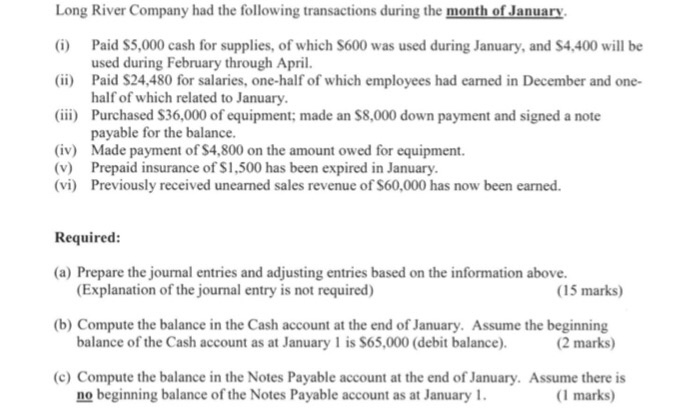

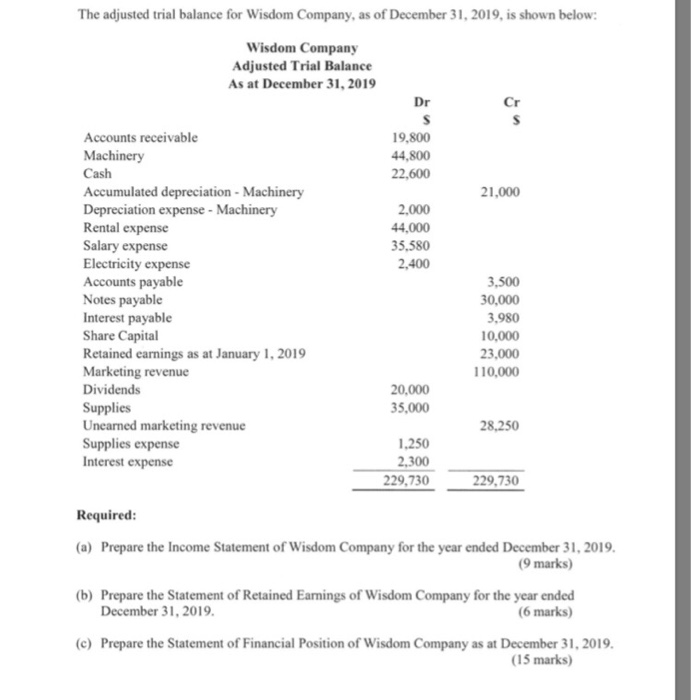

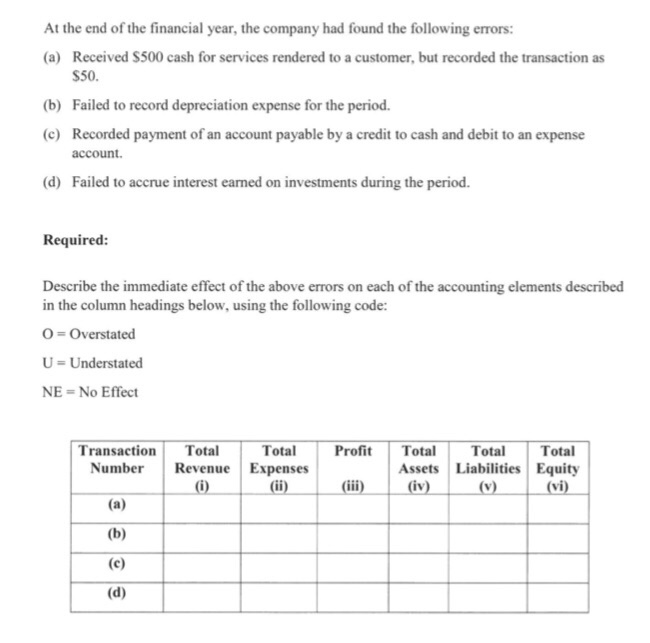

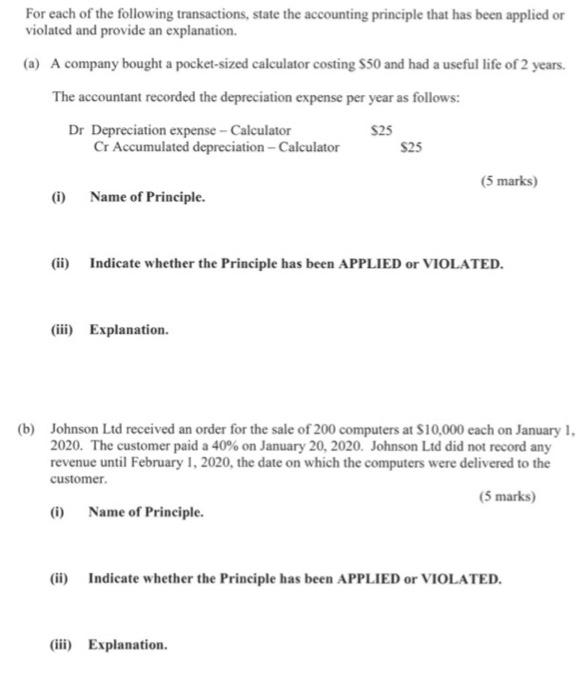

Long River Company had the following transactions during the month of January (i) Paid $5,000 cash for supplies, of which S600 was used during January, and $4,400 will be used during February through April. (ii) Paid S24,480 for salaries, one-half of which employees had earned in December and one- half of which related to January. (iii) Purchased $36,000 of equipment; made an $8,000 down payment and signed a note payable for the balance. (iv) Made payment of $4,800 on the amount owed for equipment. (v) Prepaid insurance of $1,500 has been expired in January. (vi) Previously received unearned sales revenue of $60,000 has now been earned. Required: (a) Prepare the journal entries and adjusting entries based on the information above. (Explanation of the journal entry is not required) (15 marks) (b) Compute the balance in the Cash account at the end of January. Assume the beginning balance of the Cash account as at January 1 is $65,000 (debit balance). (2 marks) (c) Compute the balance in the Notes Payable account at the end of January. Assume there is no beginning balance of the Notes Payable account as at January 1. (1 marks) The adjusted trial balance for Wisdom Company, as of December 31, 2019, is shown below: Wisdom Company Adjusted Trial Balance As at December 31, 2019 Dr 19,800 44,800 22,600 21,000 2.000 44,000 35.580 2,400 Accounts receivable Machinery Cash Accumulated depreciation - Machinery Depreciation expense - Machinery Rental expense Salary expense Electricity expense Accounts payable Notes payable Interest payable Share Capital Retained earnings as at January 1, 2019 Marketing revenue Dividends Supplies Unearned marketing revenue Supplies expense Interest expense 3,500 30,000 3.980 10,000 23,000 110,000 20,000 35,000 28,250 1.250 2.300 229,730 229,730 Required: (a) Prepare the Income Statement of Wisdom Company for the year ended December 31, 2019. (9 marks) (b) Prepare the Statement of Retained Earings of Wisdom Company for the year ended December 31, 2019. (6 marks) (c) Prepare the Statement of Financial Position of Wisdom Company as at December 31, 2019. (15 marks) At the end of the financial year, the company had found the following errors: (a) Received $500 cash for services rendered to a customer, but recorded the transaction as $50. (b) Failed to record depreciation expense for the period. (c) Recorded payment of an account payable by a credit to cash and debit to an expense account. (d) Failed to accrue interest earned on investments during the period. Required: Describe the immediate effect of the above errors on each of the accounting elements described in the column headings below, using the following code: O=Overstated U = Understated NE = No Effect Transaction Number Profit Total Total Revenue Expenses Total Assets (iv) Total Total Liabilities Equity (v) (vi) (0) (a) (b) For each of the following transactions, state the accounting principle that has been applied or violated and provide an explanation. (a) A company bought a pocket-sized calculator costing $50 and had a useful life of 2 years. The accountant recorded the depreciation expense per year as follows: S25 Dr Depreciation expense - Calculator Cr Accumulated depreciation - Calculator $25 (5 marks) (i) Name of Principle. (ii) Indicate whether the Principle has been APPLIED or VIOLATED. (iii) Explanation. (b) Johnson Ltd received an order for the sale of 200 computers at $10,000 each on January 1, 2020. The customer paid a 40% on January 20, 2020. Johnson Lid did not record any revenue until February 1, 2020, the date on which the computers were delivered to the customer. (5 marks) (1) Name of Principle. (ii) Indicate whether the Principle has been APPLIED or VIOLATED. (iii) Explanation