Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LONG RUN INDICATORS Justify with your argument on the position for long run of each category of the company based on these 5 Long Run

LONG RUN INDICATORS

Justify with your argument on the position for long run of each category of the company based on these 5 Long Run Indicators.

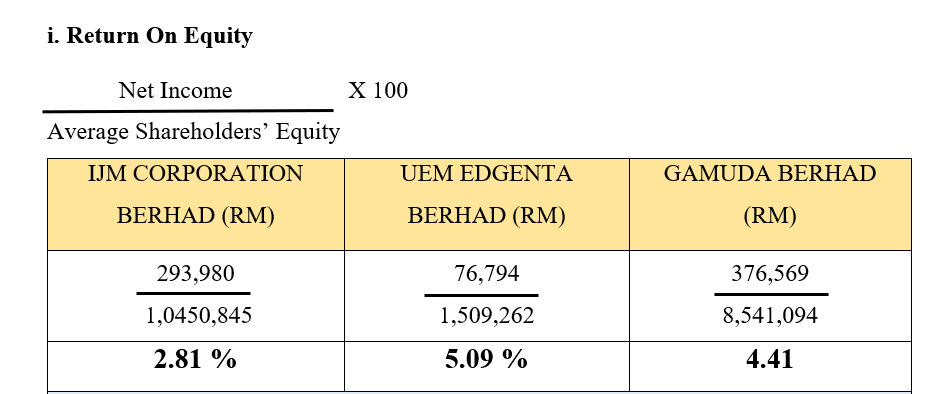

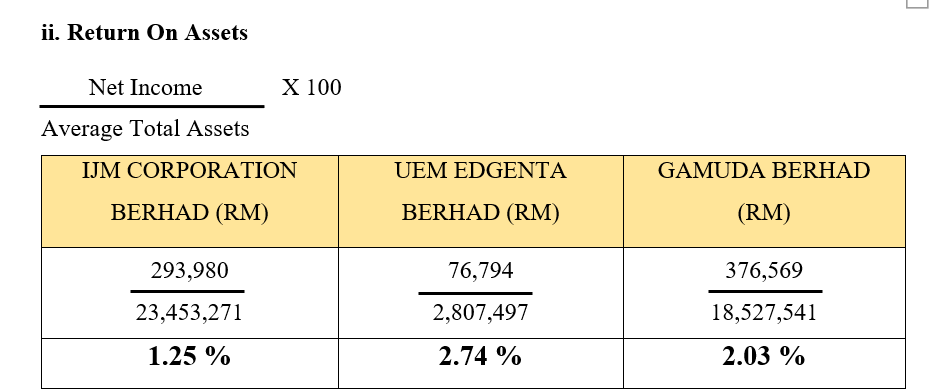

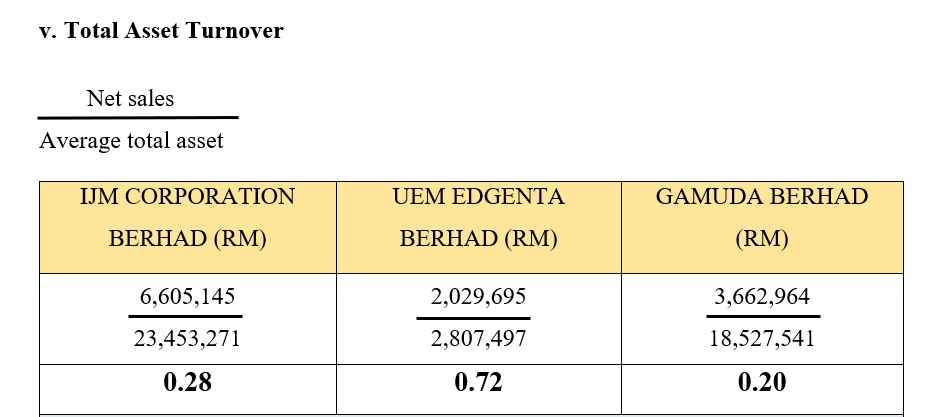

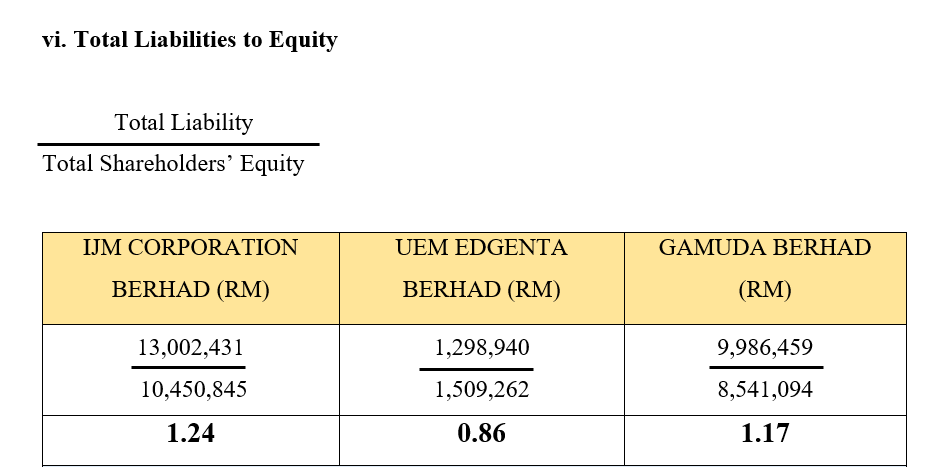

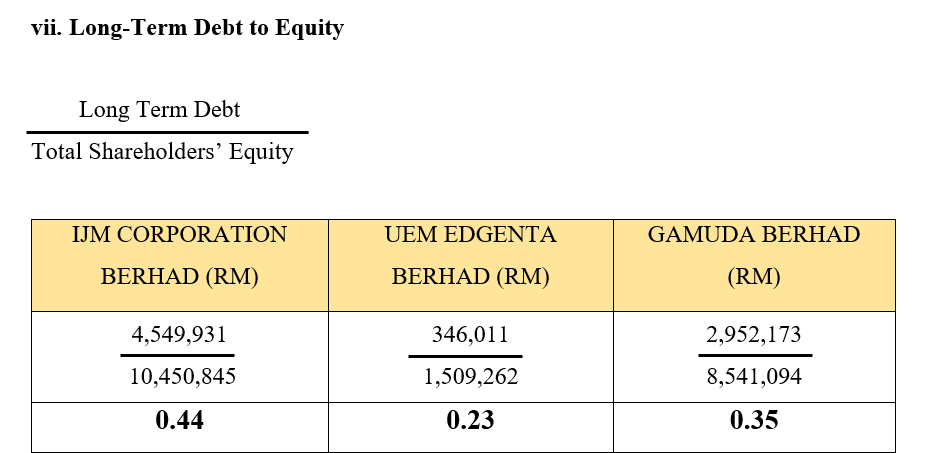

i. Return On Equity Net Income X 100 Average Shareholders' Equity IJM CORPORATION UEM EDGENTA GAMUDA BERHAD BERHAD (RM) BERHAD (RM) (RM) 293,980 76,794 376,569 1,0450,845 1,509,262 8,541,094 2.81 % 5.09 % 4.41 [ ii. Return On Assets Net Income X 100 Average Total Assets IJM CORPORATION UEM EDGENTA GAMUDA BERHAD BERHAD (RM) BERHAD (RM) (RM) 293,980 76,794 376,569 23,453,271 2,807,497 18,527,541 1.25 % 2.74 % 2.03 % . v. Total Asset Turnover Net sales Average total asset IJM CORPORATION UEM EDGENTA GAMUDA BERHAD BERHAD (RM) BERHAD (RM) (RM) 6,605,145 2,029,695 3,662,964 23,453,271 2,807,497 18,527,541 0.28 0.72 0.20 vi. Total Liabilities to Equity Total Liability Total Shareholders' Equity IJM CORPORATION UEM EDGENTA GAMUDA BERHAD BERHAD (RM) BERHAD (RM) (RM) 13,002,431 1,298,940 9,986,459 10,450,845 1,509,262 8,541,094 1.24 0.86 1.17 vii. Long-Term Debt to Equity Long Term Debt Total Shareholders' Equity IJM CORPORATION UEM EDGENTA GAMUDA BERHAD BERHAD (RM) BERHAD (RM) (RM) 4,549,931 346,011 2,952,173 10,450,845 1,509,262 8,541,094 0.44 0.23 0.35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started