Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Longhorn Corporation provides low-cost food delivery services to senior citizens. At the end of the year on December 31, 2021, the company reports the following

Longhorn Corporation provides low-cost food delivery services to senior citizens. At the end of the year on December 31, 2021, the company reports the following amounts:

| Cash | $ | 1,300 | Service revenue | $ | 71,700 | ||

| Equipment | 20,000 | Cost of goods sold (food expense) | 54,200 | ||||

| Accounts payable | 2,600 | Buildings | 22,000 | ||||

| Delivery expense | 3,400 | Supplies | 1,600 | ||||

| Salaries Expense | 6,300 | Salaries payable | 900 |

In addition, the company had common stock of $22,000 at the beginning of the year and issued an additional $2,200 during the year. The company also had retained earnings of $9,400 at the beginning of the year.

Required:

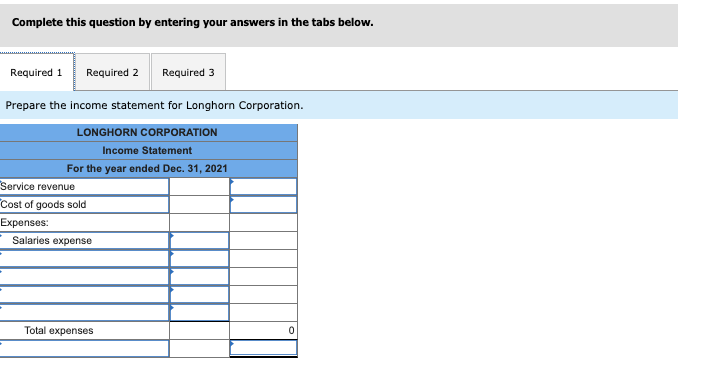

- Prepare the income statement for Longhorn Corporation.

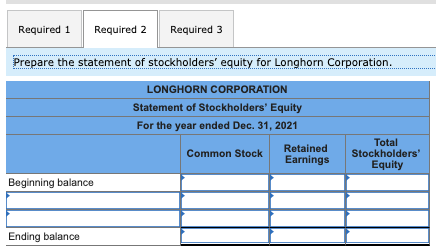

- Prepare the statement of stockholders equity for Longhorn Corporation.

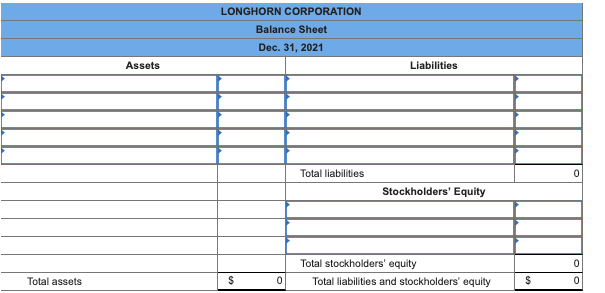

- Prepare the balance sheet for Longhorn Corporation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started