Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Long problems, Please provide detail solution step by step, Thank you Guadalupe Olayo produces grandfather clocks. Each grandfather clock normally sells for $1,500. The following

Long problems, Please provide detail solution step by step, Thank you

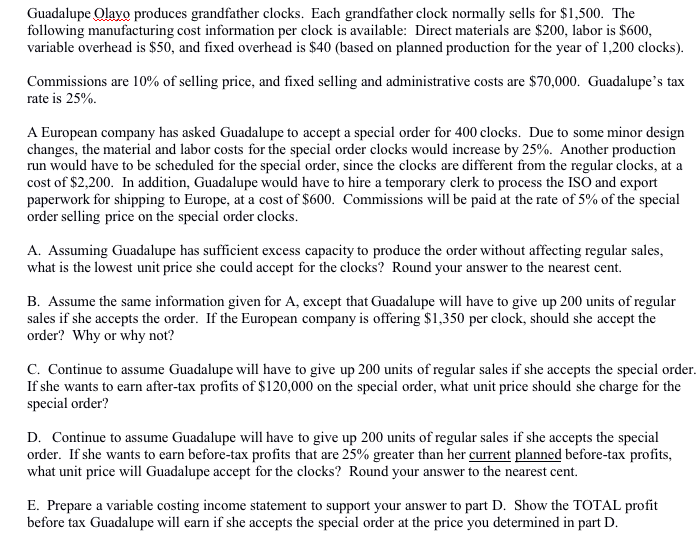

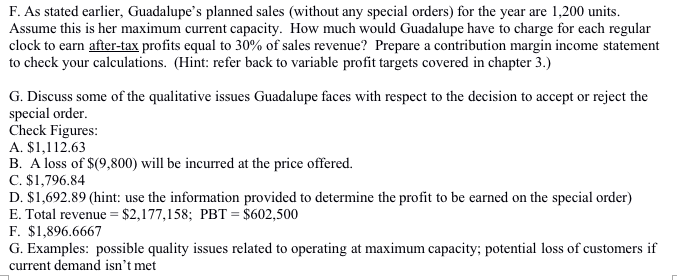

Guadalupe Olayo produces grandfather clocks. Each grandfather clock normally sells for $1,500. The following manufacturing cost information per clock is available: Direct materials are $200, labor is $600, variable overhead is $50, and fixed overhead is $40 (based on planned production for the year of 1,200 clocks). Commissions are 10% of selling price, and fixed selling and administrative costs are $70,000. Guadalupe's tax rate is 25% A European company has asked Guadalupe to accept a special order for 400 clocks. Due to some minor design changes, the material and labor costs for the special order clocks would increase by 25%. Another production run would have to be scheduled for the special order, since the clocks are different from the regular clocks, at a cost of $2,200. In addition, Guadalupe would have to hire a temporary clerk to process the ISO and export paperwork for shipping to Europe, at a cost of $600. Commissions will be paid at the rate of 5% of the special order selling price on the special order clocks. A. Assuming Guadalupe has sufficient excess capacity to produce the order without affecting regular sales, what is the lowest unit price she could accept for the clocks? Round your answer to the nearest cent. B. Assume the same information given for A, except that Guadalupe will have to give up 200 units of regular sales if she accepts the order. If the European company is offering $1,350 per clock, should she accept the order? Why or why not? C. Continue to assume Guadalupe will have to give up 200 units of regular sales if she accepts the special order. If she wants to earn after-tax profits of $120,000 on the special order, what unit price should she charge for the special order? D. Continue to assume Guadalupe will have to give up 200 units of regular sales if she accepts the special order. If she wants to earn before-tax profits that are 25% greater than her current planned before-tax profits, what unit price will Guadalupe accept for the clocks? Round your answer to the nearest cent. E. Prepare a variable costing income statement to support your answer to part D. Show the TOTAL profit before tax Guadalupe will earn if she accepts the special order at the price you determined in part D. F. As stated earlier, Guadalupe's planned sales (without any special orders) for the year are 1,200 units. Assume this is her maximum current capacity. How much would Guadalupe have to charge for each regular clock to earn after-tax profits equal to 30% of sales revenue? Prepare a contribution margin income statement to check your calculations. (Hint: refer back to variable profit targets covered in chapter 3.) G. Discuss some of the qualitative issues Guadalupe faces with respect to the decision to accept or reject the special order. Check Figures: A. $1,112.63 B. A loss of $(9,800) will be incurred at the price offered. C. $1,796.84 D. $1,692.89 (hint: use the information provided to determine the profit to be earned on the special order) E. Total revenue = $2,177,158; PBT = $602,500 F. $1,896.6667 G. Examples: possible quality issues related to operating at maximum capacity; potential loss of customers if current demand isn't met Guadalupe Olayo produces grandfather clocks. Each grandfather clock normally sells for $1,500. The following manufacturing cost information per clock is available: Direct materials are $200, labor is $600, variable overhead is $50, and fixed overhead is $40 (based on planned production for the year of 1,200 clocks). Commissions are 10% of selling price, and fixed selling and administrative costs are $70,000. Guadalupe's tax rate is 25% A European company has asked Guadalupe to accept a special order for 400 clocks. Due to some minor design changes, the material and labor costs for the special order clocks would increase by 25%. Another production run would have to be scheduled for the special order, since the clocks are different from the regular clocks, at a cost of $2,200. In addition, Guadalupe would have to hire a temporary clerk to process the ISO and export paperwork for shipping to Europe, at a cost of $600. Commissions will be paid at the rate of 5% of the special order selling price on the special order clocks. A. Assuming Guadalupe has sufficient excess capacity to produce the order without affecting regular sales, what is the lowest unit price she could accept for the clocks? Round your answer to the nearest cent. B. Assume the same information given for A, except that Guadalupe will have to give up 200 units of regular sales if she accepts the order. If the European company is offering $1,350 per clock, should she accept the order? Why or why not? C. Continue to assume Guadalupe will have to give up 200 units of regular sales if she accepts the special order. If she wants to earn after-tax profits of $120,000 on the special order, what unit price should she charge for the special order? D. Continue to assume Guadalupe will have to give up 200 units of regular sales if she accepts the special order. If she wants to earn before-tax profits that are 25% greater than her current planned before-tax profits, what unit price will Guadalupe accept for the clocks? Round your answer to the nearest cent. E. Prepare a variable costing income statement to support your answer to part D. Show the TOTAL profit before tax Guadalupe will earn if she accepts the special order at the price you determined in part D. F. As stated earlier, Guadalupe's planned sales (without any special orders) for the year are 1,200 units. Assume this is her maximum current capacity. How much would Guadalupe have to charge for each regular clock to earn after-tax profits equal to 30% of sales revenue? Prepare a contribution margin income statement to check your calculations. (Hint: refer back to variable profit targets covered in chapter 3.) G. Discuss some of the qualitative issues Guadalupe faces with respect to the decision to accept or reject the special order. Check Figures: A. $1,112.63 B. A loss of $(9,800) will be incurred at the price offered. C. $1,796.84 D. $1,692.89 (hint: use the information provided to determine the profit to be earned on the special order) E. Total revenue = $2,177,158; PBT = $602,500 F. $1,896.6667 G. Examples: possible quality issues related to operating at maximum capacity; potential loss of customers if current demand isn't metStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started