4.964 4.970 4.975 4.979 6.551 6.566 6.642 5.548 4.997 6.233 6.246 6.661 5.554 4.999 Print Done Future Value of $1 1.041 1.749 1.267 | 1.629 Periods | 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 12% | 14% | 15% 1.010 | 1.020 | 1.030 | 1.040 | 1.050 | 1.060 | 1.070 | 1.080 | 1.090 | 1.100 | 1.120 | 1.140 | 1.150 1.020 | 1.040 | 1.061 | 1.082 | 1.103 | 1.124 | 1.145 | 1.166 | 1.188 1.210 | 1.254 | 1.300 | 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.521 1.082 | 1.126 | 1.170 1.216 1.262 1.311 1.360 | 1.412 1.464 1.574 1.689 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2.011 1.062 1.126 1.194 1.265 | 1.340 1.419 1.501 | 1.587 | 1.677 | 1.772 1.974 2.195 2.313 1.072 1.149 1.230 1.316 | 1.407 1.504 1.606 1.714 1.828 11.949 12.211 2.502 2.660 1.083 | 1.172 1.369 | 1.477 1.594 1.718 1.851 1.993 | 2.144 2.476 2.853 3.059 1.094 11.195 1.305 1.423 | 1.551 1.689 1.838 1.999 2.172 2.358 2.773 3.252 3.518 1.105 1.219 1.344 1.480 1.791 1.967 2.159 2.367 12.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1.710 | 1.898 2.105 | 2.332 2.580 | 2.853 3.479 4.226 4.652 1.127 1.268 | 1.426 1.601 1.796 2.012 12.252 2.518 2.813 3.138 3.896 4.818 5.350 1.138 11.294 | 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4.363 5.492 6.153 1.149 11.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.798 4.887 6.261 7.076 1.161 1.346 1.558 1.801 2.079 2.397 | 2.759 3.172 3.642 4.177 5.474 7.138 8.137 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 13.970 4.595 6.130 8.137 9.358 1.184 1.400 1.653 1.948 2.292 2.693 3.159 3.700 4.328 5.054 16.866 9.276 10.76 1.196 1.428 1.702 2.026 12.407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 1.208 1.457 1.754 2.107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 12.06 14.23 1.220 1.486 2.191 12.653 3.207 3.870 4.661 5.604 6.727 9.646 13.74 16.37 1.232 1.516 | 1.860 | 2.279 | 2.786 3.400 4.141 5.034 6.109 7.400 10.80 15.67 18.82 1.245 1.546 2.370 2.925 3.604 4.430 5.437 6.659 8.140 12.10 17.86 1.257 11.577 1.974 2.465 3.072 3.820 4.741 5.871 17.258 | 13.55 20.36 24.89 1.270 | 1.608 | 2.033 | 2.563 | 3.225 | 4.049 | 5.072 16.341 | 7.911 19.850 | 15.18 | 23.21 | 28.63 45 6 7890HQ846 BNB99w889 1.806 1.916 21.64 1232 1.516 1.860 12.279 2.786 13.400 14.141 5.034 16.109 7.400 10.80 15.67 18.82 1.245 1.546 | 1.916 | 2.370 2.925 3.604 4.430 5.437 6.659 8.140 12.10 17.86 21.64 1.257 11.577 1.974 2.465 3.072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 24.89 1.270 1.608 2.033 12.563 3.225 14.049 5.072 6.341 7.911 9.850 15.18 23.21 28.63 1.282 1.641 2.094 12.666 3.386 4.292 5.427 6.848 8.623 10.83 17.00 26.46 32.92 1.295 1.673 2.157 2.772 3.556 4.549 5.807 7.396 9.399 11.92 19.04 | 30.17 37.86 1.308 1.707 2.221 12.883 3.733 4.822 6.214 7.988 10.25 13.11 21.32 134.39 43.54 1.321 1.741 2.288 2.999 3.920 5.112 6.649 8.627 11.17 14.42 123.88 | 39.20 50.07 1.335 1.776 2.357 3.119 4.116 5.418 7.114 9.317 12.17 | 15.86 26.75 44.69 57.58 1.811 | 2.427 | 3.243 | 4.322 | 5.743 | 7.612 | 10.06 | 13.27 17.45 129.96 150.95 66.21 1.489 12.208 3.262 4.801 | 7.040 10.29 14.97 21.72 31.41 45.26 193.05 188.9 267.9 1.645 | 2.692 | 4.384 17.107 | 1.47 | 18.42 | 29.46 | 46.90 | 74.36 | 117.4 | 289.0 | 7002 | 1,084 1.348 Future Value of Ordinary Annuity of $1 | 1.000 | 10on 13.23 Periods | 1% || 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 12% | 14% | 15% 1.000 1.000 1.000 | 1.000 | 1.000 - | 1.000 || | 1.000 11.000 1.000 | | 1.000 | 1.000 | 1.000 2010 2.020 2.030 | 2.040 2.050 12.060 2.070 12.080 2.090 2.100 2.120 12.140 2.150 3.030 3.060 3.091 13.122 3.153 3.184 3.215 3.246 3.278 3.310 3.374 3.440 3.473 4.060 4.122 4.184 4.246 4.310 | 4.375 4.440 4.506 4.573 4.641 4.779 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.353 6.610 6.742 6.152 | 6.308 6.468 16.633 6.802 6.975 7.153 7.336 7.523 7.716 18.115 18.536 18.754 7.214 7.434 7.662 7.898 8.142 8.394 8.654 18.923 9.200 9.487 10.09 10.73 11.07 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.64 11.03 11.44 12.30 13.73 9.369 9.755 10.16 10.58 11.03 11.49 11.98 12.49 13.02 | 13.58 | 14.78 | 16.09 16.79 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.19 15.94 17.55 | 19.34 20.30 11.57 12.17 12.81 13.49 | 14.21 14.97 || 15.78 16.65 17.56 18.53 20.65 | 23.04 24.35 12.68 13.41 14.19 15.03 15.92 16.87 | 17.89 18.98 20.14 21.38 24.13 27.27 29.00 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34.35 14.95 15.97 17.09 18.29 19.60 121.02 22.55 24.21 26.02 27.98 32.39 37.58 40.50 16.10 17.29 18.60 20.02 21.58 123.28 | 25.13 27.15 29.36 31.77 37.28 43.84 47.58 17.26 18.64 | 20.16 | 21.82 23.66 | 25.67 | 27.89 | 30.32 || 33.00 35.95 | 42.75 | 50.98 55.72 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 | 36.97 40.54 48.88 59.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 34.00 37.45 41.30 45.60 55.75 68.39 75.84 20.81 22.84 25.12 27.67 30.54 33.76 37.38 41.45 46.02 51.16 63.44 178.97 88.21 22.02 24.30 26.87 29.78 33.07 36.79 141.00 45.76 51.16 57.28 72.05 91.02 102.4 23.24 25.78 28.68 31.97 35.72 | 39.99 | 44.87 | 50.42 | 56.76 64.00 81.70 104.8 118.8 24.47 27.30 30.54 34.25 38.51 43.39 49.01 55.46 62.87 71.40 92.50 120.4 137.6 25.72 28.85 32.45 36.62 41.43 47.00 53.44 60.89 69.53 79.54 104.6 | 138.3 159.3 26.97 | 30.42 134.43|39.08 | 44.50 | 50.82 158.18 | 66.76 176.79 | 88.50 | 118.2 | 158.7 | 184.2 234567890HQ8466MB9%a888 23.24 24.47 25.72 26.97 28.24 25.78 27.30 28.85 30.42 32.03 28.68 30.54 32.45 34.43 36.46 31.97 34.25 36.62 39.08 41.65 35.72 38.51 41.43 44.50 47.73 39.99 43.39 47.00 50.82 54.86 44.87 49.01 53.44 58.18 63.25 50.42 55.46 60.89 66.76 73.11 56.76 62.87 69.53 76.79 84.70 64.00 81.70 71.40 92.50 79.54 104.6 88.50 118.2 98.35 | 133.3 104.8 120.4 138.3 158.7 181.9 118.8 137.6 159.3 184.2 212.8 29.53 30.82 32.13 33.45 34.78 48.89 64.46 33.67 35.34 37.05 38.79 40.57 60.40 84.58 38.55 40.71 42.93 45.22 47.58 75.40 112.8 44.31 47.08 49.97 52.97 56.08 51.11 54.67 58.40 62.32 66.44 59.16 63.71 68.53 73.64 79.06 154.8 1548 290.3 68.68 74.48 80.70 87.35 94.46 79.95 87.35 95.34 104.0 113.3 93.32 102.7 113.0 124.1 136.3 109.2 121.1 134.2 148.6 164.5 150.3 169.4 190.7 214.6 241.3 208.3 238.5 272.9 312.1 356.8 245.7 283.6 327.1 377.2 434.7 1,779 7,218 95.03 152.7 120. 8 209.3 199.6 199.6 406.5 259.1 573.8 337.9 815,1 442.6 1,164 767.1 2,400 1,342 4,995 Print Done